Macro Theme:

Key dates ahead:

- 9/4: Jobless Claims/PMI

- 9/5: NFP

Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

- Resistance: 6,500

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,400, 6,350, 6,300, 6,175

Founder’s Note:

Futures are 20 bps higher ahead of 8:30AM ET Jobs data and 10AM PMI.

TLDR: We stay with bulls until/unless SPX <6,400. Today we anticipate a more muted session, with the bigger trigger being tomorrows NFP.

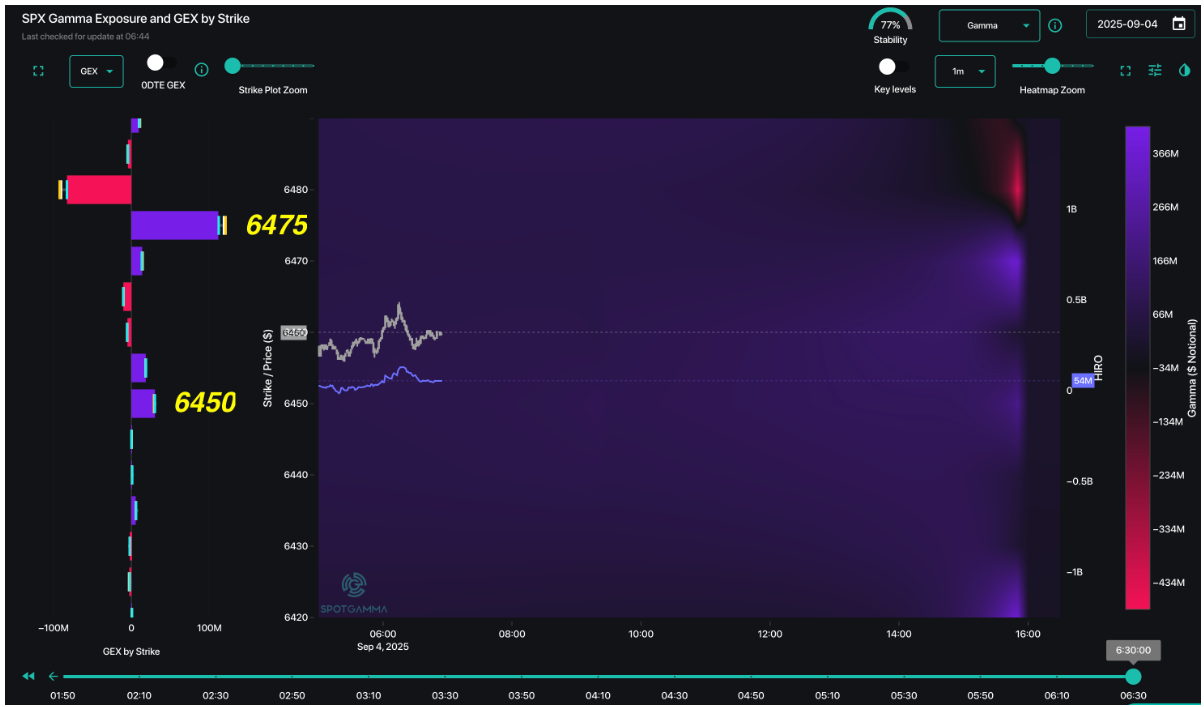

Key levels today is the 0DTE condor at 6,475 as a likely top area for today. Above there is 6,500. To the downside we have a 6,450, and a break of that level likely leads to 6,420 (SPY 640). Below there we have the major

pivot

support level of 6,400. We will flip back to risk-off if that level is broken. We don’t think 6,500 or <6,400 is on tap for today, due to NFP tomorrow.

On this topic, while markets are eyeing this mornings data, its clearly tomorrow’s NFP which is causing the most hand wringing. You can see this via SPX term structure which is rather elevated for tomorrow. This isn’t a massive volatility expectation, but clearly carries a 3-4 vol point premium to anything past Friday. This signals that if NFP is in-line, equities should rally.

Quick single stock note: GOOGL had huge options volume yesterday, and we see a lot of negative gamma up into 250. IV’s are not overly expensive (per Compass). If this equity rally resumes, we like this stock, and Sep call spreads/flies may be a nice way to play a move into 250.

We want to end here on GLD, which is up nearly 5% this week and 35% YTD.

Historically a major sign of interim tops is a “stock up, vol up” move, which would place the IV rank in the upper half of this chart. We didn’t quite get that with the latest GLD move, but we note that call skew is now reducing, suggesting that traders are start to sell calls and/or buy puts. This syncs with data from FlowPatrol yesterday that showed big GDX call sellers & a big 40k put roll, and several GLD call rolls. Both of these serve to alleviate upside pressure – although in a commodity based asset we always hesitate to say that the ETF will wag the commodity dog. So in this case we look at it more on sentiment: its clear traders are monetizing upside.

From a positioning perspective, we see a huge positive gamma strike at 330 in GLD, and virtually no positions above that level. Again, from a sentiment perspective, this suggests a move up to 330 and little expectations of a sudden move above that.

|

|

/ESU25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6458.96 |

$6448 |

$643 |

$23414 |

$570 |

$2349 |

$233 |

|

SG Gamma Index™: |

|

0.391 |

-0.424 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.62% |

0.62% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.50% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6450.96 |

$6440 |

$642 |

$23375 |

$569 |

$2355 |

$233 |

|

Absolute Gamma Strike: |

$6010.96 |

$6000 |

$640 |

$23725 |

$560 |

$2300 |

$230 |

|

Call Wall: |

$6510.96 |

$6500 |

$650 |

$23725 |

$580 |

$2375 |

$235 |

|

Put Wall: |

$6425.96 |

$6415 |

$635 |

$22500 |

$560 |

$2260 |

$220 |

|

Zero Gamma Level: |

$6420.96 |

$6410 |

$642 |

$23006 |

$573 |

$2344 |

$235 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.04 |

0.684 |

1.234 |

0.687 |

0.998 |

0.786 |

|

Gamma Notional (MM): |

$510.638M |

‑$608.19M |

$10.662M |

‑$403.468M |

$6.619M |

‑$179.187M |

|

25 Delta Risk Reversal: |

-0.057 |

-0.052 |

-0.067 |

-0.054 |

-0.037 |

-0.034 |

|

Call Volume: |

462.507K |

1.306M |

8.284K |

652.482K |

12.394K |

196.964K |

|

Put Volume: |

763.18K |

1.749M |

11.226K |

901.177K |

22.916K |

390.38K |

|

Call Open Interest: |

7.693M |

5.345M |

69.514K |

3.583M |

314.44K |

3.725M |

|

Put Open Interest: |

13.266M |

12.847M |

82.56K |

6.141M |

487.315K |

8.343M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6500, 6400, 6450] |

|

SPY Levels: [640, 630, 635, 645] |

|

NDX Levels: [23725, 23400, 23000, 23500] |

|

QQQ Levels: [560, 570, 550, 565] |

|

SPX Combos: [(6751,92.57), (6700,96.82), (6674,72.35), (6648,95.84), (6622,87.62), (6609,76.98), (6603,99.34), (6577,94.69), (6558,88.48), (6551,97.07), (6539,85.46), (6532,87.88), (6526,94.38), (6519,79.22), (6513,96.72), (6506,97.29), (6500,99.37), (6493,77.94), (6487,92.34), (6481,96.63), (6474,98.76), (6468,91.25), (6461,91.67), (6455,87.11), (6448,90.79), (6429,70.88), (6422,90.35), (6416,98.89), (6410,99.13), (6403,97.56), (6397,69.84), (6390,86.32), (6384,73.20), (6377,93.36), (6371,78.59), (6358,96.23), (6352,92.45), (6339,81.38), (6332,85.66), (6313,93.33), (6300,94.55), (6287,68.25), (6274,74.76), (6261,80.68), (6248,92.50), (6210,82.66), (6197,90.49), (6177,78.48), (6158,74.75), (6152,81.77)] |

|

SPY Combos: [648.59, 643.47, 658.84, 636.43] |

|

NDX Combos: [22993, 23719, 22595, 22385] |

|

QQQ Combos: [559.96, 577.5, 549.78, 545.26] |