Macro Theme:

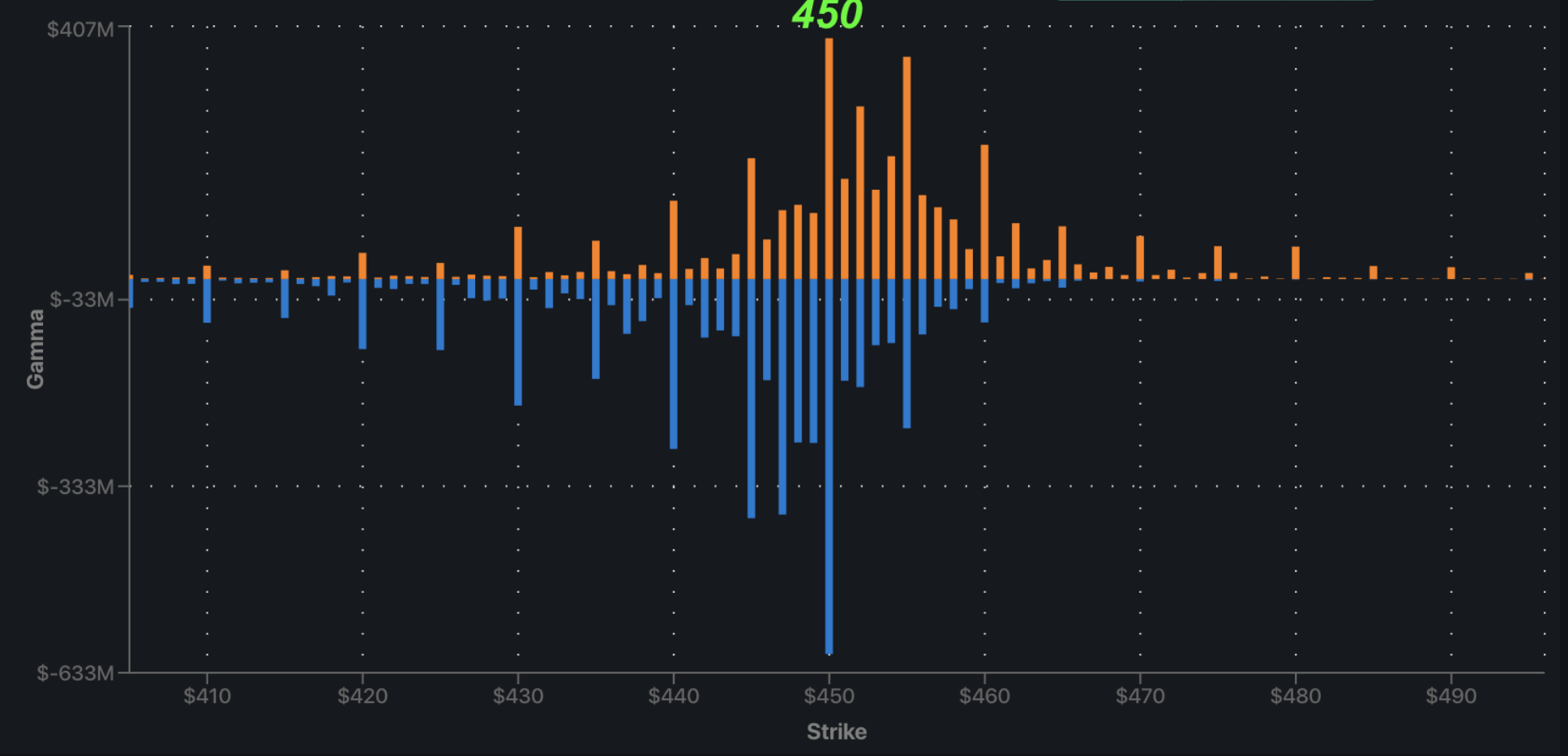

Short Term Resistance: 4,500

Short Term Support: 4,450

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,600 SPX Call Wall

Major Range Low/Support: 4,400

‣ Entering into the week of 9/11, there are a litany of catalysts including: CPI (13th), big Sep OPEX (15th), VIX Exp & FOMC (20th). *

‣ Our trade is to enter “long volatility” positions into CPI, with current ATM IV’s for a 30 day SPX option is 11.8% (too low, in our view). A bullish CPI/FOMC could produce a sharp upside shift, in which case we’d target >4,600 into the end of Sep. A bearish reaction could move the market <4,400. We think the market is underpricing our target levels.**

*updated 9/5

**updated 9/12

Founder’s Note:

Futures are off 20bps to 4,530. Support for today is at 4,480, then 4,450. Resistance is at 4,500. Today’s open/close range is a very narrow 0.59%.

In QQQ support is at 375, with resistance at 377.

Today should be the volatility trough, as tomorrow’s CPI marks several events which could invoke volatility: 9/15 OPEX, 9/20 VIX Exp/FOMC.

We see little reason for the S&P to break from the 4,450 – 4,500 range today, as markets likely exhibit strong, mean reverting behavior. This should be similar to what we’ve seen over the last several sessions, where the initial AM move is faded into the afternoon. We’d anticipate this range being broken tomorrow.

We also flag the SPY 450 as the major gamma strike, which should keep the upside lid on things for today. Looking forward, we will lean on this strike as our bull/bear

pivot

line, looking to favor upside if the S&P can get up over this level.

While we do not often trade structures into events, we thought it might be an interesting exercise today, as we think traders may want to position this afternoon before the CPI catalyst tomorrow AM.

This particular structure owns a longer dated, -5% SPX OTM Dec put option vs a Sep 29th ~2% OTM call. These strikes are delta neutral near current SPX levels (4475), with a structure that profits if the equity market moves toward 4400 or 4550 by Sep 30.

This is not a trade recommendation. If you chose to enter a trade, you should adjust this structure based on your portfolio and outlook.

Currently we believe IV is low, and so our idea here is to start with long options, and then we may add short legs to the trade (i.e. turn single legs to spreads) after CPI to take advantage of the market reaction.

For example, if you are long equities and simply looking for protection, the primary risk in this structure is the decay of the Dec put should the CPI reading come in at or below expectations. You could adjust the call shorter in time & strike to reduce the cost of the call.

Bearish:

If the market declines after the CPI, IV should markedly increase which benefits the longer dated put option, and you may be able to sell a further downside Dec put to turn the structure into a spread, or sell a shorter pre-FOMC put to enter into a calendar spread.

Bullish:

The shorted dated call may jump in value on an equity jump, in which case we would take advantage of an upside pop, looking to turn the call into a call spread, or fly with a maximum profit target in the 4,600-4,650 area. The carry cost of the put after this inital CPI reaction should be de-minimus, and we’d prefer to hold it through FOMC.

The main risk for this structure is a 4,500 pin through FOMC, which IV coming down sharply. This scenario seems rather unlikely, as if the SPX stays flat with declining IV, that IV drop should eventually invoke a tailwind for equities.

Also note that traders looking to place smaller notional trades like want to use XSP which is the 1/10 the size of SPX, and roughly same notional size as SPY. The advantage to XSP over SPY is that its cash settled, and you avoid any SPY dividend pricing issues (SPY goes EX-DIV this Friday).

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4487 | $448 | $15463 | $376 | $1855 | $184 |

| SpotGamma Implied 1-Day Move: | 0.59% | 0.59% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.90% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4480 | $447 | $15390 | $377 | $1855 | $189 |

| Absolute Gamma Strike: | $4500 | $450 | $15500 | $375 | $1850 | $185 |

| SpotGamma Call Wall: | $4600 | $450 | $14625 | $385 | $1860 | $192 |

| SpotGamma Put Wall: | $4400 | $440 | $15175 | $360 | $1850 | $182 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4461 | $447 | $14966 | $376 | $1907 | $191 |

| Gamma Tilt: | 1.068 | 0.912 | 1.308 | 0.952 | 0.793 | 0.431 |

| SpotGamma Gamma Index™: | 0.516 | -0.098 | 0.041 | -0.023 | -0.024 | -0.162 |

| Gamma Notional (MM): | $46.873M | ‑$361.361M | $4.519M | ‑$48.842M | ‑$24.466M | ‑$1.675B |

| 25 Day Risk Reversal: | -0.038 | -0.035 | -0.036 | -0.037 | -0.029 | -0.034 |

| Call Volume: | 421.155K | 1.427M | 8.69K | 698.431K | 17.825K | 162.408K |

| Put Volume: | 853.378K | 2.072M | 15.693K | 1.008M | 29.512K | 415.255K |

| Call Open Interest: | 6.602M | 6.807M | 65.342K | 5.052M | 229.607K | 3.737M |

| Put Open Interest: | 13.402M | 14.144M | 95.349K | 9.937M | 395.732K | 7.89M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4550, 4500, 4450, 4400] |

| SPY Levels: [450, 448, 445, 440] |

| NDX Levels: [15500, 15400, 15000, 14625] |

| QQQ Levels: [380, 377, 375, 370] |

| SPX Combos: [(4698,95.38), (4676,73.98), (4667,84.02), (4649,91.33), (4627,76.00), (4604,74.74), (4600,98.82), (4591,73.37), (4582,85.78), (4577,93.21), (4568,76.42), (4559,80.83), (4555,91.35), (4550,97.66), (4546,75.94), (4541,86.94), (4537,76.95), (4528,88.73), (4523,98.84), (4519,90.62), (4514,93.71), (4510,86.91), (4505,89.27), (4501,99.52), (4492,81.95), (4465,84.40), (4461,76.52), (4452,93.89), (4429,81.67), (4425,87.76), (4420,74.76), (4416,86.20), (4411,79.45), (4402,99.00), (4384,77.60), (4375,83.64), (4362,75.12), (4353,81.33), (4348,88.00), (4303,81.56), (4299,96.17), (4281,73.34), (4272,73.31)] |

| SPY Combos: [432.78, 442.65, 457.9, 452.96] |

| NDX Combos: [15788, 14767, 15664, 15587] |

| QQQ Combos: [374.26, 364.08, 360.69, 389.33] |

SPX Gamma Model

View All Indices Charts

0 comentarios