Macro Theme:

Major Resistance: $4,300

Pivot Level: $4,200

Interim Support: $4,250

Range High: $4,300 Call Wall

Range Low: $4,000 Put Wall

‣ We are neutral on the S&P, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX

Founder’s Note:

Futures are once again flat, with SG levels largely unchanged. 4,300-4,305 (SPY 430) remains major overhead resistance. Support remains at the SPY 427 level (SPX 4,275). Volatility is anticipated to remain low.

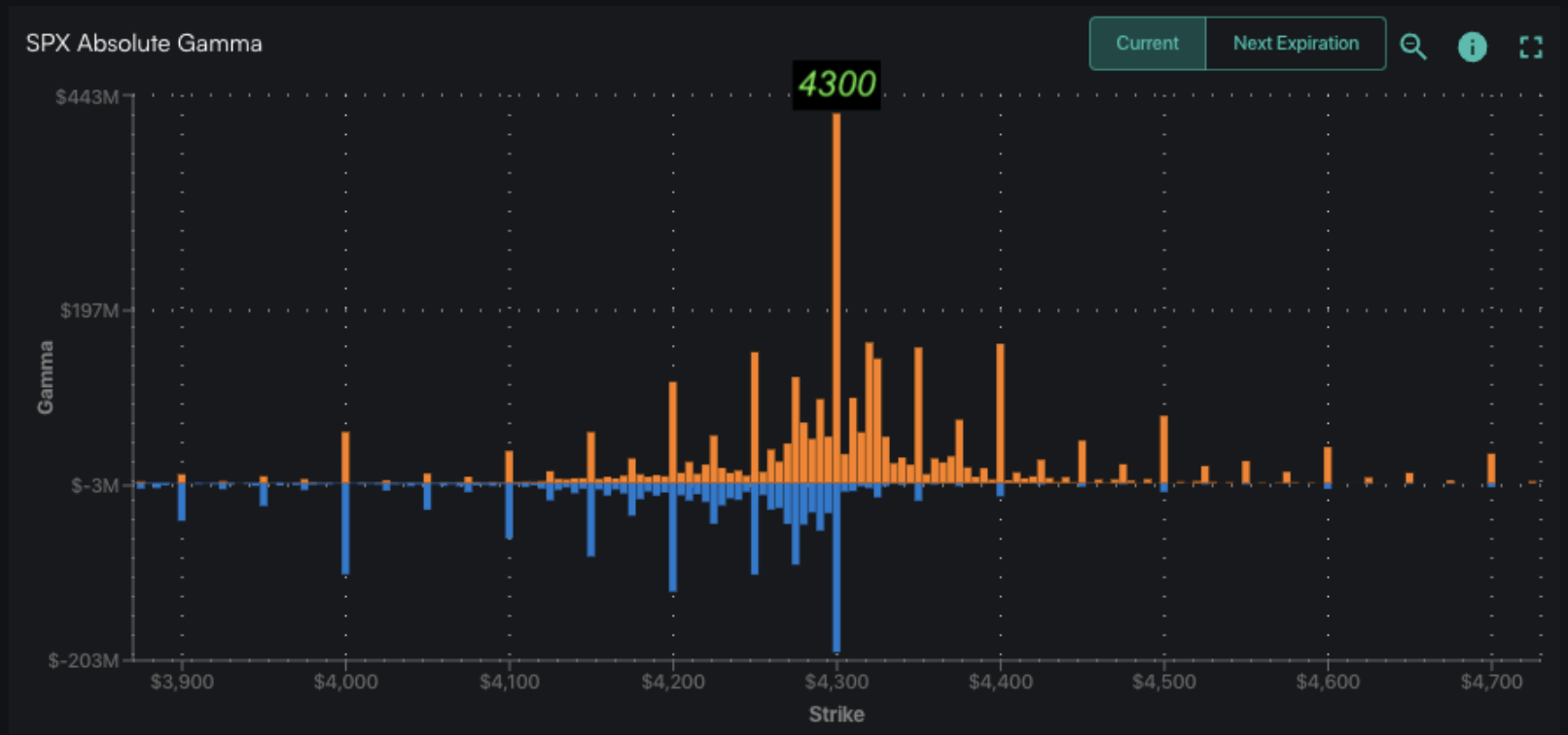

The SPY Call Wall has rolled higher to 435, which is a function of both calls being added to that strike but also puts filling in the 425-430 range. We see calls being added above for SPX, too, however 4,300 is a massive call strike level, as shown below. We therefore believe 4,300 holds as the major upside resistance point into Monday. Ultimately calls being added at strikes above is a net positive.

In QQQ’s the key range remains 350-355.

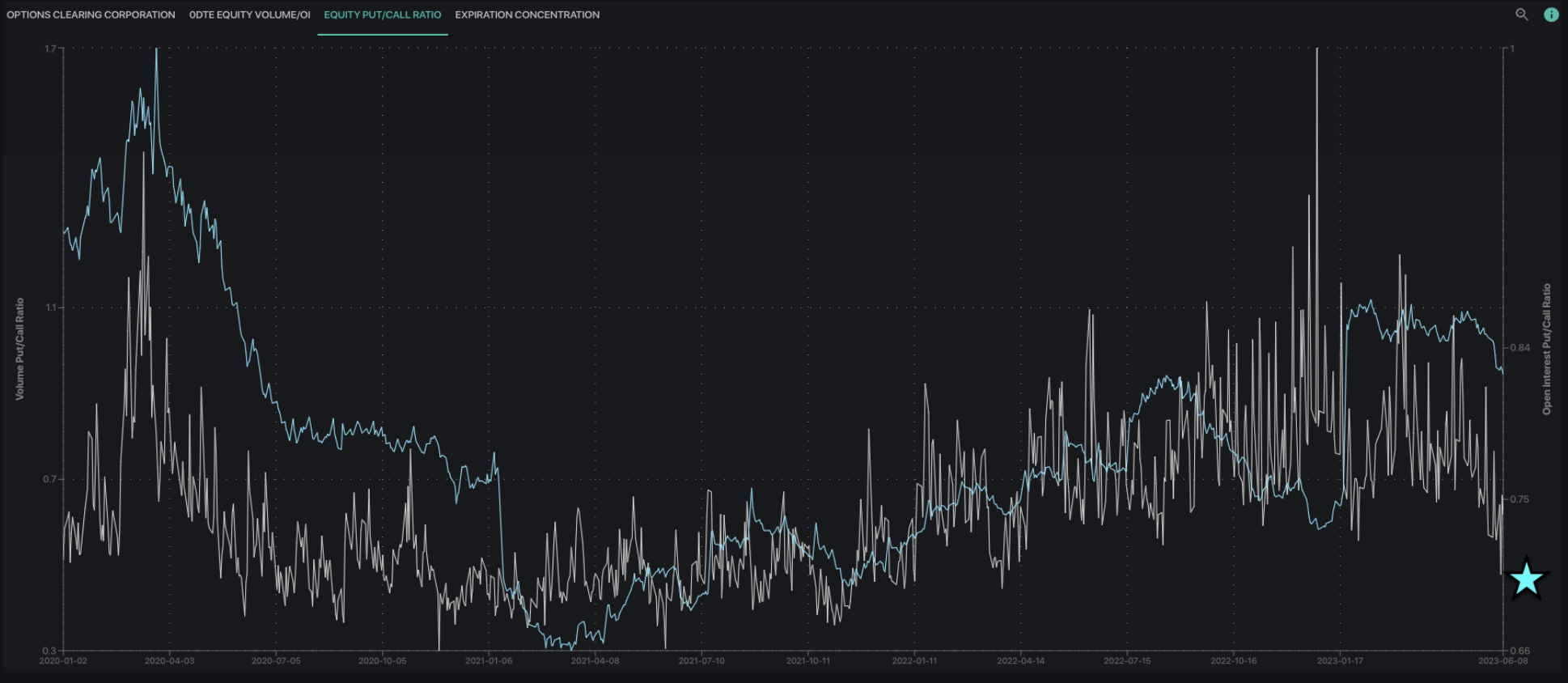

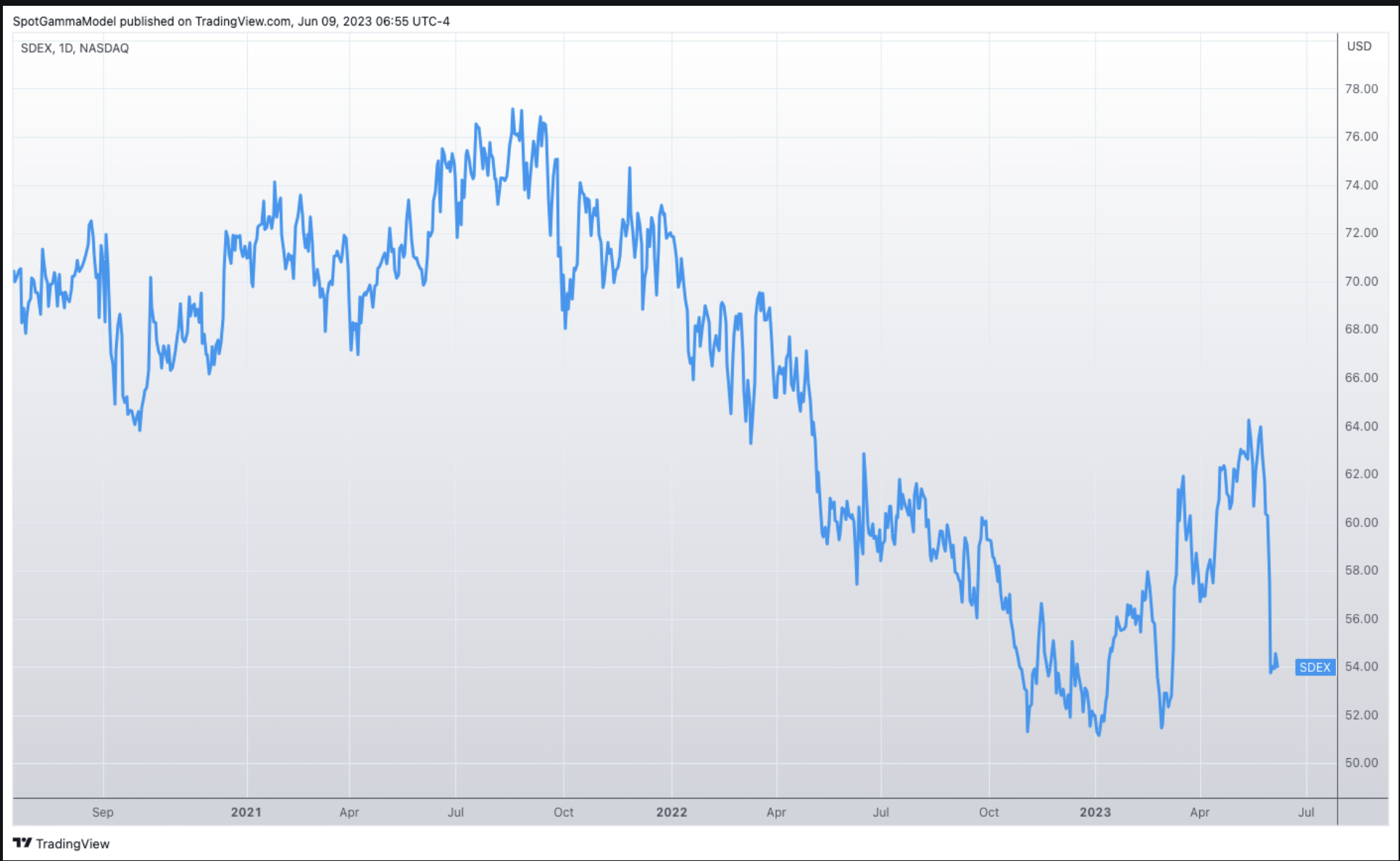

While the major Index/ETF side of things is quiet, the “memes” are firing off. Names like BYND and CVNA were up +20% showing that the momentum chasing, speculative fast money is back in action. This has driven equity put call readings sharply lower, and nearly back to 2021 days. Of course realized volatility (1 month = 12%), implied volatility (VIX 13’s), major equities, etc are all back to those liquidity fueled 2021 levels. It should be noted that the lowest quality remains well below ’21 (looking at you, ARKK).

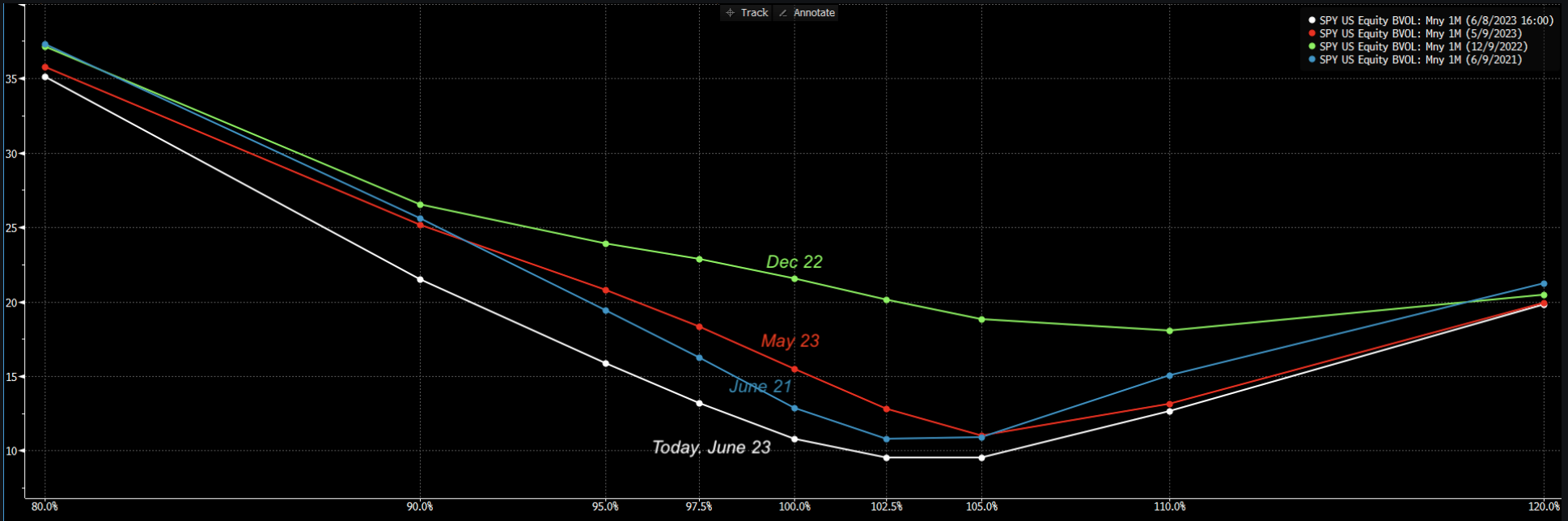

Skew has also collapsed post-Debt Ceiling, which implies that prices/demand for OTM puts has tanked. Its hard to blame put buyers – that has been the pain trade.

For comparison we’ve plotted 1 month SPY skew across various time frames. What you can see is that SPY IV is lower than at any point in the last two years. You can also note that the smallest spread between now (white) and that massive ’21 rally (blue) are the upside strikes 102-105%.

Through all of this, its hard to not view this market as becoming a crowded long. This seems to be reflective in the rolling nature of the chase – first AI now onto small caps and memes. The tricky part is that these conditions can persist, and very well may with a benign FOMC next week.

We are, however, looking for some consolidation in equities through FOMC and the call-heavy OPEX. Fortunately, with IV at these relative lows we think owning a bit of Index downside protection here is cheap, and may be funded by single stocks calls that have a rich skew.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4293 |

$429 |

$14483 |

$353 |

$1880 |

$186 |

|

SpotGamma Implied 1-Day Move: |

0.78% |

0.78% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.16% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4245 |

$429 |

$13475 |

$351 |

$1850 |

$183 |

|

Absolute Gamma Strike: |

$4300 |

$430 |

$13850 |

$350 |

$1800 |

$185 |

|

SpotGamma Call Wall: |

$4300 |

$435 |

$15125 |

$360 |

$1790 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$427 |

$14480 |

$332 |

$1750 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4205 |

$425 |

$0 |

$352 |

$1862 |

$185 |

|

Gamma Tilt: |

1.625 |

0.928 |

2.282 |

1.019 |

1.045 |

1.144 |

|

SpotGamma Gamma Index™: |

2.731 |

-0.072 |

0.094 |

0.007 |

0.003 |

0.023 |

|

Gamma Notional (MM): |

$943.595M |

$543.748M |

$12.846M |

‑$32.995M |

$2.401M |

$186.096M |

|

25 Day Risk Reversal: |

-0.041 |

-0.042 |

-0.037 |

-0.036 |

-0.028 |

-0.018 |

|

Call Volume: |

552.775K |

1.934M |

9.076K |

755.371K |

21.725K |

517.066K |

|

Put Volume: |

863.908K |

2.514M |

7.767K |

1.196M |

31.137K |

441.164K |

|

Call Open Interest: |

6.689M |

7.511M |

76.497K |

5.162M |

224.657K |

4.123M |

|

Put Open Interest: |

13.249M |

14.746M |

72.327K |

10.569M |

393.777K |

8.282M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4300, 4275, 4250, 4200] |

|

SPY Levels: [430, 428, 427, 425] |

|

NDX Levels: [15125, 15100, 15000, 13850] |

|

QQQ Levels: [355, 353, 350, 340] |

|

SPX Combos: [(4500,97.03), (4474,82.14), (4448,93.88), (4427,86.03), (4401,99.81), (4388,77.50), (4380,78.70), (4375,97.22), (4371,90.68), (4367,84.86), (4358,87.22), (4354,92.84), (4349,99.55), (4345,82.05), (4341,92.82), (4337,83.40), (4328,94.75), (4324,99.64), (4319,99.77), (4315,95.53), (4311,98.81), (4307,84.92), (4298,99.95), (4289,93.21), (4285,77.88), (4276,87.95), (4272,77.55), (4264,78.48), (4251,86.37), (4148,87.11), (4100,91.63)] |

|

SPY Combos: [432.56, 434.28, 442.43, 437.28] |

|

NDX Combos: [14556, 14759, 15121, 13846] |

|

QQQ Combos: [341.74, 364.34, 336.09, 359.39] |