Macro Theme:

Short Term Resistance: 4,550 SPX Call Wall

Short Term Support: 4,500

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,550 SPX Call Wall

Major Range Low/Support: 4,400

‣ If the NFP print is benign on 9/1, it combine with the Labor Day holiday (next Monday) to likely lead to lower Index IV’s and supported stocks over the next week.*

‣ Entering into the week of 9/11, there are a litany of catalysts including: CPI, big Sep OPEX, VIX Exp & FOMC. This suggests to us vol may be under pressure another ~2 weeks, and then risks pick up.*

‣ While we have no particular reason to be bearish, we note that a strong rally into OPEX/VIX Exp would certainly clear up the downside “padding” that we’ve been enjoying (and discussing) over the last few weeks. This could make downside into end of September/October “more available”.*

*updated 8/31

**updated 8/16

Founder’s Note:

Futures are flat to 4,525. The

Call Walls

have shifted higher to 452 SPY (4,525 SPX) and 4,550 SPX. These are now our main overhead resistance points. Support below is at 4,500 then down at 4,460. Our daily range further contracts to 0.68%.

Resistance above in QQQ is 380, with first support at 376. Support below there is 370.

450 SPY & 4,500 SPX are very large gamma levels, and likely to to remain so in through September OPEX. This means that 4,500 a solid support zone, should we get some weakness today. We believe traders can remain long of equities here until/unless 4,500 is broken.

Should we be near the 450/4,500 area next week, this strike zone may be more like a magnet into OPEX whereas now these related charm flows are less material (i.e. they shouldn’t combat markets grinding higher). To this point the

Call Walls

have shifted higher, with 4,550 is our new upside target (from 4,500, yesterday).

Index implied volatility has been smoked, as seen in the VIX which is now down to 13.5 from 17’s last week. As discussed yesterday, lower implied vols are likely to trend into next week particularly if realized volatility moves lower (like we believe it should).

Where IV’s may not come down is in single stocks.

Into June and July there was a huge bid to calls, particularly in tech. This led to narrow market breadth, and a huge decline in the correlation measure, plotted below. This timeframe can be basically framed as “sell SPX vol to buy single stock vol”. With July OPEX, upside in single stocks stalled, and that, combined with the passing of earnings, zapped high stock IV’s. As a result, stocks declined in August and correlation unwound (single stock vol down and index vol up).

Now, with traders eyeing rate pauses, tech has re-bid as traders enter back into single stock calls, and sell index vol. Correlation is moving back down.

Our expectation is this general trend continues in through next week. The curve ball here is now Friday’s NFP. If the report confirms the slowing showed in the JOLTS data, then things should likely continue higher (particularly big tech). If the NFP data is strong (i.e. economically positive) then one wonders if that muddies rate forecasts, and may pull some of the bid out of tech. We’ll outline major levels for the downside in tomorrows AM note, but 4,500 is our “risk

pivot”

level. This means that a pop below that level, combined with a corresponding jump in Index IV could push stocks back down toward 4,400, which may then become the sticky strike into Sep OPEX.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4514 | $451 | $15462 | $376 | $1903 | $188 |

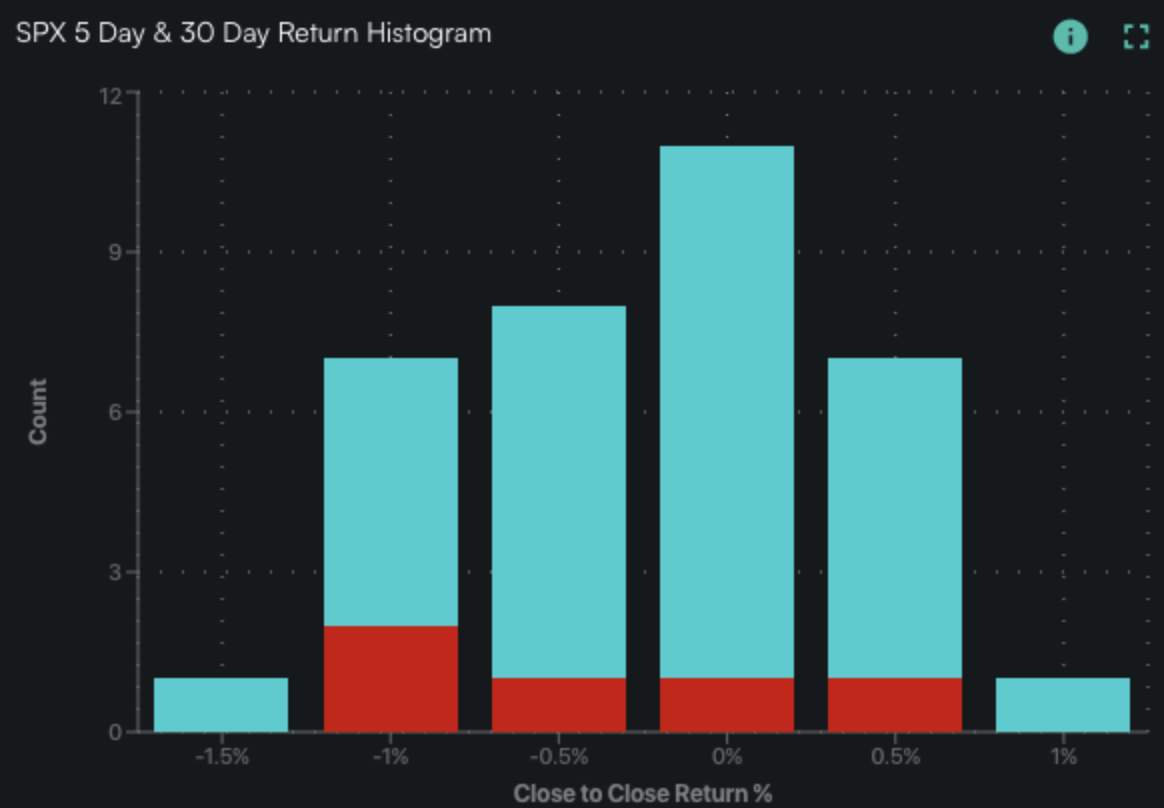

| SpotGamma Implied 1-Day Move: | 0.68% | 0.68% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.10% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4450 | $450 | $14620 | $376 | $1855 | $190 |

| Absolute Gamma Strike: | $4500 | $450 | $15000 | $370 | $1900 | $190 |

| SpotGamma Call Wall: | $4550 | $452 | $14625 | $385 | $1860 | $192 |

| SpotGamma Put Wall: | $4300 | $440 | $15250 | $350 | $1750 | $185 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4455 | $450 | $14305 | $376 | $1927 | $194 |

| Gamma Tilt: | 1.202 | 0.969 | 1.418 | 1.046 | 0.844 | 0.594 |

| SpotGamma Gamma Index™: | 1.279 | -0.034 | 0.042 | 0.020 | -0.016 | -0.086 |

| Gamma Notional (MM): | $392.532M | ‑$130.738M | $4.834M | $75.227M | ‑$13.77M | ‑$871.467M |

| 25 Day Risk Reversal: | -0.036 | -0.038 | -0.034 | -0.037 | -0.027 | -0.037 |

| Call Volume: | 554.981K | 1.944M | 8.231K | 947.252K | 11.535K | 170.56K |

| Put Volume: | 938.908K | 2.623M | 16.602K | 1.204M | 22.765K | 475.822K |

| Call Open Interest: | 6.435M | 6.885M | 61.156K | 5.043M | 226.079K | 3.571M |

| Put Open Interest: | 13.183M | 14.904M | 81.778K | 10.083M | 412.465K | 7.583M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4600, 4550, 4500, 4450] |

| SPY Levels: [452, 450, 445, 440] |

| NDX Levels: [16000, 15500, 15000, 14625] |

| QQQ Levels: [380, 377, 375, 370] |

| SPX Combos: [(4727,74.48), (4700,95.77), (4673,83.23), (4664,92.68), (4650,95.43), (4623,87.37), (4605,84.61), (4601,98.60), (4596,74.52), (4592,73.83), (4578,80.44), (4574,96.34), (4569,82.09), (4565,87.41), (4560,79.88), (4556,94.99), (4551,98.85), (4546,90.23), (4542,93.62), (4537,75.45), (4533,84.31), (4528,89.35), (4524,98.85), (4519,88.83), (4510,85.69), (4501,93.88), (4416,74.45), (4407,79.69), (4402,90.40), (4375,81.44), (4357,76.71), (4348,87.01), (4325,81.17), (4307,82.44), (4298,95.79)] |

| SPY Combos: [453.71, 451.45, 461.37, 456.41] |

| NDX Combos: [15803, 15587, 16004, 14767] |

| QQQ Combos: [386.8, 361.94, 358.18, 381.9] |

SPX Gamma Model

View All Indices Charts

0 comentarios