Macro Theme:

Short Term SPX Resistance: 5,400

Short Term SPX Support: 5,300

SPX Risk Pivot Level: 5,312

Major SPX Range High/Resistance: 5,312

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for a blow-off top into early next week.

- Upside scenario:

- 5,400 is major resistance into FOMC 6/12

- Downside scenario:

- A break of 5,300 likely leads to a test of 5,200

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES & NQ futures are both flat at 5,360 & 19,070, respectively.

Key SG levels for the SPX are:

- Support: 5,250, 5,311, 5,300

- Resistance: 5,359, 5,369, 5,385, 5,400

- 1 Day Implied Range: 0.56%

For QQQ:

- Support: 460, 455

- Resistance: 470

IWM:

- Support: 200

- Resistance: 204, 210, 220

NFP 8:30 AM ET

Roaring Kitty Livestream 12pm ET (here)

NVDA 10:1 split – post-close

Levels for today:

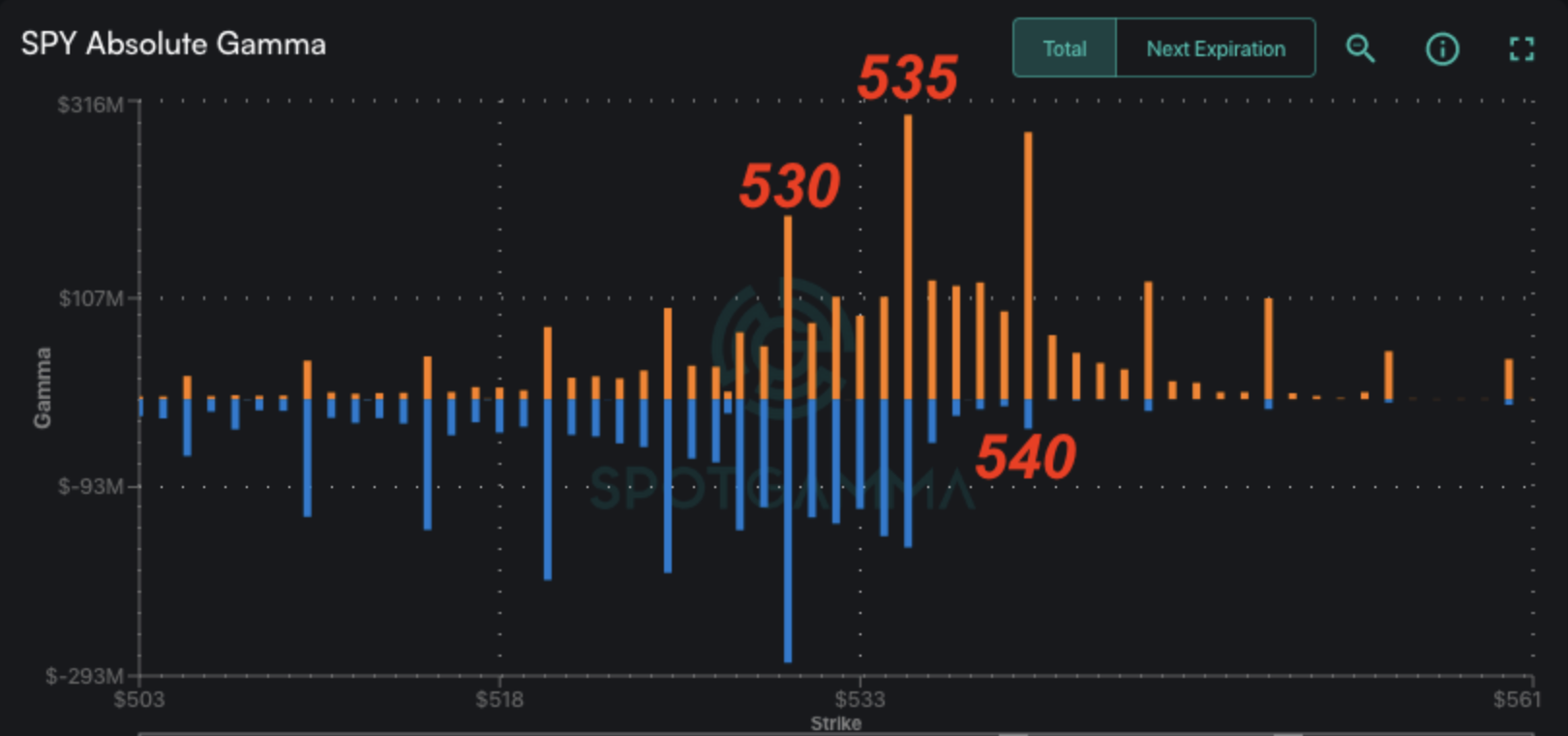

- Major support today is at 5,300. Our models flip to risk-off <5,300. Note that this risk off level is newly updated (from 5,250), as large 5,300 long put positions were added in recent days.

- Major resistance today is at 5,400 – 5,411 (SPY 540).

- SPX 5,350 – 5,360 (SPY 535) is the

pivot

area after NFP, as it is the center of positive gamma.

- A break and hold >SPY 535 is the “all clear” for a move to 5,400.

- Conversely a break <5,350 gives weight to a test of 5,300.

Today should be quite fascinating on many fronts.

1) NFP

Today’s 0DTE straddle (ref 5,350, IV 24.4%) is priced at $35, or 65 bps. We think that could be a bit light, as the big target levels are closer to 1% away from at-the-money (i.e. 5,400 & 5,300 are both 1% away from current SPX value of 5,350).

We covered the vol space in detail in yesterday’s note. Should the NFP come across as benign, wed expect vol to get slammed ahead of the weekend. The expirations immediately following FOMC will hold a relative bid, but pre-FOMC and +1 month vol likely sinks lower. That is a tailwind for equities.

A hot number likely leads to a drop from 5,350 to 5,300, which is a major support level. Below 5,300, however, is a pocket of negative gamma and high downside risk.

2) GME

This chart is of GME (orange) vs SPX (blue) from peak meme-mania: Jan 25th, 2021 (original here). As you can see, the SPX flash-crashed rather violently just as GME stock doubled intraday, and then reversed. Why these two were so highlight correlated that day is up for argument – our best guess was that it was margin-call related (ex: Melvin Capital). It all honesty, the reason doesn’t much matter. Traders just need to be aware of the possibly strange (and quick) Index impacts from this seemingly small stock that has the worlds attention, particularly around 12 ET today.

We also have to revel at the levels of IV. Last nights 1-DTE options went out at 1,200% IV – something I’ve never seen before. That’s implying something like a 75% 1-day move – which is obviously insane. Its also a massive hurdle for Kitty to pump against, as his live video passing is likely to drain off a lot of “event-vol” in the name, which is a headwind for the stock.

Logically-sound individuals wouldn’t want to buy calls in the stock at these IV’s, but selling OTM puts could be interesting due to these incredibly high IV’s. The idea being that if the stock goes lower, vol crushes with it.

If you RoarkingKitty, how do you possibly trigger something that warrants higher that 1,000% IV? His 100k June Exp 20 strike calls (currently worth +$500mm) are currently so deep in-the-money that they don’t currently offer any upside gamma-squeeze. If he rolled those up to a higher strike it would add to MM gamma, and hedging pressure, above. If the retail crowd pumped the stock into that roll, it could trigger dealer flows to push into that overhead gamma.

You can see in our gamma impact plot below how

call gamma

(orange) wanes >$60 – this implies that dealer hedging pressure reduces sharply above that level. GME degens likely need “moar gamma” above. In the short term this is a massive uphill battle for GME’ers.

3) NVDA

We are calling for an end to the NVDA outperformance with the stock split, as outlined yesterday AM. NVDA could well have very strong sessions Monday/Tuesday as the stock price “drops” to ~120/share, but that is where we think the buck stops. And, to be clear, the stock could ultimately go higher in the future particularly if the general equity market goes higher, but the performance gap (shown below) likely contracts. On this, we see >=$1300 as where the call positions fizzle out.

If we were going to express this as a trade, it would be short NVDA vs long some basket of other semi-stocks (this is not a recommendation).

A full writeup is coming on this, but in addition to the “split mania” highlighted yesterday AM, you can add the DOJ probe (which zapped momentum yesterday AM), Jensen selling some shares, and even the “shirt signing”.

For today & into Monday/Tuesday, we have to respect that NVDA could move wildly, and that would drag equities with it, particularly to the upside as we saw on Wednesday.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5363.26 |

$5352 |

$534 |

$19021 |

$463 |

$2049 |

$203 |

|

SG Gamma Index™: |

|

1.593 |

-0.062 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.56% |

0.56% |

0.56% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5336.26 |

$5325 |

$534 |

$18590 |

$461 |

$2070 |

$204 |

|

Absolute Gamma Strike: |

$5311.26 |

$5300 |

$530 |

$18600 |

$460 |

$2050 |

$200 |

|

Call Wall: |

$5411.26 |

$5400 |

$540 |

$18600 |

$470 |

$2100 |

$220 |

|

Put Wall: |

$5111.26 |

$5100 |

$520 |

$18690 |

$460 |

$2000 |

$200 |

|

Zero Gamma Level: |

$5293.26 |

$5282 |

$533 |

$18549 |

$459 |

$2075 |

$206 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.21 |

0.934 |

1.667 |

1.129 |

0.759 |

0.626 |

|

Gamma Notional (MM): |

$690.967M |

$330.476M |

$16.722M |

$458.431M |

‑$37.973M |

‑$654.469M |

|

25 Delta Risk Reversal: |

-0.024 |

-0.016 |

-0.025 |

-0.009 |

-0.016 |

-0.007 |

|

Call Volume: |

470.375K |

1.056M |

8.302K |

530.011K |

9.009K |

282.907K |

|

Put Volume: |

858.777K |

2.388M |

12.115K |

675.555K |

19.999K |

510.236K |

|

Call Open Interest: |

7.332M |

6.012M |

62.522K |

4.154M |

337.709K |

4.165M |

|

Put Open Interest: |

14.751M |

14.387M |

93.438K |

7.158M |

581.247K |

8.594M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5300, 5000, 5350, 5200] |

|

SPY Levels: [530, 535, 540, 525] |

|

NDX Levels: [18600, 19000, 18500, 18700] |

|

QQQ Levels: [460, 450, 470, 465] |

|

SPX Combos: [(5599,96.50), (5572,92.82), (5551,92.50), (5524,82.16), (5508,82.28), (5497,99.35), (5481,70.80), (5476,87.76), (5471,76.15), (5460,71.66), (5455,76.09), (5449,99.05), (5439,83.06), (5428,88.54), (5423,98.02), (5417,82.04), (5412,94.19), (5406,94.30), (5401,99.89), (5396,85.19), (5390,90.03), (5385,94.36), (5380,92.99), (5374,98.06), (5369,92.32), (5364,76.31), (5358,93.56), (5353,73.35), (5348,96.73), (5342,80.96), (5326,77.33), (5315,74.17), (5299,92.86), (5289,78.83), (5283,71.47), (5224,75.79), (5208,74.04), (5198,94.07), (5176,70.52), (5150,89.87), (5123,76.38), (5101,94.31)] |

|

SPY Combos: [539.45, 549.08, 536.78, 544.26] |

|

NDX Combos: [19497, 19287, 18888, 19097] |

|

QQQ Combos: [469.9, 464.8, 452.75, 459.7] |

0 comentarios