ES futures are -57bps to 5,293. NQ futures are -65bps to 18,814. Key SG levels for the SPX are: Support: 5,275, 5,265, 5,250 Resistance: 5,300, 5,311, 5,333, 5,350 1 Day Implied Range: 0.54% For QQQ: Support: 450, 440 Resistance: 460, 465 IWM: Support: 205, 200, 190...

Macro Theme: Short Term SPX Resistance: 5,331 Short Term SPX Support: 5,285 SPX Risk Pivot Level: 5,300 Major SPX Range High/Resistance: 5,400 Major SPX Range Low/Support: 5,000 Into the end of May, we look for implied volatility/VIX to continue sliding lower,...

Informe Option Levels

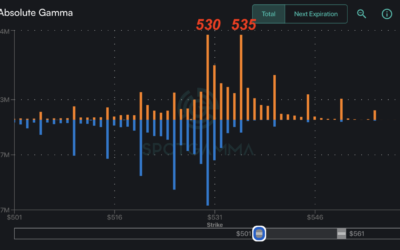

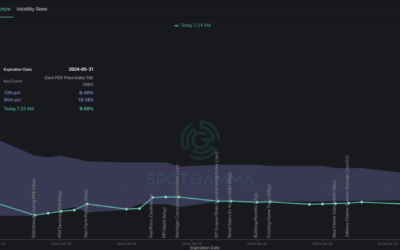

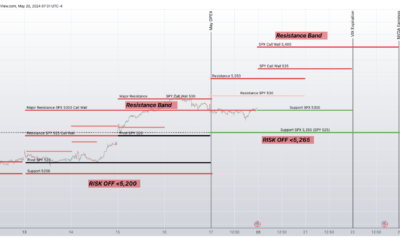

Macro Theme: Short Term SPX Resistance: 5,350 Short Term SPX Support: 5,265 SPX Risk Pivot Level: 5,265 Major SPX Range High/Resistance: 5,320 (SPY 530) Major SPX Range Low/Support: 5,000 For the week of 5/20*: 5,300 is a large base of support, with large...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,350 Short Term SPX Support: 5,265 SPX Risk Pivot Level: 5,265 Major SPX Range High/Resistance: 5,320 (SPY 530) Major SPX Range Low/Support: 5,000 For the week of 5/20*: 5,300 is a large base of support, with large...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,320 (SPY 530) Short Term SPX Support: 5,276 SPX Risk Pivot Level: 5,265 Major SPX Range High/Resistance: 5,320 (SPY 530 Call Wall) Major SPX Range Low/Support: 5,000 For the week of 5/13 we see several catalysts, which...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,265 (SPY 525 Call Wall) Short Term SPX Support: 5,200 SPX Risk Pivot Level: 5,200 Major SPX Range High/Resistance: 5,300 (SPX Call Wall) Major SPX Range Low/Support: 5,000 For the week of 5/13 we see several catalysts,...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,244 Short Term SPX Support: 5,200 SPX Risk Pivot Level: 5,200 Major SPX Range High/Resistance: 5,300 (SPX Call Wall) Major SPX Range Low/Support: 5,000 For the week of 5/13 we see several catalysts, which should lead to...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,200 (SPX Call Wall) Short Term SPX Support: 5,150 SPX Risk Pivot Level: 5,100 Major SPX Range High/Resistance: 5,200 (SPX Call Wall) Major SPX Range Low/Support: 4,800 For the week of 5/5 we see few catalysts, which...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,200 (SPX Call Wall) Short Term SPX Support: 5,150 SPX Risk Pivot Level: 5,100 Major SPX Range High/Resistance: 5,200 (SPX Call Wall) Major SPX Range Low/Support: 4,800 For the week of 5/5 we see few catalysts, which...

Informe Option Levels

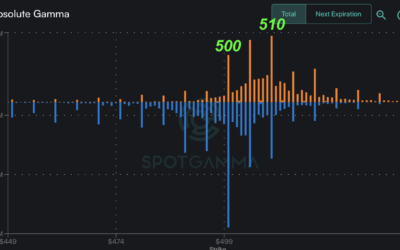

Macro Theme: Short Term SPX Resistance: 5,065 (SPY 505) Short Term SPX Support: 4,980 SPX Risk Pivot Level: 5,000 Major SPX Range High/Resistance: 5,115 (SPY 510) Major SPX Range Low/Support: 4,800 ‣ 5,100-5,115 (SPY 510) is the likely high into next...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,100 Short Term SPX Support: 5,020 (SPY 510) SPX Risk Pivot Level: 5,000 Major SPX Range High/Resistance: 5,100 Major SPX Range Low/Support: 4,800 ‣ 5,100-5,116 (SPY 510) is the likely high into next weeks 5/1 FOMC. We...

Informe Option Levels

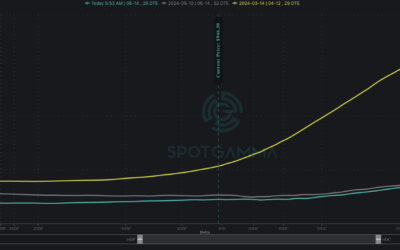

Macro Theme: Short Term SPX Resistance: 5,200 Short Term SPX Support: 5,100 SPX Risk Pivot Level: 5,200 Major SPX Range High/Resistance: 5,300 Major SPX Range Low/Support: 5,000 ‣ Monday & Tuesday flows could be supportive of equities based on charm + vanna...