Macro Theme:

Short Term Resistance: 4,500

Short Term Support: 4,450

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,600 SPX Call Wall

Major Range Low/Support: 4,400

‣ Entering into the week of 9/11, there are a litany of catalysts including: CPI (13th), big Sep OPEX (15th), VIX Exp & FOMC (20th). *

‣ Our trade is to enter “long volatility” positions into CPI, with current ATM IV’s for a 30 day SPX option is 11.8% (too low, in our view). A bullish CPI/FOMC could produce a sharp upside shift, in which case we’d target >4,600 into the end of Sep. A bearish reaction could move the market <4,400. We think the market is underpricing our target levels.**

*updated 9/5

**updated 9/12

Founder’s Note:

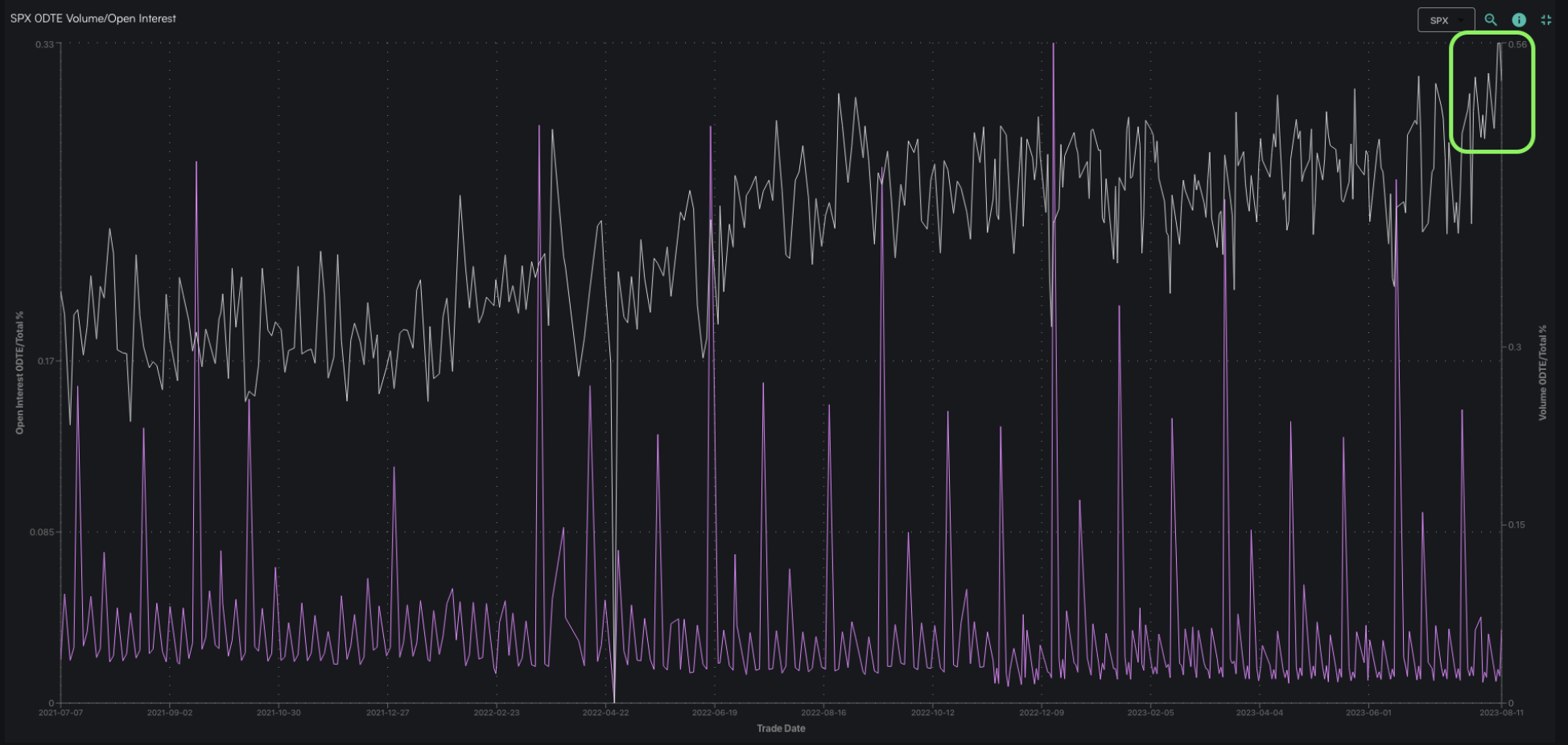

ES futures are fractionally lower to 4,510 ahead of the 8:30AM CPI print. Support is at 4,450, 4,430 & 4,400. Resistance above is at 4,485, 4,500 & 4,525. Our estimated 1 day move is 0.54%, which is one of the tightest ranges we’ve ever seen. This informs us that there is a lot of OPEX gamma built up, which should bring Index mean reversion. However, due to the CPI, we anticipate this range will be tested on the day. If the CPI deviates sharply from expectations, then the range would likely be broken.

In QQQ support is at the 370

Put Wall,

with resistance at the 376, then the 380

Call Wall.

For the last 1-2 weeks we’ve been experiencing relatively low volatility, particularly in the S&P, and that low-vol window is now closing with the AM CPI. This means that while we have been forecasting tight ranges which favors the S&P mean reverting, we may now start to get more directional movement. Yesterday we outlined our target areas into the end of September, as well as a basic trade structure to work around. Today we would be looking to take advantage of any major move, by selling short term pre-FOMC legs against these longer dated positions.

Today’s 0DTE SPX straddle is going for $28 or 62bps (ref 4,460, IV 23%), which is not far off of our implied move of 54bps. This fairly low volatility pricing is in the context of a term structure that is rather depressed. The nodes highlighted below show there is an IV premium tied to the CPI & FOMC events.

If the CPI is <=expectations then these nodes flatten back down with the rest of the structure, which is a tailwind for stocks. If the CPI is >=expected then the rest of term structure likely shifts higher, resulting in a flattening of the curve as traders price more risk around the FOMC.

With the market not expecting a whole lot, equities are also wrapped up in a load of volatility-suppressing large gamma positions. This can be seen in the plot below, wherein the S&P currently sits in the center of this “box”. We’d expect, at a minimum, today’s CPI to shift the S&P to one side of this box. These large gamma positions are going to go away with OPEX, and lately we’ve been seeing their pinning-effects wane in the 1-2 days before OPEX. This is why we are now entering into a window wherein the S&P may be more free to move, rather than pin the 4,450-4,500 range as we’ve done this week.

Where things are likely to get a bit spicier is in tech, as forward guidance arguably has an asymmetric impact on the tech sector. 1 month QQQ realized vol has been 17% vs 11% for the SPX. Further, the downside positioning is much thinner in QQQ (pre-market $372), which sits just above its $370

Put Wall.

Below is our QQQ vanna model, which shows that some downside movement could quickly spark some dealer selling, which invokes higher volatility. This is seen by the rising delta estimates in grey, and the IV-adjusted delta estimates in purple.

Here is our specific outlook for today:

- CPI higher than expectations: 4,400-4,425 as IV picks up, and tech drags down the S&P

- CPI in line: 4,475 – 4,500 as event vol comes down which gives equities a tailwind

- CPI lower than expectations: 4,500-4,525

Call Wall

as equities react to the prospect of “no more hikes”

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4461 | $445 | $15289 | $372 | $1855 | $184 |

| SpotGamma Implied 1-Day Move: | 0.54% | 0.54% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.90% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4485 | $446 | $15380 | $375 | $1855 | $187 |

| Absolute Gamma Strike: | $4450 | $450 | $15500 | $370 | $1850 | $185 |

| SpotGamma Call Wall: | $4525 | $450 | $14625 | $380 | $1860 | $190 |

| SpotGamma Put Wall: | $4400 | $440 | $15175 | $370 | $1850 | $182 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4469 | $448 | $14687 | $375 | $1922 | $191 |

| Gamma Tilt: | 0.938 | 0.784 | 1.019 | 0.787 | 0.811 | 0.426 |

| SpotGamma Gamma Index™: | -0.502 | -0.251 | 0.003 | -0.121 | -0.023 | -0.168 |

| Gamma Notional (MM): | ‑$340.50M | ‑$857.154M | $3.096M | ‑$478.925M | ‑$22.614M | ‑$1.726B |

| 25 Day Risk Reversal: | -0.038 | -0.033 | -0.036 | -0.037 | -0.029 | -0.032 |

| Call Volume: | 497.527K | 1.429M | 6.638K | 742.866K | 9.757K | 191.367K |

| Put Volume: | 757.246K | 2.313M | 12.615K | 1.035M | 20.643K | 360.407K |

| Call Open Interest: | 6.693M | 6.902M | 66.019K | 5.157M | 232.381K | 3.807M |

| Put Open Interest: | 13.403M | 14.441M | 95.151K | 10.103M | 402.968K | 7.907M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4500, 4475, 4450, 4400] |

| SPY Levels: [450, 448, 445, 440] |

| NDX Levels: [15500, 15400, 15200, 15000] |

| QQQ Levels: [380, 375, 370, 360] |

| SPX Combos: [(4667,73.74), (4649,88.56), (4600,97.91), (4578,73.07), (4573,89.96), (4560,74.82), (4551,98.24), (4547,76.42), (4542,86.64), (4533,87.70), (4529,92.24), (4524,98.82), (4520,85.00), (4515,88.39), (4511,88.09), (4502,97.42), (4489,79.82), (4466,75.68), (4462,84.39), (4453,89.62), (4449,95.54), (4444,75.70), (4440,79.85), (4435,87.85), (4431,93.39), (4426,84.73), (4422,89.92), (4413,91.97), (4408,80.21), (4404,93.87), (4399,98.65), (4391,82.22), (4386,81.08), (4382,78.52), (4377,89.72), (4350,95.19), (4341,81.24), (4324,81.15), (4301,98.76), (4270,76.29), (4252,93.10)] |

| SPY Combos: [447.31, 437.5, 449.54, 457.12] |

| NDX Combos: [15183, 14770, 15580, 15794] |

| QQQ Combos: [380.63, 356.02, 377.65, 375.78] |

SPX Gamma Model

View All Indices Charts

0 comentarios