Macro Theme:

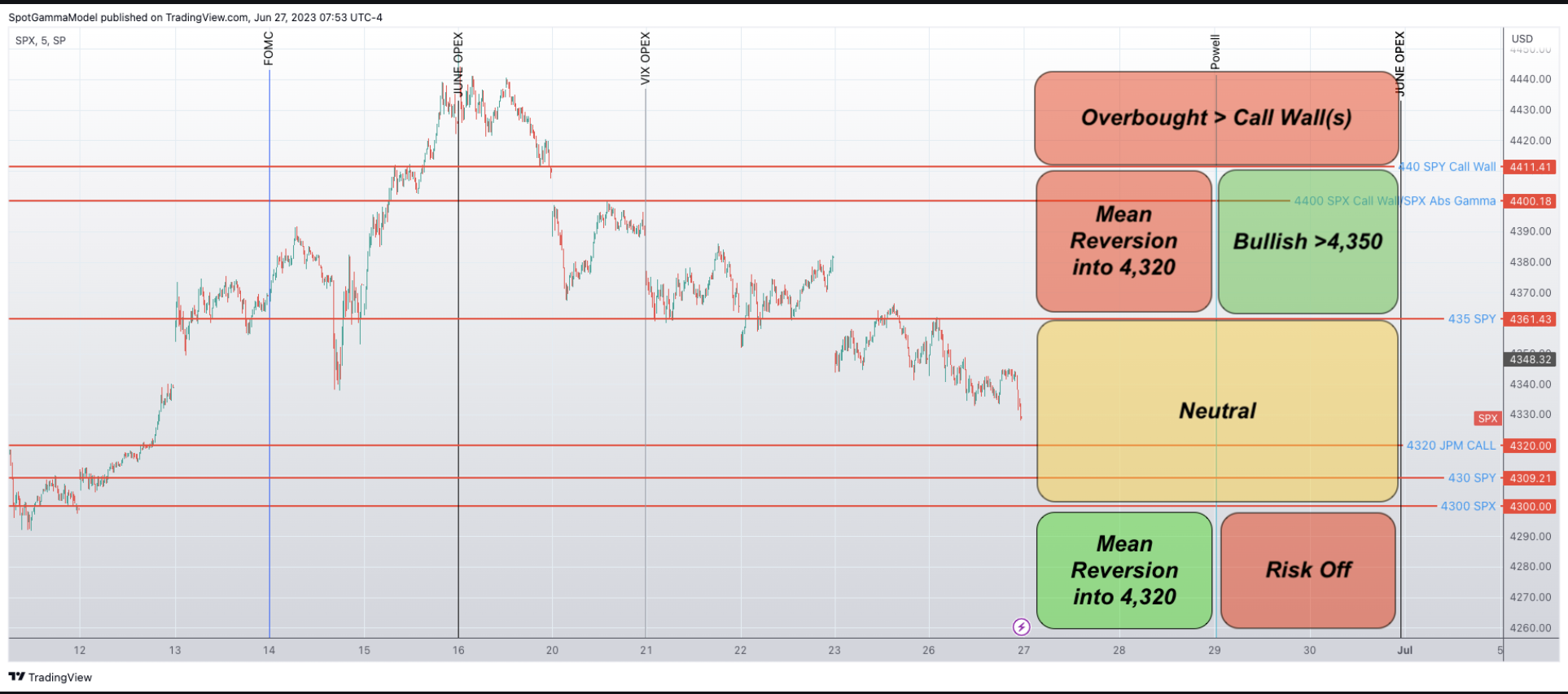

Major Resistance: 4,400 – 4,410 (SPY 440 Call Wall)

Pivot Level: 4,400

Interim Support: 4,320

Range High: 4,410

Range Low: 4,000 Put Wall

‣ We are neutral on the SPX, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX with a target of 4,320. A break of 4,400 flips our stance back to bullish SPX

‣ We favor QQQ & megacap tech longs based on recent, lower relative call IV’s

Founders Note:

Futures are marginally higher to 4,380. SG levels remain unchanged with resistance at 4,350 – 4,360 (SPY 435), followed by 4,400. A cluster of support levels show below at 4,320, 4,310 (SPY 430) and 4,300.

For today in QQQ 355 is support, and 360 is now resistance.

The SPX is down ~2.5% from its high on June 16th OPEX, having closed yesterday just above our target price of 4,320. Tech is fairing worse, with QQQ -4% since 6/16.

This 4,320 level is obviously the most watched level into 6/30 OPEX, which makes it the center of attraction (more on this shortly).

We have been targeting this 4,320 area after June 16th OPEX, and are now looking for the S&P to find support in this 4,320-4,300 range. This support view is based on the large, balanced (puts & calls) gamma positions tied to strikes in this area (4,300, 4,320 & 430 SPY), and the markets attention to this 4,320 level.

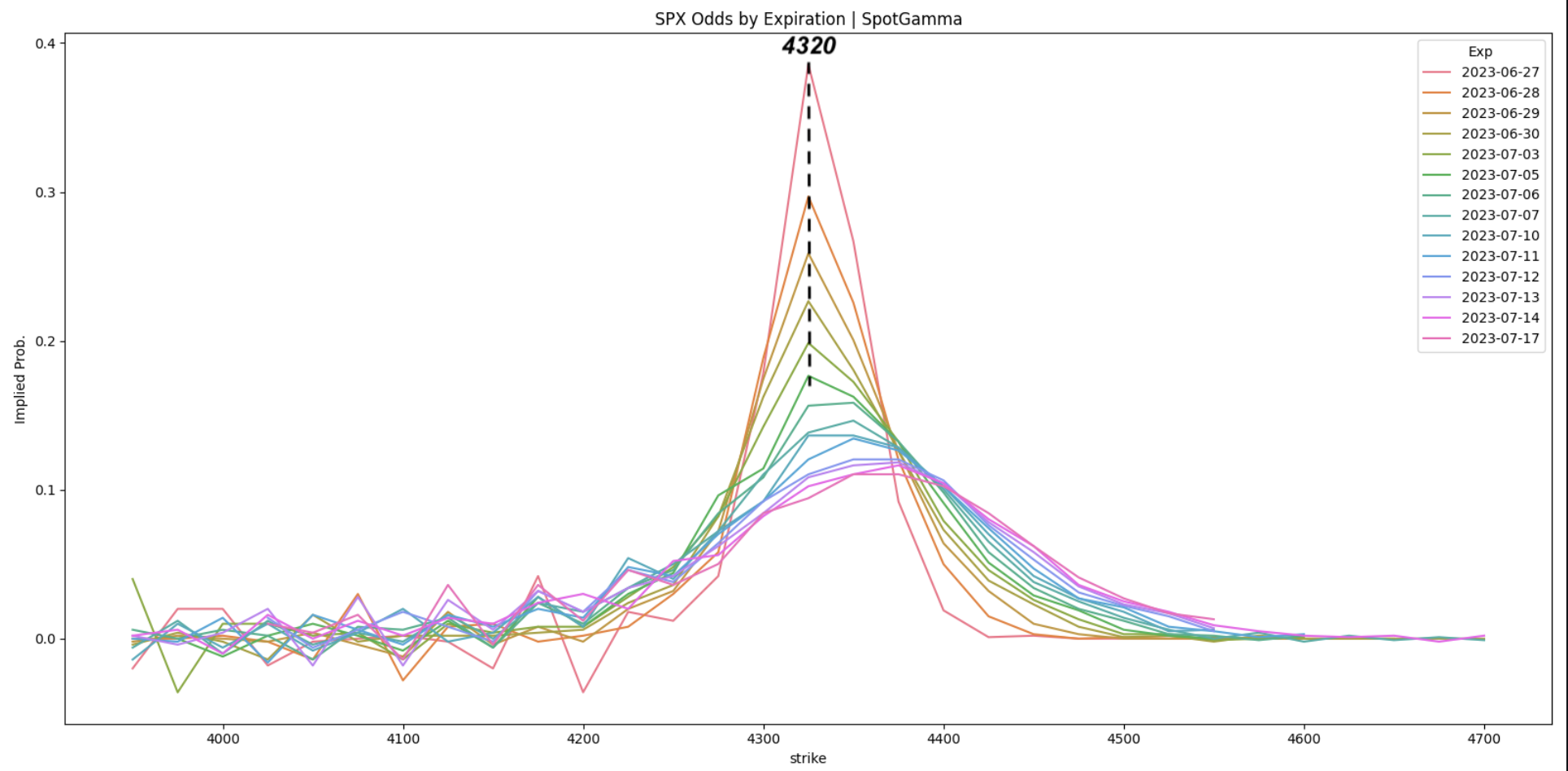

And, while much attention is given to this JPM strike, one could argue its for good reason. This is not only because you can see it in the gamma positioning above, but when we look at options-implied pricing we see 4,320 as the markets consensus SPX price target. This is seen through the plot below wherein we back out the odds of the S&P closing at a given level(s) on a given expiration. As marked below 4,320 holds the highest odds for all expirations through 7/3. Market makers & dealers are the ones setting the prevailing options prices, based primarily on inventory/exposure. Through this lens – they’re pricing a JPM 4,320 pin.

Where some edge may come in is the fact that we don’t think this pin holds for much longer than tomorrow, as we have Powell on 6/29 and a lot of flows, both JPM related and quarter end equity rebalancing, set to unlock on 6/30 (as per yesterdays note).

Additionally, from GS via ZH:

“Goldman’s Gillian Hood, who calculates that heading into month- and quarter-end, the bank’s trading desk model estimates a net of $26 billion of US equities to sell from US pensions given the moves in equities and bonds over the month. This, as Hood puts it, “is expected to be a significant rebalancing event”, or said otherwise, we are facing a huge pension dump in the coming days just as liquidity shrivels post last Friday’s Russel rebalance.”

We’re unsure of if those rebalancing flows will manifest, and/or if they’ll drive the market through our key support line of 4,300. However, we feel pretty confident that there are a lot of forces which should make pinning 4,320 on 6/30 rather unlikely. Not only that, we think that the JPM collar dealers are incentivized to act in new & unexpected ways (i.e. entering & hedging the trade) which veils the mechanics and related impacts of the execution on 6/30 (see our recent discussion with former derivs desk head Tom Jarck here).

This brings us back to the price probability plot above – if the whole world is planning on 4,320 then is edge found betting on a move away from there? To this point Friday’s ATM straddle (ref 4,340) is currently trading at 12% IV….

Lastly, we turn over to the tech space wherein we’ve seen a significant cooling of call IV’s. This can be seen through our risk reversal measurement (now available for all stocks on the EquityHub). Shown below is AMD, and as the stock has reversed back toward $100 the stocks IV has come in, too. We’ve been of the view that the cooling of call IV’s and some reversion in these AI prices would lead to some dip buyers, and many of these names are now trading at their “Key Gamma Strikes”. Generally speaking, should these key gamma levels break to the downside, we may be stopped out on this long view.

Along those some lines we’ve now updated our view of the S&P as follows. We were bearish (see here) on the S&P <4,400 with a target of 4,320. Into 4/29 we still look to play mean reversion into the 4,320 area. Post 6/29, particularly into 6/30, we look for a move away from 4,320 which results in a bearish outlook on <4,300, and bullish >4,350.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4328 |

$433 |

$14891 |

$362 |

$1821 |

$180 |

|

SpotGamma Implied 1-Day Move: |

0.83% |

0.83% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.22% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4345 |

$434 |

$14800 |

$362 |

$1850 |

$183 |

|

Absolute Gamma Strike: |

$4300 |

$430 |

$15200 |

$360 |

$1800 |

$180 |

|

SpotGamma Call Wall: |

$4400 |

$440 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$430 |

$14475 |

$355 |

$1780 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4303 |

$435 |

$13880 |

$364 |

$1873 |

$186 |

|

Gamma Tilt: |

1.021 |

0.692 |

2.298 |

0.783 |

0.671 |

0.604 |

|

SpotGamma Gamma Index™: |

0.116 |

-0.328 |

0.079 |

-0.082 |

-0.024 |

-0.069 |

|

Gamma Notional (MM): |

‑$29.544M |

‑$1.32B |

$9.26M |

‑$411.621M |

‑$22.352M |

‑$708.789M |

|

25 Day Risk Reversal: |

-0.038 |

-0.024 |

-0.029 |

-0.025 |

-0.028 |

-0.035 |

|

Call Volume: |

442.959K |

1.708M |

6.042K |

594.359K |

19.922K |

298.217K |

|

Put Volume: |

832.982K |

2.141M |

6.978K |

974.277K |

50.332K |

568.199K |

|

Call Open Interest: |

5.638M |

6.108M |

54.883K |

4.157M |

183.75K |

3.432M |

|

Put Open Interest: |

11.642M |

12.85M |

59.623K |

8.935M |

332.891K |

7.13M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4400, 4350, 4320, 4300] |

|

SPY Levels: [435, 434, 433, 430] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [365, 360, 355, 350] |

|

SPX Combos: [(4524,88.52), (4502,97.96), (4476,92.18), (4450,95.86), (4437,74.13), (4428,75.10), (4424,92.02), (4415,81.68), (4411,74.94), (4398,99.27), (4394,84.89), (4389,81.24), (4376,97.17), (4363,86.38), (4359,80.58), (4355,82.35), (4350,93.97), (4342,93.87), (4324,86.97), (4320,95.80), (4316,95.36), (4312,85.92), (4303,79.06), (4299,95.81), (4294,96.54), (4290,85.08), (4286,80.74), (4277,89.37), (4268,84.62), (4260,81.11), (4251,92.79), (4247,79.35), (4199,94.58), (4195,85.76), (4151,88.94)] |

|

SPY Combos: [434.93, 444.9, 440.13, 432.33] |

|

NDX Combos: [15189, 14579, 15204, 14370] |

|

QQQ Combos: [366.68, 364.87, 371.76, 351.8] |