Macro Theme:

Short Term SPX Resistance: 5,100

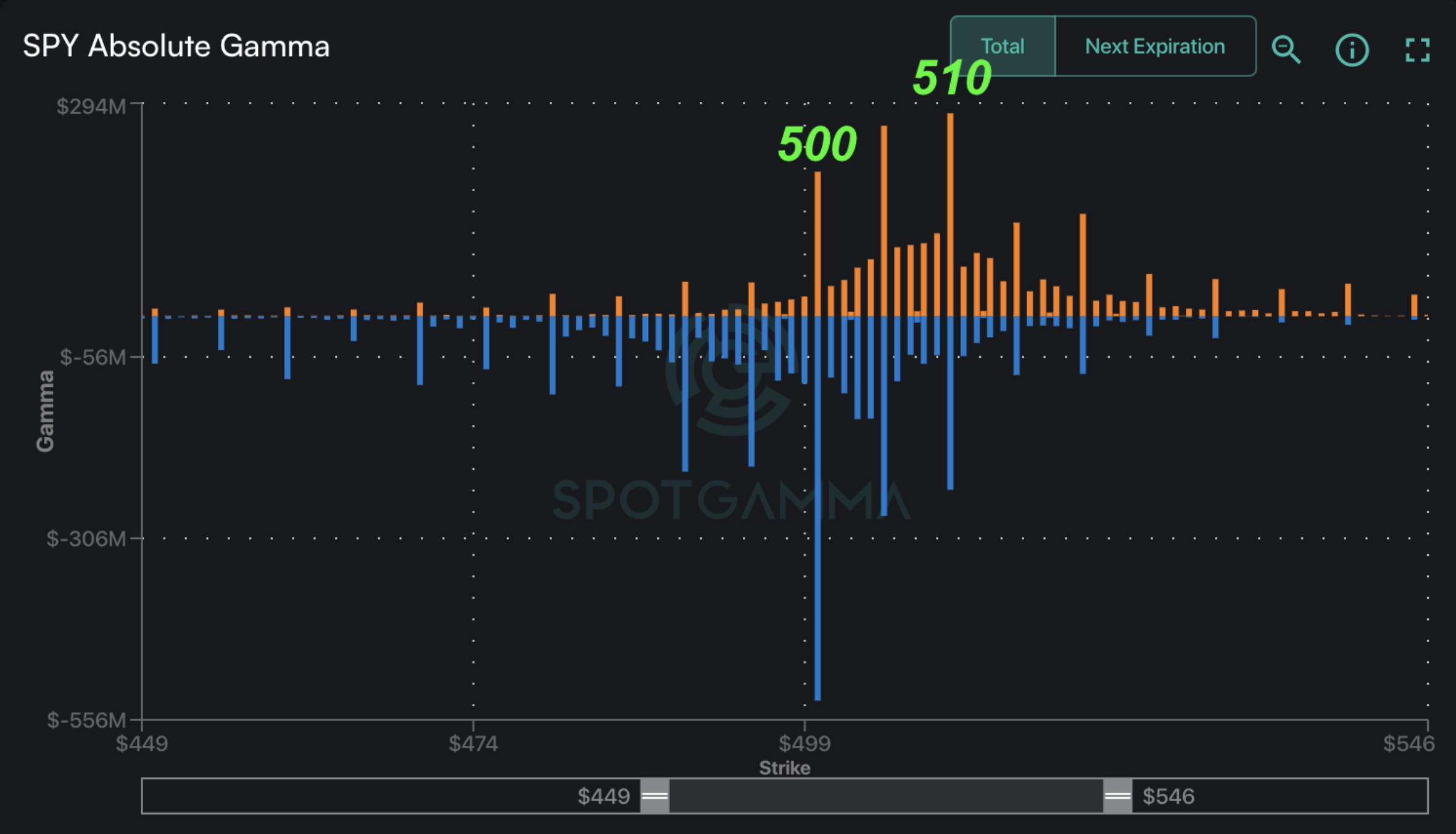

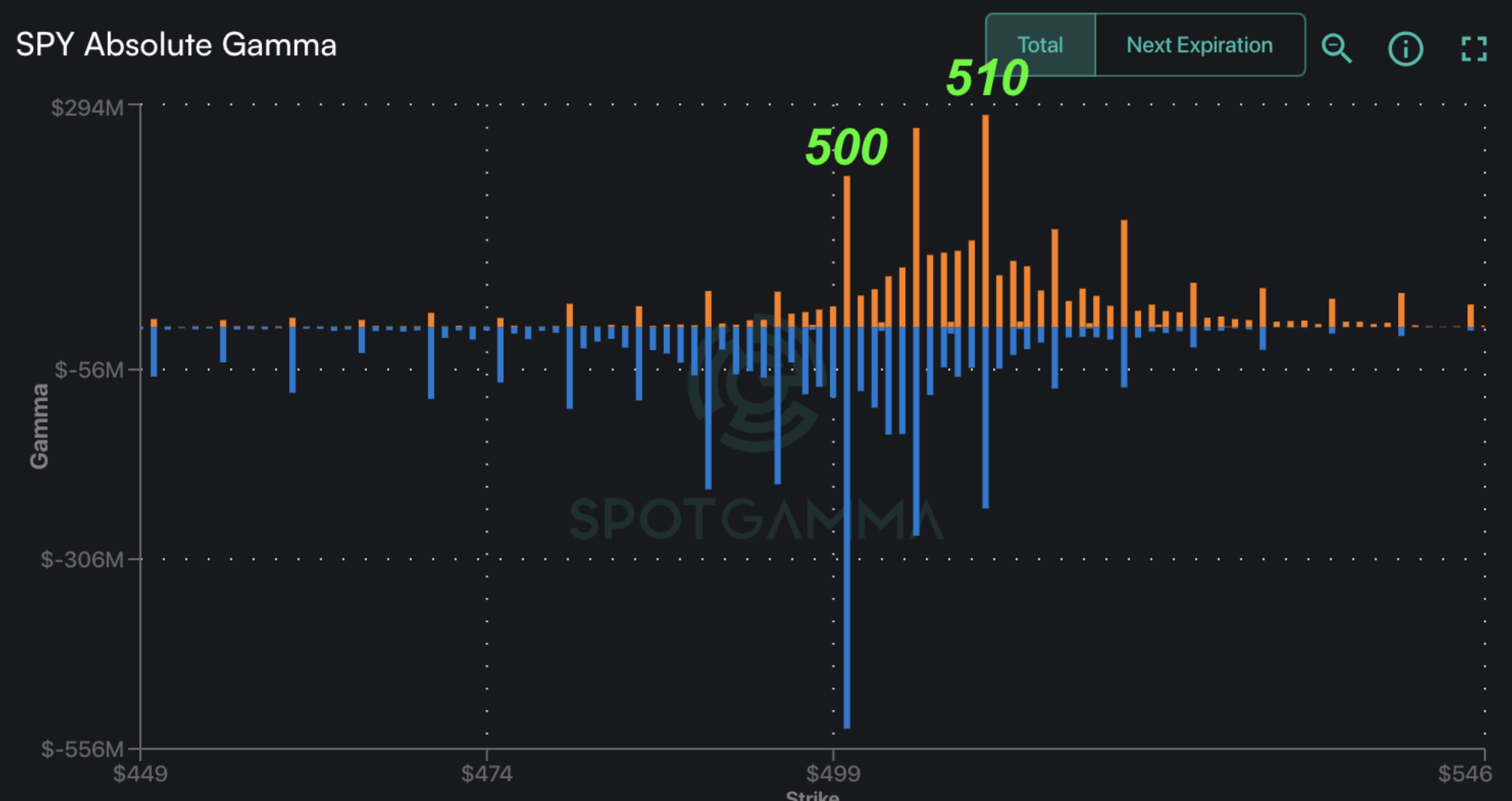

Short Term SPX Support: 5,020 (SPY 510)

SPX Risk Pivot Level: 5,000

Major SPX Range High/Resistance: 5,100

Major SPX Range Low/Support: 4,800

‣ 5,100-5,116 (SPY 510) is the likely high into next weeks 5/1 FOMC. We think 4,975 – 5,000 will remain as major support in through FOMC.*

*updated 4/24

Founder’s Note:

ES +25bps to 5,118. NQ futures +60bps to 17,722.

Key SG levels for the SPX are:

- Support: 5,075, 5,050

- Resistance: 5,100, 5,116 (SPY 510)

- 1 Day Implied Range: 0.62%

For QQQ:

- Support: 425, 420

- Resistance: 426, 430

IWM:

- Support: 195

- Resistance: 200, 202, 205

5 Year Note auction 1:00PM ET

TSLA +12% to 162 after ER

META reports tonight, with an implied move of 7%

The equity market rebound continued yesterday, with futures playing the S&P within striking distance of major 5,100 SPX – 5,115 (SPY 510) resistance. We think realized vol will now start to contract as the market digests gains, with focus also shifting to single stock plays due to earnings. From our perspective, SPX is now “fairly valued” around 5,100, as vanna flows are reduced, and positive gamma is building up around at-the-money strikes.

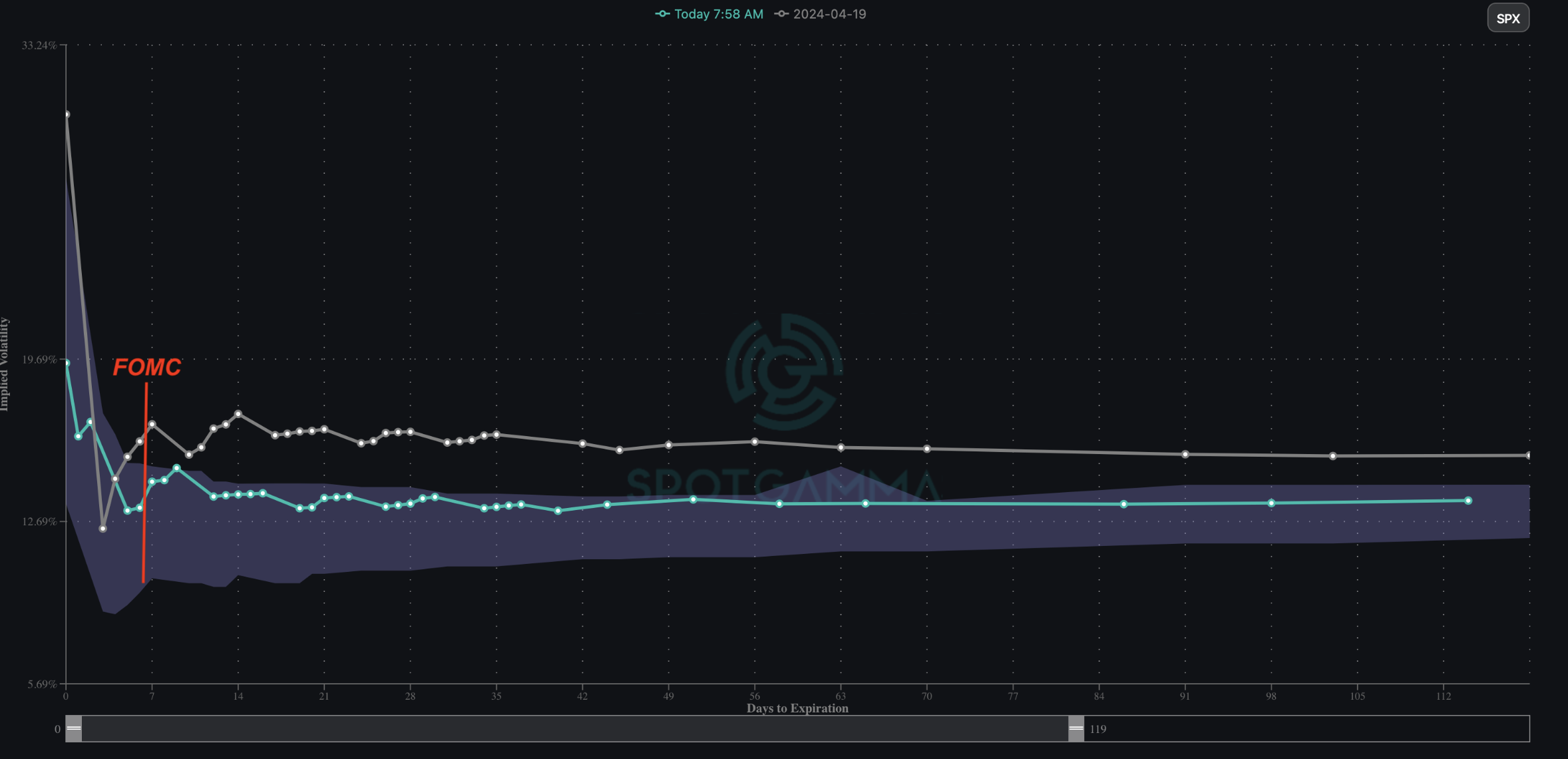

Vols also fell further, with Friday’s SPX term structure (gray) going from above the 90-day statistical range (gray cone) to a more “average” reading this AM (teal). While 0-5 DTE contracts may see a further vol contraction, we think its unlikely that longer dated IV shifts much further due to next Wed FOMC (5/1).

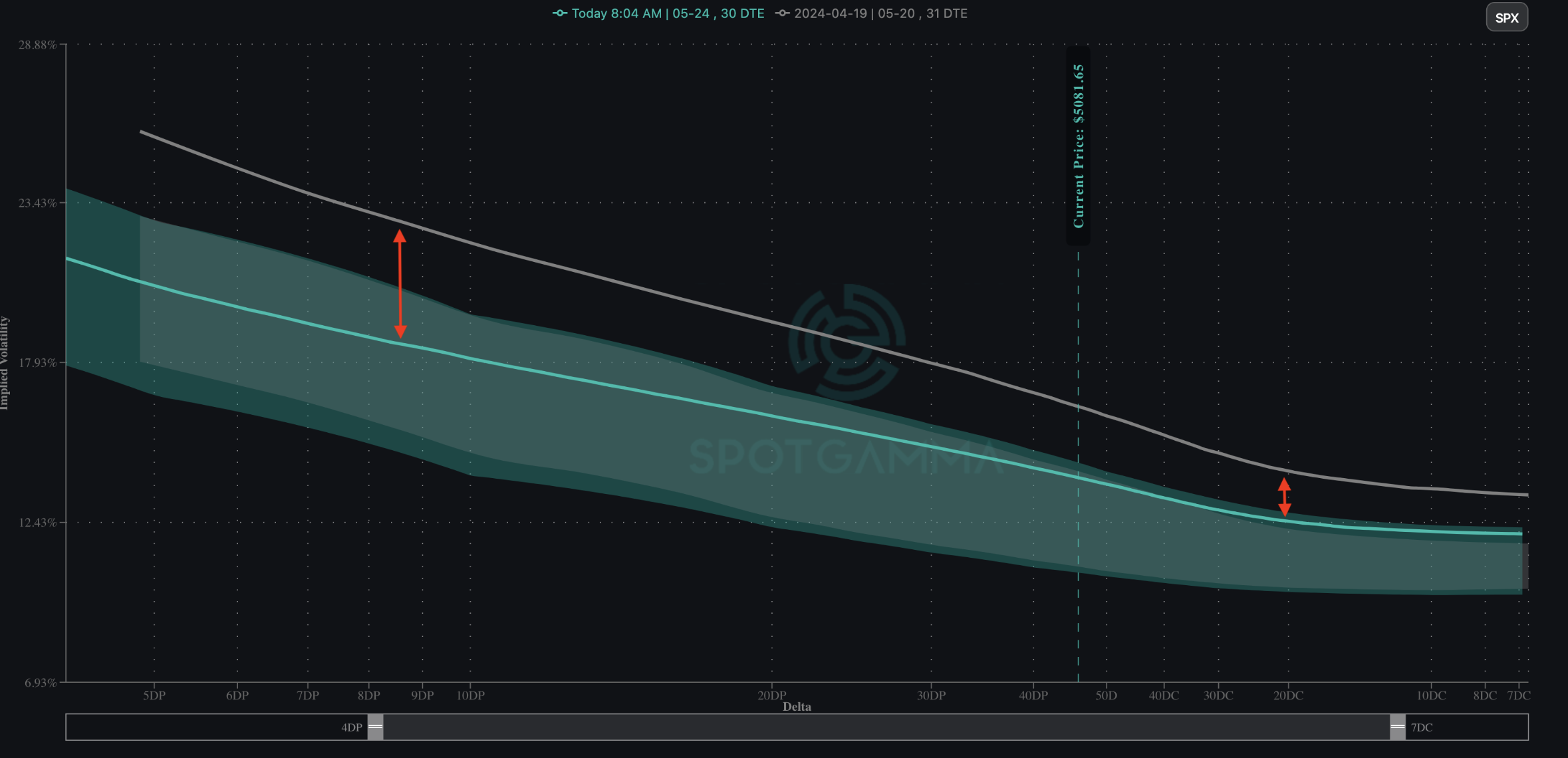

What has been particularly pummeled is skew, with out-of-the-money puts being asymmetrically crushed. You can see this in the SPX 1-month skew, with those lower strike put options dropping much further relative to at-the-money (Friday in gray, this morning in teal). This is hedging demand (and costs to hedge) falling sharply, as traders have suddenly

pivot

ed away from “risk-off”.

You may recall that on Monday we referred to vol as rich…well, now it seems fairly valued.

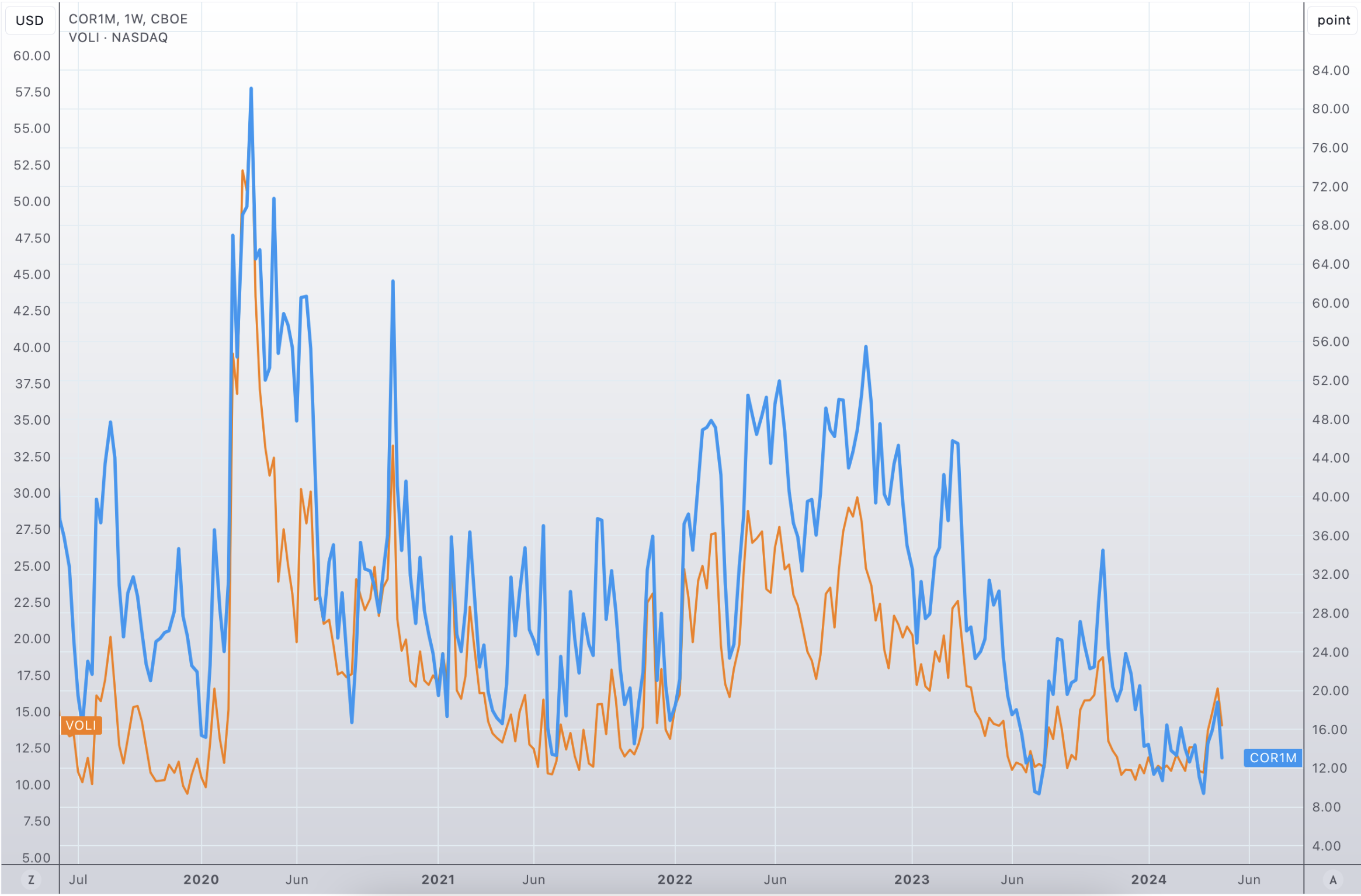

Taking a brief review of last weeks selling, it was clear that single stocks were moving violently lower relative to SPX. And, while SPX was weak, realized vol never really jumped. Instead, SPX had a lengthy, near-record string of daily declines, resulting in a total MTD 4-5% decline. From a volatility perspective, this single-stock jump-down vs index drift-down was like we had seen from the start of ’24, only single stocks were earlier moving violently higher relative to the SPX grind up.

The argument that we made, which seems to have merit today, is that all those reflexive flows that built up related to the chip-sector-chase/0DTE/systematic call overwriting were, last week, unwinding. The result of this is that metrics like record low correlation & record low realized vol started to reverse, and SPX went from massive strings of up-days to a long series of down-days.

Said another way, the selling narrative was geopolitics & rates, but we think those were mainly a trigger for overcrowded trades to unwind.

Since stocks started bouncing on Monday, we now see both correlation (blue) and implied vol (orange) reversing sharply back to lows as traders buy-the-dip in things that worked so well earlier this year.

As noted above, this leaves us now “fairly valued” on the Index side, having recovered from oversold levels, and heading into FOMC and major earnings announcements. We think this will setup a clear directional trade over the next week, and into May OPEX. We may very well end up locked back into the flows that dominated the market earlier this year, particularly if tech earnings are strong, and traders come out of May FOMC with expectations of a cut coming later this summer.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5070 | $505 | $17471 | $425 | $2002 | $198 |

| SpotGamma Implied 1-Day Move: | 0.62% | 0.62% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5075 | $505 | $17225 | $426 | $2050 | $202 |

| Absolute Gamma Strike: | $5000 | $500 | $17250 | $420 | $2050 | $200 |

| SpotGamma Call Wall: | $5100 | $520 | $17250 | $430 | $2200 | $220 |

| SpotGamma Put Wall: | $5000 | $500 | $16000 | $420 | $1960 | $195 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5079 | $508 | $17296 | $427 | $2043 | $206 |

| Gamma Tilt: | 0.896 | 0.694 | 1.151 | 0.731 | 0.720 | 0.495 |

| SpotGamma Gamma Index™: | -1.254 | -0.348 | 0.034 | -0.116 | -0.036 | -0.113 |

| Gamma Notional (MM): | ‑$450.711M | ‑$1.033B | $3.594M | ‑$457.882M | ‑$34.874M | ‑$985.504M |

| 25 Delta Risk Reversal: | -0.026 | 0.00 | -0.032 | -0.006 | -0.022 | 0.002 |

| Call Volume: | 656.631K | 1.477M | 21.72K | 2.277M | 20.929K | 381.18K |

| Put Volume: | 1.382M | 1.993M | 15.978K | 2.973M | 27.079K | 823.328K |

| Call Open Interest: | 10.022M | 6.28M | 60.834K | 3.945M | 310.724K | 3.818M |

| Put Open Interest: | 19.774M | 12.895M | 76.208K | 6.189M | 540.752K | 7.979M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5200, 5150] |

| SPY Levels: [500, 505, 510, 490] |

| NDX Levels: [17250, 17500, 18000, 17600] |

| QQQ Levels: [420, 430, 425, 415] |

| SPX Combos: [(5299,97.81), (5278,86.25), (5253,96.26), (5228,84.31), (5202,97.36), (5177,87.08), (5172,72.29), (5152,83.87), (5147,70.97), (5121,84.49), (5116,92.60), (5111,90.91), (5106,84.46), (5101,99.89), (5096,99.46), (5086,75.17), (5050,90.37), (5045,75.12), (5040,99.28), (5035,98.72), (5030,71.38), (5025,96.36), (5015,93.18), (5000,99.33), (4994,79.04), (4989,76.32), (4984,82.45), (4974,96.99), (4969,73.49), (4964,85.38), (4959,71.38), (4954,70.93), (4949,97.94), (4934,75.03), (4929,91.85), (4924,76.98), (4913,87.04), (4903,99.29), (4878,95.26), (4863,78.12), (4853,97.31), (4827,90.88)] |

| SPY Combos: [502.08, 494.5, 499.55, 504.61] |

| NDX Combos: [17244, 17262, 17052, 16842] |

| QQQ Combos: [421.31, 425.99, 416.21, 406.01] |

0 comentarios