Macro Theme:

Short Term SPX Resistance: 4,623

Short Term SPX Support: 4,550

SPX Risk Pivot Level: 4,500

Major SPX Range High/Resistance: 4,600

Major SPX Range Low/Support: 4,400

‣ We look for higher volatility this week (12/11), triggered by 12/12 CPI, 12/13 FOMC and into the huge 12/15 OPEX.*

‣ 4,600 is our current max upside target. If the Call Wall(s) roll higher it opens the door for higher S&P500 levels. Call Walls in QQQ/IWM are higher at 400/190, suggesting more upside is available.*

‣A break of 4,550 is our “risk off” level.*

‣ January OPEX is setting up to be a major event, with a risk that expiring large long call positions could pull markets lower into mid-January.*

*updated 12/11

Founder’s Note:

ES Futures are flat at 4,656. Key SG levels for the SPX are:

- Support: 4,600, 4,550

- Resistance: 4,608, 4,623, 4,641

- 1 Day Implied Range: 0.61%

For QQQ resistance is at 395 & 400. Support is at 388, then 385.

IWM resistance: 190. Support 185 & 179.

The S&P

Call Walls

have not rolled higher despite the SPX close at 4,600 on Friday. We therefore consider a move >4,600 as overbought until/unless the Call Wall(s) roll up. Major Call Wall resistance for QQQ & IWM remain higher at 400 & 190, respectively. As the QQQ/IWM have room to their

Call Walls

, we think long positions there should outperform S&P through mid-week.

There is also the IWM call skew that we touched on last week, and exists today. Below is 30DTE skew for IWM, and you can see that upside strikes have higher IV than at any point in the last +30 days (shaded cone). This implies there are heavier long call positions in IWM (vs relative short calls in QQQ/SPX), which could fuel relative volatility in the IWM’s as dealers chase small caps both higher, and lower. If you are bullish this means larger upside swings, but can also lead to larger relative downside, too.

While things are anticipated to be quiet today, traders are watching some very large treasury auctions midday. This feeds into CPI tomorrow, FOMC Wednesday, and the large OPEX on Friday.

This weeks large events are triggers for volatility, which we argue has been stifled by the large options positions set to expire on Friday. The result of this is what we have dubbed “terminal volatility”. Consider our SG 1-day implied range, which hit 55bps on Friday (61bps today). This is very near a low in our data, and is syncing with major implied volatility lows in markets (i.e. VIX ~12), as shown in the plot below.

Our implied move is gamma-derived, and the removal of large expiration positions with OPEX should lead to an increase in daily ranges. Further, the CPI/FOMC catalysts should spark a new directional move into year end. This all syncs up with markets that should get more active into the tail end of this week, through year end.

For now, 460SPY/4,600SPX is a beast of a level, and the top of our trading range. If/when this level rolls up, we would raise our top.

Our initial, short term risk-off level is now 4,550, but a break of that level likely leads to a test of 4,500. A break of <4,500 is our longer term risk-off signal.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4604 | $460 | $16084 | $392 | $1880 | $186 |

| SpotGamma Implied 1-Day Move: | 0.61% | 0.61% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.86% |

|

|

|

|

|

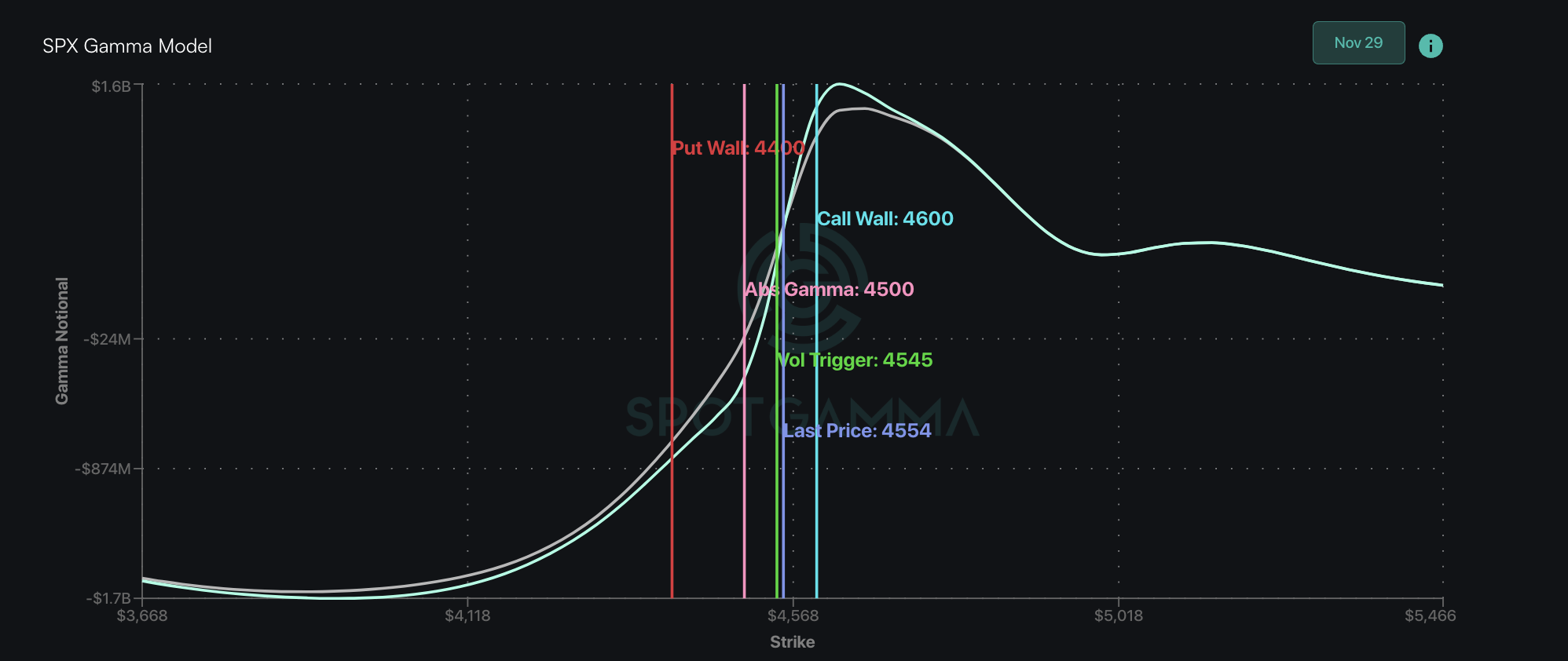

| SpotGamma Volatility Trigger™: | $4500 | $459 | $15740 | $383 | $1810 | $180 |

| Absolute Gamma Strike: | $4600 | $460 | $15825 | $390 | $1900 | $185 |

| SpotGamma Call Wall: | $4600 | $460 | $15825 | $400 | $1880 | $190 |

| SpotGamma Put Wall: | $4400 | $450 | $14000 | $360 | $1700 | $170 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4543 | $456 | $15220 | $388 | $1766 | $179 |

| Gamma Tilt: | 1.405 | 1.183 | 2.214 | 1.227 | 1.191 | 1.989 |

| SpotGamma Gamma Index™: | 2.509 | 0.160 | 0.141 | 0.080 | 0.017 | 0.127 |

| Gamma Notional (MM): | $827.919M | $634.767M | $15.852M | $452.84M | $8.303M | $1.321B |

| 25 Day Risk Reversal: | -0.02 | -0.024 | -0.02 | -0.023 | -0.007 | -0.01 |

| Call Volume: | 718.44K | 1.787M | 12.23K | 722.068K | 20.105K | 527.819K |

| Put Volume: | 1.14M | 2.217M | 14.712K | 979.502K | 42.652K | 555.903K |

| Call Open Interest: | 7.801M | 7.714M | 64.127K | 4.571M | 305.653K | 5.525M |

| Put Open Interest: | 14.139M | 14.149M | 77.173K | 8.416M | 488.075K | 8.415M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4650, 4600, 4550, 4500] |

| SPY Levels: [460, 459, 458, 455] |

| NDX Levels: [16000, 15900, 15825, 15500] |

| QQQ Levels: [395, 390, 385, 380] |

| SPX Combos: [(4798,96.62), (4775,85.68), (4752,98.47), (4724,92.80), (4719,74.36), (4701,99.83), (4692,78.18), (4678,88.03), (4673,96.83), (4669,80.88), (4664,81.25), (4660,83.04), (4655,82.26), (4650,99.83), (4646,75.82), (4641,96.98), (4637,83.40), (4632,94.19), (4623,99.81), (4618,92.65), (4614,93.85), (4609,95.43), (4604,97.33), (4600,99.91), (4581,76.02), (4540,72.72), (4526,78.71), (4517,97.37), (4503,73.52), (4498,90.83), (4475,83.19), (4448,91.06), (4402,95.77)] |

| SPY Combos: [461.73, 471.86, 466.79, 464.49] |

| NDX Combos: [15827, 16197, 16406, 16615] |

| QQQ Combos: [387.69, 397.1, 402.2, 392] |

SPX Gamma Model

Strike: $4,861

- Next Expiration: $1,096,486,526

- Current: $1,118,557,258

View All Indices Charts

0 comentarios