Macro Theme:

Short Term Resistance: 4,600 Call Wall – 4,615 (SPY 460 Call Wall)

Short Term Support: 4,550

Risk Pivot Level: 4,500 – 4,515 (SPY 450)

Major Range High/Resistance: 4,615

Major Range Low/Support: 4,400

‣ The bullish case remains intact with SPX >4,500* and a current upside target of the major 4,600 Call Wall**

‣ As realized volatility shifts lower, it suggests implied volatility should grind down, too. This may result in mid-12 VIX.**

‣ Risk shifts higher on a break of 4,500, wherein we would look for a test of 4,400 with a VIX shift towards 20*

*updated 7/24

**updated 7/27

Founder’s Note:

Futures are up 50bps to 4620, which places the 4,600 – 4,615 (SPY 460)

Call Wall

resistance in play for today. Support below shows at 4,565 (SPY 455) & 4,550. Our model continues to forecast relatively tight trading ranges, with a maximum intraday range of 81bps.

In QQQ the top end of our range currently sits at 385, with first support at 380/379. The 375

Put Wall

remains our range low.

Powell kept the crowd calm yesterday, which served to further deflate implied volatility. Short dated at-the-money IV’s are now down in the 8’s, which is working with 1 month realized volatility at 8.9. This decline in IV, which, combined with the embrace of positive gamma, is supportive of equities.

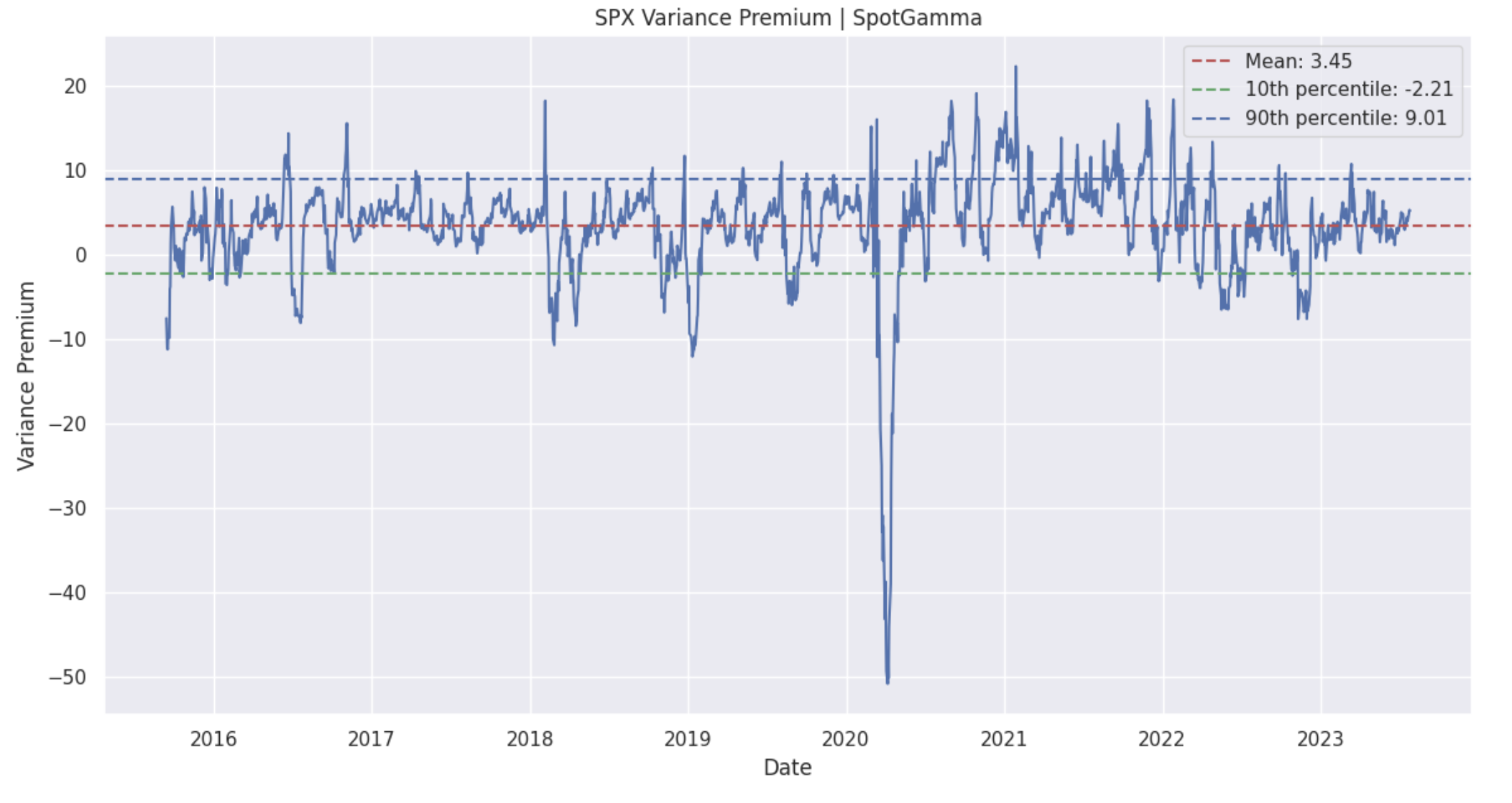

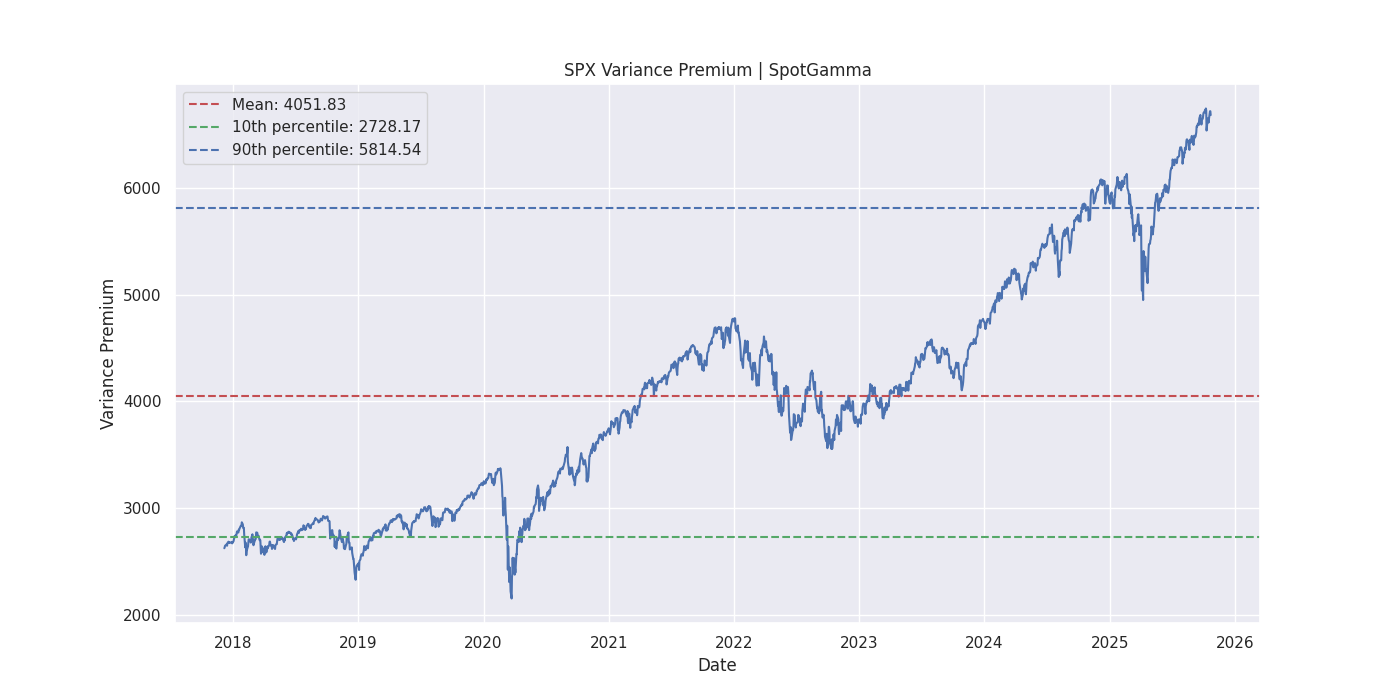

If you look at the long term spread between VIX & 1 month realized SPX volatility, its 3.5, as shown below. This suggests that a 12-handle VIX is also not unreasonable.

In regards to that positive gamma, positions (both puts & calls) continue to fill in around current S&P prices. Further, calls keep being added to strikes above with peak positive gamma now in the low 4,600’s. This is the iterative process of S&P prices sliding higher, and supportive puts are sold into weakness. This optically looks like a straddle in the plot below, with calls (orange) and puts (blue) holding an equal weighting across strikes. These positions serve to reduce volatility, which provides a vanna-based equity tailwind.

As the S&P drifts higher, new calls are added at strikes above, which is what rolls the

Call Wall

up to create fresh upside targets.

From this position we think its hard for volatility to spike, as the market has to wear down to a place wherein hedging flows shift from “supportive” to “coercive”. As noted yesterday, <4,500 is the level at which we currently see downside risk materializing, and is the “stop out” on our long position.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4566 |

$455 |

$15499 |

$377 |

$1980 |

$196 |

|

SpotGamma Implied 1-Day Move: |

0.81% |

0.81% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.11% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4545 |

$456 |

$15425 |

$379 |

$1940 |

$194 |

|

Absolute Gamma Strike: |

$4600 |

$455 |

$15475 |

$380 |

$1970 |

$195 |

|

SpotGamma Call Wall: |

$4600 |

$460 |

$15475 |

$385 |

$1970 |

$200 |

|

SpotGamma Put Wall: |

$4300 |

$450 |

$15000 |

$375 |

$1800 |

$185 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4506 |

$454 |

$14556 |

$379 |

$1990 |

$196 |

|

Gamma Tilt: |

1.34 |

0.914 |

1.91 |

0.808 |

0.922 |

1.018 |

|

SpotGamma Gamma Index™: |

1.617 |

-0.086 |

0.068 |

-0.078 |

-0.005 |

0.002 |

|

Gamma Notional (MM): |

$504.382M |

‑$427.467M |

$6.587M |

‑$462.104M |

‑$3.733M |

$34.24M |

|

25 Day Risk Reversal: |

-0.025 |

-0.018 |

0.001 |

0.002 |

-0.017 |

-0.019 |

|

Call Volume: |

431.622K |

1.427M |

5.545K |

736.678K |

8.411K |

196.446K |

|

Put Volume: |

928.276K |

1.793M |

8.154K |

843.523K |

13.537K |

372.196K |

|

Call Open Interest: |

5.995M |

6.607M |

55.211K |

4.379M |

184.531K |

3.475M |

|

Put Open Interest: |

12.27M |

13.559M |

66.334K |

8.987M |

346.015K |

6.907M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4600, 4550, 4500, 4400] |

|

SPY Levels: [460, 455, 454, 450] |

|

NDX Levels: [16500, 16000, 15475, 15000] |

|

QQQ Levels: [380, 378, 375, 370] |

|

SPX Combos: [(4749,95.07), (4727,75.35), (4699,98.52), (4676,88.64), (4672,82.43), (4667,93.36), (4649,98.40), (4640,86.68), (4631,89.77), (4626,97.46), (4622,92.84), (4617,87.58), (4612,89.44), (4608,92.91), (4603,85.21), (4599,99.85), (4594,86.29), (4590,92.29), (4585,81.43), (4580,90.47), (4576,94.71), (4571,82.48), (4562,78.09), (4553,77.38), (4548,81.41), (4539,73.63), (4530,74.21), (4512,87.57), (4503,75.68), (4498,88.15), (4398,80.84)] |

|

SPY Combos: [458.69, 463.7, 468.71, 461.42] |

|

NDX Combos: [15468, 15391, 15189, 15809] |

|

QQQ Combos: [375.28, 373.77, 383.59, 368.87] |