Macro Theme:

Key dates ahead:

- 12/12 PPI/Jobs

- 12/18 FOMC

- 12/20 OPEX

- 12/31 OPEX Q-end

Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in “buy the dip mode” until/unless <6,000.

(12/12 Post) Into year end, we are operating from this playbook:

- SPX is unlikely to break over 6,110 before 12/18. We may elect some <=6DDTE collar some positions as a result.

- Select single stocks may have some more “juice to squeeze” this week, but we anticipate a consolidation phase into 12/18

- Assuming the SPX is within 1% of 6,055 after 12/20 OPEX, we think SPX pins 6,055 into 12/31 Exp

- January sets up to potentially weak & our prime time to look for an equity correction, with 1/17 OPEX of note.

Key SG levels for the SPX are:

- Support: 6,050, 6,000

- Resistance: 6,100, 6,112

- As of 12/06:

- Long equities if >6,000

- Short equities if SPX <6,000

QQQ:

- Support: 525, 520

- Resistance: 530, 535

IWM:

- Support: 238, 235

- Resistance: 240, 245

Founder’s Note:

Futures are higher: ES 36bps, NQ +75bps after big AVGO ER’s last night +15% to 212.

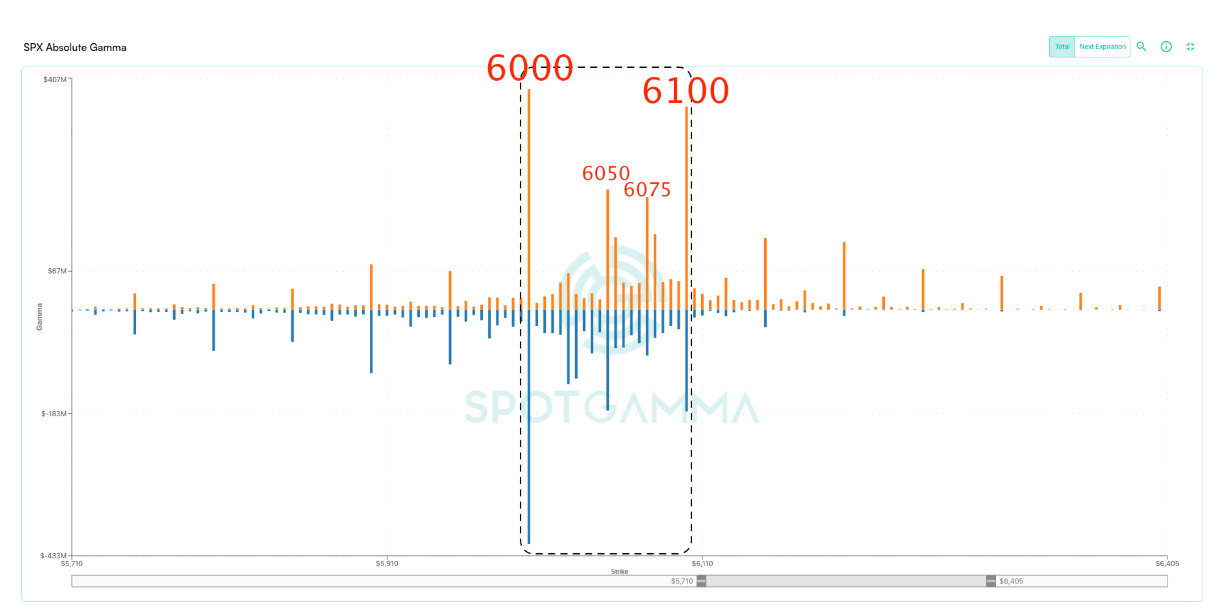

For the S&P500, that means we bounce of of yesterday’s big 6,050 support an into a (relatively) small resistance node at 6,075, with much larger resistance stacked at 6,100 & 6,110 (SPY 610) above. In regards to 610 SPY, it was, 2 days ago an incredible $800mm in call gamma.

It has shrunk to $500mm, which still leaves it as the largest call gamma strike in the S&P500 (bigger than any SPX strike).

This massive gamma all makes for what we think is another ~40bps (i.e. 6,075-6,110) of upside left in the SPX before 12/18 FOMC/ 12/20 OPEX.

As we had made mention of in yesterday’s note: “The Nasdaq does seem to have more available upside, with resistance at 530 & 535 (Call Wall) for QQQ.” That is NOT to say we called for blowout AVGO earnings – but it was an expressed that NQ has/had more room volatility. With Q’s at 531 pre-market, we can see the Q

Call Wall at 535 – that is our current upside resistance line (~1%).

Further, AVGO’s results may provide a critical shot-in-the-arm for the semi complex (SMH, candles) which has been nonexistent during the recent rally (SPY, red). We suspect the sector will see some further strength today, but then likely pins into next weeks key events.

We covered AVGO in yesterday’s Q&A, and flagged 200 as an upper bound (+9%) for the stock, based on the size of call positions (orange) and implied move. The implied move was 5%, and now the stock is up +15% to 212, so clearly there are some short-vol traders force to cover this AM.

212 places the stock in “overbought” territory, which is this zone wherein call gamma

fades. You can see this in via the orange curve flattening >210 (black box). This signals to us that there is no call gamma >210, and so dealer-induced momentum should wane.

Finally, we recently wrote a piece on why we think TSLA is set to stall out & consolidate at 420. It uses many of our tools to break down the TSLA options complex. Check it out.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6126.56 | $6051 | $604 | $21615 | $526 | $2361 | $234 |

| SG Gamma Index™: |

| 1.096 | 0.188 |

|

|

|

|

| SG Implied 1-Day Move: | 0.50% | 0.50% | 0.50% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6120.56 | $6045 | $604 | $21340 | $527 | $2400 | $234 |

| Absolute Gamma Strike: | $6075.56 | $6000 | $605 | $21000 | $520 | $2400 | $230 |

| Call Wall: | $6175.56 | $6100 | $610 | $22000 | $530 | $2310 | $240 |

| Put Wall: | $6105.56 | $6030 | $600 | $20800 | $505 | $2300 | $230 |

| Zero Gamma Level: | $6091.56 | $6016 | $603 | $21238 | $521 | $2391 | $236 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.105 | 1.152 | 1.597 | 1.094 | 0.796 | 0.797 |

| Gamma Notional (MM): | $117.965M | $652.654M | $14.661M | $207.385M | ‑$33.79M | ‑$306.113M |

| 25 Delta Risk Reversal: | -0.031 | -0.022 | -0.032 | -0.016 | -0.01 | -0.008 |

| Call Volume: | 378.28K | 1.171M | 8.958K | 600.584K | 21.63K | 430.556K |

| Put Volume: | 701.583K | 1.727M | 7.287K | 865.06K | 29.717K | 478.048K |

| Call Open Interest: | 8.008M | 6.459M | 74.226K | 3.698M | 347.839K | 4.193M |

| Put Open Interest: | 14.577M | 12.723M | 101.302K | 6.893M | 569.093K | 8.435M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 6075] |

| SPY Levels: [605, 600, 610, 606] |

| NDX Levels: [21000, 22000, 21400, 21500] |

| QQQ Levels: [520, 530, 525, 510] |

| SPX Combos: [(6348,90.11), (6299,96.88), (6275,70.93), (6257,70.91), (6251,97.94), (6227,86.91), (6209,82.60), (6203,99.50), (6190,74.89), (6178,76.28), (6172,94.80), (6160,95.65), (6148,99.27), (6142,91.07), (6136,82.21), (6130,86.27), (6124,95.04), (6118,94.27), (6112,81.78), (6106,98.37), (6100,99.94), (6094,78.92), (6088,97.02), (6082,98.81), (6075,99.74), (6057,96.58), (6051,92.16), (6045,93.04), (6039,95.83), (6033,85.89), (6027,99.92), (6015,87.96), (6009,93.44), (6003,94.53), (5991,69.06), (5985,81.96), (5979,70.85), (5973,93.98), (5954,83.78), (5948,91.57), (5942,71.85), (5924,80.83), (5900,91.77), (5876,69.11), (5852,85.07), (5827,75.14), (5797,90.16), (5773,70.02)] |

| SPY Combos: [609.32, 619.04, 614.18, 609.93] |

| NDX Combos: [21767, 21961, 21810, 22004] |

| QQQ Combos: [535.22, 529.92, 535.75, 539.99] |

0 comentarios