Macro Theme:

Short Term SPX Resistance: 5,015 (SPY 500)

Short Term SPX Support: 4,9700 (SPY 495)

SPX Risk Pivot Level: 4,900

Major SPX Range High/Resistance: 5,000

Major SPX Range Low/Support: 4,800

‣ Volatility should continue to contract into 2/14 VIX expiration – 2/16 equity expiration. Major downside “risk-off” occurs on a break of 4,900, which is our first major support. 5,000 is major resistance.*

*updated 2/7

Founder’s Note:

ES Futures are flat to 5,010. NQ futures are flat at 17,843.

Key SG levels for the SPX are:

- Support: 4,968, 4,950

- Resistance: 5,000, 5015

- 1 Day Implied Range: 0.81%

For QQQ:

- Support: 430, 425

- Resistance: 440

Call Wall

IWM:

- Support: 190, 187

- Resistance: 196, 200

Call Wall

The S&P

Call Walls

have held at SPX 5,000 / SPY 500 (SPX 5,015 equivalent) which remains the top of our trading range, and heavy resistance. We will continue to view this as major resistance until/unless the

Call Walls

roll higher.

Further, the biggest gamma strike on the board is now the SPY 500 level, which added ~$300mm in absolute

call gamma

yesterday. SPY 495 (SPX 4,970) is support for today, followed by 4,950.

With yesterday’s rally, vols sank even lower. Here we see that SPX ATM IV’s are near lows going back over the past 60 days (i.e. bottom of the shaded cone). There is a very mild 1/2 vol pt boost for next weeks 2/13 CPI, but outside of that, volatility markets are pricing clear sailing ahead. The earliest window we’ve highlighted for change to current market dynamics is next weeks 2/14 VIX exp – 2/16 OPEX.

Despite the lackluster index vol, the chase remains in single stocks – particularly tech. Here we have produced a Skew Rank, which shows us how high call IV is relative to put IV. As you can see, semis (pink), several Mag 7’s (blue), and major ETF’s (green) have high skews relative to the last year of data. This implies there is long call demand and/or put selling in these names. Keep in mind that these percentile rankings are unique to each stock/ETF, and so SPY having a high rank is relative to historical SPY data, not that SPY skew is higher than NVDA.

Long call demand infers negative gamma, which means dealers/MM’s have to buy stock into higher stock prices. This creates a large momentum trade, and as calls decay/expire and/or IV subsides, the upward stock momentum can flip.

This period reminds us a lot of June ’23, wherein there were these heavy call skews due to the AI revolution. As you can see, there was a brief period of consolidation after June OPEX as call positions shuffled, and we are on watch for a similar reversion after Feb OPEX, too. Until next week, we see little to change the prevailing winds.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4995 | $498 | $17755 | $431 | $1950 | $193 |

| SpotGamma Implied 1-Day Move: | 0.81% | 0.81% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.86% |

|

|

|

|

|

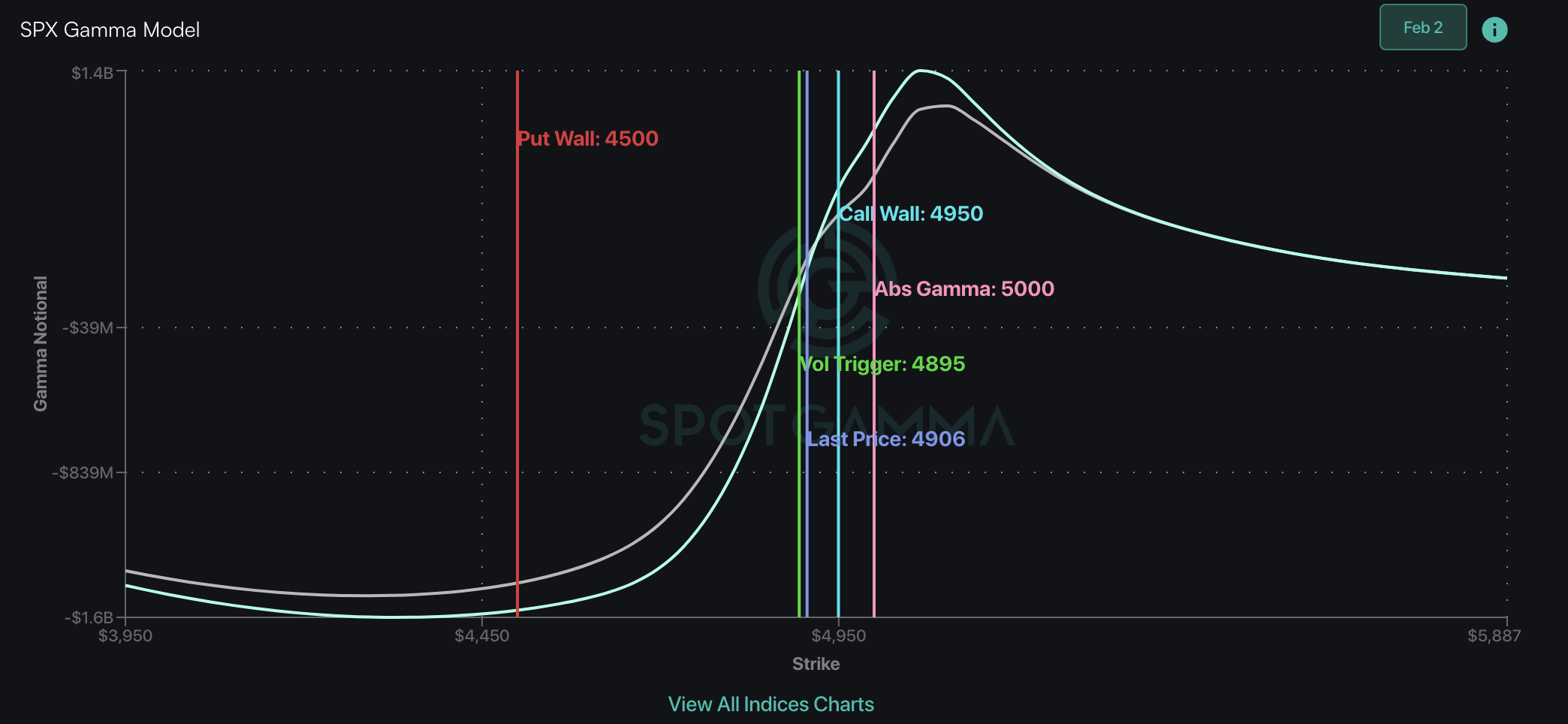

| SpotGamma Volatility Trigger™: | $4895 | $492 | $16970 | $428 | $1915 | $192 |

| Absolute Gamma Strike: | $5000 | $500 | $17100 | $430 | $2000 | $190 |

| SpotGamma Call Wall: | $5000 | $500 | $17100 | $440 | $1920 | $200 |

| SpotGamma Put Wall: | $4500 | $470 | $16000 | $415 | $1800 | $187 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4892 | $493 | $16550 | $428 | $1975 | $196 |

| Gamma Tilt: | 1.411 | 1.214 | 1.97 | 1.20 | 0.886 | 0.739 |

| SpotGamma Gamma Index™: | 2.263 | 0.192 | 0.094 | 0.078 | -0.011 | -0.06 |

| Gamma Notional (MM): | $647.569M | $561.186M | $10.133M | $350.834M | ‑$9.722M | ‑$556.933M |

| 25 Delta Risk Reversal: | -0.024 | -0.013 | -0.02 | -0.013 | -0.016 | -0.013 |

| Call Volume: | 460.089K | 2.123M | 11.963K | 881.002K | 13.30K | 432.313K |

| Put Volume: | 1.031M | 3.112M | 11.743K | 1.113M | 23.601K | 639.80K |

| Call Open Interest: | 6.408M | 6.628M | 54.787K | 4.235M | 250.239K | 4.569M |

| Put Open Interest: | 13.163M | 15.509M | 70.935K | 8.145M | 448.351K | 8.154M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 4950, 4900, 4800] |

| SPY Levels: [500, 495, 498, 497] |

| NDX Levels: [17100, 17600, 17000, 17625] |

| QQQ Levels: [430, 415, 425, 440] |

| SPX Combos: [(5200,97.77), (5175,74.82), (5150,93.37), (5125,87.24), (5115,84.36), (5100,99.33), (5080,76.89), (5075,93.61), (5065,81.01), (5055,79.60), (5050,99.21), (5040,80.68), (5035,87.44), (5030,85.60), (5025,99.31), (5020,83.83), (5015,98.97), (5010,91.76), (5005,85.08), (5000,99.97), (4990,82.20), (4975,96.32), (4955,78.79), (4950,95.37), (4900,87.17), (4850,77.55)] |

| SPY Combos: [502.93, 512.89, 497.94, 507.91] |

| NDX Combos: [18092, 17879, 17844, 17098] |

| QQQ Combos: [420.73, 444.94, 434.99, 419.86] |

SPX Gamma Model

Strike: $5,435

- Next Expiration: $475,437,936

- Current: $475,885,311

View All Indices Charts

0 comentarios