Macro Theme:

Short Term Resistance: 4,550

Short Term Support: 4,450

Risk Pivot Level: 4,500 – 4,515 (SPY 450)

Major Range High/Resistance: 4,600 – 4,615 (SPY 460/SPX 4,600 Call Wall(s))

Major Range Low/Support: 4,400

‣ We look for market support in to Wednesday 8/16 VIX Exp, with 4,500-4,550 short term resistance*

‣ Current positioning suggests 4,400 would be a major interim low, with traders likely taking a directional cue from Jackson Hole on 8/24-8/26*

‣ <4,400 would be a significant “risk off” as dealer negative gamma increases*

*updated 8/14

Founder’s Note:

Futures are 50bps lower to 4,480 after Fitch threatened to downgrade US banks, hot UK data is pushing rates, and Chinese markets are lower. Key SG levels are unchanged, with support at 4,460 & 4,450. Support below there is at 4,430. Resistance above is at 4,472, then 4,500. The implied move remains tight: 0.68% open/close range.

In QQQ the

Put Wall

support holds at 365, with resistance above at 370.

The critical element to watch here is implied volatility. Along with the 50 bps ES decline, the VIX has popped to 16, from yesterdays closing low of 14.8. This shaky premarket action is set to shift into a cash session that has been suppressing volatility. Along with that, we believe there are VIX exp flows that may serve to push IV/VIX lower into tomorrow’s AM expiration. Framing this another way, the options market does not yet appear to be positioned to accelerate volatility, but instead work against it. If IV fails to revert after the open, that may indicate that equities are set to shift lower.

We would anticipate a push back towards yesterdays 4,480 level (4,500 in ES), with a reversion in IV’s. Our stop is SPX <4,450, as a break of 4,450 implies a test of 4,400.

The three elements that may change this “vol suppression” dynamic are:

- the removal of at-the-money positions through expiration,

- the SPX declining to 4,400, which reduces at-the-money positions, and/or

- an increase in long volatility demand

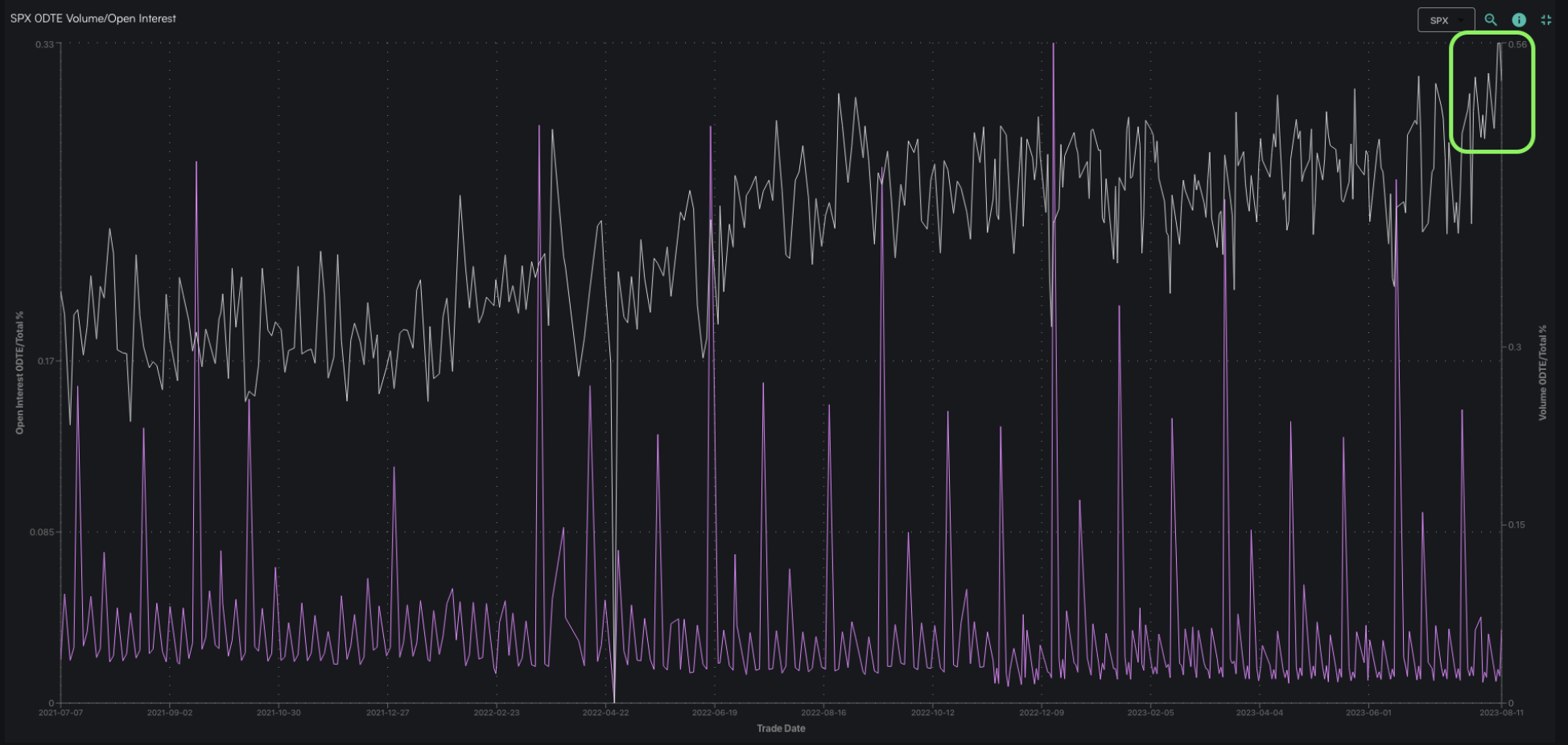

The “bat signal” for higher risk is a sustained increase in implied volatility, because that is a sign that traders are seeking to hedge downside risks. We’re all aware of the dominance of 0DTE, and what seems like a focus on short dated flows in the options space. Further, there is a mantra that long puts have failed to perform for some time to due a lack of response in IV. Basically, through ’22 long vega, which is higher for longer dated options, did not pay despite equity declines.

This briefly changed when the March bank crisis hit as traders had to hedge “known unknowns”. If/when a bank would fail, and the regulators response to that, was not something you could hedge with a 0DTE. This led to a pop in IV (VOLI, in blue), and demand for tail risk/long vega (SDEX/put skew, orange).

As the regulatory response seemed to satisfy traders, focus turned to the long AI chase, which was funded through the selling of S&P downside through June/July.

Most recently, around a cadre of smaller catalysts (particularly the burn off of single stock call demand & correlation unwind), we saw SPX skew recover and IV elevate. This, in our view, was more of a short cover vs long volatility demand. With IV’s at multi-year lows, why press shorts?

Because this August OPEX is not particularly large (and its well balanced) we do not see an options directional “lean” from expiration. However, starting Wednesday it does seem that volatility can loosen up which results in larger trading ranges.

Additionally, we’re all aware that Sep OPEX is a quarterly expiration, which generally contains larger options positions. There really aren’t material put positions until down <=4,300, and so that reflexive, negative gamma “trapdoor” of a sustained decline requires an event to spark some long volatility demand which gives a kicker to that downside put hedging. The concern here is that with any market weakness after next weeks Jackson Hole events, Sep options start to pick up in value.

August of ’22 frames this current situation rather well. As you can see there was general weakness/OPEX consolidation before Powell delivered a blow to markets (“J-HOLE”). That was followed by a hot CPI reading, and from there large puts fed the downside in through the Sep expiration(s).

Here, we see 4,400 as this “pre-Jackson Hole” support level, and then its up to the Fed to determine direction.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4489 |

$448 |

$15205 |

$370 |

$1920 |

$190 |

|

SpotGamma Implied 1-Day Move: |

0.68% |

0.68% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.12% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4485 |

$450 |

$15090 |

$370 |

$1955 |

$193 |

|

Absolute Gamma Strike: |

$4500 |

$450 |

$15475 |

$370 |

$1900 |

$190 |

|

SpotGamma Call Wall: |

$4600 |

$455 |

$15475 |

$380 |

$1970 |

$200 |

|

SpotGamma Put Wall: |

$4400 |

$445 |

$14700 |

$365 |

$1750 |

$190 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4497 |

$450 |

$14940 |

$375 |

$1945 |

$196 |

|

Gamma Tilt: |

0.966 |

0.749 |

1.575 |

0.778 |

0.738 |

0.597 |

|

SpotGamma Gamma Index™: |

-0.225 |

-0.321 |

0.073 |

-0.111 |

-0.028 |

-0.079 |

|

Gamma Notional (MM): |

‑$244.715M |

‑$1.275B |

$9.192M |

‑$597.687M |

‑$29.188M |

‑$777.018M |

|

25 Day Risk Reversal: |

-0.035 |

-0.044 |

-0.045 |

-0.041 |

-0.033 |

-0.031 |

|

Call Volume: |

429.222K |

1.607M |

7.731K |

755.055K |

42.588K |

259.024K |

|

Put Volume: |

797.618K |

2.241M |

15.091K |

935.542K |

56.57K |

313.822K |

|

Call Open Interest: |

6.416M |

7.062M |

63.474K |

4.857M |

223.068K |

3.641M |

|

Put Open Interest: |

13.304M |

15.054M |

85.56K |

10.026M |

412.893K |

7.547M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4550, 4500, 4450, 4400] |

|

SPY Levels: [450, 448, 445, 440] |

|

NDX Levels: [15500, 15475, 15175, 15000] |

|

QQQ Levels: [375, 370, 365, 360] |

|

SPX Combos: [(4701,95.30), (4674,77.40), (4665,90.54), (4652,94.88), (4625,88.38), (4611,82.57), (4602,97.11), (4575,89.30), (4562,90.29), (4548,94.49), (4544,86.29), (4539,84.32), (4535,79.36), (4530,91.20), (4526,94.05), (4521,90.16), (4517,84.93), (4512,91.46), (4477,87.14), (4472,95.72), (4463,74.25), (4459,95.24), (4454,92.83), (4450,97.61), (4441,86.25), (4436,73.41), (4432,88.38), (4427,88.62), (4418,75.71), (4409,91.06), (4400,97.58), (4373,83.55), (4360,82.47), (4351,95.12), (4310,83.43), (4301,95.29)] |

|

SPY Combos: [441.83, 431.52, 461.54, 436.45] |

|

NDX Combos: [15479, 14993, 14780, 15601] |

|

QQQ Combos: [381.57, 369.35, 364.16, 354.16] |