Macro Theme:

Short Term Resistance: 4,550

Short Term Support: 4,450

Risk Pivot Level: 4,500 – 4,515 (SPY 450)

Major Range High/Resistance: 4,600 – 4,615 (SPY 460/SPX 4,600 Call Wall(s))

Major Range Low/Support: 4,400

‣ Thursday 8/10 CPI may spark a directional trend from 4,500 into August 18th OPEX*

‣ The bullish case remains intact with SPX >=4,500 and we hold a current upside target of major 4,600 resistance*

‣ Current positioning suggests 4,400 would be a major low*

*updated 8/8

Founder’s Note:

ES futures are 50bps lower to 4515. Key SG levels remain unchanged, with support at 4,475, then 4,450. The resistance/pinning area remains at 4,500 – 4,510 (SPY 410), with further resistance above there at 4,520 (Vol Trigger). Our daily move estimate continue to be tight at 75bps.

In QQQ levels are unchanged: support at 370

Put Wall,

with resistance at 375-376, then 380.

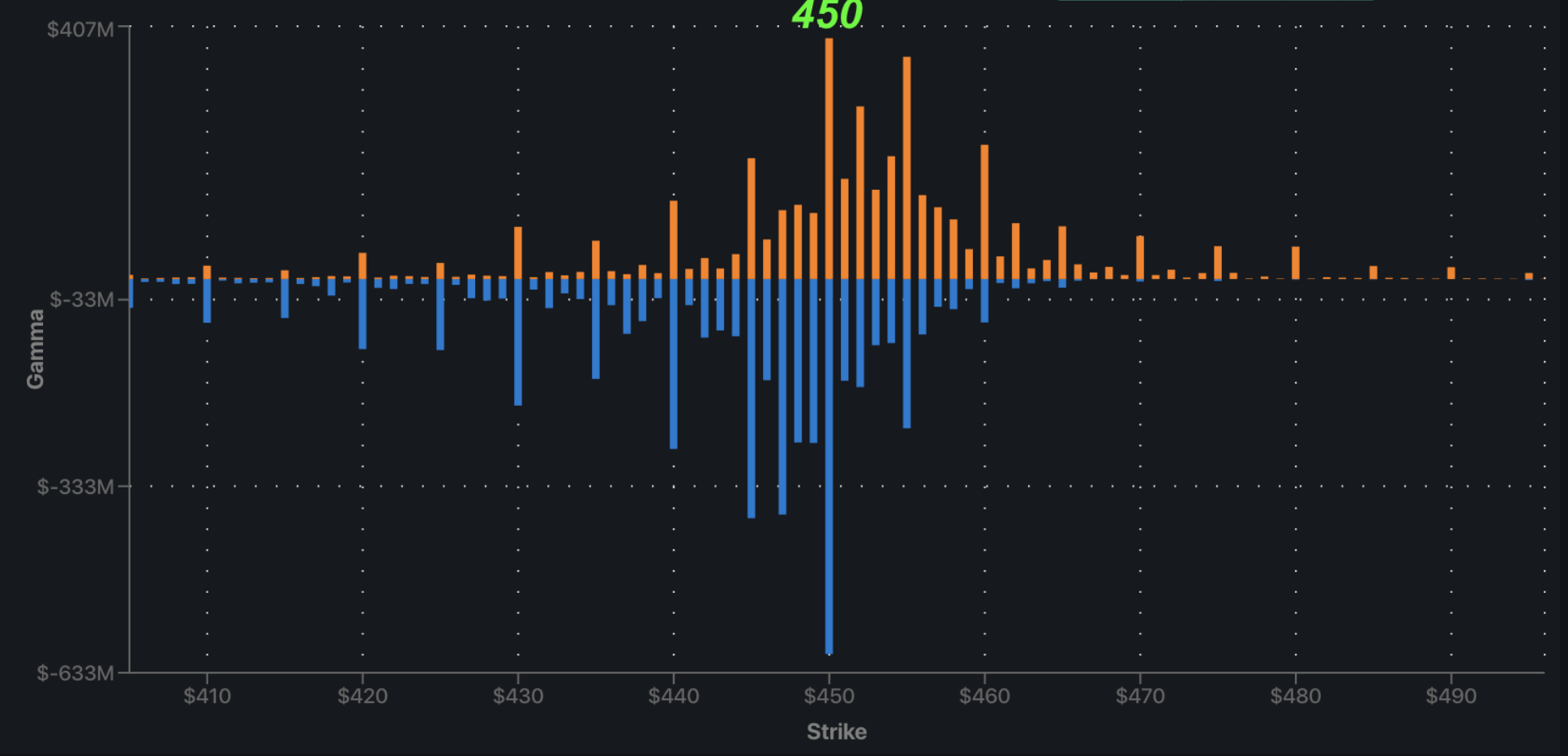

SPY 450 (SPX 4,510) and SPX 4,500 are the largest gamma levels on the board, and the S&P has been sticking to this strike(s). As we’ve stuck to this level, positions have filled in in & around 450,4,500 which likely now governs/restricts volatility.

Framing this another way, our view over the last several sessions was that a break of 4,500 would lead to a rapid test of the 4,400 level, and an above average spike in volatility (aka higher vol-of-vol). While vol did perk up rather quickly, the probes below 4,500 were met with dip buyers. We now do not see anything to support a sharp, rapid decline. This is not to say that the S&P cannot sell off, just that we see solid support at 4,450 & 4,400 which slows the decline.

We’re still of the view that Thursday’s CPI data will spark a directional move as event volatility shifts/adjusts, sparking a move down toward 4,400 or up to 4,600 which then feeds into August OPEX as a turning point.

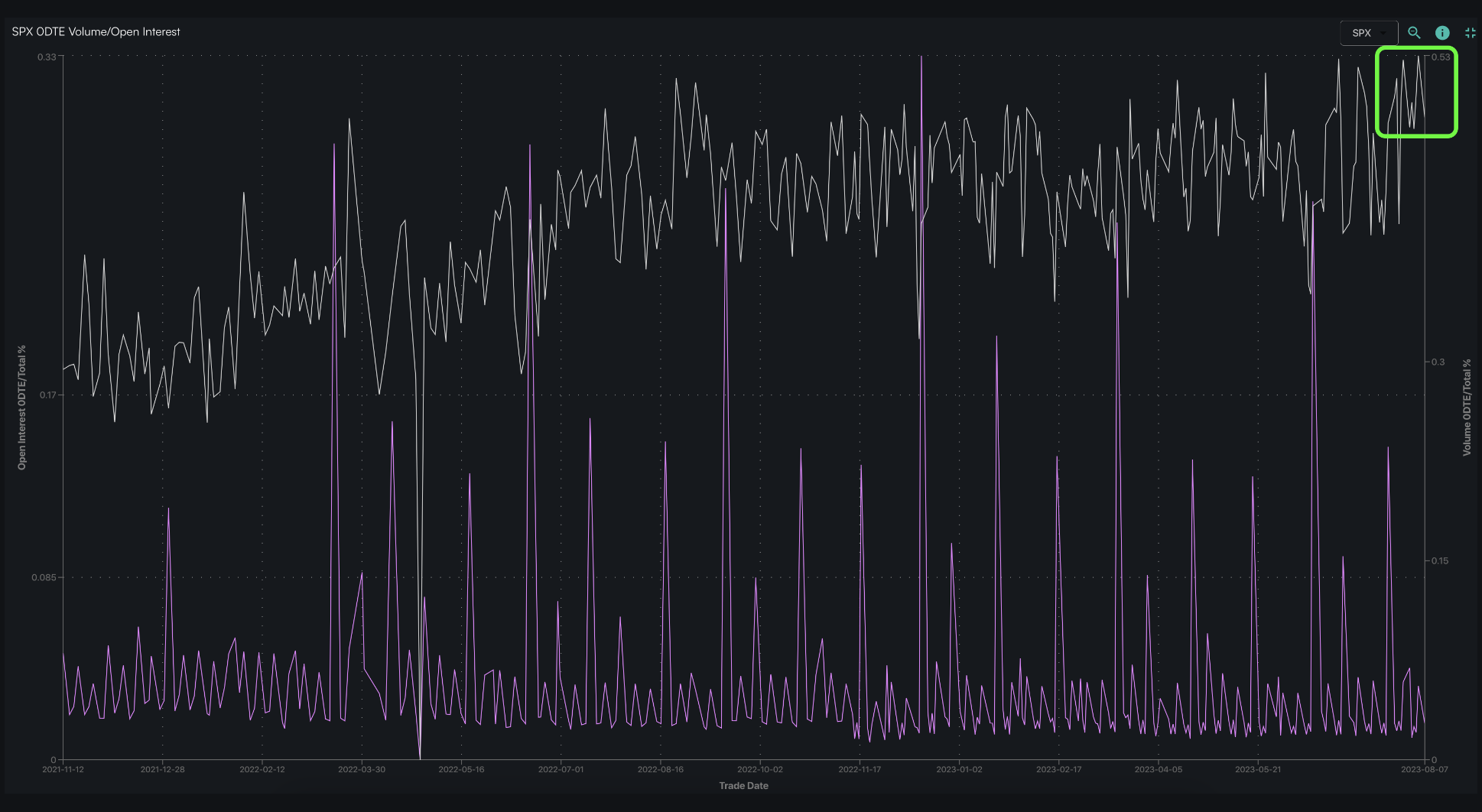

Why did the market fail to respond to the onset of negative gamma and increased IV? We laid out some of our thoughts on this during yesterdays Q&A (video here), but one of the main things that caught our eye was very elevated levels of 0DTE volume. Plotted below in white is SPX 0DTE volume, and as you can see volume has recently been pegged in this very unique “all time high zone”. Further, 8/4 registered the highest 0DTE volume ever (as a % of total volume).

Our view on 0DTE is and has been that it suppresses volatility through invoking hedging flows that cause equity mean reversion. Below is a chart showing the last several days of 0DTE S&P500 options

flow in teal (SPX,SPY & ESF). What you see is the flow appears to be working inversely to moves away from 4,500 (red line). spikes higher as the SPX moves <4,500 implying traders are buying calls and selling puts. Then, drops when the SPX rallies >4,500 which comes from puts bought and/or calls sold.

The two most significant moments of magnitude were the ~11AM dip below 4,500 on the 3rd, and the very large selling on Friday afternoon as the SPX tested 4,540. This certainly warrants an updated study, which we’ll undertake ASAP (see our previous study, here).

While we continue to monitor 0DTE flows, our other data now implies today and likely tomorrow to be relatively low volatility sessions with the S&P revolving around 4,500 through Thursday. SPX IV’s for today & tomorrow are <=9% which suggests the market is pricing in very low volatility, too. Timing short dated calendar spreads (i.e. selling pre-CPI calls/puts into strenght/weakness to buy longer dated) and post-CPI call/put flies playing moves into 4,400/4,600 might be interesting setups out of CPI and into Aug OPEX.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4518 | $450 | $15407 | $375 | $1958 | $194 |

| SpotGamma Implied 1-Day Move: | 0.76% | 0.76% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.11% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4520 | $451 | $15380 | $376 | $1955 | $196 |

| Absolute Gamma Strike: | $4500 | $450 | $15475 | $375 | $1970 | $190 |

| SpotGamma Call Wall: | $4600 | $460 | $15475 | $385 | $1970 | $200 |

| SpotGamma Put Wall: | $4500 | $447 | $15000 | $370 | $1800 | $185 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4526 | $453 | $14801 | $380 | $1984 | $197 |

| Gamma Tilt: | 1.007 | 0.740 | 1.739 | 0.753 | 0.842 | 0.734 |

| SpotGamma Gamma Index™: | 0.046 | -0.325 | 0.075 | -0.115 | -0.014 | -0.044 |

| Gamma Notional (MM): | ‑$140.626M | ‑$1.336B | $8.524M | ‑$580.974M | ‑$12.82M | ‑$408.093M |

| 25 Day Risk Reversal: | -0.05 | -0.038 | -0.046 | -0.04 | -0.036 | -0.034 |

| Call Volume: | 470.50K | 1.348M | 8.301K | 633.043K | 14.816K | 162.156K |

| Put Volume: | 867.59K | 2.118M | 14.042K | 1.222M | 22.344K | 379.017K |

| Call Open Interest: | 6.28M | 6.892M | 59.178K | 4.536M | 200.824K | 3.545M |

| Put Open Interest: | 13.043M | 14.641M | 79.128K | 9.772M | 378.643K | 7.234M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4600, 4550, 4500, 4400] |

| SPY Levels: [455, 450, 447, 445] |

| NDX Levels: [16000, 15500, 15475, 15000] |

| QQQ Levels: [380, 375, 370, 360] |

| SPX Combos: [(4726,74.13), (4699,96.98), (4677,85.70), (4672,77.24), (4663,93.62), (4649,97.47), (4631,78.78), (4627,93.89), (4613,83.83), (4600,98.96), (4591,85.13), (4582,84.11), (4577,94.93), (4568,81.12), (4564,84.24), (4559,89.89), (4555,83.93), (4550,93.45), (4546,91.44), (4541,89.26), (4537,85.02), (4532,81.13), (4523,91.45), (4509,82.34), (4500,98.27), (4496,84.28), (4491,96.80), (4487,76.12), (4482,87.88), (4478,92.52), (4473,94.93), (4464,88.35), (4460,90.01), (4451,93.95), (4442,82.59), (4424,81.59), (4410,85.09), (4401,95.47), (4360,75.25), (4351,92.86), (4311,76.16), (4302,95.20)] |

| SPY Combos: [443.05, 462.88, 448.01, 452.96] |

| NDX Combos: [15469, 15192, 15269, 15808] |

| QQQ Combos: [380.06, 373.3, 368.05, 388.31] |

0 comentarios