Macro Theme:

Short Term SPX Resistance: 5,200 (SPX Call Wall)

Short Term SPX Support: 5,150

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 (SPX Call Wall)

Major SPX Range Low/Support: 4,800

- For the week of 5/5 we see few catalysts, which should lead to contracting volatility, and upside equity drift.

- 5,200 – 5,215 is major resistance into OPEX week.

- 5,165 (SPY 515) likely remains a key pivot level (support/resistance area) through 5/10

- On a larger time frame, 5,100 is short term support. A break <5,100 pushes the S&P into a more fluid zone, wherein 5,000 is major, long term support.

- 5/22 NVDA earnings, which follows 5/17 OPEX, should be a major turning point for equities.

*updated 5/7

Founder’s Note:

ES futures are flat to 5,213. NQ futures are flat to 18,195.

Key SG levels for the SPX are:

- Support: 5,165, 5,150, 5,100

- Resistance: 5,200, 5,208

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 440, 437, 435

- Resistance: 445

IWM:

- Support: 202, 200

- Resistance: 210

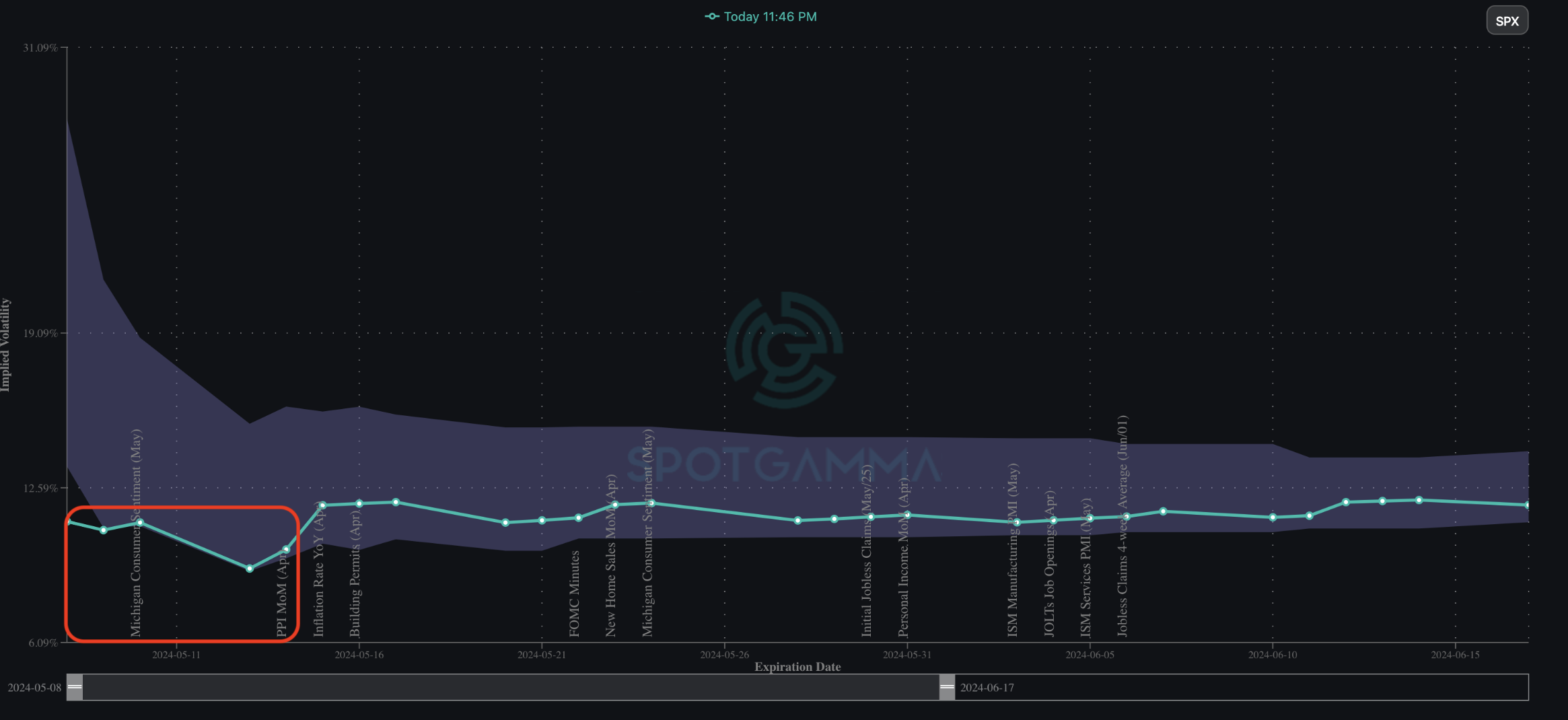

Equity indices were in grind mode yesterday, which is producing 90-day lows in short term implied volatility. Those lows can be seen in the SPX term structure, as shown below (red box). We see little reason to move off the grind today, with resistance above at 5,200 – 5,208 (SPX/SPY

Call Walls

). Support below shows at 5,165 (SPY 515) & 5,150.

At some point, implied vols often reach lows that are no longer viable.

This is part of a cycle, wherein we exit a relative high volatility regime, after which volatility is sold (as with April). This lifts equities, leading to contractions in realized volatility due to decaying vanna flows and the embrace of large, positive gamma (i.e. 5,200

Call Wall

).

In response, IV’s drop to levels that price in low realized volatility out in time. Consider that 10-11% IV’s are pricing in ~65bps daily ranges in the SPX – those are not exactly large daily ranges.

Regardless, and as anticipated, low IV/RV is where we are in the current cycle.

Eventually, we get a small data point or event that leads to these very tight IV’s breaking (ex: traders were short options at 10% IV, and realized jumps to 15%), which forces short volatility traders to cover, which in turn leads volatility expands.

In this case, the target time frame for that happening is next week, and you can see above IV’s are mildly higher to the right of the red box. Next weeks IV’s are a bit higher for those given dates due to incoming data points, indicating traders are pricing in relatively higher IV for those dates. So, the issue here is that this relatively higher IV is anchored to the low realized vol we’ve been experiencing this week, as well as the lack of volatility hedging demand (i.e. SPX puts and VIX calls).

This, in our view, is not a “red alert” situation for next week, but a place for equities to consolidate/daily ranges to expand, and volatility to trend a bit higher.

Where things will be more likely interesting is out of 5/17 OPEX, and 5/22 NVDA earnings. The 22nd is also VIX expiration – which has also been related to changes in volatility.

NVDA earnings are currently looking less impactful than in recent NVDA events. Shown below is current 1-month skew (teal) vs skew heading into the mid-March NVDA GTC event (gray). Those rich call skews in March served as a barrier for not only higher NVDA prices, but the market leading semi-sector, too. Calls simply got too expensive to probabilistically pay off.

In this case the NVDA skews are (so far) much more mild, which tells us that if NVDA posts solid earnings, it may have more room to run. As this is the leading stock of the leading sector, it could trigger a nice directional move for equities overall. The key here, too, is that this catalyst comes after the clearing of OPEX/VIX exp positions, which may allow for more equity index movement.

As there are still several days to earnings, traders could still come in and bid up this skew, and so we will be watching this closely.

| SG Level | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5187 | $517 | $18091 | $440 | $2064 | $204 |

| SG Implied 1-Day Move: | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SG Volatility Trigger™: | $5165 | $517 | $17780 | $437 | $2050 | $204 |

| Absolute Gamma Strike: | $5000 | $515 | $18000 | $440 | $2050 | $200 |

| SG Call Wall: | $5200 | $520 | $17250 | $445 | $2055 | $210 |

| SG Put Wall: | $5000 | $510 | $18130 | $430 | $1900 | $200 |

| SG Gamma Index™: | 1.181 | -0.181 | 0.126 | 0.012 | 0.023 | -0.042 |

| Metric | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5119 | $516 | $17642 | $436 | $2044 | $206 |

| Gamma Tilt: | 1.16 | 0.829 | 1.585 | 1.029 | 1.195 | 0.790 |

| Gamma Notional (MM): | $544.132M | ‑$270.182M | $14.368M | $231.412M | $18.471M | ‑$289.788M |

| 25 Delta Risk Reversal: | -0.02 | 0.003 | -0.025 | -0.001 | -0.015 | 0.008 |

| Call Volume: | 546.198K | 1.418M | 17.904K | 608.742K | 17.238K | 580.864K |

| Put Volume: | 983.447K | 1.922M | 19.076K | 946.455K | 26.796K | 1.217M |

| Call Open Interest: | 6.945M | 5.956M | 63.355K | 4.06M | 335.175K | 4.162M |

| Put Open Interest: | 13.674M | 13.641M | 79.507K | 6.656M | 545.618K | 8.635M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5200, 5150, 5100] |

| SPY Levels: [515, 520, 510, 518] |

| NDX Levels: [18000, 18100, 18200, 18500] |

| QQQ Levels: [440, 435, 430, 438] |

| SPX Combos: [(5400,97.40), (5374,76.09), (5349,94.69), (5323,92.15), (5302,98.72), (5276,96.35), (5271,75.02), (5266,79.73), (5260,74.69), (5255,74.28), (5250,98.18), (5245,77.01), (5240,88.49), (5234,86.14), (5229,91.39), (5224,97.77), (5219,95.22), (5214,79.87), (5208,94.63), (5203,87.97), (5198,99.70), (5188,81.93), (5177,86.92), (5167,86.39), (5146,72.65), (5136,75.66), (5131,70.86), (5125,85.17), (5115,86.89), (5074,76.71), (5068,72.00), (5048,88.01), (5027,74.03), (5017,84.69), (5001,95.07), (4975,90.36), (4949,89.32)] |

| SPY Combos: [519.27, 514.61, 515.13, 519.79] |

| NDX Combos: [18001, 18290, 17675, 18489] |

| QQQ Combos: [438.1, 445.14, 449.99, 439.86] |

0 comentarios