Macro Theme:

Short Term SPX Resistance: 5,260 (SPY 525 Call Wall)

Short Term SPX Support: 5,200

SPX Risk Pivot Level: 5,188

Major SPX Range High/Resistance: (5,260 SPY 525 Call Wall)

Major SPX Range Low/Support: 5,000

‣ 5,260 is the upside target.*

‣ 5,188 is critical support, up from 5,100 on 3/20.*

‣ 5,300 is our target into March month end.*

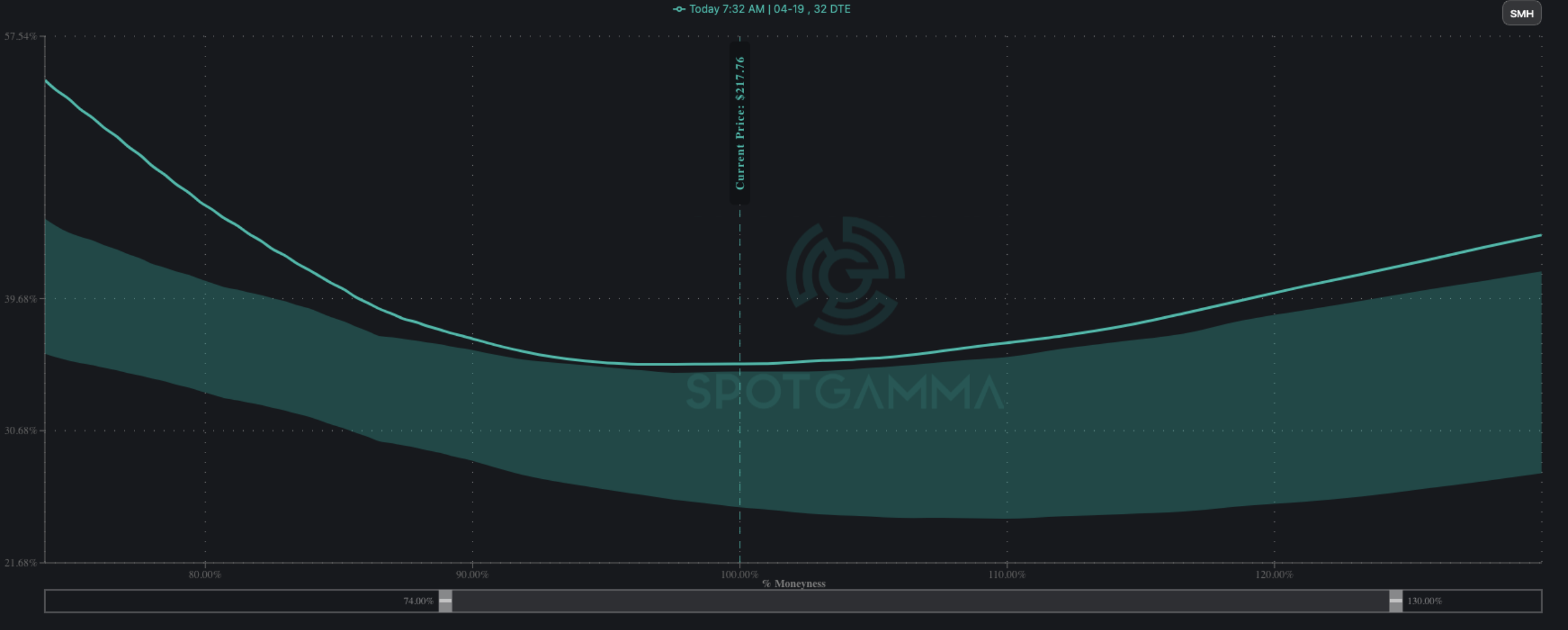

‣ NVDA’s event on 3/18 failed to renew the call bid in the chip sector, likely triggering longer term consolidation in the space (ref: 216 in SMH).**

‣ Mag7 ex-NVDA is our preferred way to play longs in the equities going forward, as their low call skews may attract bids, which could restart these stocks higher.**

*updated 3/21

**updated 3/19

Founder’s Note:

ES are +30bps to 5,300. NQ futures are +70bps to 18,615.

Key SG levels for the SPX are:

- Support: 5,210, 5,200, 5,188

- Resistance: 5,250 (SPX

Call Wall

), 5,260 (SPY 525

Call Wall

)

- 1 Day Implied Range: 0.74%

For QQQ:

- Support: 440, 435

- Resistance: 445, 450

Call Wall

IWM:

- Support: 200

- Resistance: 210

Call Wall

There is a TBill auction at 11:30AM ET, and a 10year TIPS auction at 1pm ET.

TLDR: 5,250 is our current overhead target/max upside level, with 5,188 our new “risk off” level. Per our recent views, we’d anticipate an eventual move to 5,300 by months-end, the prerequisite being a

Call Wall

roll to 5,300. Further, there is no signal that the options market is trying to fade this move, either, as vols were crushed yesterday.

Equities (NQ candles, ES yellow), and other risk proxies like BTC (orange) and gold (blue), shot out of yesterday’s FOMC like a cannon. This brought record equity index price levels a roll of the SPX & SPY

Call Walls

to 5,250/525. Further we note Micron up 17% after earnings, adding a boost to the chip sector.

Forward Volatility (i.e. IV) was absolutely pummeled, with the VIX at 1-month lows just <13. You can also see the IV deflation via the SPX term structure, below, which compares Tuesday’s closing IV’s (gray) vs this mornings (green). As you can see we are at fresh multi-month lows, which is denoted by current levels being below the shaded gray cone, which covers the 10th to 90th %ile IV range over the last 60 days.

The left tail was pressed to new relative lows, as shown in 1-month skew (left red arrow). As you can see, current downside strike IV’s are now relatively lower that at any point over the last few months. Considering how uber-bullish the market has been YTD, that’s saying something!

Conversely, the right tail holds “average” IV levels (right red arrow). Taken together this is, on net, a “sell put, buy call” position.

Lastly: We’ve felt that a bullish move in equities out of FOMC would be led by the Mag7 names, specifically AAPL, GOOGL, META, AMZN, MSFT, and that the chip sector would cool off. This morning we see the DOJ looking into AAPL (-1% premarket), and MU posting a great ER number (+17% premarket). This has the SMH up nearly 3% premarket, which may obviously re-ignite chip sector call skews. We’re not ready to throw in the towel on this call, but regardless if the chip sector call skew turns back up its another major “risk on” proxy. It does feel like Powell has just fed the rampant speculators a bunch of sugar and tossed them in front of their buy buttons…

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5224 | $520 | $18240 | $443 | $2074 | $206 |

| SpotGamma Implied 1-Day Move: | 0.74% | 0.74% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.24% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5190 | $519 | $17750 | $443 | $2025 | $202 |

| Absolute Gamma Strike: | $5000 | $515 | $17900 | $440 | $2100 | $200 |

| SpotGamma Call Wall: | $5250 | $525 | $17900 | $450 | $2040 | $210 |

| SpotGamma Put Wall: | $5000 | $512 | $17500 | $430 | $1900 | $200 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5155 | $519 | $17390 | $443 | $2085 | $204 |

| Gamma Tilt: | 0.987 | 0.624 | 1.464 | 0.656 | 0.787 | 0.725 |

| SpotGamma Gamma Index™: | -0.08 | -0.512 | 0.044 | -0.172 | -0.016 | -0.054 |

| Gamma Notional (MM): | $533.256M | $212.398M | $4.567M | $78.444M | ‑$3.73M | $207.794M |

| 25 Delta Risk Reversal: | -0.019 | -0.007 | -0.026 | -0.017 | -0.003 | -0.009 |

| Call Volume: | 354.553K | 1.257M | 7.403K | 672.775K | 10.524K | 318.155K |

| Put Volume: | 741.383K | 1.946M | 8.045K | 1.072M | 16.81K | 601.469K |

| Call Open Interest: | 5.829M | 5.744M | 37.435K | 3.519M | 201.931K | 3.911M |

| Put Open Interest: | 12.47M | 14.902M | 55.781K | 6.781M | 371.018K | 7.232M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5200, 5150, 5100] |

| SPY Levels: [515, 520, 510, 512] |

| NDX Levels: [17900, 18000, 18500, 17500] |

| QQQ Levels: [440, 430, 435, 439] |

| SPX Combos: [(5449,97.77), (5423,74.15), (5397,92.12), (5371,87.18), (5345,99.07), (5340,77.17), (5329,73.57), (5324,91.45), (5319,91.43), (5308,78.75), (5298,99.61), (5287,92.56), (5277,92.69), (5272,94.94), (5266,86.56), (5246,95.53), (5240,72.40), (5235,86.44), (5225,89.46), (5219,87.79), (5209,87.91), (5204,72.20), (5198,87.78), (5193,90.81), (5188,97.16), (5178,94.78), (5172,86.59), (5167,93.62), (5157,92.22), (5151,80.24), (5146,91.49), (5136,88.54), (5131,74.12), (5125,88.37), (5120,74.56), (5115,79.11), (5094,79.72), (5073,72.30), (5063,83.35), (5057,76.82), (5047,96.13), (4995,84.22)] |

| SPY Combos: [527.77, 532.45, 542.86, 516.84] |

| NDX Combos: [18112, 17875, 17474, 18094] |

| QQQ Combos: [440.66, 434.89, 425.13, 440.22] |

0 comentarios