Macro Theme:

Short Term SPX Resistance: 5,311

Short Term SPX Support: 5,250

SPX Risk Pivot Level: 5,311

Major SPX Range High/Resistance: 5,311

Major SPX Range Low/Support: 5,000

- Starting on 5/31 Core PCE traders are likely to focus on rate narratives into early June, due to ISM inflation data, NonFarms & FOMC on 6/12.

- 5,300 – 5,312 is major resistance into the close of Monday 6/3

- A break of 5,250 likely leads to a test of 5,200

- <5,200 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX) and a move down into 5,000

Founder’s Note:

ES futures are +10bps to 5,300. NQ futures are +45 bps to 18,675.

Key SG levels for the SPX are:

- Support: 5,275, 5,260, 5,250, 5200

- Resistance: 5,300, 5,312

- 1 Day Implied Range: 0.53%

For QQQ:

- Support: 450, 440

- Resistance: 452, 455, 460

IWM:

- Support: 205, 200

- Resistance: 208, 210

ISM PMI Manufacturing & JOLTS 10AM ET.

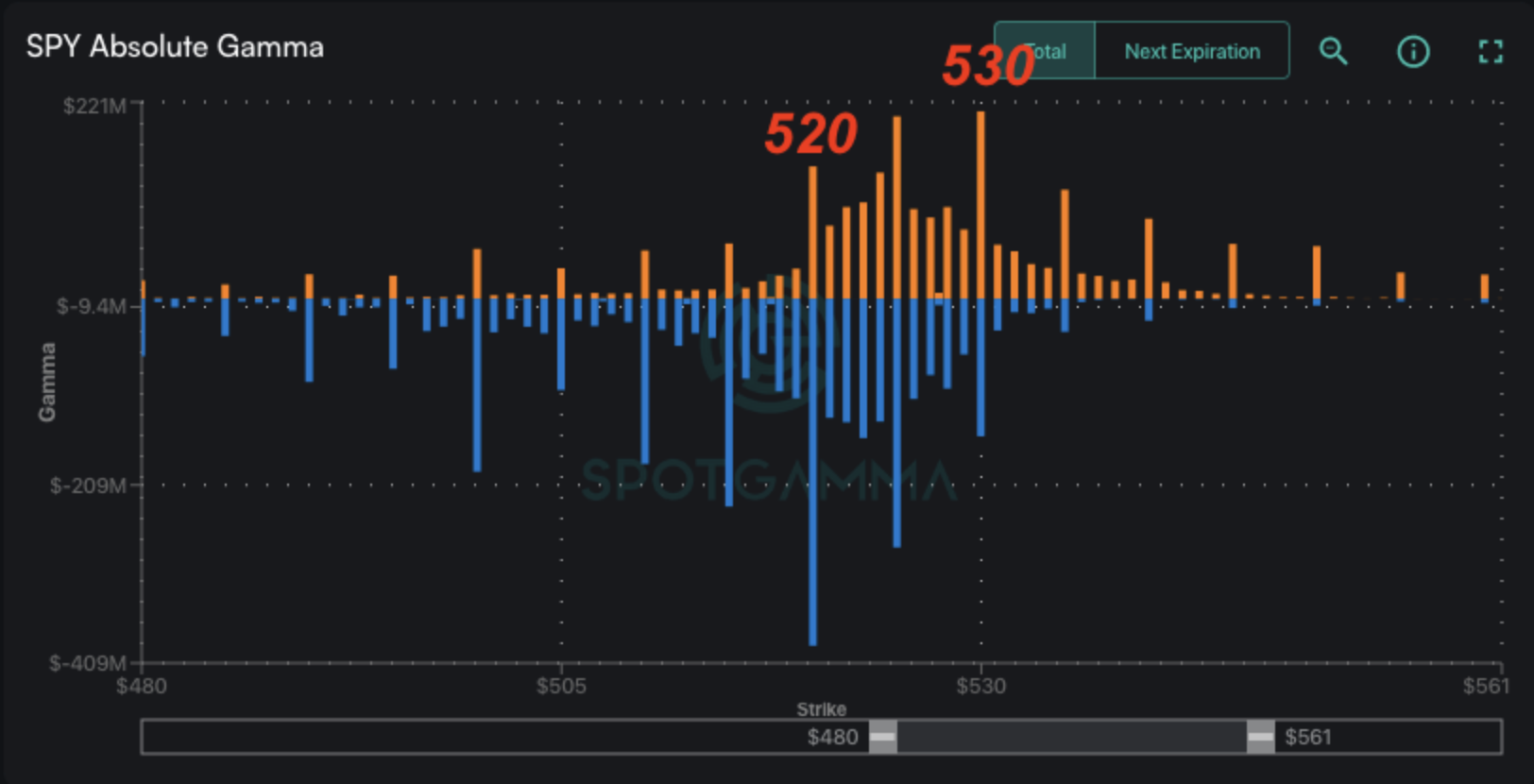

For today we see heavy resistance at 5,300 – 5,312 (SPY 530), with support at 5,275, 5,260 (SPY 525) & 5,250.

It was a very interesting session on Friday, in which the SPX sold off 1% to 5,200, before staging a very powerful +1.6% rally up to 5,275. This move highlighted the “fluidity” of that <5,250 area due to local negative gamma (note: we state that its “local” because we believe

gamma flips

negative <5,250, but then back positive on approach of 5,000). Friday’s month-end rally shoved the SPX back up into a positive gamma zone – one which took several days for the SPX to digest last week. More on this momentarily.

In regards to Friday’s move, we saw put sellers step when SPX <=5,200, and some fairly strong call buying at that level. This call buying combined with a very large +$6bn MOC to force equities higher. Our view was that Friday’s move felt very positionally driven (i.e. hedging & month end), and not a function of “value” being unlocked on the test of 5,200, with upcoming data likely dictating a more tangible move. Said another way: hot ISM data could easily push us back down to 5,200. In no way are we “all clear”.

Between 5,250 & 5,312 is our “neutral zone”, as highlighted in yellow. We’d expect price churn and see little directional edge in this zone.

- Should we break < 5,250 we’d again look for a quick test of 5,200.

- >SPY 530 our models would flip to “risk on” with a target at the SPX 5,400

Call Wall.

The yellow zone above is an area with predominantly

call gamma

positions in the SPY & SPY (orange bars, below). However, you can see that <525 SPY/ 5,250 SPX

put gamma

positions (blue bars) pick up, which likely invokes volatility a la Friday.

What likely determines forward direction is rates, or at least rate narratives. As you can see below, SPX term structure (teal) is about average relative to the last 90 days (shaded statistical cone), with a large relative kink for Friday’s NFP & then 6/12 FOMC. These appear to be the data points that really matter for equities, with the ISM prints today/Wednesday being added into the mix. We could easily see mixed data, and a bunch of price “ping-pong” until Powell more concretely sets forward rate expectations.

On this note its hard for implied volatility to fully settle, as the release of one data points event-vol immediately feeds into the hand-wringing of the next data point.

Out of FOMC there is a massive June OPEX (6/21), and quarter end positions (6/28) which should allow for clean price & volatility targets.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5291.94 | $5277 | $527 | $18536 | $450 | $2070 | $205 |

| SG Gamma Index™: |

| -1.055 | -0.402 |

|

|

|

|

| SG Implied 1-Day Move: | 0.53% | 0.53% | 0.53% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5274.94 | $5260 | $526 | $18560 | $452 | $2090 | $205 |

| Absolute Gamma Strike: | $5014.94 | $5000 | $520 | $18600 | $450 | $2100 | $200 |

| Call Wall: | $5414.94 | $5400 | $535 | $18600 | $465 | $2200 | $220 |

| Put Wall: | $5214.94 | $5200 | $520 | $18450 | $440 | $2000 | $200 |

| Zero Gamma Level: | $5261.94 | $5247 | $526 | $18351 | $450 | $2080 | $208 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.889 | 0.650 | 1.077 | 0.783 | 0.787 | 0.627 |

| Gamma Notional (MM): | $281.976M | ‑$95.779M | $8.971M | ‑$73.722M | ‑$21.913M | ‑$421.996M |

| 25 Delta Risk Reversal: | -0.032 | 0.00 | -0.035 | -0.022 | 0.00 | -0.02 |

| Call Volume: | 1.315M | 2.02M | 22.936K | 1.146M | 21.124K | 215.529K |

| Put Volume: | 2.122M | 2.356M | 34.768K | 1.295M | 45.96K | 408.341K |

| Call Open Interest: | 7.111M | 5.799M | 58.048K | 3.96M | 319.704K | 3.909M |

| Put Open Interest: | 14.217M | 12.896M | 85.424K | 6.669M | 559.823K | 8.304M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5300, 5200, 5250] |

| SPY Levels: [520, 525, 530, 515] |

| NDX Levels: [18600, 18500, 18000, 18400] |

| QQQ Levels: [450, 440, 445, 455] |

| SPX Combos: [(5499,97.27), (5452,94.51), (5425,81.71), (5399,98.86), (5378,71.42), (5373,91.65), (5362,71.34), (5351,93.70), (5330,73.38), (5320,78.49), (5309,74.95), (5304,87.41), (5299,93.86), (5288,76.05), (5278,88.66), (5256,96.69), (5251,91.40), (5241,87.23), (5235,73.08), (5225,73.74), (5214,78.56), (5209,82.83), (5204,93.00), (5198,97.66), (5193,82.74), (5188,81.76), (5183,90.18), (5177,82.31), (5172,80.56), (5167,83.63), (5161,76.82), (5156,88.11), (5151,96.61), (5140,74.76), (5124,90.55), (5103,80.79), (5098,95.11), (5051,87.80), (5024,71.47)] |

| SPY Combos: [523.45, 543.48, 518.71, 524.5] |

| NDX Combos: [18592, 18092, 18296, 19130] |

| QQQ Combos: [450.35, 453.07, 465.26, 444.93] |

0 comentarios