Macro Theme:

Short Term Resistance: 4,550

Short Term Support: 4,450

Risk Pivot Level: 4,500 – 4,515 (SPY 450)

Major Range High/Resistance: 4,600 – 4,615 (SPY 460/SPX 4,600 Call Wall(s))

Major Range Low/Support: 4,400

‣ Thursday 8/10 CPI may spark a directional trend from 4,500 into August 18th OPEX*

‣ The bullish case remains intact with SPX >=4,500 and we hold a current upside target of major 4,600 resistance*

‣ Current positioning suggests 4,400 would be a major low*

*updated 8/8

Founder’s Note:

ES futures are flat at 4,485. For today we see a band of levels at 4,460-4,470 which is where the implied SPX open is. Support below there shows at 4,450, then 4,429. Resistance above is 4,478 & 4,500. The one day implied range continues to be tight at 74bps.

In QQQ the

Put Wall

holds at 365, which is major support. Resistance is at 370.

The data suggests that volatility should continue to be contained, even if markets shift lower. In other words, being short delta may be working, while long vega/volatility has not. We’d look for volatility to respond materially on a break of 4,400.

Also worth watching: yesterday was the second time in a week that major put flow entered as the SPX pushed >4,525. The magnitude of put flows in a short duration is what matters here, and can be seen in purple, below. This was reminiscent of the large put flows that stamped out last Friday’s rally into 4,540 (chart here, note here).

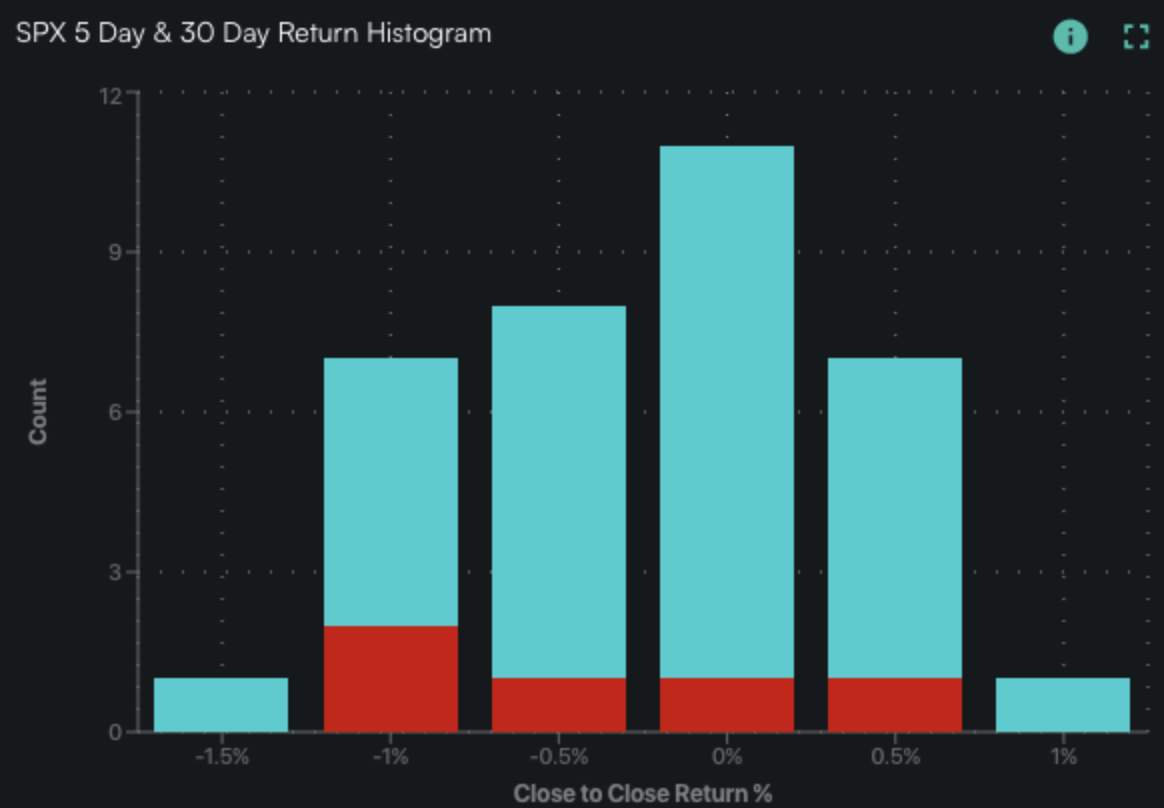

Despite the large intraday swings, the market has directionally done very little. This is displayed through the return histogram, with the last 5 SPX sessions in red. With this, S&P IV has generally done very little, as, for example, the 15.75 VIX is unchanged vs 5 sessions ago.

While SPX IV’s are stable, they’re up vs their June/July lows. This appears to be resulting in a reversion in correlation, which suggests that single stock IV’s are now coming down vs SPX IV’s. This can be seen in the plot below of the CBOE 1 month correlation index, which recently made lows not seen since 2017.

Another way to view this is that the AI narrative and tight market breadth that was a feature of June’s big rally – that’s unwound/unwinding & those names are all moving back with the pack. While these stocks are generally moving lower, many of their IV’s are contracting due to passing of earnings.

Obviously the S&P/NQ Indexes are derived from the price of its components, and so weakness in major components will weigh on them. However, outside of seeing that large put flow into moves >4,525, the options flow seems to turn to positive delta flow when the SPX moves <4,500. Further, there does not yet appear to be demand for longer term puts as seen in both open interest changes and IV’s. If that downside demand picks up, particularly near 4,400, then we’d anticipate IV’s to jump and the daily moves to become much more directional (vs mean reverting as we are having now).

One last item of note, August OPEX is not shaping up to be very large for SPX, but it is material for SPY & QQQ. There is also a decent amount of positions rolling off today for SPY & QQQ, which is reflected in the gamma curve for QQQ (blue = today’s measure, grey = ex-today). These positions are slightly out of the money puts & calls (which could go ITM today). Optically it looks like strangle type positions (calls above, puts below) around 445 SPY & 370 QQQ. This implies that today may be sticky, but we may get some larger movement to start next week as these positions are reset.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4469 |

$445 |

$15129 |

$368 |

$1922 |

$190 |

|

SpotGamma Implied 1-Day Move: |

0.74% |

0.74% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.11% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4485 |

$447 |

$15090 |

$370 |

$1955 |

$193 |

|

Absolute Gamma Strike: |

$4500 |

$447 |

$15475 |

$370 |

$1970 |

$190 |

|

SpotGamma Call Wall: |

$4600 |

$460 |

$15475 |

$385 |

$1970 |

$200 |

|

SpotGamma Put Wall: |

$4400 |

$440 |

$15000 |

$365 |

$1800 |

$190 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4510 |

$452 |

$14866 |

$376 |

$1962 |

$196 |

|

Gamma Tilt: |

0.838 |

0.687 |

1.358 |

0.689 |

0.727 |

0.596 |

|

SpotGamma Gamma Index™: |

-1.14 |

-0.436 |

0.043 |

-0.163 |

-0.027 |

-0.084 |

|

Gamma Notional (MM): |

‑$585.013M |

‑$1.784B |

$5.921M |

‑$798.462M |

‑$27.233M |

‑$796.268M |

|

25 Day Risk Reversal: |

-0.053 |

-0.043 |

-0.048 |

-0.046 |

-0.044 |

-0.041 |

|

Call Volume: |

552.71K |

2.872M |

9.772K |

1.272M |

13.652K |

358.707K |

|

Put Volume: |

932.203K |

4.03M |

13.889K |

1.392M |

28.534K |

728.866K |

|

Call Open Interest: |

6.423M |

7.427M |

61.22K |

4.858M |

205.771K |

3.708M |

|

Put Open Interest: |

13.509M |

15.411M |

81.832K |

9.996M |

389.619K |

7.596M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4600, 4550, 4500, 4400] |

|

SPY Levels: [450, 447, 445, 440] |

|

NDX Levels: [15500, 15475, 15250, 15000] |

|

QQQ Levels: [375, 370, 365, 360] |

|

SPX Combos: [(4675,74.39), (4666,88.79), (4652,93.93), (4625,87.72), (4599,96.49), (4576,87.53), (4558,86.82), (4549,87.45), (4545,77.55), (4541,75.09), (4532,79.73), (4527,89.86), (4518,77.77), (4491,85.55), (4478,96.52), (4474,77.05), (4469,93.79), (4465,93.86), (4460,95.04), (4456,92.43), (4451,97.28), (4442,82.69), (4429,92.45), (4424,92.81), (4420,83.09), (4411,92.52), (4402,97.93), (4389,74.26), (4380,87.54), (4375,82.62), (4357,81.34), (4348,96.65), (4339,75.70), (4326,74.33), (4308,83.96), (4299,96.90), (4259,76.35), (4250,90.62)] |

|

SPY Combos: [439.23, 447.26, 459.3, 444.13] |

|

NDX Combos: [15477, 14978, 15068, 15189] |

|

QQQ Combos: [377.78, 365.62, 367.83, 360.83] |