Macro Theme:

Short Term Resistance: 4,500

Short Term Support: 4,475

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,600 SPX Call Wall

Major Range Low/Support: 4,400

‣ The first week of Sep (post Labor Day holiday) is likely lead to lower Index IV’s which supports stocks into 9/11.*

‣ Entering into the week of 9/11, there are a litany of catalysts including: CPI (13th), big Sep OPEX (15th), VIX Exp & FOMC (20th). *

‣ While we have no particular reason to be bearish, we note that a strong rally into OPEX/VIX Exp would certainly clear up the downside “padding” that we’ve been enjoying (and discussing) over the last few weeks. This could make downside into end of September/October “more available”. Traders looking to hedge may want to therefore consider put positions before the 13th.*

*updated 9/5

Founder’s Note:

Futures are 20bps lower to 4493. Support below is at 4,475, then 4,450. Resistance above is 4,500 – 4,508 (SPY 450), then 4,424. Our daily move remains at 68bps (open to close range).

For QQQ support is at 377 & 375. Resistance is at 380.

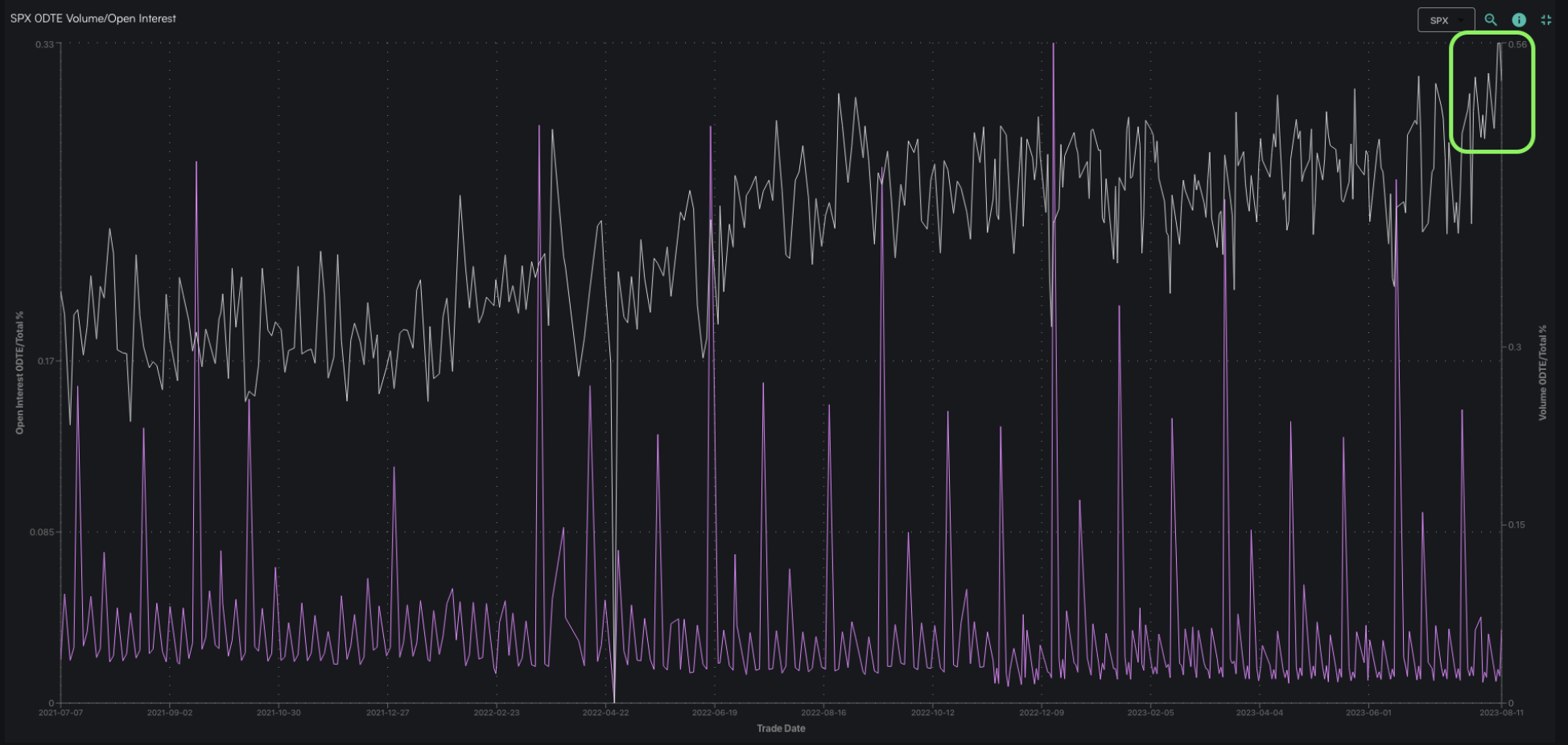

There is a lot of hand-wringing in the macro space as yields have pushed higher over the last few days (10Y 4.25%), but equities remain rather resilient. Yesterday’s SPX range was a meager 18 handles (40bps), and we see a similar, tight range on tap for today (68bps). Not only are the SG models reflecting this low volatility stance, but today’s 0DTE straddle (ref 4,485) is just $19.7 with a 14% IV.

Below is the major index/ETF delta by expiration (calls = orange, puts = blue), and you can see how large SEP OPEX is vs other expirations. These positions, we believe, suppress SPX volatility.

This does not mean the S&P cannot go lower, just that it is likely more of a grind down, vs precipitous fall. As you can see below for SPY, there are large positions down at 445 & 440 both which should act as support levels.

There are three ways for the gamma position to reduce, which should increase our volatility estimates:

- OPEX removes ATM positions.

- Most of the gamma is concentrated around 4,500, and therefore if we move to 440SPY/4,400SPX gamma our volatility estimates should increase. It would likely take a few sessions of “grind” to reach 440.

- The increase of put positions (unlikely pre-CPI).

If you are bearish here, the relative cost of picking up some longer dated puts now vs waiting for early next week (when we think vol increases) is fairly low. The IV’s for downside strikes have been coming down (as shown below for Dec exp.), and those are unlikely to drop materially before next weeks CPI. Further, the longer dated options don’t have much time decay.

We think you can balance any downside put positions which some cheaper short dated call structures, as if the CPI & FOMC provide a dovish surprise we could quickly slip up into the 4600-4650 area into the end of September (JPM call collar strike = 4,660).

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4496 | $449 | $15508 | $378 | $1880 | $186 |

| SpotGamma Implied 1-Day Move: | 0.68% | 0.68% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.03% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4475 | $449 | $14620 | $377 | $1855 | $190 |

| Absolute Gamma Strike: | $4500 | $450 | $15500 | $375 | $1900 | $185 |

| SpotGamma Call Wall: | $4600 | $455 | $14625 | $385 | $1860 | $192 |

| SpotGamma Put Wall: | $4300 | $445 | $15175 | $350 | $1750 | $187 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4470 | $448 | $14347 | $377 | $1992 | $194 |

| Gamma Tilt: | 1.035 | 0.813 | 1.378 | 0.998 | 0.774 | 0.489 |

| SpotGamma Gamma Index™: | 0.103 | -0.218 | 0.041 | -0.001 | -0.024 | -0.127 |

| Gamma Notional (MM): | $14.757M | ‑$793.277M | $4.005M | $4.569M | ‑$22.858M | ‑$1.287B |

| 25 Day Risk Reversal: | -0.041 | -0.038 | -0.039 | -0.042 | -0.034 | -0.039 |

| Call Volume: | 412.593K | 1.268M | 8.425K | 699.178K | 16.548K | 347.841K |

| Put Volume: | 765.034K | 1.951M | 15.356K | 982.193K | 29.779K | 681.572K |

| Call Open Interest: | 4.414M | 6.775M | 62.902K | 4.929M | 221.597K | 3.593M |

| Put Open Interest: | 9.135M | 14.266M | 86.944K | 9.812M | 408.487K | 7.742M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4600, 4550, 4500, 4400] |

| SPY Levels: [452, 450, 445, 440] |

| NDX Levels: [16000, 15500, 15000, 14625] |

| QQQ Levels: [380, 377, 375, 370] |

| SPX Combos: [(4699,93.85), (4677,78.13), (4663,89.69), (4650,91.11), (4627,74.54), (4605,77.98), (4600,96.39), (4573,86.36), (4555,84.03), (4551,88.57), (4533,80.05), (4524,91.97), (4501,82.01), (4474,84.49), (4456,88.75), (4416,75.02), (4402,79.12), (4398,88.71), (4353,77.28), (4348,77.06), (4303,78.75), (4299,94.03)] |

| SPY Combos: [452.84, 457.79, 450.15, 455.09] |

| NDX Combos: [15787, 16005, 15586, 15183] |

| QQQ Combos: [385.69, 390.61, 380.4, 370.57] |

SPX Gamma Model

View All Indices Charts

0 comentarios