Macro Theme:

Short Term Resistance: 4,500

Short Term Support: 4,450

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,600 SPX Call Wall

Major Range Low/Support: 4,400

‣ Entering into the week of 9/11, there are a litany of catalysts including: CPI (13th), big Sep OPEX (15th), VIX Exp & FOMC (20th). *

‣ Our trade is to enter “long volatility” positions into CPI, with current ATM IV’s for a 30 day SPX option is 11.8% (too low, in our view). A bullish CPI/FOMC could produce a sharp upside shift, in which case we’d target >4,600 into the end of Sep. A bearish reaction could move the market <4,400. We think the market is underpricing our target levels.**

*updated 9/5

**updated 9/12

Founder’s Note:

Futures are flat at 4,555 as we head into today’s OPEX. For SPX, support is at 4,492 then 4,450. Resistance above is at the 4,525

Call Wall.

The 1-Day Implied move stays very thin at 0.54% (open/close SPX range).

In QQQ support is at 370, with resistance at 377 & the 380

Call Wall.

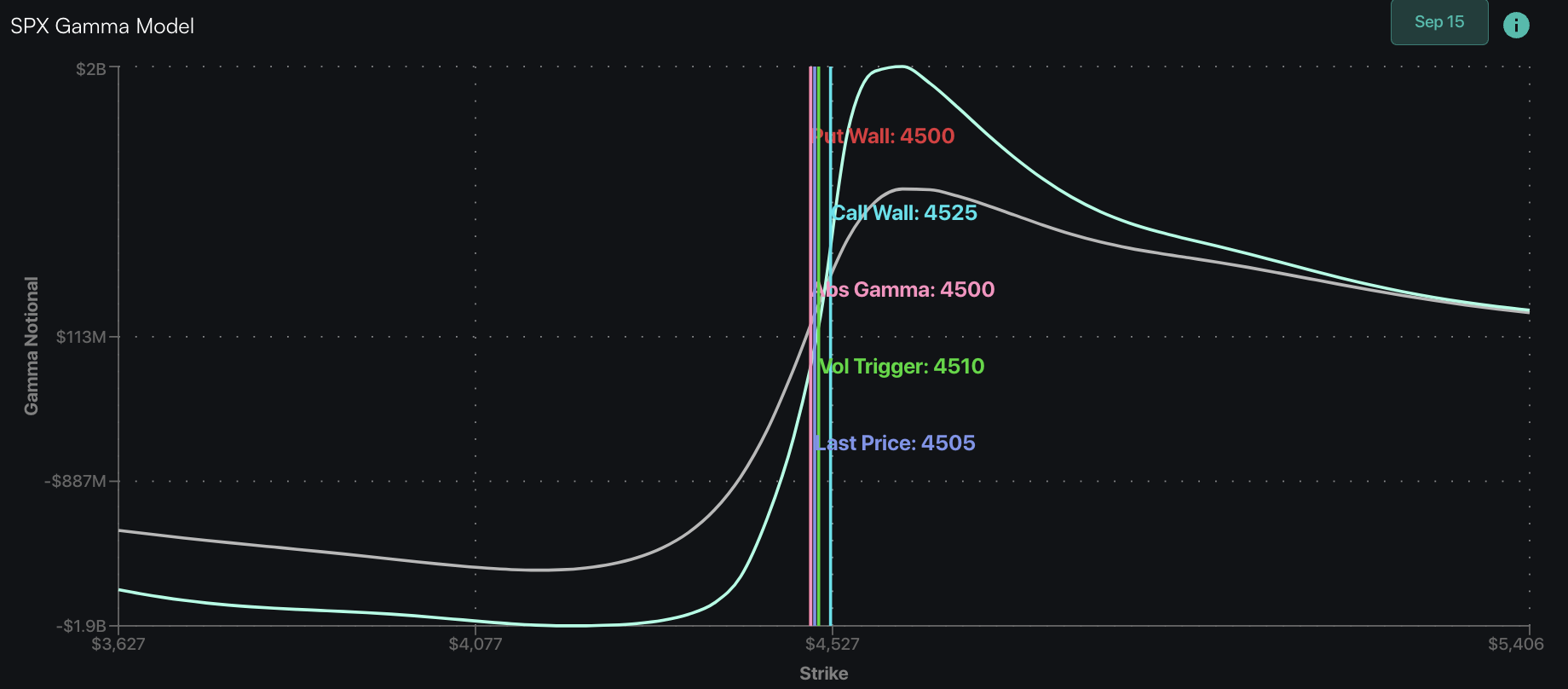

Yesterday the SPX finally pulled up into the large 4,500 strike as implied volatility continued its descent. First, in regards to the strike gamma at 450/4,500 – it is a beast as seen in the plot below. 1/2 of this position should be removed with today’s expiration, which should help to untether equities into next week. For today we would anticipate equities holding in the 4,500 – 4,525 range.

In terms of the volatility crush – that can be seen in term structure, below, but also in the 12 handle VIX which is the lowest since Jan ’20. Lower implied volatility is an equity tailwind, and traders will likely press vol “risk free” until Tuesday, and then pause into 9/20 FOMC. This should keep equities supported into Wednesday AM.

While yesterday the options positions expiring for today appeared to be neutral (put vs

call delta

expiring), we can now see that there is more of a call imbalance as equities rallied. This is shown in the relative size of

call delta

(orange) vs

put delta

(blue). Generally we read a call imbalance into expiration as cause for equity market weakness next week, but this may not be as clean of a setup due to the VIX exp + FOMC on 9/20. Statistically we can’t offer much here as there are ~4 dates since Jan ’20 wherein we have a large OPEX with FOMC 3 trading days after, and the average 1 day forward after OPEX is 0%.

On Tuesday we proposed some SPX targets, and a trade structure which was a framework for our views out of these catalysts (CPI/OPEX/FOMC) and into the end-of-month. The bullish idea here was (and remains) that a benign CPI would crush IV, which would be a tailwind for equities, which were also supported by high levels of OPEX gamma. The reduction of gamma should now allow for more equity movement next week, and an “in-line” FOMC would lead to a further reduction in IV – another bullish trigger. A post-FOMC rally could then play into large upside 4660 JPM call strikes into EOM, which could pull equities even higher.

Conversely, the in-line CPI seems to have traders inferring that the FOMC will not spark any downside volatility, and we have little view on this. We do however feel that one risk here is that the SEP OPEX/VIX Exp is clearing out downside put positions, which may have been supporting equities for the last several weeks. As OPEX rolls off, you can see in the gamma model below that the downside positioning shifts “up and out” as the “elbow” of that model moves from ~4,400 to ~4,200. This implies that there are now fewer puts down below, which in this case may mean there is less to absorb an equity decline.

If you recall into August markets moved ~5% lower, but it was a grind over several days/weeks with IV remaining rather contained. Due to OPEX positions expiring, should the FOMC upset markets it could result in faster downside with higher relative IV’s.

Our view was that, into CPI, you may want to enter trades that initially had single legs, so you could take advantage of any pre-FOMC moves. We think traders should add end-of-month short legs to any upside call positions early next week to cap off any negative FOMC reaction.

Today may also be an opportune time to sell some Tuesday calls or call spreads, particularly if there is another rally today which energizes those short dated calls.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4505 | $450 | $15473 | $377 | $1866 | $185 |

| SpotGamma Implied 1-Day Move: | 0.56% | 0.56% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.90% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4510 | $449 | $15500 | $378 | $1855 | $187 |

| Absolute Gamma Strike: | $4500 | $450 | $15500 | $375 | $1860 | $185 |

| SpotGamma Call Wall: | $4525 | $451 | $15550 | $380 | $1860 | $190 |

| SpotGamma Put Wall: | $4500 | $440 | $15500 | $375 | $1850 | $185 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4479 | $449 | $15434 | $376 | $1919 | $189 |

| Gamma Tilt: | 1.116 | 0.901 | 1.229 | 0.906 | 1.102 | 0.531 |

| SpotGamma Gamma Index™: | 0.976 | -0.105 | 0.039 | -0.05 | 0.013 | -0.133 |

| Gamma Notional (MM): | $78.333M | ‑$727.085M | $728.569K | ‑$275.015M | ‑$3.594M | ‑$1.28B |

| 25 Day Risk Reversal: | -0.029 | -0.026 | -0.032 | -0.03 | -0.022 | -0.025 |

| Call Volume: | 603.762K | 2.422M | 13.815K | 735.715K | 15.753K | 385.487K |

| Put Volume: | 987.667K | 2.804M | 12.717K | 1.152M | 22.108K | 575.942K |

| Call Open Interest: | 6.885M | 6.062M | 63.93K | 5.17M | 247.878K | 3.889M |

| Put Open Interest: | 13.741M | 15.179M | 101.156K | 10.246M | 442.13K | 7.87M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4515, 4510, 4500, 4495] |

| SPY Levels: [452, 451, 450, 445] |

| NDX Levels: [15500, 15475, 15450, 15400] |

| QQQ Levels: [380, 377, 375, 370] |

| SPX Combos: [(4699,96.05), (4676,78.56), (4663,84.00), (4649,93.97), (4627,81.44), (4600,99.25), (4591,83.65), (4582,86.72), (4577,93.01), (4568,77.67), (4564,79.73), (4559,88.56), (4555,82.81), (4550,99.58), (4546,90.31), (4541,96.99), (4537,97.62), (4532,99.41), (4523,99.96), (4519,96.86), (4514,89.87), (4505,91.92), (4501,98.89), (4496,97.72), (4492,88.61), (4487,78.63), (4483,75.39), (4460,74.69), (4451,91.51), (4442,77.75), (4424,76.69), (4420,77.76), (4401,98.19), (4374,77.23), (4352,92.69), (4302,76.37), (4298,95.93)] |

| SPY Combos: [453.55, 443.64, 433.74, 463.91] |

| NDX Combos: [15582, 15381, 15505, 15675] |

| QQQ Combos: [373.19, 383.01, 375.08, 378.1] |

0 comentarios