Macro Theme:

Short Term Resistance: 4,450 – 4,465 (SPY 445 Call Wall)

Short Term Support: 4,415 (SPY 440) – 4,400

Risk Pivot Level: 4,400

Major Range High/Resistance: 4,500 Call Wall

Major Range Low/Support: 4,200 Put Wall

‣ We maintain a bullish stance while the SPX is >4,400 and below the 4,500 Call Wall (updated: 7/3/23)

‣ We anticipate declining market volatility into 7/21 July OPEX (updated: 7/3/23)

‣ A downside break of 4,400 is our “risk off” signal (updated: 7/3/23)

Founder’s Note:

Futures are down 40bps to 4,465. Key SG levels are unchanged, with major resistance at 4,450 – 4,465 (SPY 450). Support shows at 4,415 (SPY 440) – 4,400.

In QQQ the Call Wall has retracted from 375 to 372. 370 is first resistance, with 372 now the top of our QQQ range. Support shows at 365.

We anticipate the trading action to be much like that of the last few sessions: tight & mean reverting which translates into low volatility.

1 month S&P realized volatility continues to grind lower and is now at 10.6%. This is the lowest reading since December ’22 and, in theory, functions to move the floor of implied volatility (i.e. VIX) lower. Generally speaking we view lower volatility as supportive of equity prices.

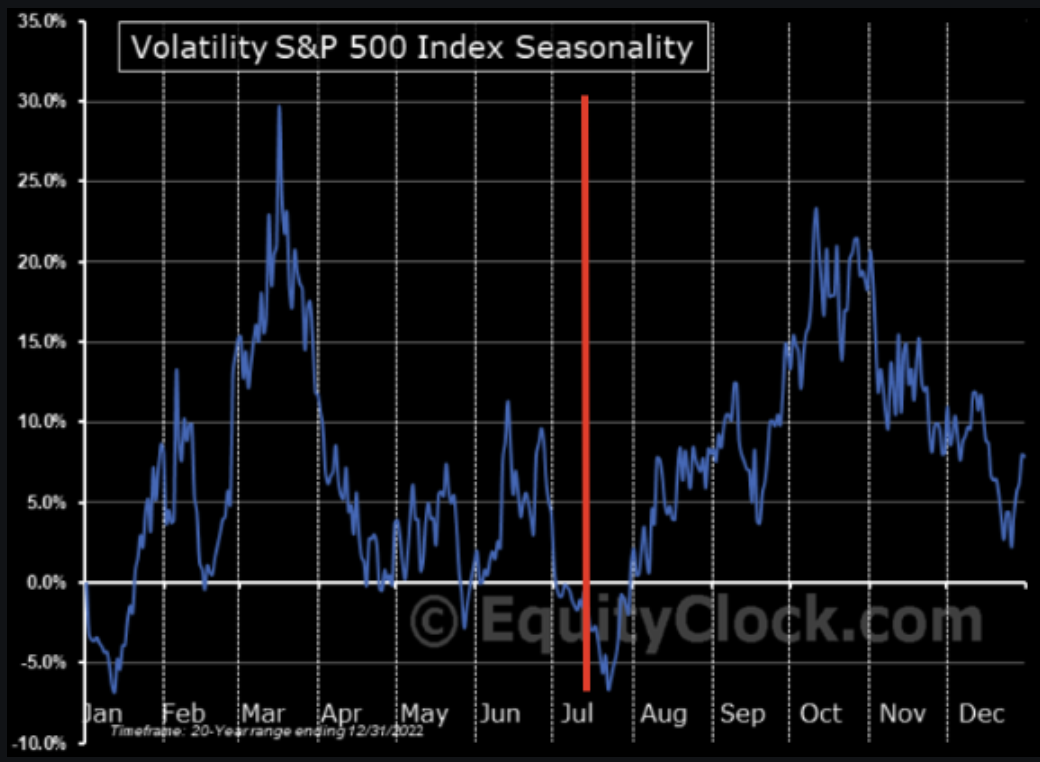

Aside from the current trading/macro environment, July tends to be a very quiet month for volatility, as shown below (h/t TME).

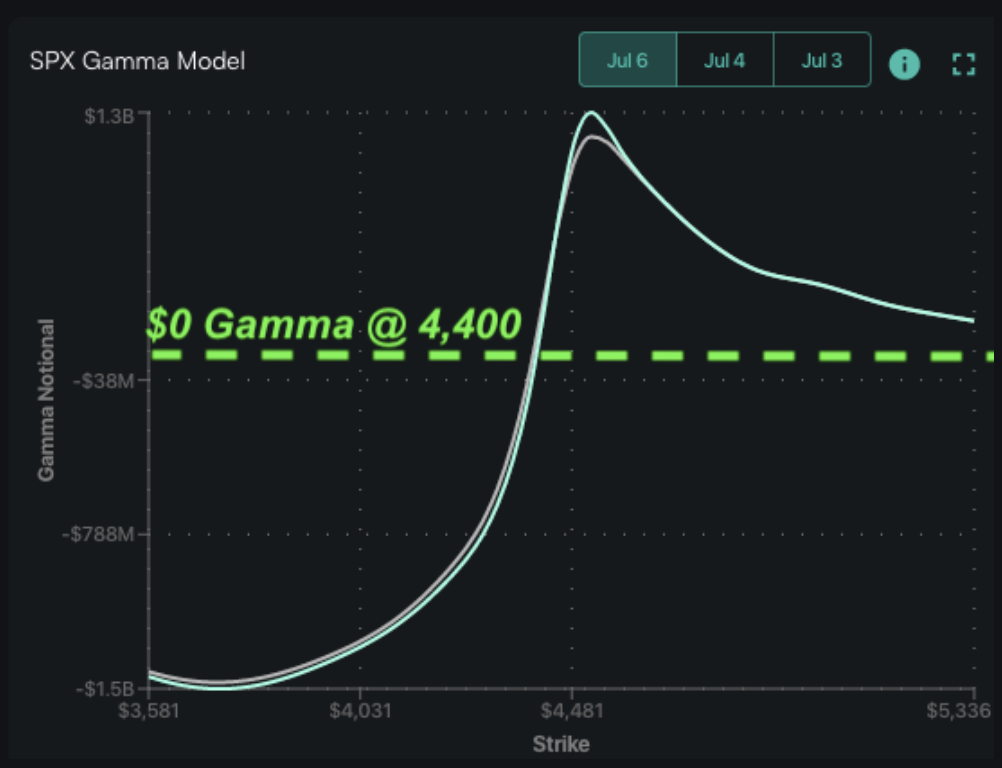

Through our lens there are two ways for this volatilitity dampening to break down. The first is with OPEX, which is still 2 weeks out (7/21). The second is with a downside break of 4,400, which is where we’d anticipate gamma beginning to flip from positive (above 4,400) to negative (below 4,400).

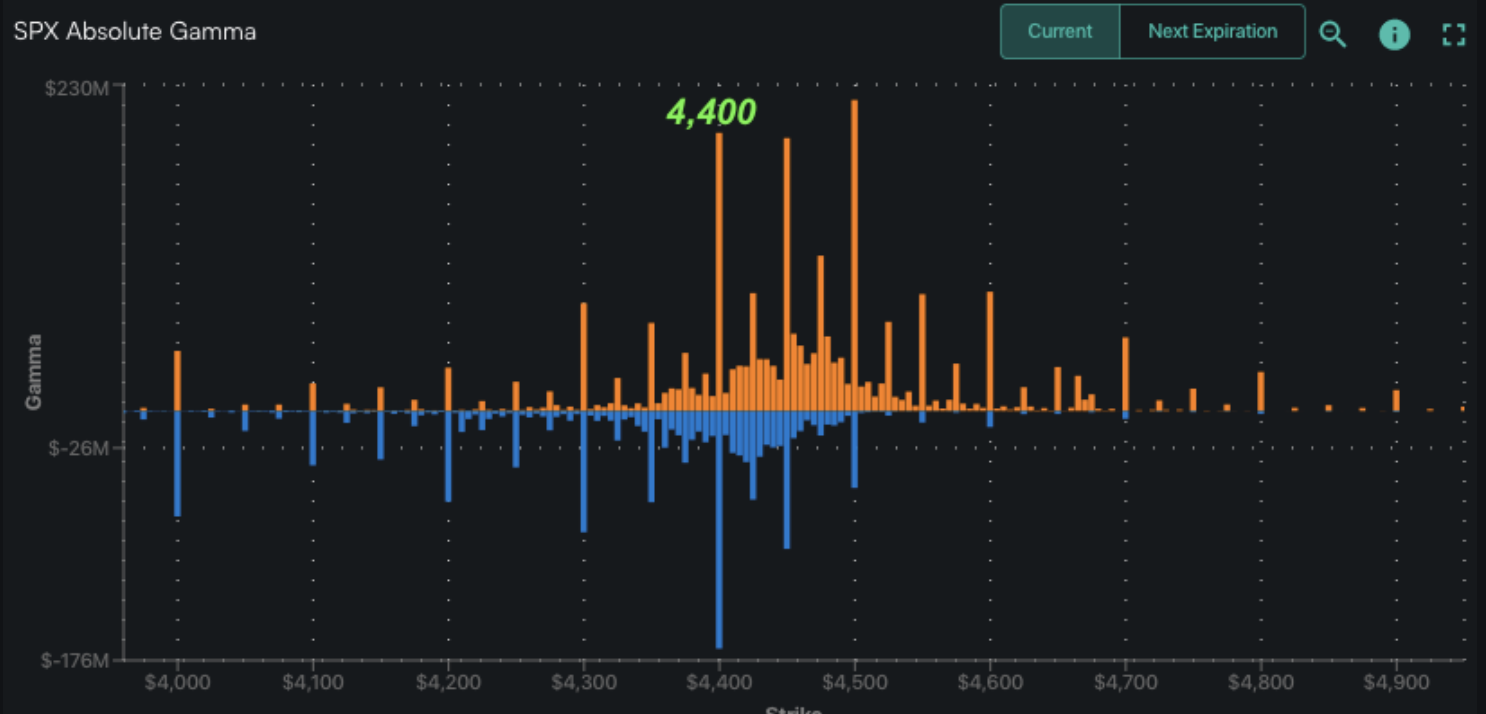

You can also see how substantial 4,400 is in the SPX gamma strike positioning, below. Because this is such a large strike we’d anticipate it would serve as meaningful support. Further, we’d estimate that it would first take several sessions to test and wear away this 4,400 level.

The primary implication of this is that, while above 4,400 we view lower SPX prices as “consolidation” and maintain a bullish. If 4,400 is lost, we’d look to position for a higher volatility environment which may warrant adding downside put protection.

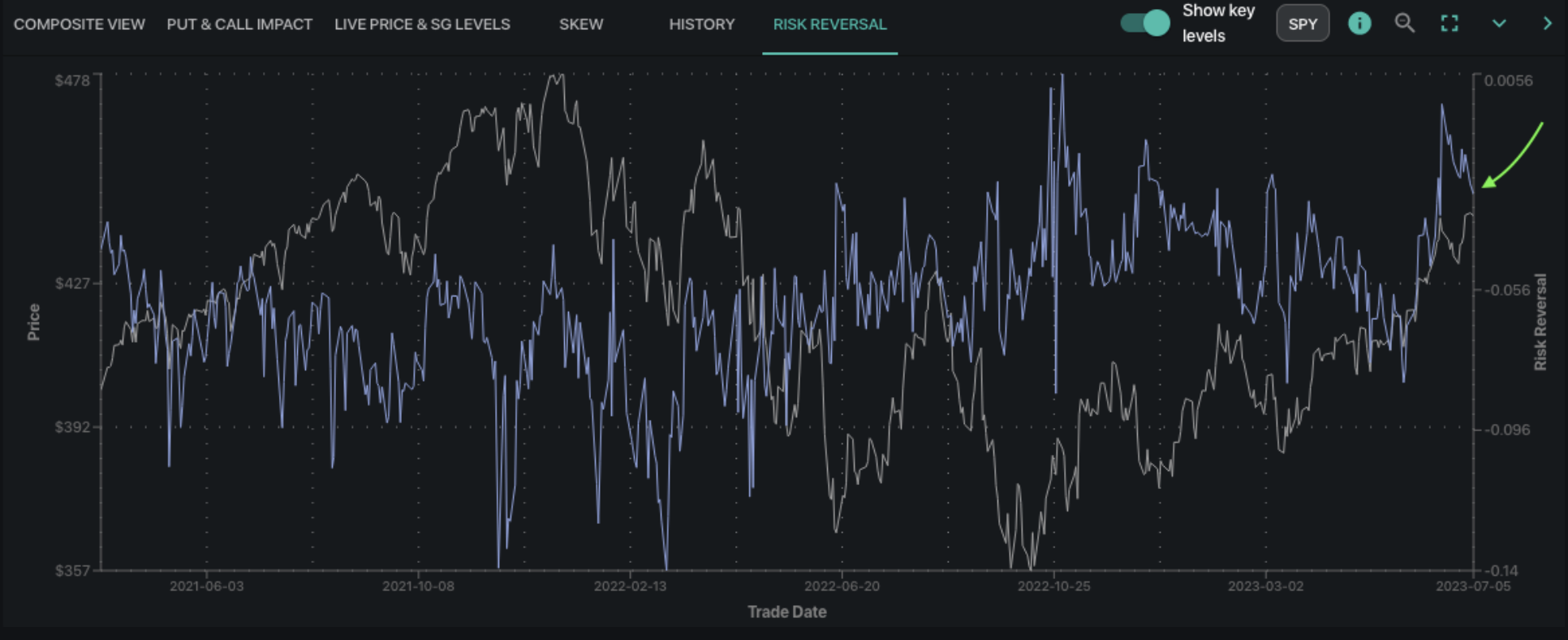

Adding to this, we see that large index/ETF “risk reversal” is well of highs, but remains elevated vs long term prices. This broadly depicts calls as trading relatively rich to puts which, if you were looking to hedge, may warrant funding puts through call sales. As a reminder, our risk reversal measures a 30 day 25 delta call – 25 delta put. Obviously factors like tenor and strike all factor greatly into the structure one might select.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4446 |

$443 |

$15203 |

$370 |

$1872 |

$185 |

|

SpotGamma Implied 1-Day Move: |

0.88% |

0.88% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.13% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4395 |

$443 |

$14825 |

$369 |

$1850 |

$186 |

|

Absolute Gamma Strike: |

$4400 |

$440 |

$15200 |

$370 |

$1880 |

$185 |

|

SpotGamma Call Wall: |

$4500 |

$445 |

$15200 |

$372 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4200 |

$420 |

$14475 |

$330 |

$1820 |

$180 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4388 |

$442 |

$14171 |

$369 |

$1882 |

$187 |

|

Gamma Tilt: |

1.462 |

0.995 |

2.759 |

1.038 |

0.927 |

0.859 |

|

SpotGamma Gamma Index™: |

1.858 |

-0.004 |

0.104 |

0.012 |

-0.005 |

-0.022 |

|

Gamma Notional (MM): |

$670.393M |

‑$35.493M |

$13.236M |

$37.255M |

‑$5.985M |

‑$202.76M |

|

25 Day Risk Reversal: |

-0.035 |

-0.029 |

-0.023 |

-0.026 |

-0.023 |

-0.02 |

|

Call Volume: |

397.774K |

1.294M |

6.675K |

497.098K |

12.194K |

303.172K |

|

Put Volume: |

822.495K |

1.893M |

6.687K |

897.151K |

19.355K |

367.181K |

|

Call Open Interest: |

5.661M |

6.223M |

57.358K |

4.075M |

200.299K |

3.482M |

|

Put Open Interest: |

11.912M |

13.397M |

64.808K |

8.917M |

365.461K |

6.964M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4500, 4450, 4400, 4300] |

|

SPY Levels: [445, 444, 443, 440] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [372, 370, 365, 360] |

|

SPX Combos: [(4665,88.25), (4651,88.85), (4625,75.17), (4598,97.80), (4576,91.33), (4549,97.80), (4527,96.73), (4518,81.12), (4514,89.15), (4509,81.94), (4505,82.65), (4500,99.82), (4496,91.54), (4491,89.23), (4487,89.63), (4478,93.72), (4474,99.10), (4469,89.66), (4465,94.48), (4460,90.20), (4456,94.02), (4451,98.86), (4425,74.32), (4398,88.74), (4345,78.47), (4251,82.04)] |

|

SPY Combos: [447.56, 444.9, 457.31, 452.44] |

|

NDX Combos: [15204, 15280, 15401, 15599] |

|

QQQ Combos: [370.04, 375.23, 372.26, 380.04] |