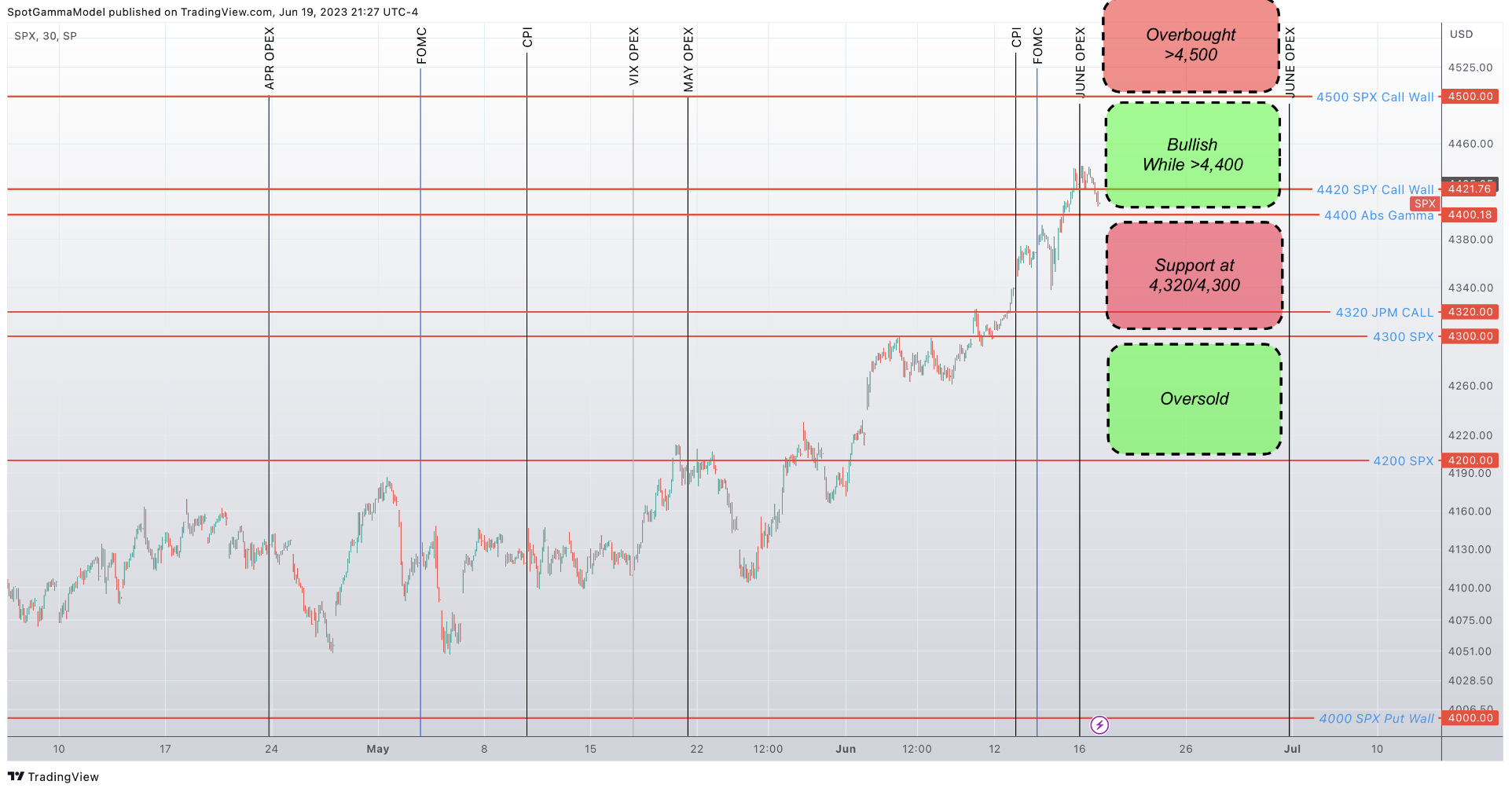

Macro Theme:

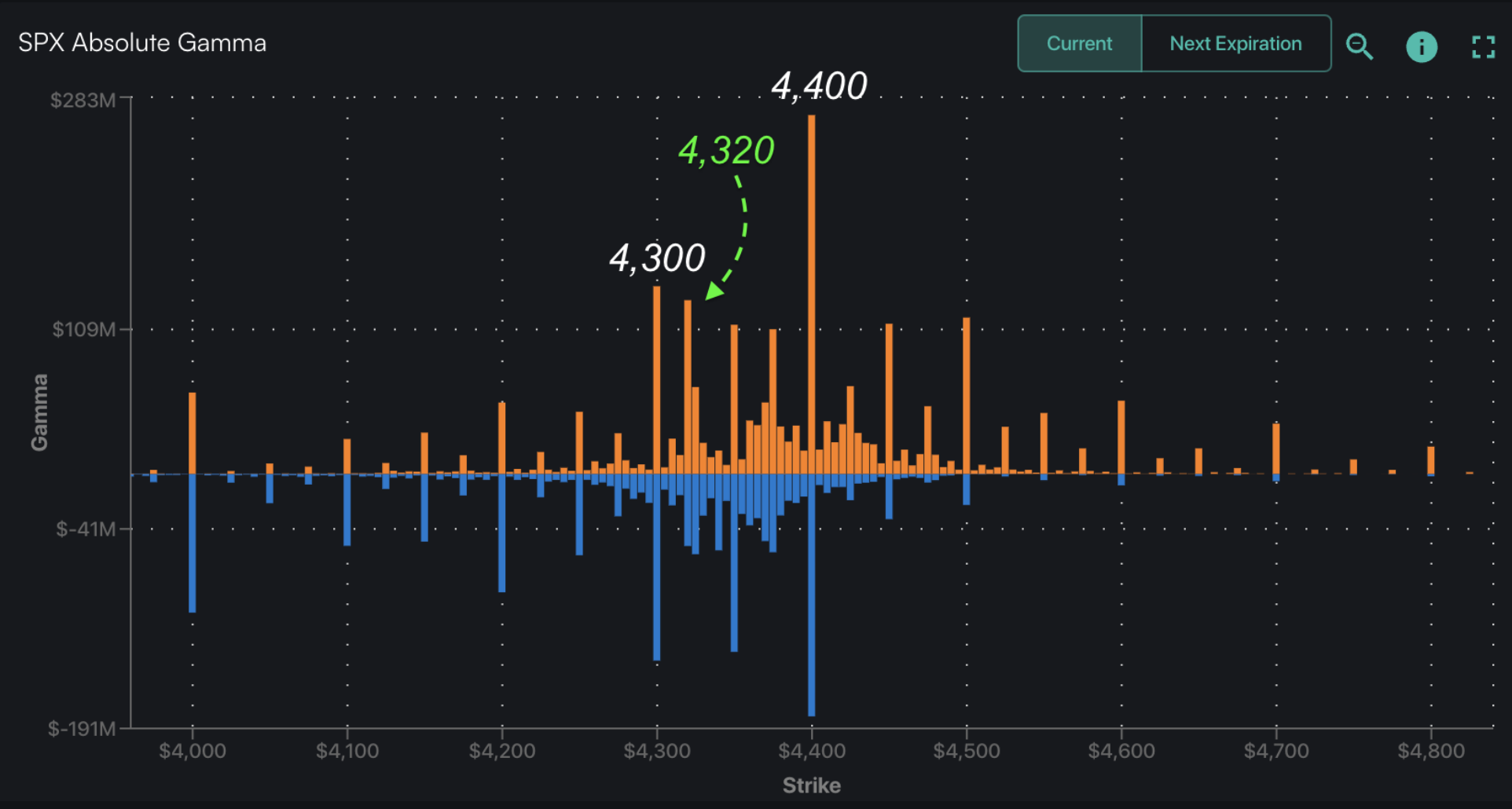

Major Resistance: $4,400

Pivot Level: $4,400

Interim Support: $4,350

Range High: $4,500 Call Wall

Range Low: $4,000 Put Wall

‣ We are neutral on the S&P, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX with a target of 4,320

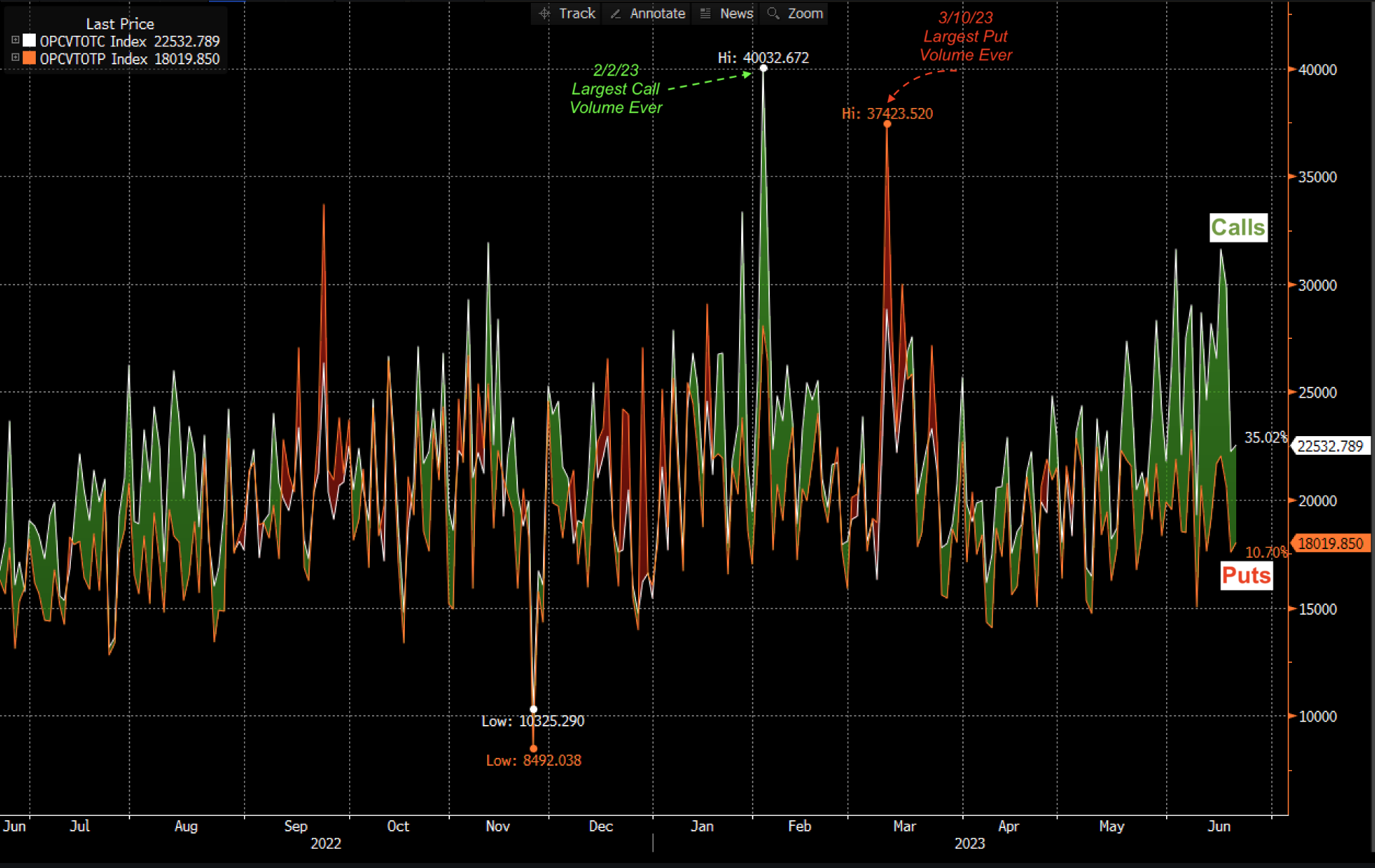

‣ Much of our data into 6/16 suggests that call buying is at major extremes, backing our views for a market correction

Founder’s Note:

Futures are lower to 4,392. Key SG levels are unchanged, with support at 4,350 followed by 4,320. Resistance above is at 4,400.

The two main talking points from derivative folks are:

“stock down, vol down”

the JPM 4,320 strike

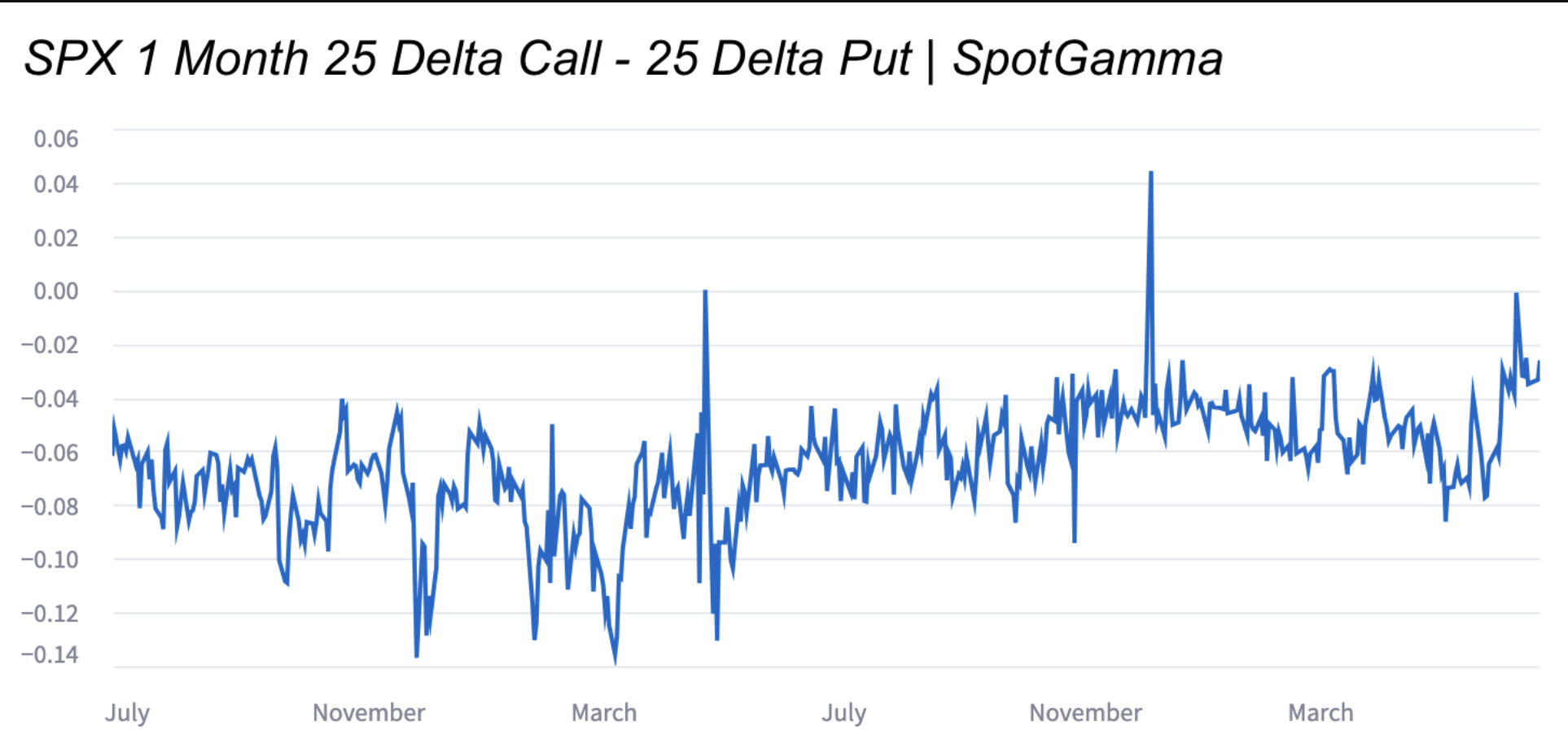

Neither of these points should come as a terrible surprise to SpotGamma readers, as the “stock down/vol down” dynamic follows a prolonged period of “stock up/vol up”. As you can see below with the SPX, call prices vs puts are now returning back to their longer term ranges, as are many other stocks/indicies (see Friday’s AM note on call extremes). Through this lens the recent equity weakness is due to the decay of call prices/IV’s and removal of large call positions at June OPEX.

Adding to this point, we still see heavy net call volumes in the US options space, with little increase in put volumes. High upside IV is drawing call sellers (via overwriting or puking longs) – no one is out looking for big put protection here.

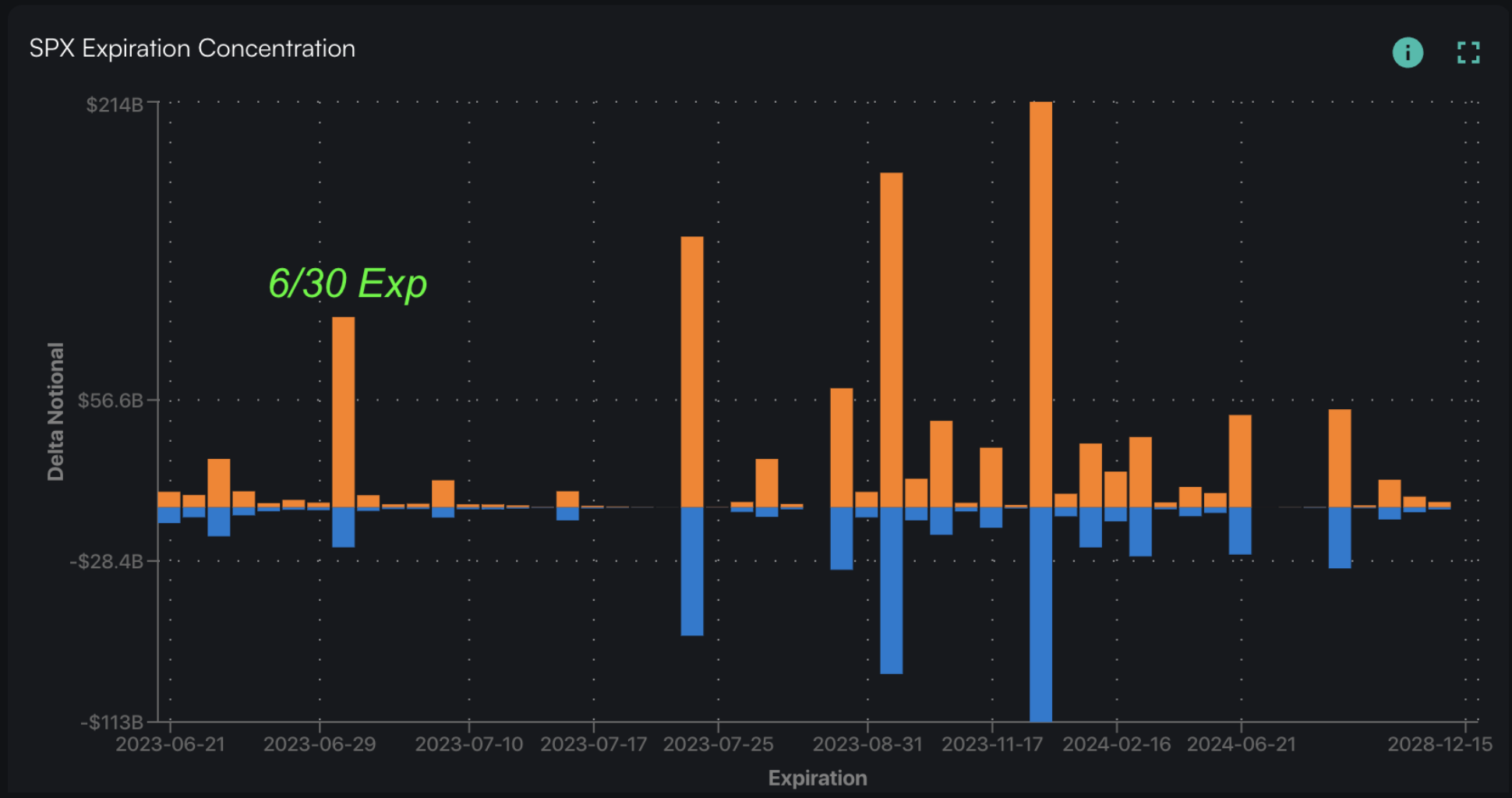

Finally we turn to the 6/30 exp 4,320 JPM collar call strike. Shown here is gamma by expiration, and as you can see that 6/30 expiration is fairly sizable. We have a pet theory that everyone’s awareness of this position may draw the market towards it. Adding to this idea we saw 16k puts added to this strike yesterday.

We see ~$100bn of deltas at this 4,320 strike for 6/30 with a total of 60k calls and 18k puts. However, as you can see here, the total gamma (calls + puts) at that strike is smaller than that of both 4,300 & 4,350 – so there are some other things going on in that price area. The gamma at these other strikes should help to form 4,300-4,350 as a support range into 6/30 expiration, and we are still of the opinion that this 4,300 strike is tested in the next few sessions.

This all lines up from the market map posted on Tuesday AM.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4365 |

$434 |

$14865 |

$362 |

$1863 |

$184 |

|

SpotGamma Implied 1-Day Move: |

0.84% |

0.84% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.32% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4355 |

$130 |

$14800 |

$364 |

$1850 |

$186 |

|

Absolute Gamma Strike: |

$4400 |

$500 |

$15200 |

$360 |

$1880 |

$180 |

|

SpotGamma Call Wall: |

$4500 |

$500 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$465 |

$14475 |

$355 |

$1750 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4308 |

$0 |

$13753 |

$364 |

$1886 |

$187 |

|

Gamma Tilt: |

1.223 |

1.98 |

2.151 |

0.780 |

0.871 |

0.781 |

|

SpotGamma Gamma Index™: |

1.054 |

0.001 |

0.067 |

-0.084 |

-0.007 |

-0.033 |

|

Gamma Notional (MM): |

$378.861M |

$3.721M |

$8.533M |

‑$389.483M |

‑$7.357M |

‑$326.071M |

|

25 Day Risk Reversal: |

-0.026 |

-0.012 |

-0.018 |

-0.013 |

-0.021 |

-0.016 |

|

Call Volume: |

567.64K |

1.897M |

8.41K |

779.26K |

13.215K |

286.621K |

|

Put Volume: |

1.149M |

2.344M |

9.196K |

1.33M |

21.935K |

397.444K |

|

Call Open Interest: |

5.626M |

53.849K |

53.587K |

4.172M |

169.992K |

3.383M |

|

Put Open Interest: |

11.538M |

36.617K |

58.245K |

8.894M |

307.647K |

7.06M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4400, 4350, 4320, 4300] |

|

SPY Levels: [550, 500, 465, 410] |

|

NDX Levels: [15200, 15150, 15000, 14000] |

|

QQQ Levels: [365, 360, 355, 350] |

|

SPX Combos: [(4575,80.45), (4549,93.21), (4523,90.85), (4501,98.78), (4475,93.96), (4462,76.21), (4449,98.03), (4440,77.77), (4436,78.45), (4431,85.63), (4427,94.31), (4418,88.29), (4414,74.79), (4409,87.66), (4401,98.70), (4392,74.95), (4374,94.91), (4357,81.39), (4348,83.88), (4339,92.90), (4322,97.90), (4296,80.76), (4287,74.98), (4252,74.97), (4200,91.60), (4152,82.30)] |

|

SPY Combos: [445.79, 441.01, 436.22, 433.62] |

|

NDX Combos: [15193, 14583, 14375, 15118] |

|

QQQ Combos: [366.01, 365.65, 370.73, 380.52] |