by Melida Montemayor | Nov 17, 2025 | Informe Option Levels

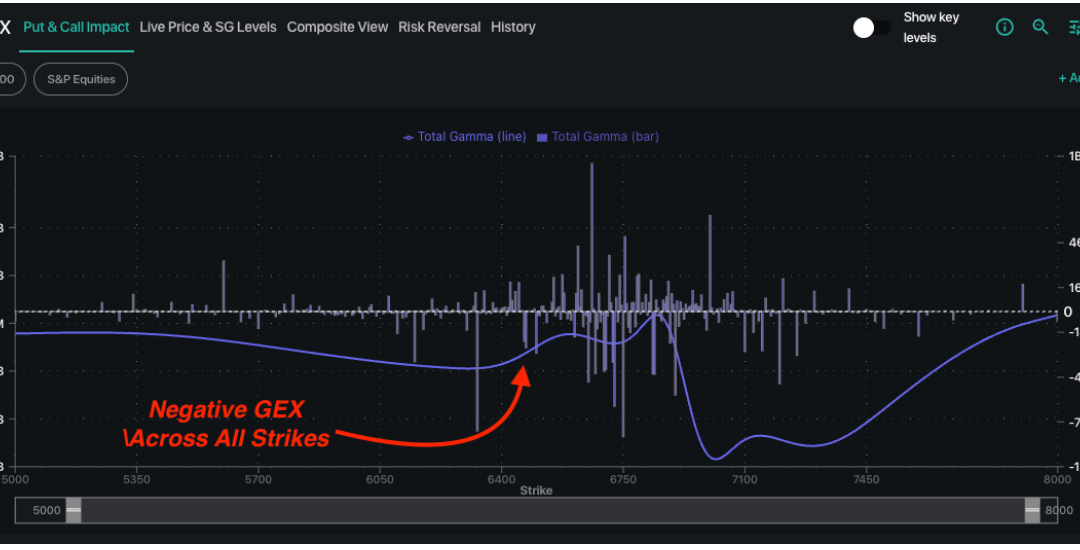

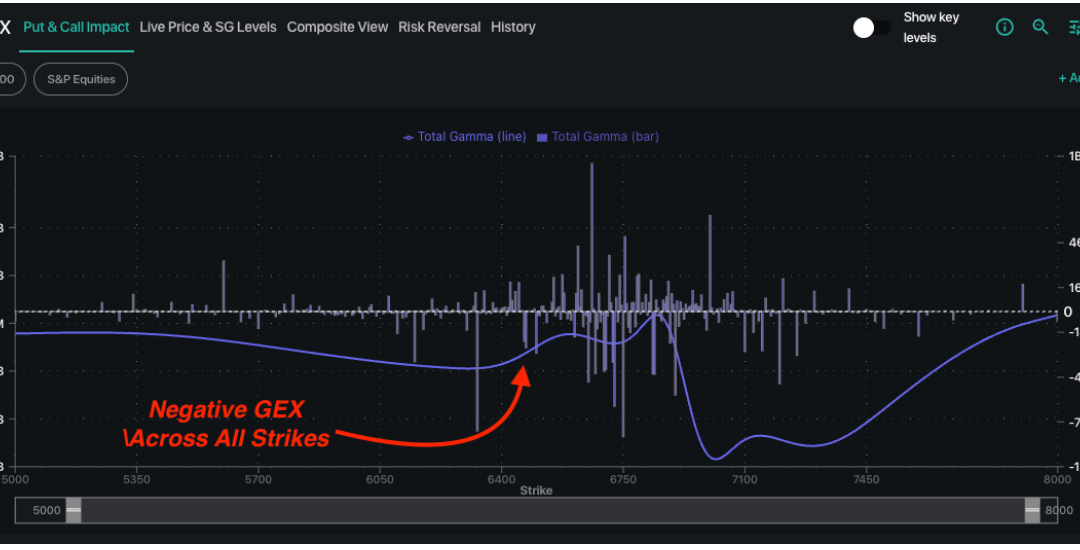

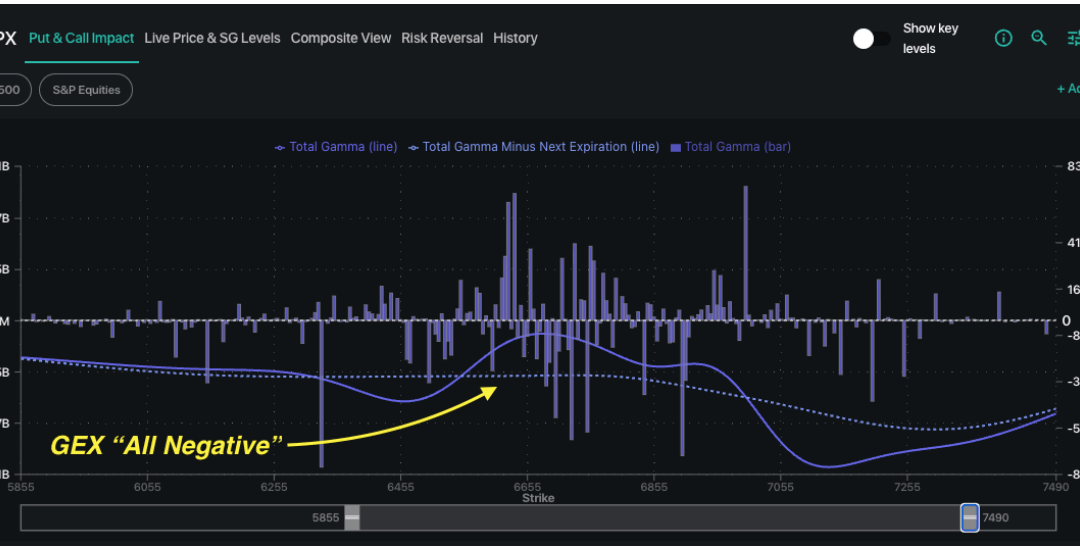

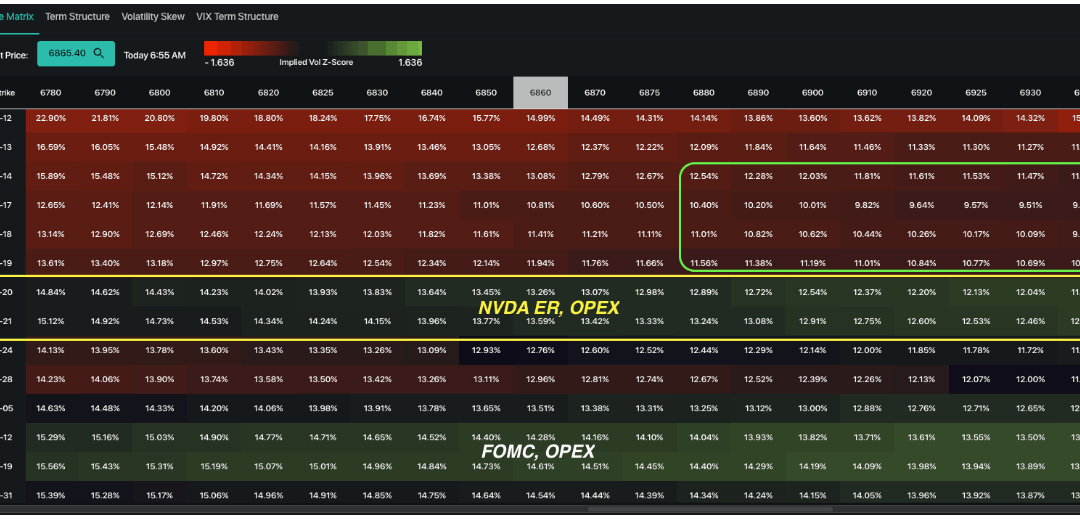

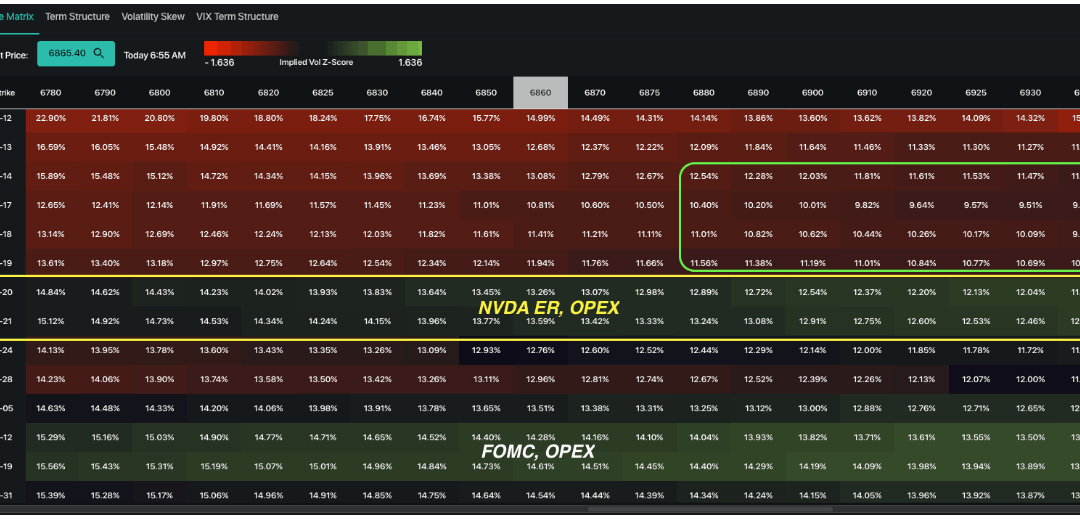

Macro Theme: Key dates ahead: 11/19: VIX Exp, NVDA ER 11/21: OPEX SG Summary: UPDATE 11/17: VIX Exp is Wed AM, and we could make the case for a sneaky vol decline & equity support into tomorrow afternoon as traders roll out NOV VIX calls. Given this, we are going...

by Melida Montemayor | Nov 14, 2025 | Informe Option Levels

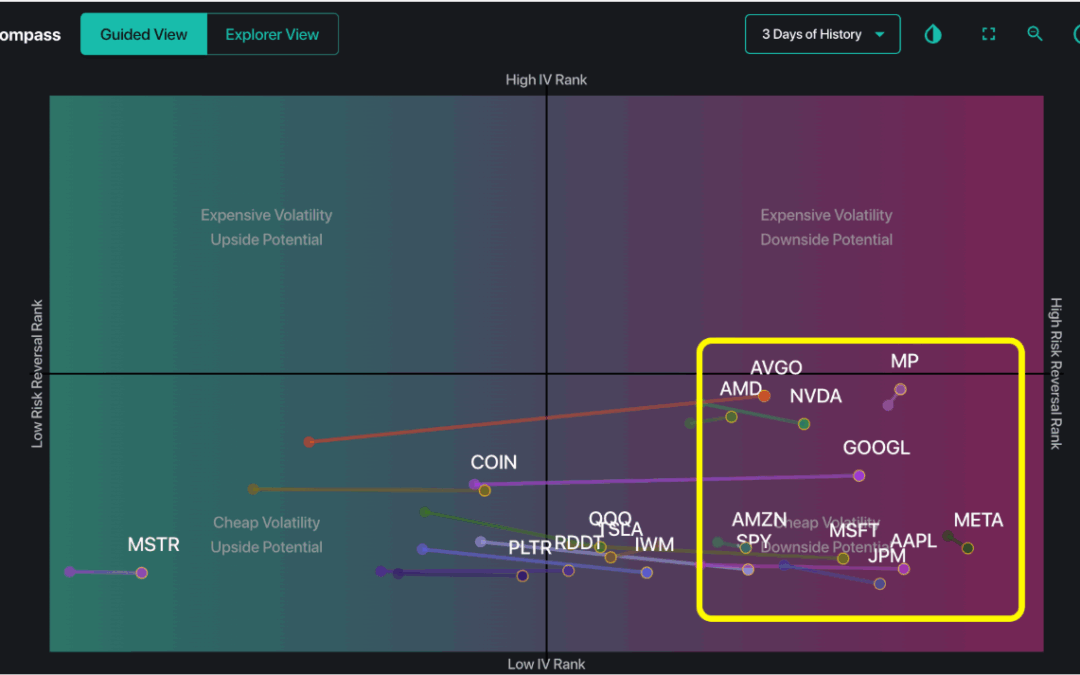

Macro Theme: Key dates ahead: 11/14: PPI 11/19: VIX Exp, NVDA ER 11/21: OPEX SG Summary: 11/10: With the government shutdown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with...

by Melida Montemayor | Nov 12, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 11/13 CPI 11/14: PPI 11/19: VIX Exp, NVDA ER 11/21: OPEX SG Summary: UPDATE 11/10: With the government shutdown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a...

by Melida Montemayor | Nov 11, 2025 | Informe Option Levels

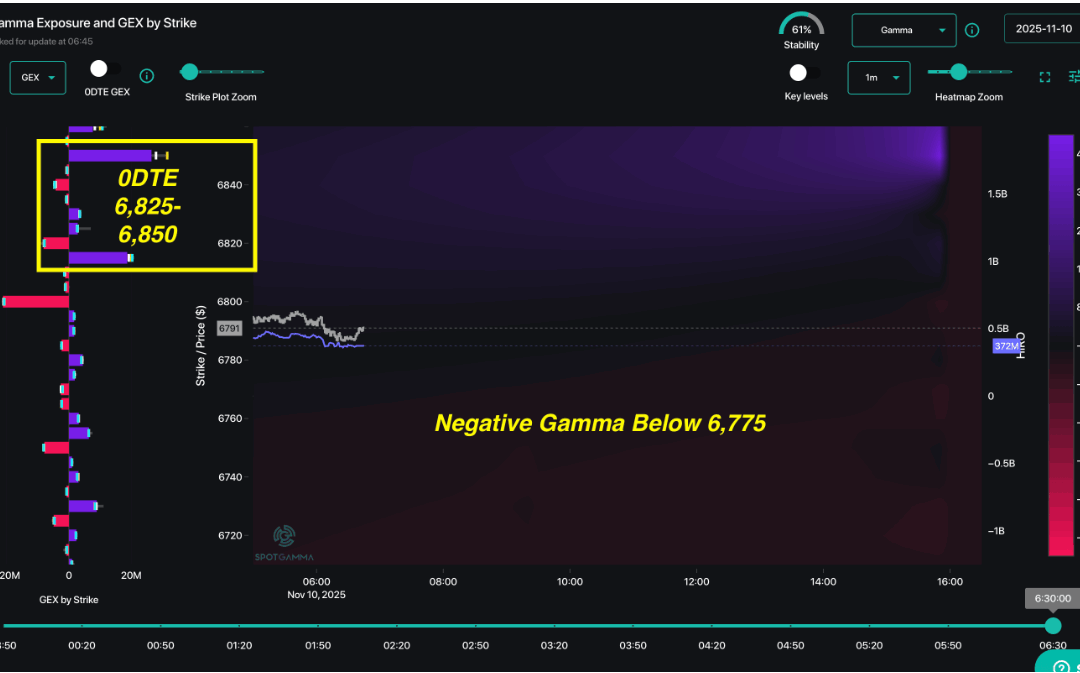

Macro Theme: Key dates ahead: 11/13 CPI 11/14: PPI 11/19: NVDA ER SG Summary: UPDATE 11/10: With the government shudown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more...

by Melida Montemayor | Nov 10, 2025 | Informe Option Levels

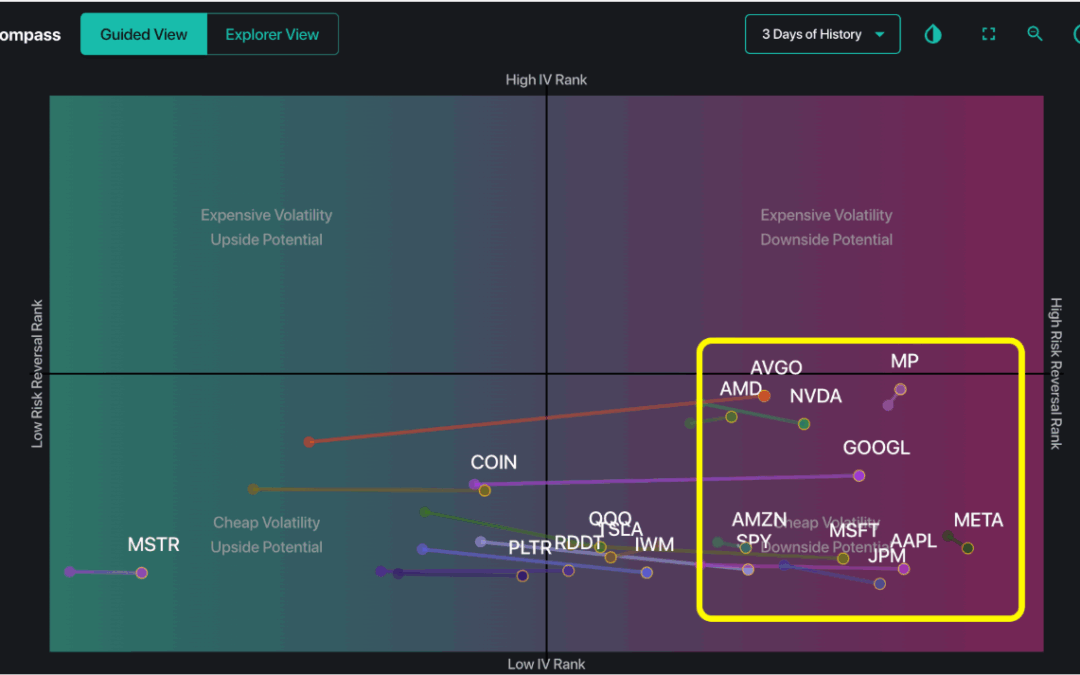

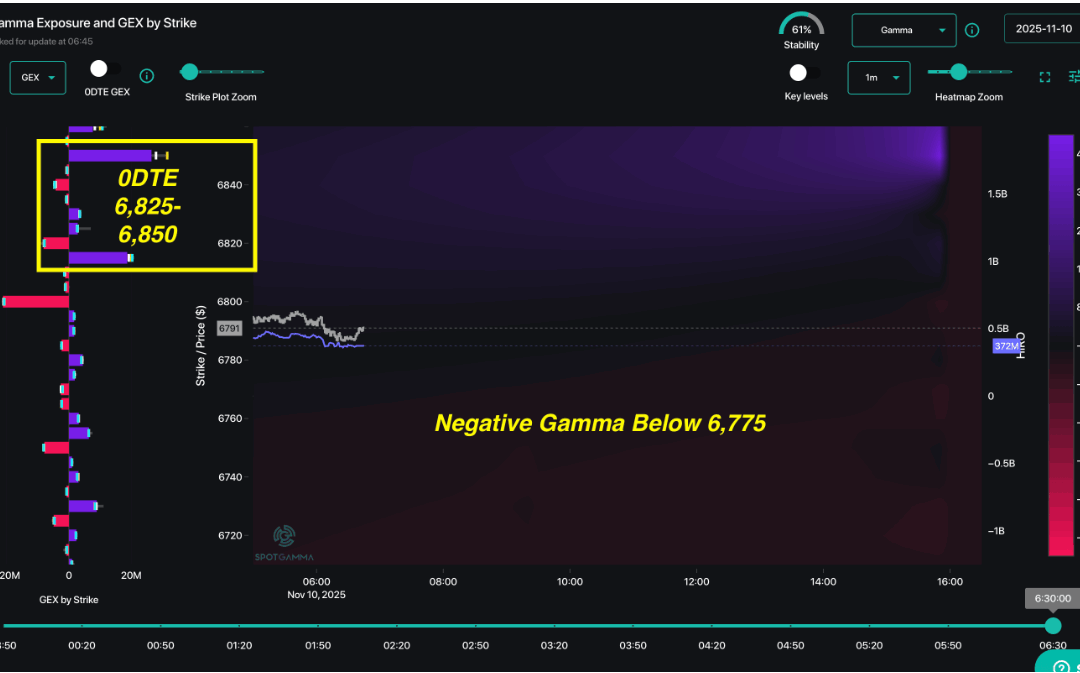

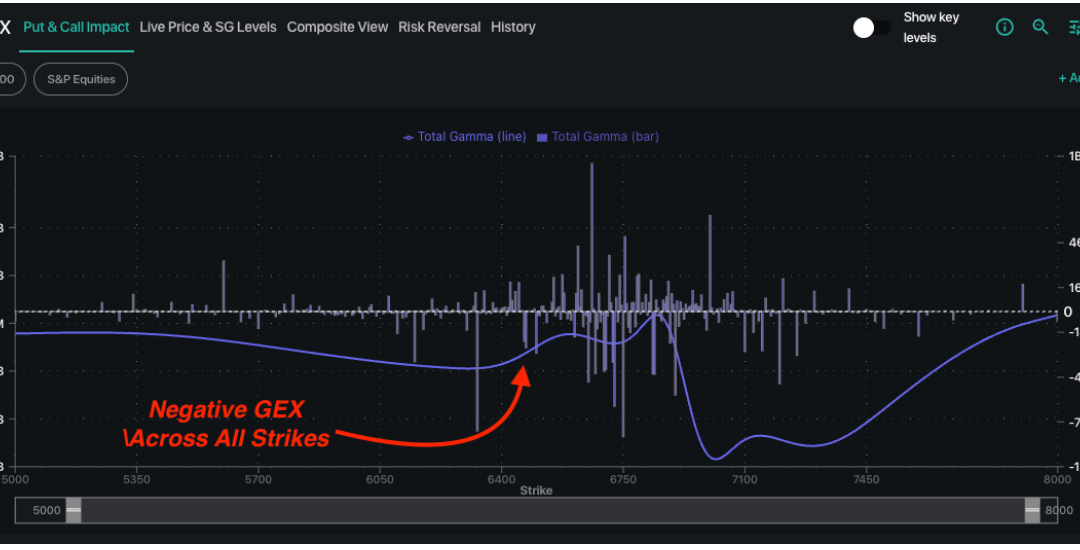

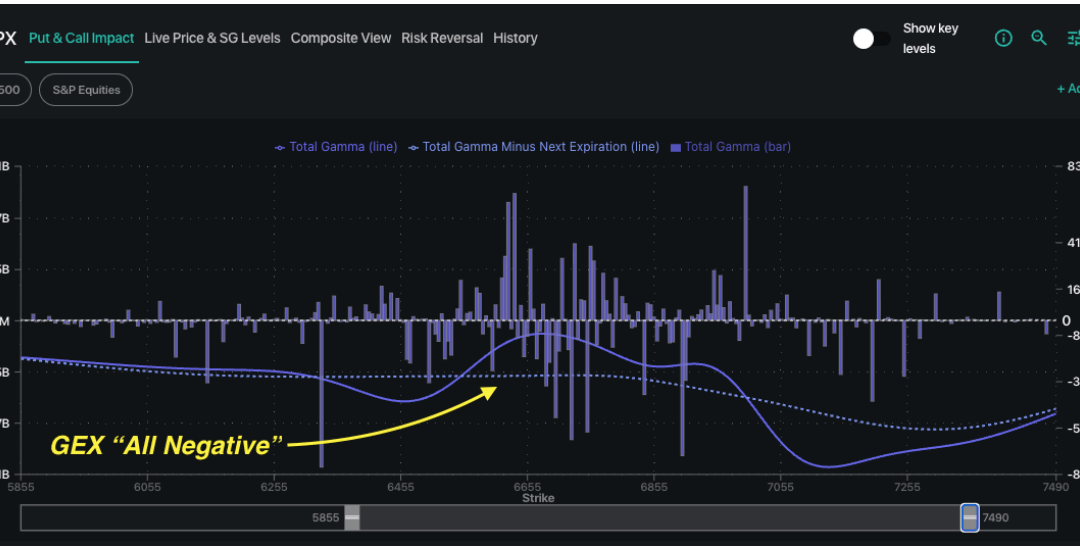

Macro Theme: Key dates ahead: 11/13 CPI 11/14: PPI 11/19: NVDA ER SG Summary: UPDATE 11/10: With the government shudown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more...