Macro Theme:

Short Term Resistance: 4,550

Short Term Support: 4,500

Risk Pivot Level: 4,500 – 4,515 (SPY 450)

Major Range High/Resistance: 4,600 – 4,615 (SPY 460/SPX 4,600 Call Wall(s))

Major Range Low/Support: 4,500

‣ The bullish case remains intact with SPX >=4,550 and we hold a current upside target of major 4,600 resistance*

‣ As realized volatility(RV) shifts lower, it suggests implied volatility should grind down, too. With RV at 9, VIX in the 12’s is reasonable*

‣ Risk shifts higher on a break of 4,500, wherein we would look for a test of 4,400 with a VIX shift towards 20*

*updated 8/2

Founder’s Note:

Futures are up 8 to 4,530 ahead of the 8:30AM ET NFP. Key SG levels remain largely the same, with support at 4,500. Resistance is at 4,515, followed by 4,550.

Major support in QQQ is at 370, with resistance at 375, then 380.

Following key earnings from last night, AAPL is down 2% premarket, while AMZN is +8%

There are two focal points here: 4,500 and implied volatility.

We’ve covered the 4,500 line in depth, marking high risk below that major support strike. There was a quick breach of that level yesterday AM, but it was met with ~$1bn in 0DTE positive delta flow. You can see this below in

HIRO,

wherein the 0DTE flow (teal) is the same magnitude as flow from all expirations (purple). This informs us that over this time frame 0DTE trading was dominant, and was used to buy the SPX dip. That 10:30ET breach was also the VIX cash session high of 17.30.

Following that early test, IV’s generally declined which has held true through this AM. Shown below is SPX term structure for today (pink) vs Wednesday (grey), and as you can see all expirations >5DTE have lower IV’s. The exception to this is today & Monday, which are elevated due to the NFP report.

Assuming the NFP report comes in line, we’d expect those <5DTE IV’s to deflate, which likely levers the S&P higher. Adding to this is traders not wanting to hold relatively expensive puts over the weekend, which could help boost equities. For this reason we are giving edge to 4,500 holding, with a test of 4,550 today.

This assessment is rendered incorrect if we break <4,500. In this scenario we see rapidly expanding IV, and look for a test of the 4,400 area as outlined in recent notes.

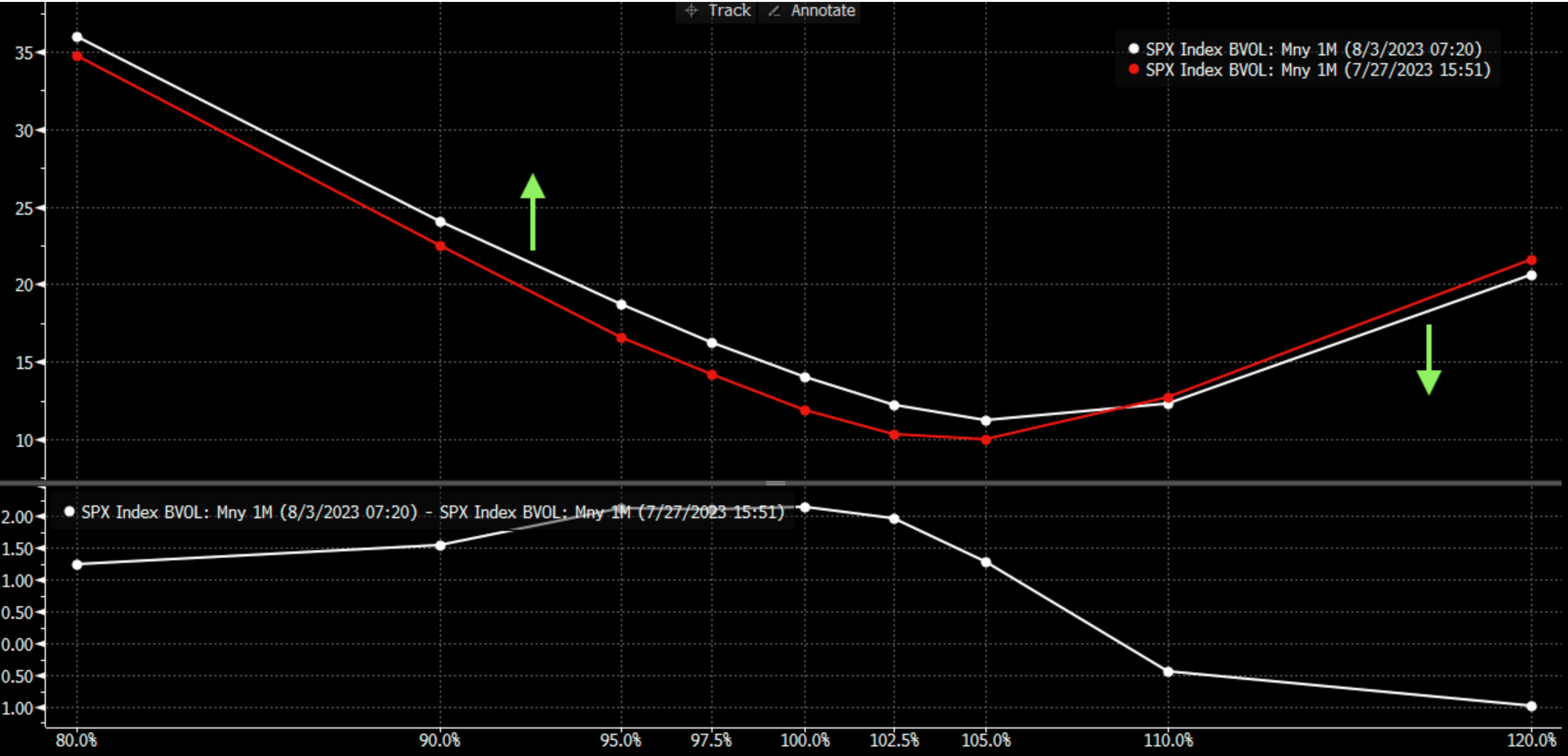

What the downgrade & bond volatility has done is shook out some of the short equity volatility crowd. The low levels of put skew has been an ongoing story, and one could argue there was so far just a snap-back/mean reversion of those low put IV’s.

This is most simply captured in the SDEX (blue) and VVIX (red) which measure the values of OTM SPY puts (SDEX) & OTM VIX calls (VVIX). As you can see there was a strong move higher in these indexes, which suggests demand/repricing for volatility. In the SPX/SDEX we suspect this is more of a short cover trade than long demand.

Additionally, as noted above, the quick test <4,500 pushed the VIX into the 17’s, which was a preview of what we think is higher vol-of-vol relative to a downside S&P move.

If this downside scenario does unfold, we would read it as a correction rather than a new bear market. Of course macro dynamics could change, but based on current positioning we do not think the options market is positioned to accelerate downside past 2-3% lower. As an example of this you can see the gamma plot shown below. The model behind this plot assumes dealers are long calls and short puts – which is obviously an extreme positioning scenario. Given this extreme scenario we see downside gamma flattening out <=4,400 which implies dealers would not have much to sell below that level. This, in theory, would alleviate downside pressure into <=4,400.

Given that implied vols inform us traders are likely short a healthy amount of puts, there is likely less negative gamma (i.e. closer to zero) and the “flattening” of this curve kicks is at a bit of a higher strike. For these reasons we have been marking 4,400 as a strong support line.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4501 |

$448 |

$15351 |

$373 |

$1961 |

$194 |

|

SpotGamma Implied 1-Day Move: |

0.76% |

0.76% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.12% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4520 |

$451 |

$15390 |

$377 |

$1950 |

$196 |

|

Absolute Gamma Strike: |

$4500 |

$450 |

$15475 |

$375 |

$1970 |

$195 |

|

SpotGamma Call Wall: |

$4600 |

$460 |

$15475 |

$385 |

$1970 |

$200 |

|

SpotGamma Put Wall: |

$4500 |

$450 |

$15000 |

$370 |

$1800 |

$190 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4509 |

$454 |

$14747 |

$381 |

$1986 |

$197 |

|

Gamma Tilt: |

0.870 |

0.631 |

1.645 |

0.658 |

0.845 |

0.731 |

|

SpotGamma Gamma Index™: |

-0.848 |

-0.487 |

0.061 |

-0.169 |

-0.012 |

-0.046 |

|

Gamma Notional (MM): |

‑$504.752M |

‑$1.901B |

$5.612M |

‑$805.294M |

‑$11.214M |

‑$411.957M |

|

25 Day Risk Reversal: |

-0.037 |

-0.028 |

-0.031 |

-0.023 |

-0.035 |

-0.034 |

|

Call Volume: |

494.713K |

1.709M |

8.343K |

909.754K |

10.663K |

262.662K |

|

Put Volume: |

889.636K |

2.419M |

15.582K |

1.185M |

20.03K |

505.514K |

|

Call Open Interest: |

6.203M |

7.067M |

58.09K |

4.644M |

197.091K |

3.632M |

|

Put Open Interest: |

12.737M |

14.505M |

75.858K |

9.708M |

368.569K |

7.328M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4600, 4550, 4500, 4400] |

|

SPY Levels: [455, 450, 447, 445] |

|

NDX Levels: [16000, 15500, 15475, 15000] |

|

QQQ Levels: [380, 375, 372, 370] |

|

SPX Combos: [(4700,96.71), (4673,85.91), (4664,92.89), (4650,96.81), (4623,93.00), (4614,86.52), (4601,98.39), (4592,81.70), (4578,74.98), (4574,93.29), (4569,79.93), (4565,79.83), (4560,78.09), (4551,79.10), (4547,76.10), (4533,74.89), (4515,97.03), (4506,76.77), (4502,99.57), (4493,93.58), (4488,97.74), (4484,93.99), (4479,85.86), (4475,98.85), (4466,78.25), (4461,93.91), (4448,94.44), (4443,78.21), (4434,85.71), (4425,83.28), (4412,90.71), (4398,95.27), (4349,91.34), (4313,75.34), (4299,95.28)] |

|

SPY Combos: [447.5, 457.38, 467.25, 462.32] |

|

NDX Combos: [15474, 15198, 15275, 15398] |

|

QQQ Combos: [376.42, 369.31, 371.56, 374.55] |