Macro Theme:

Major Resistance: $4,400

Pivot Level: $4,400

Interim Support: $4,350

Range High: $4,500 Call Wall

Range Low: $4,000 Put Wall

‣ We are neutral on the S&P, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX with a target of 4,320

‣ Much of our data into 6/16 suggests that call buying is at major extremes, backing our views for a market correction

Founder’s Note:

Futures were flat overnight, at 4,432. First resistance is at 4,400, followed by 4,430 (SPY 443). Support below shows at 4,376 & 4,350.

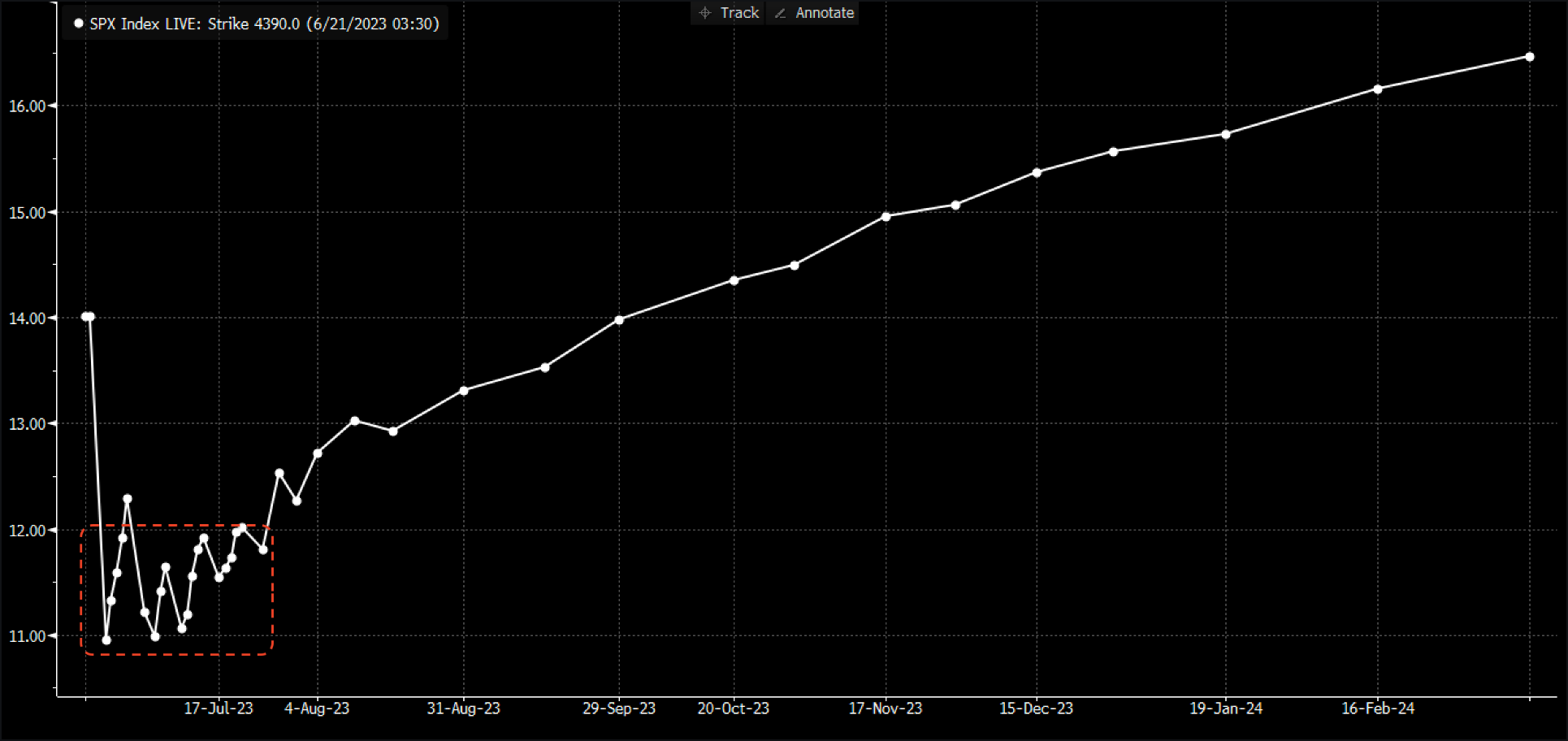

All is quiet in the options markets after Friday’s large expiration. 1 month realized volatility is around 11%, and thats about where near term forward IV’s are priced in the SPX (per term structure, below). This 11% IV equates to traders looking for max ~70bps daily moves in the S&P – a figure which is not terribly appealing to vol buyers nor sellers.

What may help shake things up is this AM’s VIX expiration.

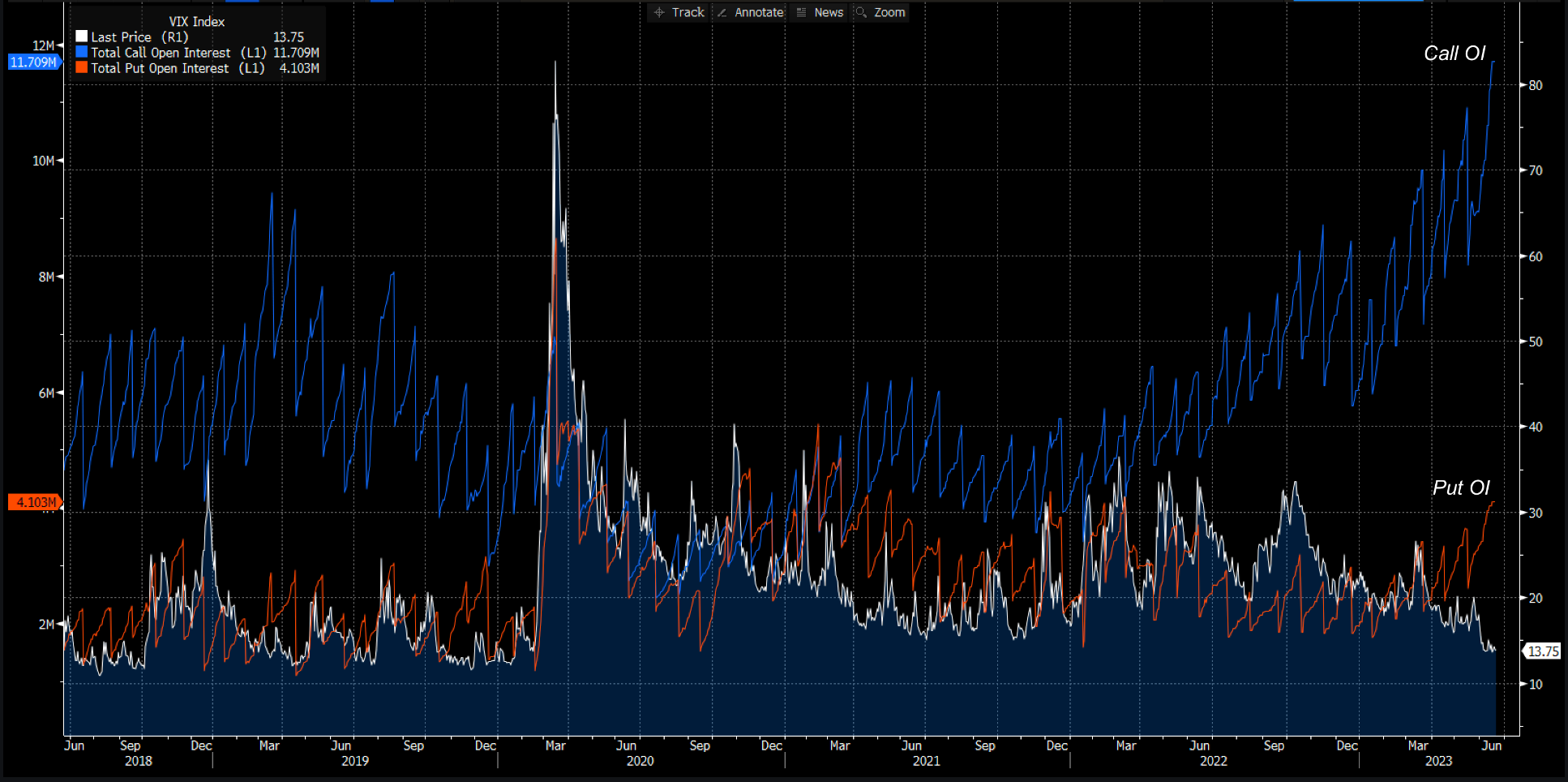

While the main VIX data point trolled out these days is the record VIX call open interest (shown below in blue), the bulk of value in VIX contracts is on the put side (red). This isn’t terribly surprising given the 13 handle VIX.

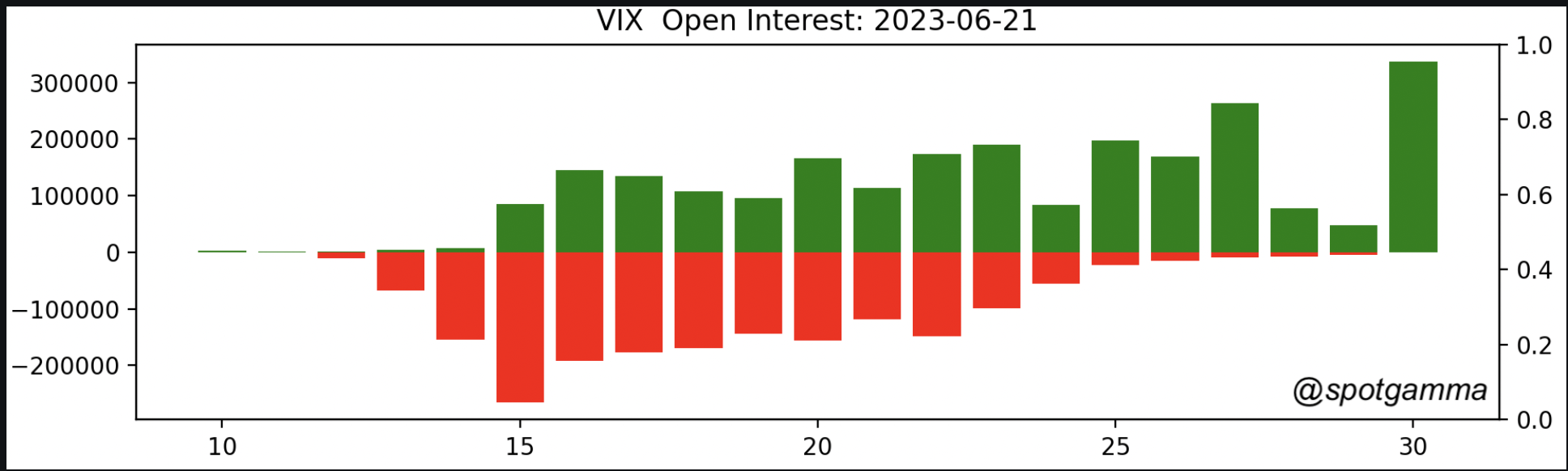

With todays VIX-Exp we are going to lose 3.9 million call contracts (33% of total), and 1.8 million puts (43% of total). As you can see below, nearly all of these VIX calls are set to expire out-of-the-money. However, there are a sizable number of in-the-money puts which were layered on after the March bank crisis.

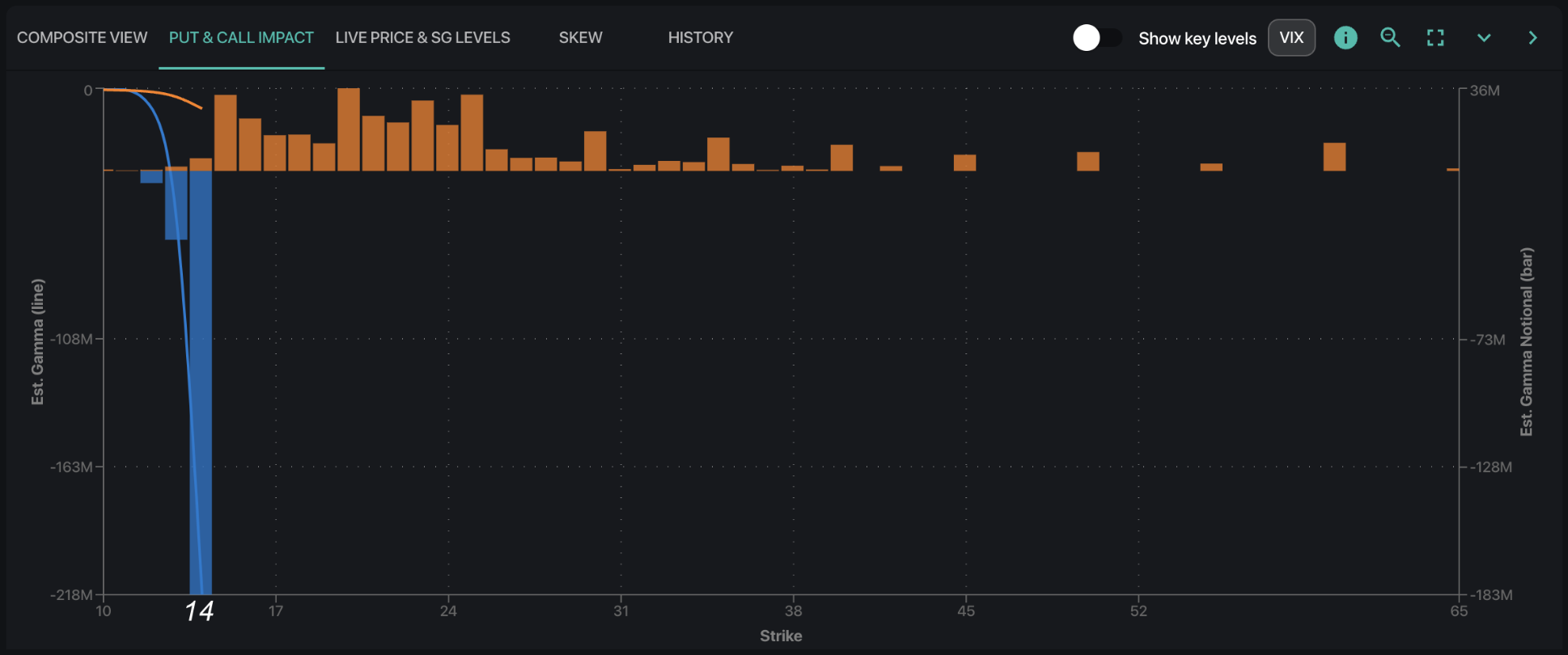

Viewing the VIX interest through the gamma-weighted EquityHub, you can see the “size” is at the14 put, and we think this has had a volatility pinning effect into todays expiration. As we clear this VIX put interest, it could add a tailwind to our bearish equity outlook via “releasing” VIX/volatility to drift higher. Further, because the VIX is at +1yr lows and SPX RV/IV is at similar lows, there arguably isn’t a big incentive to re-load on a big short vol position here.

Accordingly, as outlined in yesterday’s AM note, we remain bearish while the S&P is <4,400 and eye a test of the 4,320 area. Should the S&P close >4,400 our short view would be stopped out.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4388 |

$437 |

$15074 |

$366 |

$1866 |

$185 |

|

SpotGamma Implied 1-Day Move: |

0.88% |

0.88% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.32% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4310 |

$437 |

$14800 |

$364 |

$1850 |

$186 |

|

Absolute Gamma Strike: |

$4400 |

$440 |

$15200 |

$360 |

$1880 |

$180 |

|

SpotGamma Call Wall: |

$4500 |

$440 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$430 |

$14475 |

$362 |

$1750 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4330 |

$439 |

$13634 |

$366 |

$1890 |

$186 |

|

Gamma Tilt: |

1.269 |

0.804 |

2.46 |

0.994 |

0.888 |

0.805 |

|

SpotGamma Gamma Index™: |

1.109 |

-0.181 |

0.074 |

-0.002 |

-0.006 |

-0.028 |

|

Gamma Notional (MM): |

$553.266M |

‑$711.02M |

$9.455M |

‑$42.668M |

‑$5.866M |

‑$264.237M |

|

25 Day Risk Reversal: |

-0.031 |

-0.015 |

-0.024 |

-0.019 |

-0.027 |

-0.021 |

|

Call Volume: |

544.50K |

1.843M |

6.941K |

697.932K |

14.30K |

258.593K |

|

Put Volume: |

1.086M |

2.534M |

8.633K |

1.139M |

35.83K |

506.064K |

|

Call Open Interest: |

5.37M |

5.974M |

53.311K |

4.119M |

168.572K |

3.351M |

|

Put Open Interest: |

11.59M |

12.911M |

57.415K |

8.82M |

303.217K |

6.963M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4450, 4400, 4350, 4300] |

|

SPY Levels: [440, 437, 435, 430] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [370, 367, 365, 360] |

|

SPX Combos: [(4599,94.79), (4573,81.49), (4551,93.72), (4525,91.82), (4516,75.36), (4498,99.08), (4476,94.91), (4472,80.94), (4459,82.91), (4450,98.38), (4441,78.53), (4437,85.88), (4428,85.49), (4424,93.85), (4419,79.93), (4415,86.65), (4411,76.50), (4402,97.19), (4376,95.92), (4345,76.42), (4340,79.27), (4318,94.67), (4248,85.34), (4200,92.76)] |

|

SPY Combos: [446.41, 441.17, 443.79, 428.49] |

|

NDX Combos: [15210, 15195, 15406, 15813] |

|

QQQ Combos: [370.5, 369.77, 374.54, 379.69] |