Macro Theme:

Short Term Resistance: 4,550

Short Term Support: 4,450

Risk Pivot Level: 4,500 – 4,515 (SPY 450)

Major Range High/Resistance: 4,600 – 4,615 (SPY 460/SPX 4,600 Call Wall(s))

Major Range Low/Support: 4,400

‣ The bullish case remains intact with SPX >=4,550 and we hold a current upside target of major 4,600 resistance*

‣ As realized volatility(RV) shifts lower, it suggests implied volatility should grind down, too. With RV at 9, VIX in the 12’s is reasonable*

‣ Risk shifts higher on a break of 4,500, wherein we would look for a test of 4,400 with a VIX shift towards 20*

‣ Current positioning suggests 4,400 would be a major low.**

*updated 8/2

**updated 8/4

Founder’s Note:

Futures are 25bps higher to 4510. Resistance above shows at 4,500 & 4,510 (SPY 450), then 4,550. Support below shows at 4,475, then 4,450.

In QQQ our

Put Wall

support is at 370, with resistance at 375/376.

The next major data points come in on the 10th, with CPI & continuing claims. SPX upside is likely now limited to 4,550 until the 10th, as implied volatility holds a relative premium due to these data points.

A quick review of our stance over the last few sessions:

- Our line of demarcation between risk on & off has been 4,500, as negative gamma lurks <4,500.

- <4,500 we also anticipated a sharp vol-of-vol response should markets break his level. Because we believed there was a fair amount of put selling/low put skew into very low realized vols, any signal of risk off would lead to a quick short vol cover.

- If the S&P held 4,500 after Friday’s NFP, we were looking for an upside test of 4,550 on the session and further market strength for this week.

At 1PM ET on Friday, things seemed very much according to plan, with implied vol sinking as the SPX moved into 4,540. Then, large put flows unleashed, as shown below in purple. Initially these flows included a large 0DTE component, but much of the impulse was longer dated put buyers.

Equally as important was that we did not see signs of traders buying calls into Fridays AM rally (video breakdown here).

The SPX ultimately closed at 4,478, which was -1.4% from the intraday high, and below our critical 4,500 level.

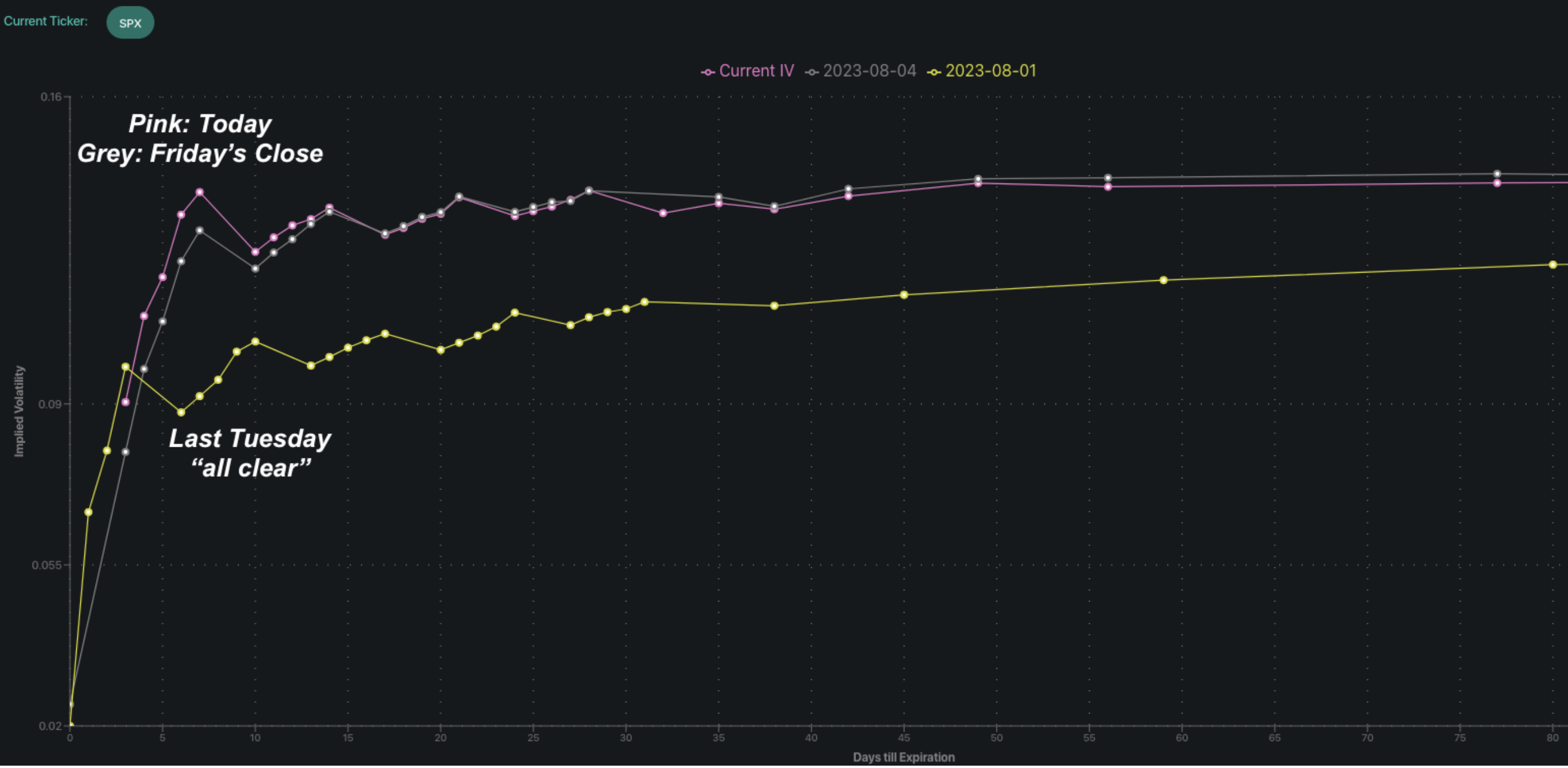

Based on current ES levels (4,510), the SPX will now open <4,500 and implied vols are at recent highs. This can be seen two images below in the SPX term structure with this morning (pink) vs Friday’s close (grey). ATM IV’s for expirations >5DTE are ~13.5% which imply 85bps daily moves in the SPX. 5 day realized vol, which is a jumpy measure, is 12.5. This suggets current IV’s are fairly valued and that there is not much of a risk premium being baked in.

We also see an increase in put skews, but so far we’re framing this increase in IV’s as short vol traders having their hands slapped vs traders hedging for major downside.

Just as 4,500 is a

pivot

point, you could read this level of IV as a

pivot

point. 13.5% is relatively expensive to the ~9% readings we’ve seen recently, however its clear that volatility has been increasing. You can see this below in the return histogram. The last 30 SPX 1 day returns in blue, and the last 5 days are in red. As a reminder 1% daily moves in the SPX is an IV of ~16%. Interestingly our volatility models continue to forecast fairly low volatility, with a 1 day max open/close SPX range of 75bps or ~35 SPX pts. Our model does not forecast any “risk premium”.

Based on this setup, we’ve been forecasting that the S&P would test the 4,400 level and we currently do not see much reason to shift from that view. There are more contracts now at 4,450, which may lead to some initial support at that level.

An interesting way to look at this downside is through our EquityHub Momentum Indicator. This essentially shows the “rate of change of gamma” (also known as “speed”). A higher slope indicates more relative hedging is required (resulting in volatility). As you can see, 4,500 is a

pivot

point in this model, with a quick rebuilding of positive gamma >4,500. Below 4,500 there are these “nodes” in the slope, which reflect large areas of local gamma at 4,450 & 4,350. We view these nodes as support/target zones, with the first now appearing at 4,450, and a larger one in the 4,400-4,350 area.

The takeaway from this is that we’re not seeing the setup for explosive downside, even though markets certainly seem less stable then they were a week ago. For this view to change we would need to see the addition of long put positions which would be seen through an expanding put skew. This may be an interesting area for calendar spreads, as we may see large swings over the next 1-2 sessions, and then a larger directional move after Wednesday’s data points.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4478 | $446 | $15274 | $372 | $1957 | $194 |

| SpotGamma Implied 1-Day Move: | 0.75% | 0.75% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.11% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4500 | $450 | $15390 | $376 | $1950 | $196 |

| Absolute Gamma Strike: | $4500 | $450 | $15475 | $375 | $1970 | $190 |

| SpotGamma Call Wall: | $4600 | $460 | $15475 | $385 | $1970 | $200 |

| SpotGamma Put Wall: | $4400 | $445 | $15000 | $370 | $1800 | $185 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4519 | $449 | $14673 | $380 | $1982 | $197 |

| Gamma Tilt: | 0.805 | 0.674 | 1.542 | 0.691 | 0.841 | 0.734 |

| SpotGamma Gamma Index™: | -1.284 | -0.39 | 0.054 | -0.137 | -0.013 | -0.043 |

| Gamma Notional (MM): | ‑$657.056M | ‑$1.616B | $6.359M | ‑$697.094M | ‑$11.408M | ‑$408.688M |

| 25 Day Risk Reversal: | -0.057 | -0.048 | -0.048 | -0.043 | -0.044 | -0.045 |

| Call Volume: | 572.40K | 2.166M | 7.253K | 890.748K | 10.996K | 222.528K |

| Put Volume: | 1.067M | 3.349M | 10.876K | 1.332M | 31.425K | 569.78K |

| Call Open Interest: | 6.195M | 6.879M | 58.46K | 4.474M | 198.004K | 3.542M |

| Put Open Interest: | 13.033M | 14.311M | 77.108K | 9.544M | 373.125K | 7.238M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4600, 4550, 4500, 4400] |

| SPY Levels: [450, 447, 445, 440] |

| NDX Levels: [16000, 15500, 15475, 15000] |

| QQQ Levels: [380, 375, 370, 360] |

| SPX Combos: [(4675,80.89), (4666,89.56), (4648,95.45), (4626,88.92), (4599,97.38), (4577,88.45), (4559,78.29), (4523,77.39), (4500,96.91), (4491,94.41), (4487,79.10), (4478,92.03), (4474,96.18), (4469,79.17), (4465,80.94), (4460,92.75), (4456,76.17), (4451,97.18), (4447,75.32), (4442,74.89), (4433,86.44), (4429,85.11), (4424,82.77), (4420,76.96), (4411,91.26), (4402,97.49), (4380,84.33), (4375,73.70), (4362,80.00), (4348,94.22), (4308,80.70), (4299,96.38), (4259,74.80)] |

| SPY Combos: [446.81, 444.13, 456.64, 445.47] |

| NDX Combos: [15473, 15199, 14985, 15810] |

| QQQ Combos: [374.99, 368.29, 370.15, 373.13] |

0 comentarios