Macro Theme:

Short Term SPX Resistance: 4,590

Short Term SPX Support: 4,540

SPX Risk Pivot Level: 4,500

Major SPX Range High/Resistance: 4,600

Major SPX Range Low/Support: 4,200

‣ IV levels are anemic (~8%), which suggests that a pop higher in IV/equity downside is due. A break of 4,500 is our “risk off” level.*

‣ 4,600 is our current max upside target, as call positions are not yet building above that level.*

*updated 11/30

Founder’s Note:

ES Futures are flat at 4,555 Key SG levels for the SPX are:

- Support: 4,550, 4,540, 4,515, & 4,500

- Resistance: 4,577, 4,590, 4,600, 4,613

- 1 Day Implied Range: 0.63%

In QQQ support is at 385 & 380, resistance is at 386 then 390.

IWM support: 181 resistance: 185, then 190.

Volatility feels like its beginning to creep back in, as yesterdays intraday move nearly used up the full 4,550 – 4,600 range that has been pinning markets down. However, our daily 1-day implied move remains very tight at 63bps, signaling we should not expect a large move for today.

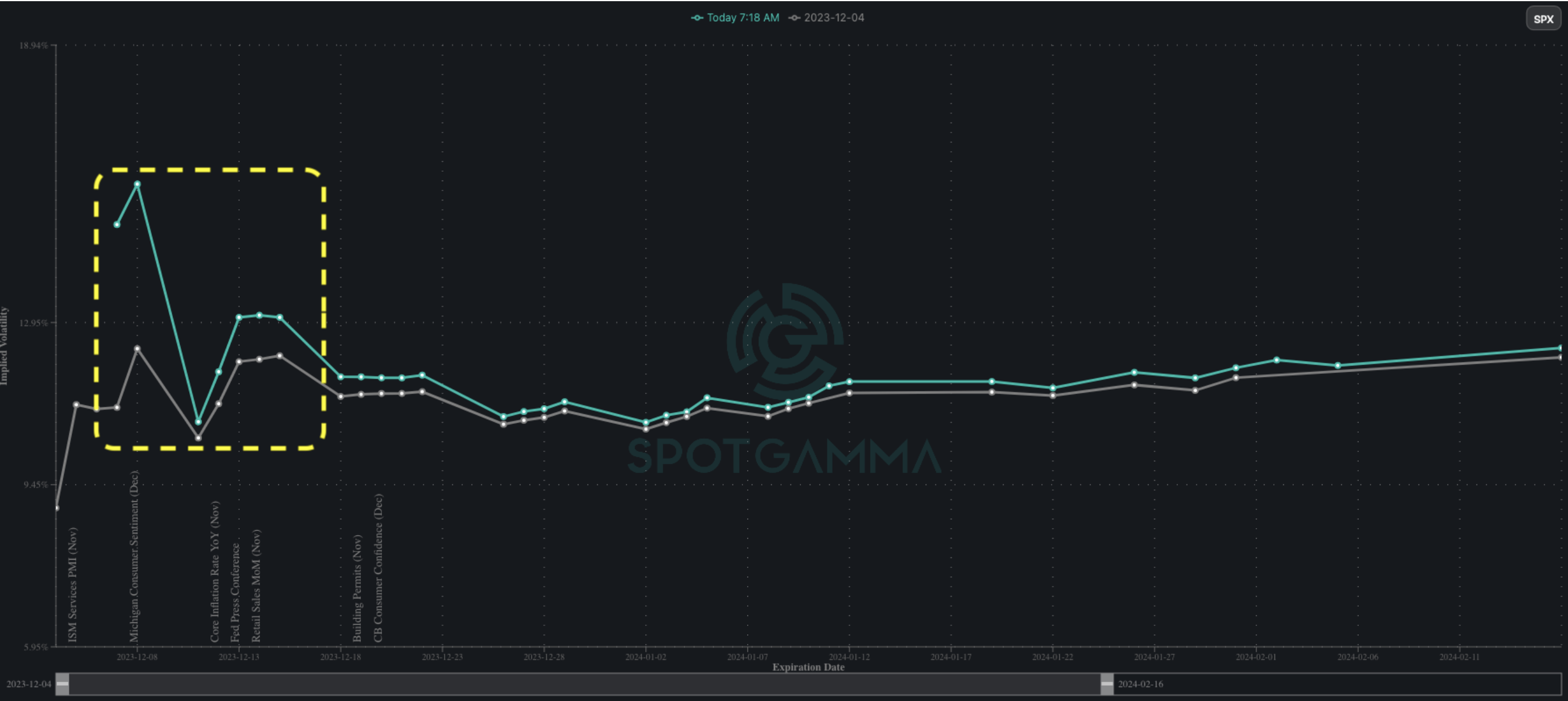

Traders are now starting to price in a bit more movement as seen in the SPX term structure, below. The green line shows this mornings at-the-money IV’s. which are now up towards 15-16% vs 8-9% a few days ago (gray line).

Tomorrow is NFP, which has the potential to shake things up. However, any move plays into a weekend, followed by a light data-day on Monday. This signals to us that unless the NFP is a major deviation, we’re unlikely to shift out of this 4,500-4,600 box before Tuesday AM.

Note, though, how low IV is for expiration >= January at ~11.5%. This suggests traders are pricing in some noise around data next week – but see very little risk out in time.

Into Tuesday the window for larger movement opens, with CPI on 12/12, then 12/13 FOMC which feeds into the very large Dec 15th OPEX. The options positions should stop shifting (& its associated impacts) into VIX expiration on the 20th.

All of this means that this map we provided on Monday remains in play.

We’ll navigate the changes next week using the

Call Wall

(s) as the high end of our range, and the 4,500 as our major “risk off” level.

Finally, we wanted to flag another big options event looming into the start of ’24, and thats the monstrous January OPEX. Below is the size of

call delta

(purple) vs puts (teal) for single stocks, and as you can see its quite a bit larger than the large December OPEX (note that Dec is a larger expiration than Jan on the Index side). The issue here is that we think these are predominantly long calls, which long stock hedges tied to them. The unwinding of these positions could spark some weakness to start next year. There will be plenty more on this idea as we push toward year-end.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4549 | $454 | $15788 | $385 | $1852 | $184 |

| SpotGamma Implied 1-Day Move: | 0.63% | 0.63% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.01% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4560 | $456 | $15740 | $386 | $1790 | $181 |

| Absolute Gamma Strike: | $4550 | $455 | $15825 | $385 | $1800 | $185 |

| SpotGamma Call Wall: | $4600 | $460 | $15825 | $400 | $1880 | $190 |

| SpotGamma Put Wall: | $4400 | $450 | $15000 | $380 | $1700 | $170 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4523 | $454 | $15166 | $384 | $1820 | $179 |

| Gamma Tilt: | 1.069 | 0.933 | 1.758 | 0.911 | 1.116 | 1.444 |

| SpotGamma Gamma Index™: | 0.513 | -0.08 | 0.099 | -0.04 | 0.012 | 0.072 |

| Gamma Notional (MM): | $285.587M | ‑$251.555M | $12.636M | ‑$175.034M | $12.881M | $816.075M |

| 25 Day Risk Reversal: | -0.02 | -0.023 | -0.018 | -0.02 | -0.005 | -0.013 |

| Call Volume: | 555.679K | 1.973M | 16.754K | 769.389K | 23.847K | 711.72K |

| Put Volume: | 889.84K | 2.042M | 17.488K | 1.042M | 26.245K | 737.525K |

| Call Open Interest: | 7.59M | 7.934M | 62.485K | 4.609M | 301.309K | 5.704M |

| Put Open Interest: | 13.548M | 14.502M | 73.734K | 8.482M | 470.315K | 8.474M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4600, 4550, 4500, 4400] |

| SPY Levels: [457, 456, 455, 450] |

| NDX Levels: [16000, 15825, 15800, 15500] |

| QQQ Levels: [390, 385, 380, 370] |

| SPX Combos: [(4750,94.21), (4727,79.72), (4704,78.67), (4699,98.65), (4681,75.92), (4677,90.49), (4654,83.88), (4649,98.42), (4640,91.39), (4631,84.03), (4627,97.33), (4622,88.96), (4613,80.49), (4608,85.82), (4604,93.95), (4599,99.80), (4590,94.29), (4581,83.63), (4577,91.05), (4572,88.40), (4558,86.67), (4554,78.66), (4549,87.43), (4545,87.53), (4540,94.61), (4536,89.76), (4531,95.66), (4527,86.49), (4522,90.32), (4513,95.69), (4504,93.11), (4499,90.09), (4490,79.72), (4481,73.87), (4477,84.58), (4472,82.38), (4449,88.41), (4399,95.70), (4349,82.79)] |

| SPY Combos: [458.65, 468.67, 463.66, 461.39] |

| NDX Combos: [15820, 16404, 16199, 15583] |

| QQQ Combos: [385.36, 394.25, 399.28, 381.11] |

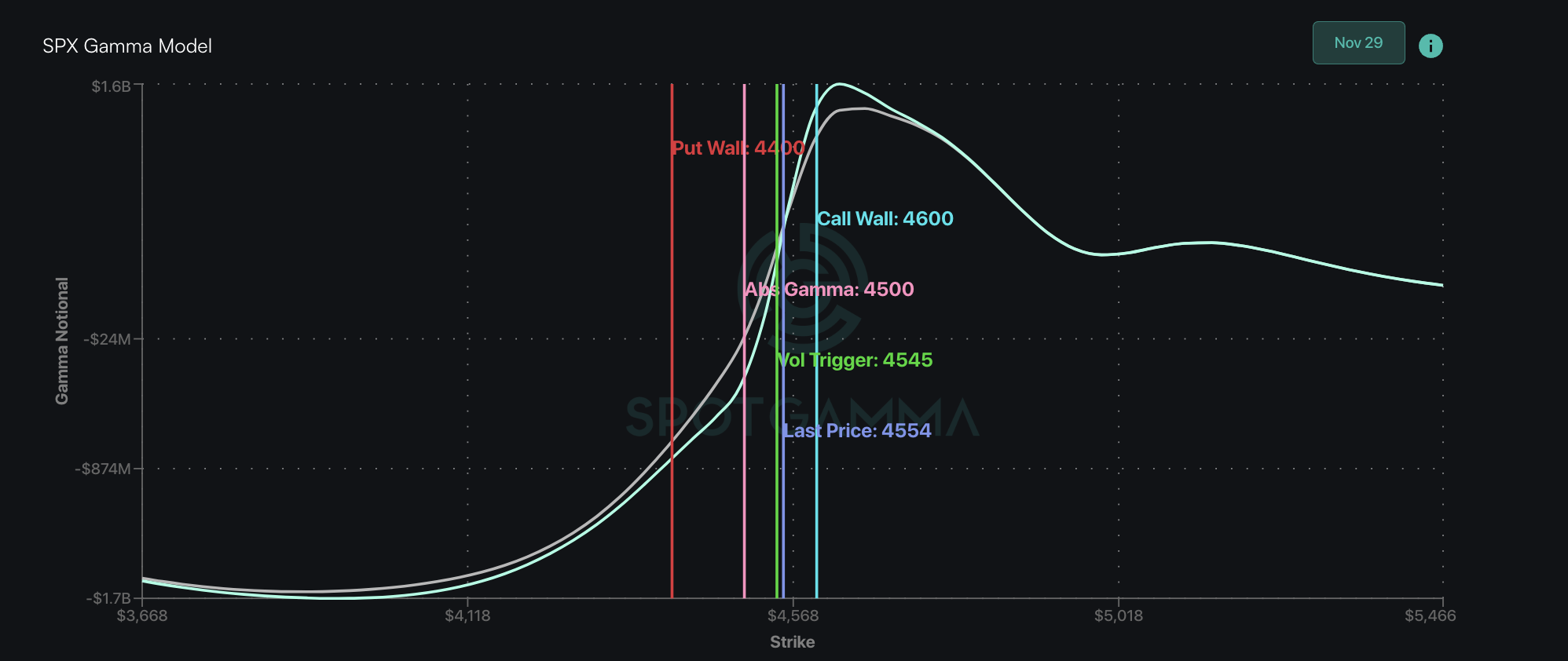

SPX Gamma Model

$3,663$4,113$4,563$5,013$5,459Strike-$1.8B-$829M$121M$1.9BGamma NotionalPut Wall: 4400Call Wall: 4600Abs Gamma: 4550Vol Trigger: 4560Last Price: 4549

View All Indices Charts

0 comentarios