Macro Theme:

Short Term SPX Resistance: 4,800

Short Term SPX Support: 4,750

SPX Risk Pivot Level: 4,700

Major SPX Range High/Resistance: 4,800

Major SPX Range Low/Support: 4,500

‣ 4,800 is our current max upside target, due to a Call Wall shift on 12/19. Call Walls in QQQ/IWM are at 415/205.*

‣ A downside break of 4,700 is our interim “risk off” level.*

‣ SPX IV’s for the final week of 2023 are extremely low, and we warn traders of “jump risk” embedded with this (see note).*

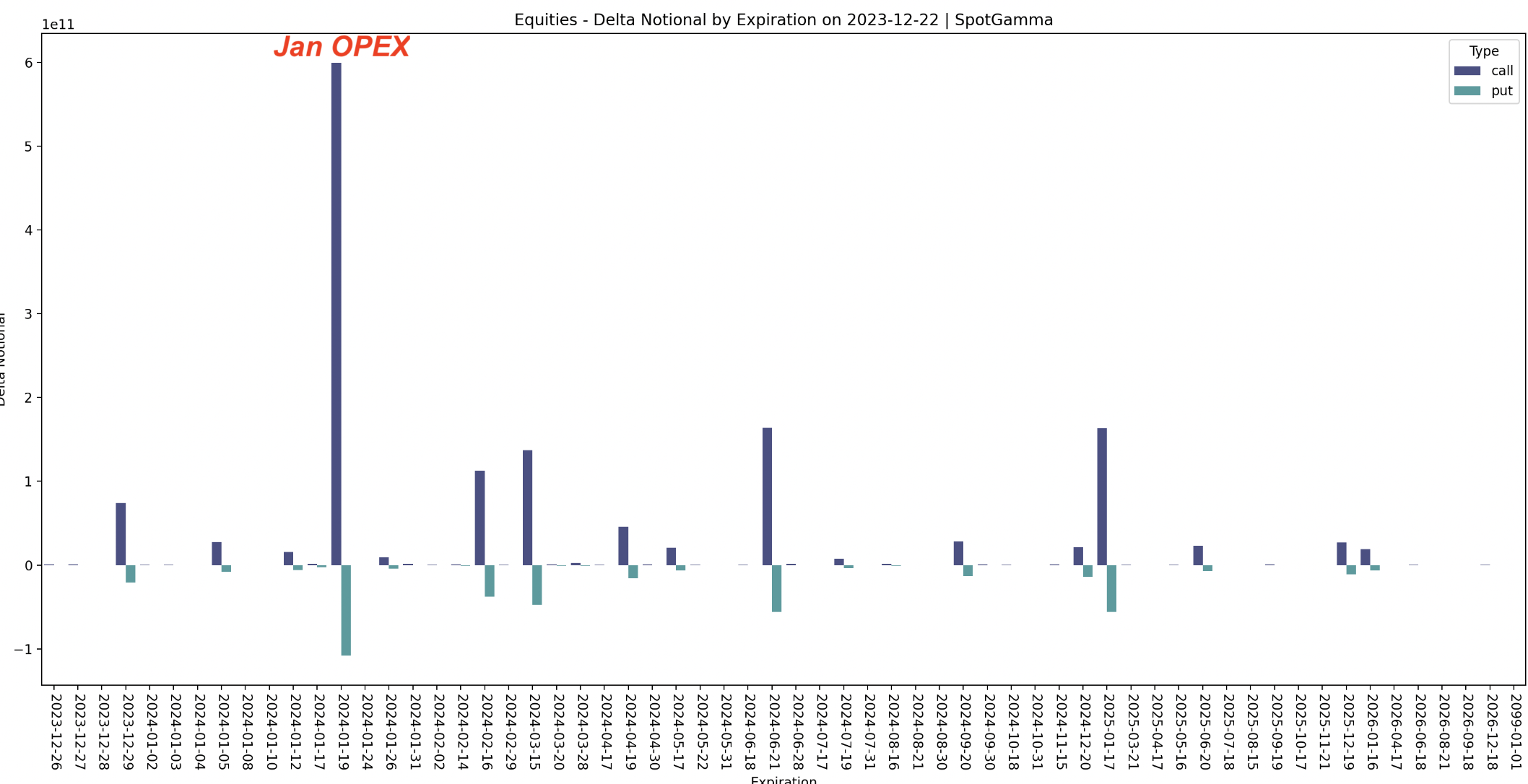

‣ January OPEX is setting up to be a major event, with a risk that expiring large long call positions could pull markets lower mid to late January.*

*updated 12/27

Founder’s Note:

ES Futures are flat at 4,824. Key SG levels for the SPX are:

- Support: 4,750, 4,700

- Resistance: 4,780, 4800, 4,815

- 1 Day Implied Range: 0.82%

For QQQ support is at 405 & 400, with resistance at 410, then the 415

Call Wall.

In IWM, support is at 200, 196 & 190, with resistance the 205

Call Wall.

The

Call Walls

have rolled higher in SPY & QQQ, to 480 & 415, respectively. These are bullish signs as they show positions building at higher strikes.

475 SPY – 4,800 continue on as the major levels for the S&P, with “grind up” being our favored scenario.

There was a bullish tilt to equities yesterday, which led to +40bps of gains in S&P, +60bps in Nasdaq, but +130bps in Russell. This outperformance/higher relative volatility in small caps was seen in yesterday’s gamma levels, as the IWM’s had more space to its 205

Call Wall

vs the tighter walls in the S&P and QQQ’s. With IWM now only ~50bps to its

Call Wall

, those excess gains may pare back.

We also saw the VIX contract to 13, which is/was more of its “fair value” level (again, see yesterday’s note), but should the S&P continue to drag along this week IV/VIX pressure should remain. This helps to keep a light vanna tailwind to equities, but the risk/reward for those selling short dated SPX options is terrible. For example, today’s SPX straddle is trading for just $15.75, or 33bps with an IV of 13%!

IV’s at these levels carry risk, as a very simple position shift from a large entity, or buyer of 0DTE options could force volatility short covering, which in turn could lead to a jump in equity prices. This, in our view, is what led to the -1.6% sell-off last Wednesday. Therefore, similar to what we wrote yesterday, maybe you don’t want to bother betting on a major jump in volatility this week, but there is just no value in betting against it.

Zooming out, as equities move higher it increases the value of call positions tied to January expiration. While last weeks December record Index expiration did not serve up volatility last week, this upcoming January expiration is heavy with single stocks, as shown below. We believe that these call positions (purple bars) could be a driver of volatility as we approach Jan 19th OPEX, due to the fact that these deep in-the-money long call positions may require large single stock hedges.

In regards to that record Dec OPEX, historically we’ve looked for call heavy expirations to result in equity weakness in the days after expiration. Some preliminary SPX data studies show that there was an edge in playing this mean reversion in 2020 & 2021, but that relationship (lots of calls expiring leading to SPX weakness) started to break down in 2022. We have some theories as to why this relationship changed, with our current focus being on 0DTE. The idea being that, for dealers, any forecasted Index post-OPEX exposures could be hedged out using SPX 0 and/or 1DTE options, resulting in less need to adjust hedges on the Monday following expiration.

Hedging the OPEX exposure could work well in SPX options as they are European style, cash settled, with a Monday expiration. For example, if its expiration Friday and I suspect that I have some SPX long delta exposure, I can just buy some of today’s SPX calls and/or Monday’s calls which limits my need to buy or sell futures. This implies less impact to the underlying market.

For single stocks, you only have American style expirations that land each Friday. In theory, a dealer may not know how many shares of stock they hold until Monday, when everything has been assigned and cleared. This means that dealers could find themselves long or short shares of various individual stocks post-OPEX, with less efficient ways to plan and hedge for that exposure. Therefore, as a dealer, if I enter Monday with a lot of say TSLA, then Ill have some TSLA stock to trade.

We are working on a more comprehensive study here, and will present those results in early January. The takeaway is that there are reasons for this holiday calm to break as we enter 2024. For more on this, you can read about last January’s expiration here.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4774 | $475 | $16878 | $410 | $2059 | $204 |

| SpotGamma Implied 1-Day Move: | 0.82% | 0.82% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.25% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4745 | $474 | $16425 | $409 | $1850 | $194 |

| Absolute Gamma Strike: | $4800 | $475 | $16650 | $410 | $2000 | $205 |

| SpotGamma Call Wall: | $4800 | $480 | $16650 | $415 | $2005 | $205 |

| SpotGamma Put Wall: | $4500 | $450 | $15800 | $360 | $1800 | $170 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4711 | $471 | $15614 | $407 | $1948 | $196 |

| Gamma Tilt: | 1.426 | 1.255 | 1.996 | 1.19 | 1.246 | 1.828 |

| SpotGamma Gamma Index™: | 2.054 | 0.233 | 0.080 | 0.064 | 0.011 | 0.081 |

| Gamma Notional (MM): | $752.366M | $905.481M | $9.373M | $299.143M | $10.469M | $776.476M |

| 25 Delta Risk Reversal: | -0.02 | -0.009 | -0.018 | -0.019 | -0.01 | -0.00 |

| Call Volume: | 429.846K | 1.217M | 15.04K | 492.735K | 21.649K | 502.205K |

| Put Volume: | 764.539K | 1.752M | 14.513K | 686.592K | 23.277K | 513.786K |

| Call Open Interest: | 6.292M | 6.627M | 49.368K | 3.652M | 204.715K | 4.39M |

| Put Open Interest: | 11.953M | 11.993M | 55.697K | 6.816M | 364.112K | 7.199M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 4800, 4750, 4700] |

| SPY Levels: [480, 476, 475, 474] |

| NDX Levels: [17000, 16650, 16500, 16000] |

| QQQ Levels: [411, 410, 409, 400] |

| SPX Combos: [(4999,99.20), (4951,91.27), (4923,83.12), (4899,98.40), (4880,75.40), (4875,90.35), (4861,76.83), (4851,99.21), (4846,72.13), (4842,81.23), (4837,77.56), (4832,90.95), (4827,98.07), (4818,98.33), (4813,81.04), (4808,94.88), (4803,83.41), (4799,99.86), (4794,93.71), (4789,97.79), (4784,88.65), (4780,96.43), (4775,92.63), (4770,90.49), (4751,93.49), (4746,82.37), (4708,78.19), (4698,87.19), (4598,86.61), (4550,78.63)] |

| SPY Combos: [480.56, 485.32, 490.55, 481.99] |

| NDX Combos: [16642, 17047, 17250, 16845] |

| QQQ Combos: [407.34, 412.26, 422.12, 417.19] |

0 comentarios