Informe Option Levels

Founder’s Note: Wed, November 20, 2024 at 7:00 AM ET Macro Theme: Key dates ahead: 11/20 VIX exp, NVDA ER NVDA ER, on 11/20 is our major EOY catalyst. Jan SMH calls are our preferred way to play upside post NVDA ER. We are flat in the S&P500 until the...

Informe Option Levels

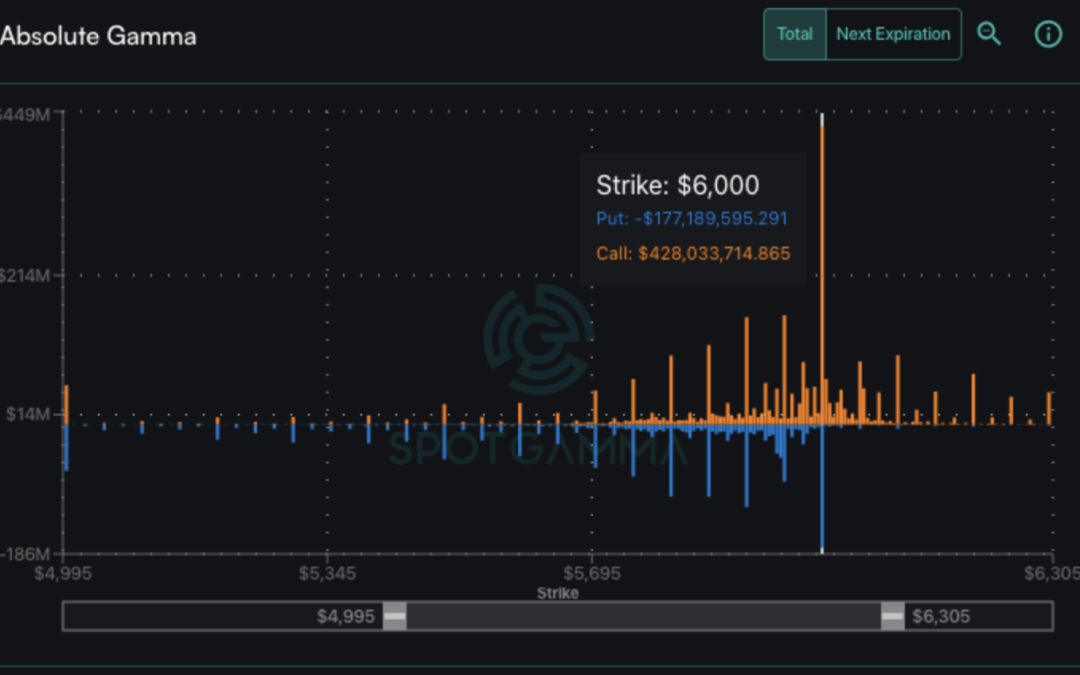

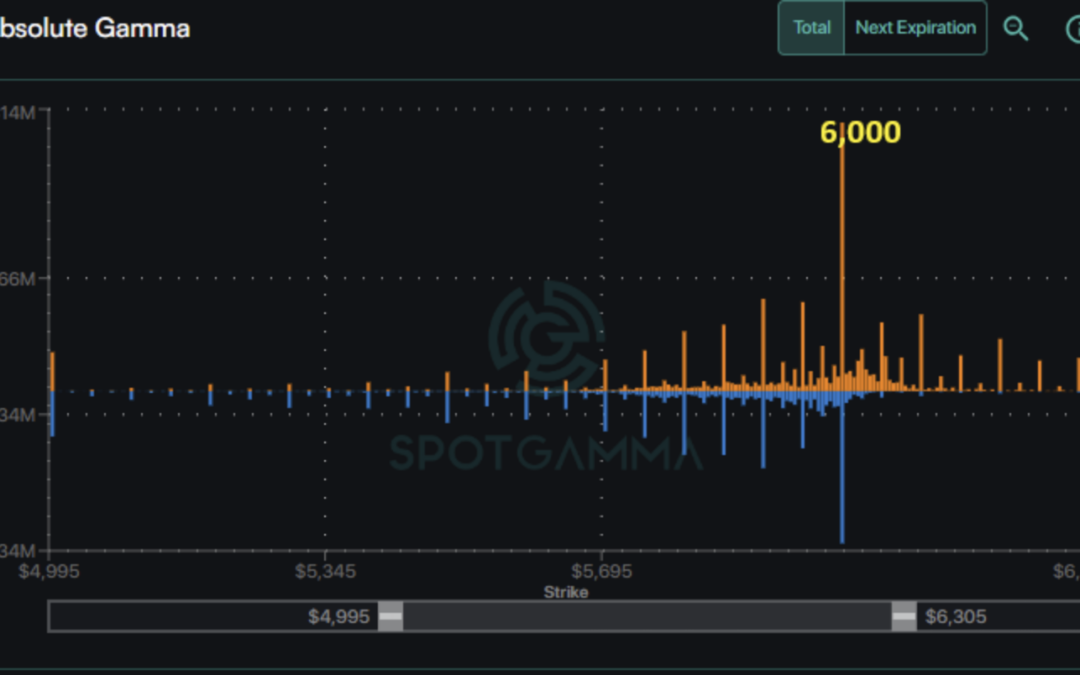

Macro Theme: Key dates ahead: 11/13 CPI 11/15 OPEX 11/20 VIX exp, NVDA ER We remain long of equities while SPX is >5,950, with an upside target of 6,050. 6,000 is a massive support/pivot level the OPEX week of 11/11. From pre-election: “Jan NVDA and/or...

Informe Option Levels

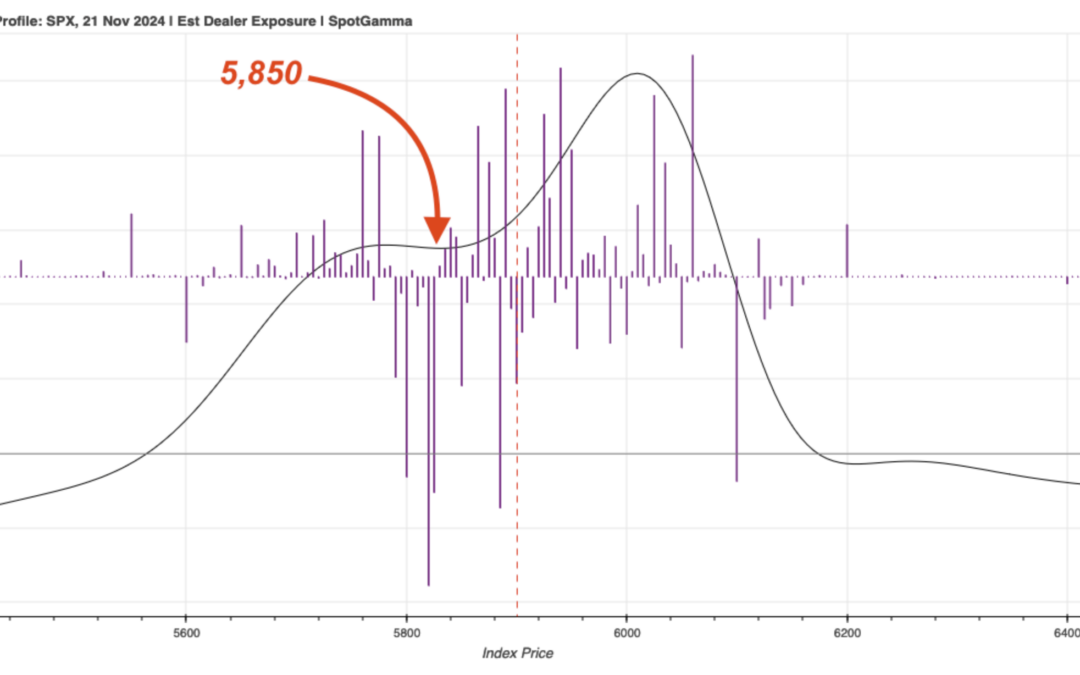

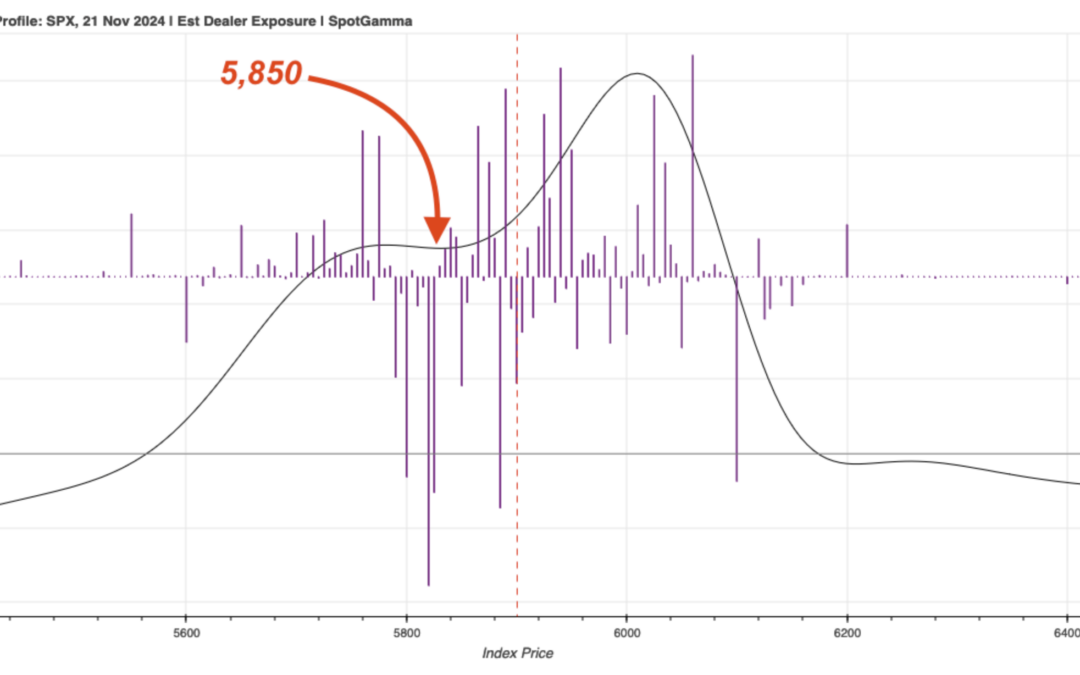

Macro Theme: Key dates ahead: 11/13 CPI We are long of equities while SPX is >5,900, with an initial upside target of 6,000 (Call Wall). From pre-election: “Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call...