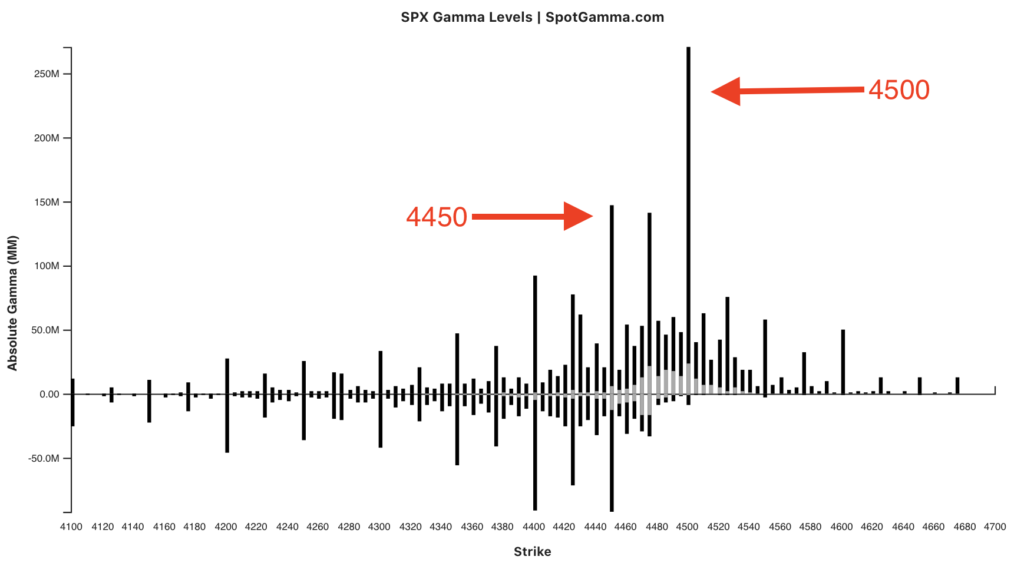

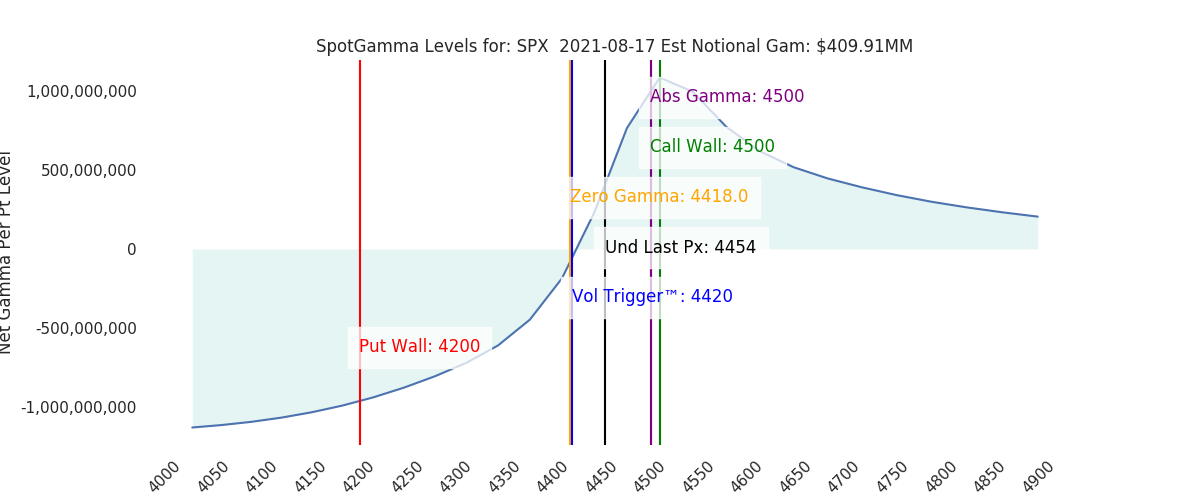

Futures have consolidated some of those gains from yesterday – back to 4450. The SG gamma index is quite high at 2.2, which leads to a very tight estimated range of 0.56% today. We see resistance at 4477 and support at 4450.

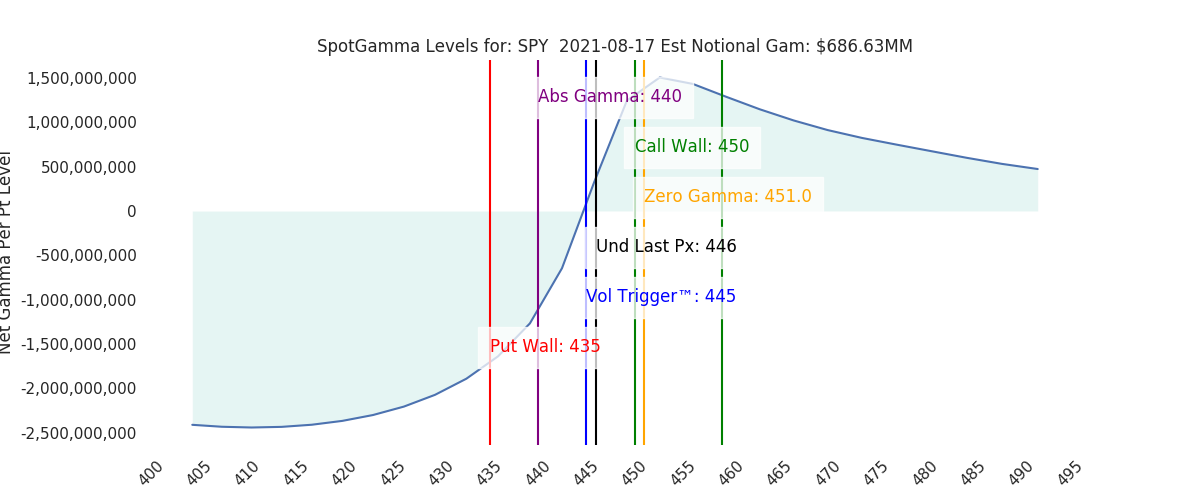

The major range should hold as 4450-4500 into Fridays OPEX, as we see little to shift the major gamma positions before then. We now look for SPY traders to reload their options positions in the 445-450 range and “lock in” this area into Friday. Therefore we think the next several days will be a “snoozefest”.

Model Overview:

4500 top, 4400 support into 8/20 OPEX.

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

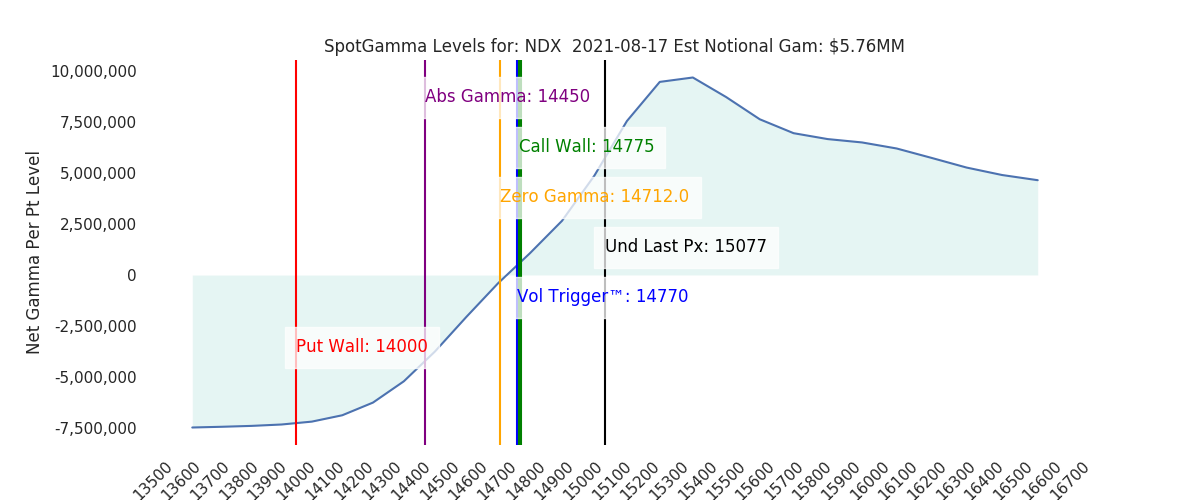

| Ref Price: | 4454 | 4470 | 446 | 15077 | 368 |

| SpotGamma Imp. 1 Day Move: | 0.56%, | 25.0 pts | Range: 4429.0 | 4479.0 | ||

| SpotGamma Imp. 5 Day Move: | 1.38% | 4450 (Monday Ref Px) | Range: 4389.0 | 4512.0 | ||

| SpotGamma Gamma Index™: | 2.21 | 1.67 | 0.15 | 0.06 | 0.01 |

| Volatility Trigger™: | 4420 | 4420 | 445 | 14770 | 367 |

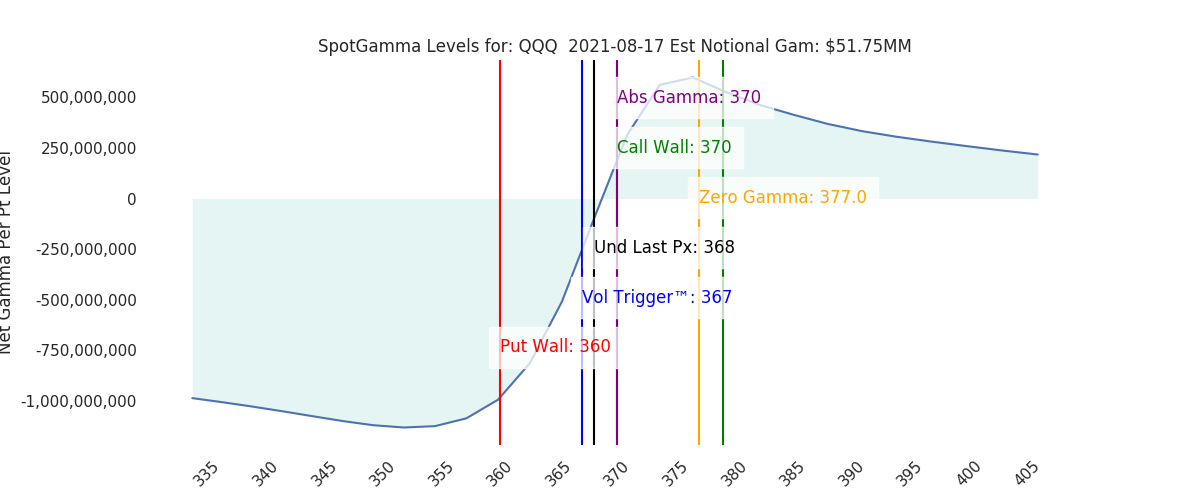

| SpotGamma Absolute Gamma Strike: | 4500 | 4450 | 440 | 14450 | 370 |

| Gamma Notional(MM): | $410 | $905 | $687 | $6 | $52 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4418 | 4402 | 0 | 0 | 0 |

| Put Wall Support: | 4200 | 4200 | 435 | 14000 | 360 |

| Call Wall Strike: | 4500 | 4500 | 450 | 14775 | 370 |

| CP Gam Tilt: | 1.69 | 1.52 | 1.19 | 1.36 | 1.03 |

| Delta Neutral Px: | 4236 | ||||

| Net Delta(MM): | $1,559,578 | $1,528,405 | $201,104 | $47,623 | $85,169 |

| 25D Risk Reversal | -0.06 | -0.05 | -0.07 | -0.06 | -0.06 |

| Top Absolute Gamma Strikes: |

|---|

| SPX: [4500, 4475, 4450, 4400] |

| SPY: [450, 446, 445, 440] |

| QQQ: [370, 368, 365, 360] |

| NDX:[15250, 15000, 14775, 14450] |

| SPX Combo: [4477.0, 4450.0, 4486.0, 4464.0, 4455.0] |

| SPY Combo: [449.2, 446.52, 450.1, 447.86, 446.97] |

| NDX Combo: [15124.0, 15320.0, 15290.0, 15185.0, 15200.0] |

0 comentarios