Macro Theme:

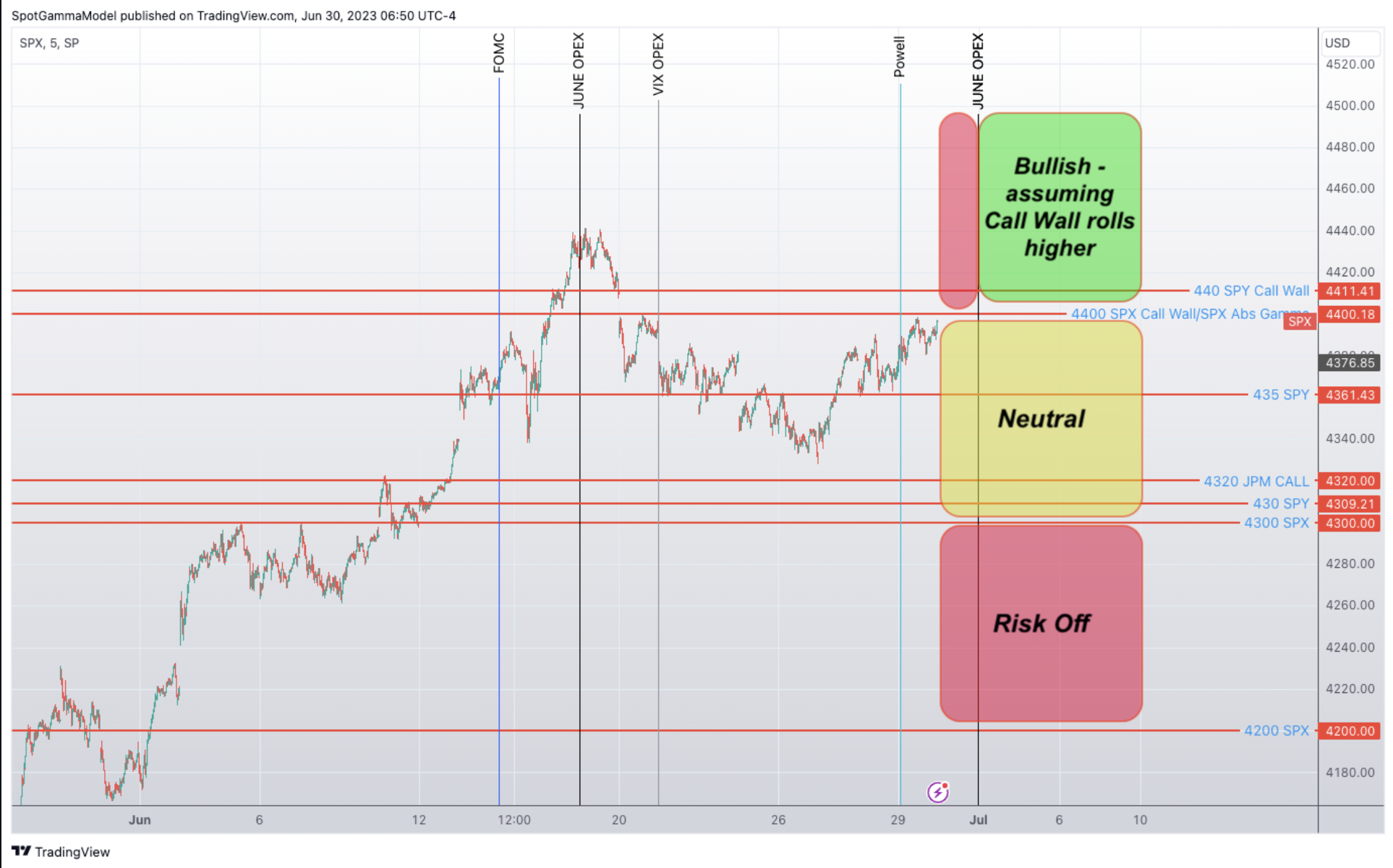

Major Resistance: 4,400 – 4,415 (SPY 440 Call Wall)

Pivot Level: 4,400

Interim Support: 4,320

Range High: 4,500

Range Low: 4,000 Put Wall

‣ An upside break of 4,400 is our “risk on” signal

‣ A downside break of 4,300 after Friday, 6/30 is our “risk off” signal

Founders Note:

Futures are 23bps higher to 4446, indicating an S&P open near the SPY 440 Call Wall (SPX 4,415). While 4,400 – 4,415 range is our major resistance line for today, it looks likely the Call Walls will roll higher for next week (4,450). Support below shows at 4,365 & 4,350.

QQQ major resistance remains at 370, with support at 365, then 360.

Some large flows apparently unlock today, which may include (as GS & JPM allege) large equity rebalances, but also the JPM collar roll. As a reminder, the short strike for the collar was 4065 in March, and the market blasted through that on 3/31 (plotted below).

As we discussed in yesterdays Member Q&A – we see no apparent edge in trying to assess what impact the roll may be for today. This is due to the fact that the timing and implementation of the trade is likely shifting around, and being mixed with what could be large flows unrelated to options. We suppose that there is some embedded edge in being aware that these larger trades can kick off today, and spark some unexpected movement.

All that being said, todays ATM straddle is going for $22 (ref: 4,410, 17.8% IV) which seems cheap given the spate of flows.

Zooming out, the overall decline in implied vol’s has now worked off any equity tailwind, as shown in our vanna model below. Typically, as implied volatility declines it reduces the long delta exposure of the dealer/market making community, which may lead them to buy back futures/equities that they are short. Should the market move>4,400 we the predominant positions in the S&P500 being call positions – and we believe dealers’s are net long calls giving them positive delta exposure. To offset this long exposure they may hedge with short delta positions such as short futures/stock.

With this as our base view, a decline in IV reduces the relative value of those calls (all else equal), allowing dealers to buy back short hedges. However, since our IV-adjusted delta (purple) model is above that of the base delta (grey), it implies there is little impact in IV now declining. In other words: “vanna” is no longer a tailwind. The implication of this is that upside volatility should reduce, and its reasonable to think we can sit on that IV floor and grind lower. Quite frankly we see nothing in positioning to indicated a significant sustained “risk off” is looming.

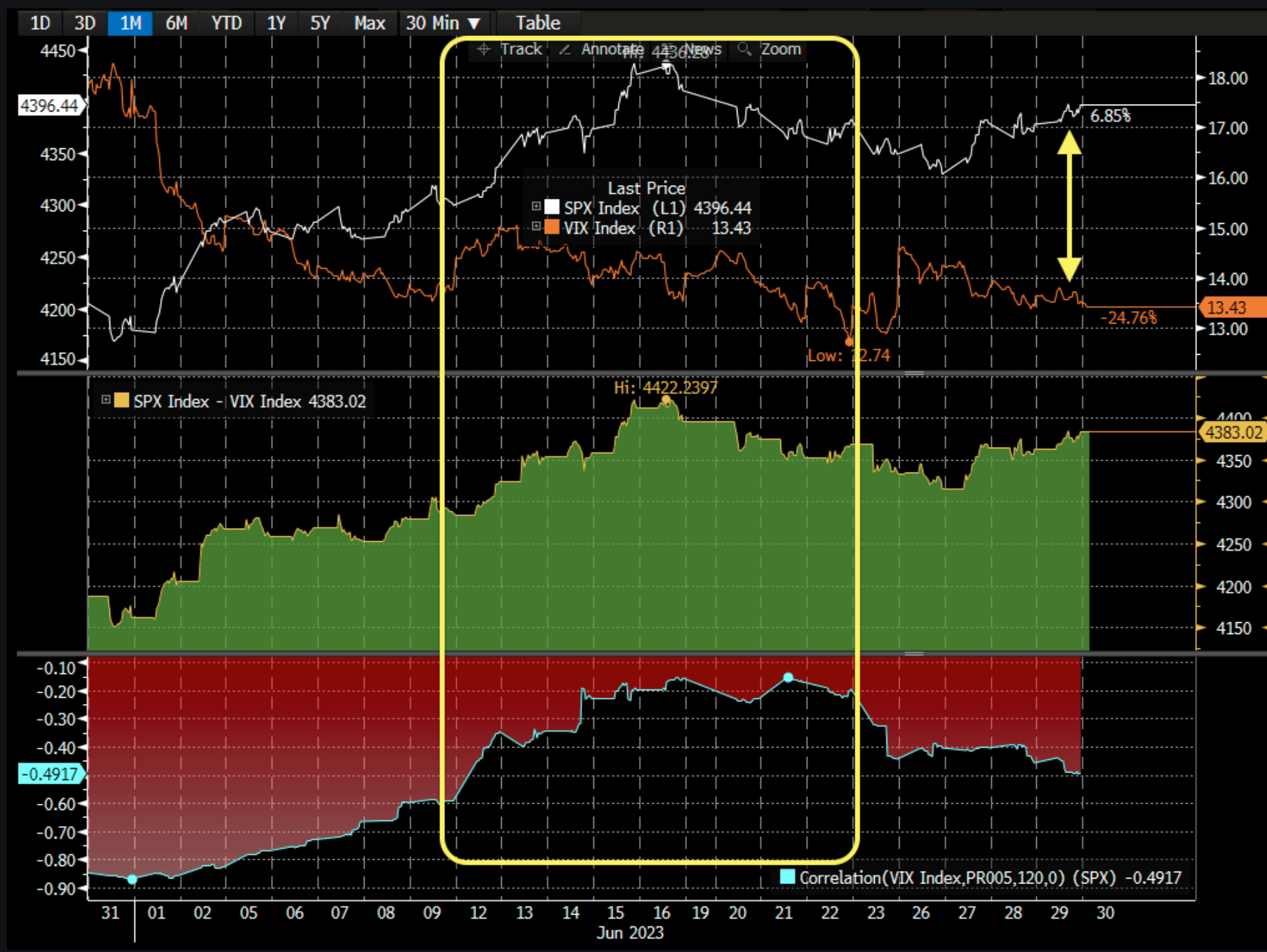

Adding to this, in yesterdays AM note we discussed the decline of rich call IV’s, which may draw equity buyers back in. In line with this “call deflation” is the relationship between the SPX & VIX, which seems to have returned to normalcy. Throughout the aggressive long call period of early-mid June there was a positive correlation between VIX & SPX due to call buying (SPX up, VIX up), and that correlation remained as those long equity calls cooled off, leading to “SPX down, VIX down”.

Through our options lens the implication of this has been, and remains, that the overbought condition from mid-June has passed.

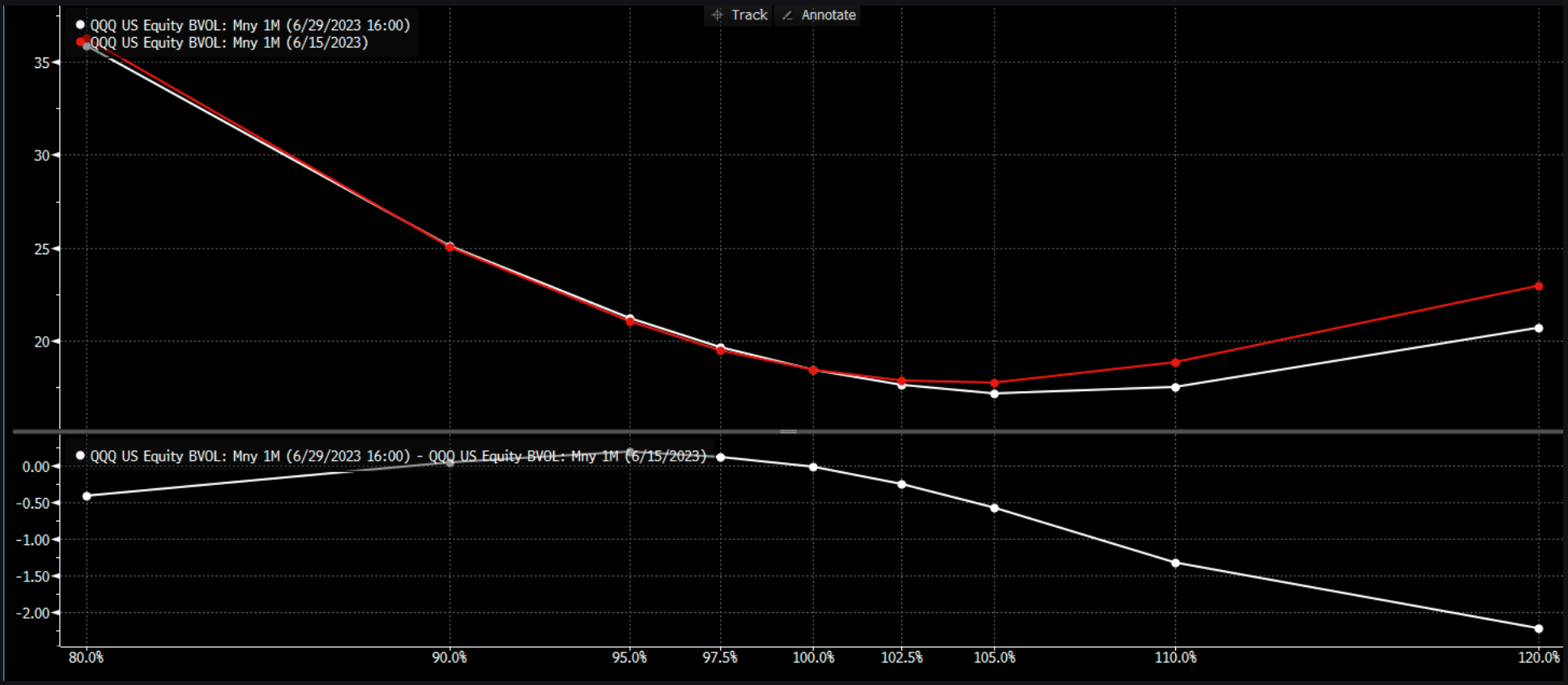

We can frame this lower call IV through skew, too. Shown below is QQQ, and you can see that upside strikes have a lower IV than that of 6/15 which is when we ran into SPX highs on OPEX day. For the record – this looks the same through a fixed strike lens, too (i.e. lower vols).

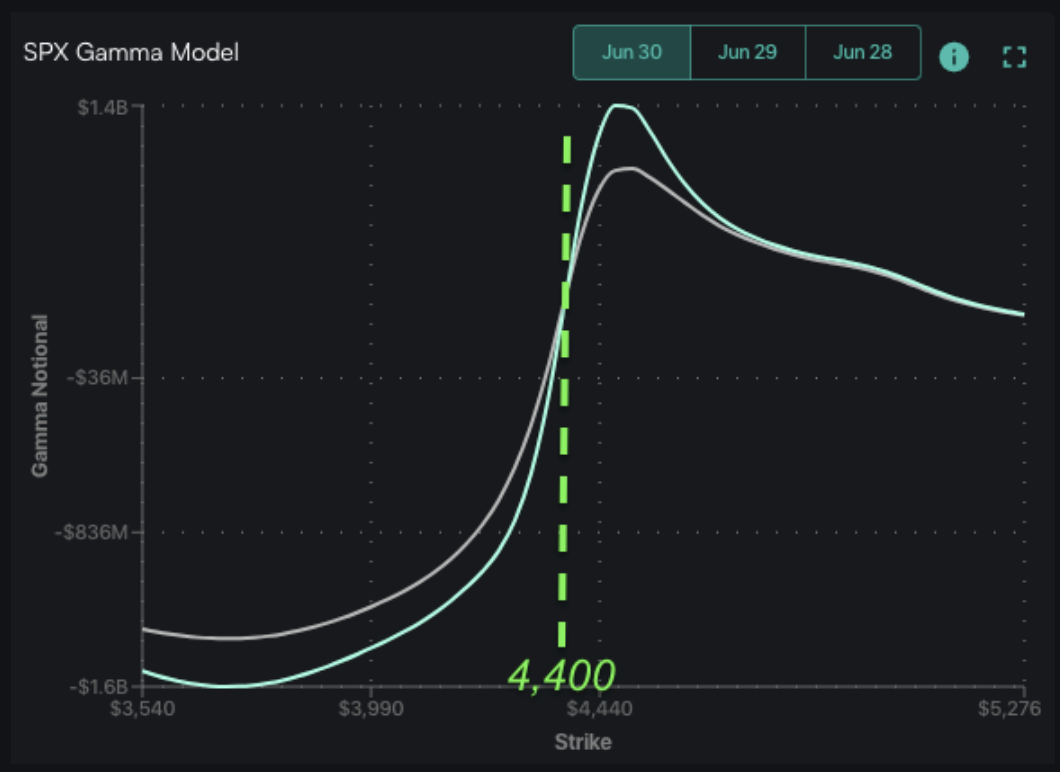

Lastly, backing this idea of reduced volatility is gamma, which is materially positive >=4,400, as shown below. It peaks into 4,450 which is the likely Call Wall for next week. Should we rally higher, then volatility should reduce in kind.

To this point, we currently forecast 0.79% intraday ranges, with our models lowest daily ranges bottom out around 0.65%. 0.65% daily moves is what we’d anticipate if the S&P moves to 4,450-4,500.

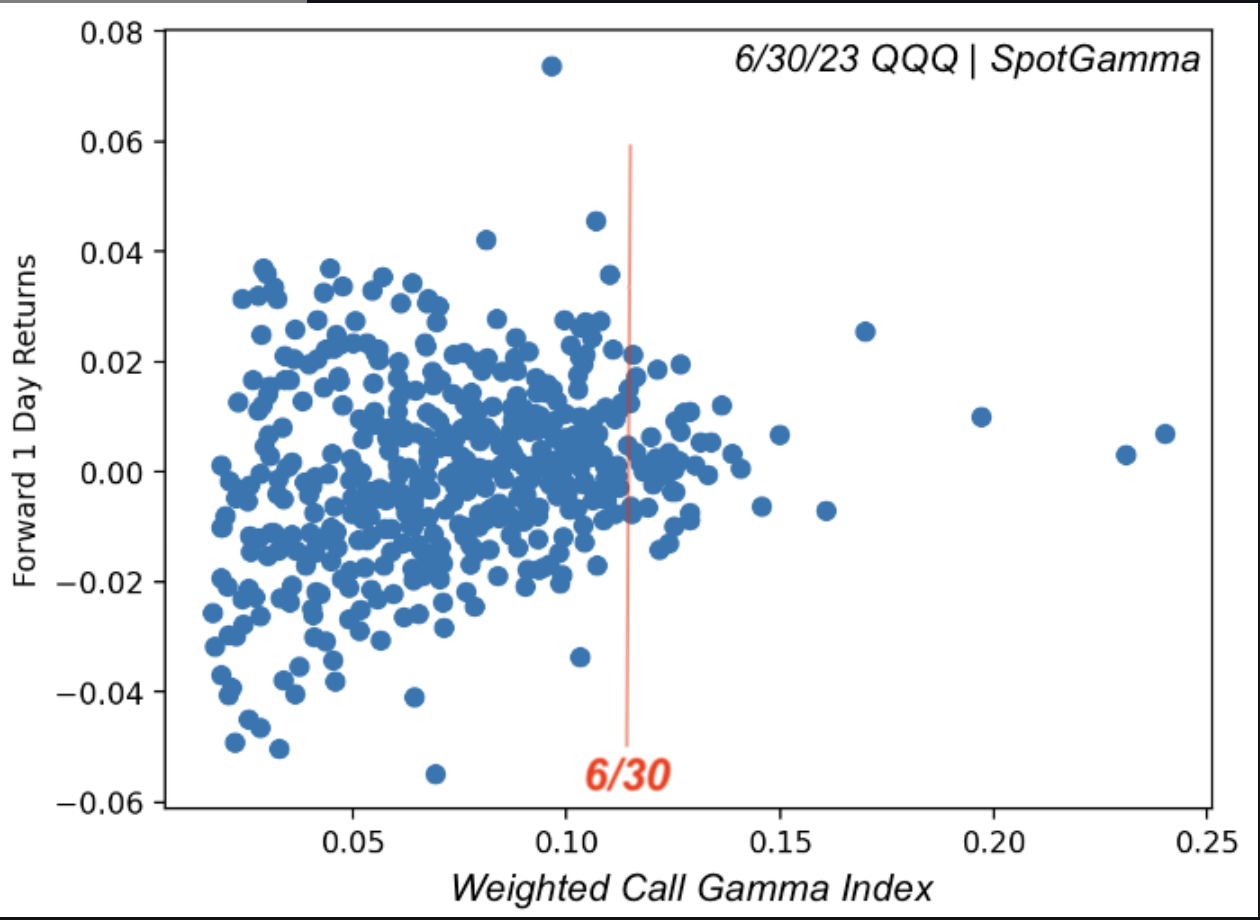

If you look at one of our proprietary gamma measurements you can see a relationship between the gamma position and lower volatility. Shown below is QQQ, with todays reading marked in red.

In summary we remain bullish of equities if the S&P closes above 4,400, with volatility continuing to reduce. While 4,400 is our Call Wall for today, we feel rather confident that Wall rolls higher for next week.

Given our view of relative volatility remaining muted in the S&P500, we prefer expressing longs through the megacap single stocks and names with a slight call skew (see yesterdays AM note).

If the S&P fails to close above 4,400 we maintain a neutral stance, with <4,300 being “risk off”.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4396 |

$438 |

$14939 |

$363 |

$1881 |

$186 |

|

SpotGamma Implied 1-Day Move: |

0.79% |

0.79% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.22% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4345 |

$436 |

$14800 |

$362 |

$1850 |

$186 |

|

Absolute Gamma Strike: |

$4400 |

$440 |

$15200 |

$365 |

$1880 |

$185 |

|

SpotGamma Call Wall: |

$4400 |

$440 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$430 |

$14475 |

$355 |

$1800 |

$180 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4338 |

$437 |

$14031 |

$366 |

$1877 |

$186 |

|

Gamma Tilt: |

1.459 |

0.963 |

2.288 |

0.888 |

1.014 |

0.917 |

|

SpotGamma Gamma Index™: |

2.113 |

-0.035 |

0.081 |

-0.044 |

0.001 |

-0.013 |

|

Gamma Notional (MM): |

$749.083M |

‑$492.432M |

$10.198M |

‑$311.052M |

$2.091M |

‑$138.016M |

|

25 Day Risk Reversal: |

-0.036 |

-0.022 |

-0.018 |

-0.019 |

-0.019 |

-0.01 |

|

Call Volume: |

464.173K |

1.781M |

5.238K |

618.653K |

20.149K |

419.207K |

|

Put Volume: |

745.675K |

1.879M |

7.601K |

874.111K |

26.178K |

572.156K |

|

Call Open Interest: |

5.843M |

6.497M |

56.024K |

4.355M |

196.661K |

3.628M |

|

Put Open Interest: |

12.165M |

14.139M |

62.156K |

9.33M |

355.114K |

7.442M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4400, 4375, 4350, 4300] |

|

SPY Levels: [440, 438, 435, 430] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [365, 360, 355, 350] |

|

SPX Combos: [(4599,95.98), (4577,85.05), (4550,95.22), (4524,93.73), (4515,80.38), (4502,99.23), (4476,97.28), (4471,77.28), (4467,83.96), (4458,84.37), (4454,84.65), (4449,99.36), (4445,91.40), (4440,91.72), (4436,95.44), (4432,93.45), (4423,98.49), (4418,94.81), (4414,97.02), (4410,92.95), (4405,93.72), (4401,99.39), (4396,87.69), (4392,84.51), (4379,75.53), (4374,97.86), (4370,73.91), (4357,77.88), (4348,76.77), (4339,79.31), (4313,84.91), (4300,75.11), (4265,73.92), (4251,86.22), (4216,78.20), (4199,92.60)] |

|

SPY Combos: [450.41, 445.59, 440.33, 442.96] |

|

NDX Combos: [15194, 14581, 15149, 15119] |

|

QQQ Combos: [369.58, 369.21, 368.12, 349.2] |