Macro Theme:

Short Term SPX Resistance: 4,200

Short Term SPX Support: 4,100

SPX Risk Pivot Level: 4,220

Major SPX Range High/Resistance: 4,300

Major SPX Range Low/Support: 4,000

‣ Nov 1st FOMC is a major turning point for equities*

‣ We view 4,000 as a major support level for the S&P500 into Nov OPEX*

‣ 4,300 is first target over 1-2 sessions if we close >4,200 on 11/1/23*

*updated 11/1

Founder’s Note:

ES Futures are off slightly to 4,195. Key SG levels for the SPX are:

- Support: 4,165, 4,150, 4,100

- Resistance: 4,200, 4,210, 4,150

- 1 Day Implied Range: 0.82%

For QQQ support is at 345. Resistance is at 350 & 355.

Today we have ISM at 10AM ET, then FOMC at 2pm ET.

For today, we are looking for a directional move that plays out over the course of several sessions, vs the relative “pinning” of the last few sessions. A close >4,200 implies a test of 4,300 over the next 1-2 sessions. We want to give edge to this bullish move extending into Nov OPEX, assuming our various key options levels move up to confirm. However, the fuel that ignites a rally here would be short covering – that is the crushing of IV and put values therein. Sharply lower IV’s is the vanna fuel that could move things rapidly higher, but then we would need to see longer dated call buyers enter to confirm that a move is set to extend. We are concerned here that a 1-2 day knee-jerk reaction higher could give way rather quickly.

Should Powell have a hawkish tilt, we look for a move down into the 4,000’s over the next several sessions. Our current stance is that 4,000 would serve to be major support, and so we believe it would take an overtly hawkish FOMC to break below this area before Nov OPEX.

You can see a deep dive into SPX levels/outcomes here, and RUT/IWM here. NDX/QQQ is at the bottom of this page.

Yesterday was an interesting session in that the lower IV/higher equities broke rank with rates, which were shifting higher. Shown below is the US10Y (orange) vs VIX (green/red), and you can see the “jaws” that formed. We think that this divergence was purely driven by both end-of-month and/or pre-FOMC adjustments. We’re of the mind that this divergence has to close. If Powell stays strong on rates then look for the VIX to quickly snap higher, back into the low 20’s. Conversely we think that “Powell on pause” leads to a bit of rate easing, which allows for the VIX to drop back toward 16.

Consider the Mag7’s, wherein the vast majority of the flow was concentrated in Friday’s expiration (aka “0DTE” for stocks). Shown below in green is HIRO for 0DTE calls, and light blue being 0DTE puts. You can see that these 0DTE positions are nearly at or above the flow from all expiration (orange = all exp calls, dark blue = all expiration puts). If traders were focused on say, long dated calls, that orange line would have +2-3x the value of Friday’s calls. This informs us that yesterday was short dated players, not long term investors at work.

The takeaway here is that the price action of the last session does not have implications for what unfolds today. If anything, the move higher over the last 1-2 sessions gives us a bit more downside padding to the major support line of 4,000.

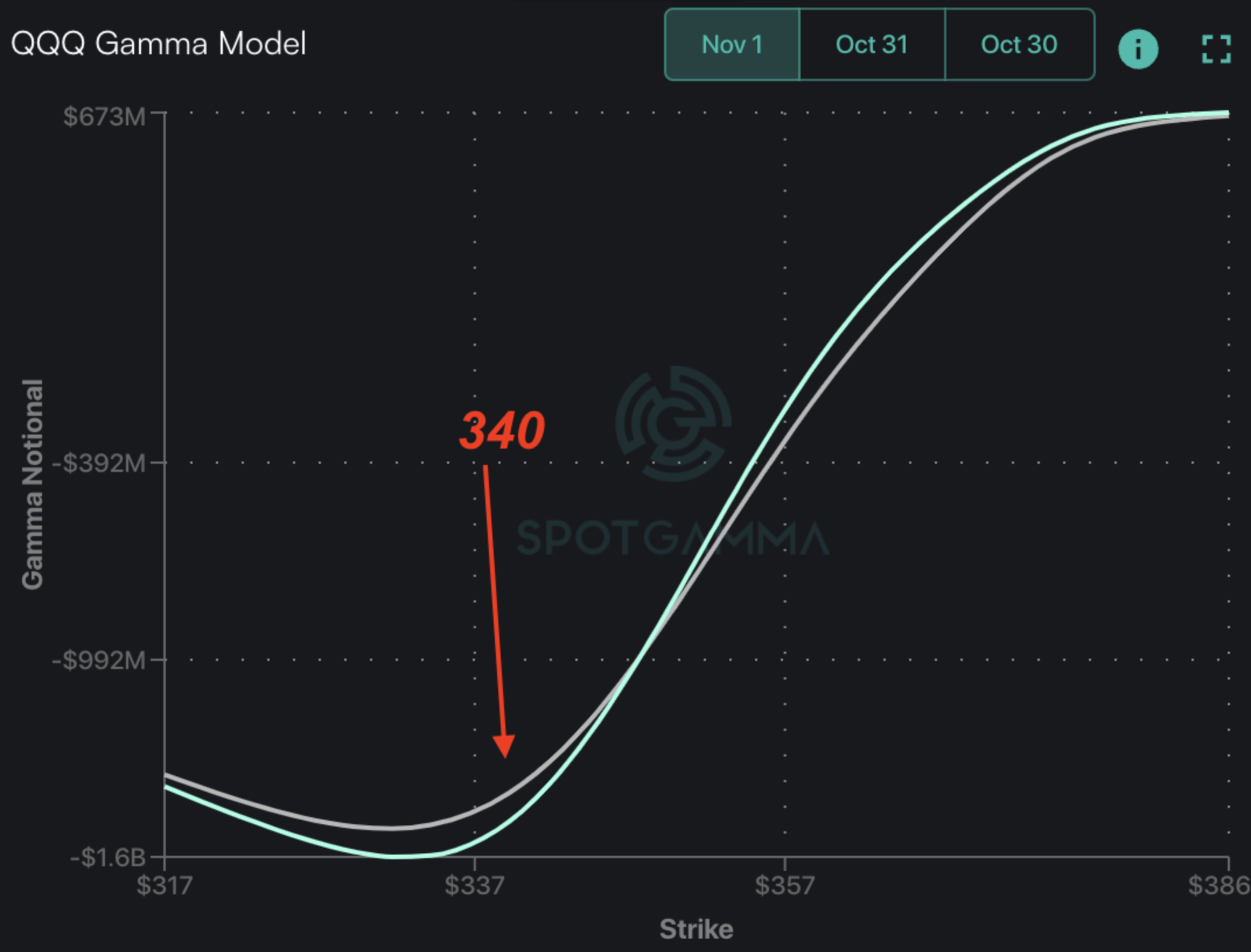

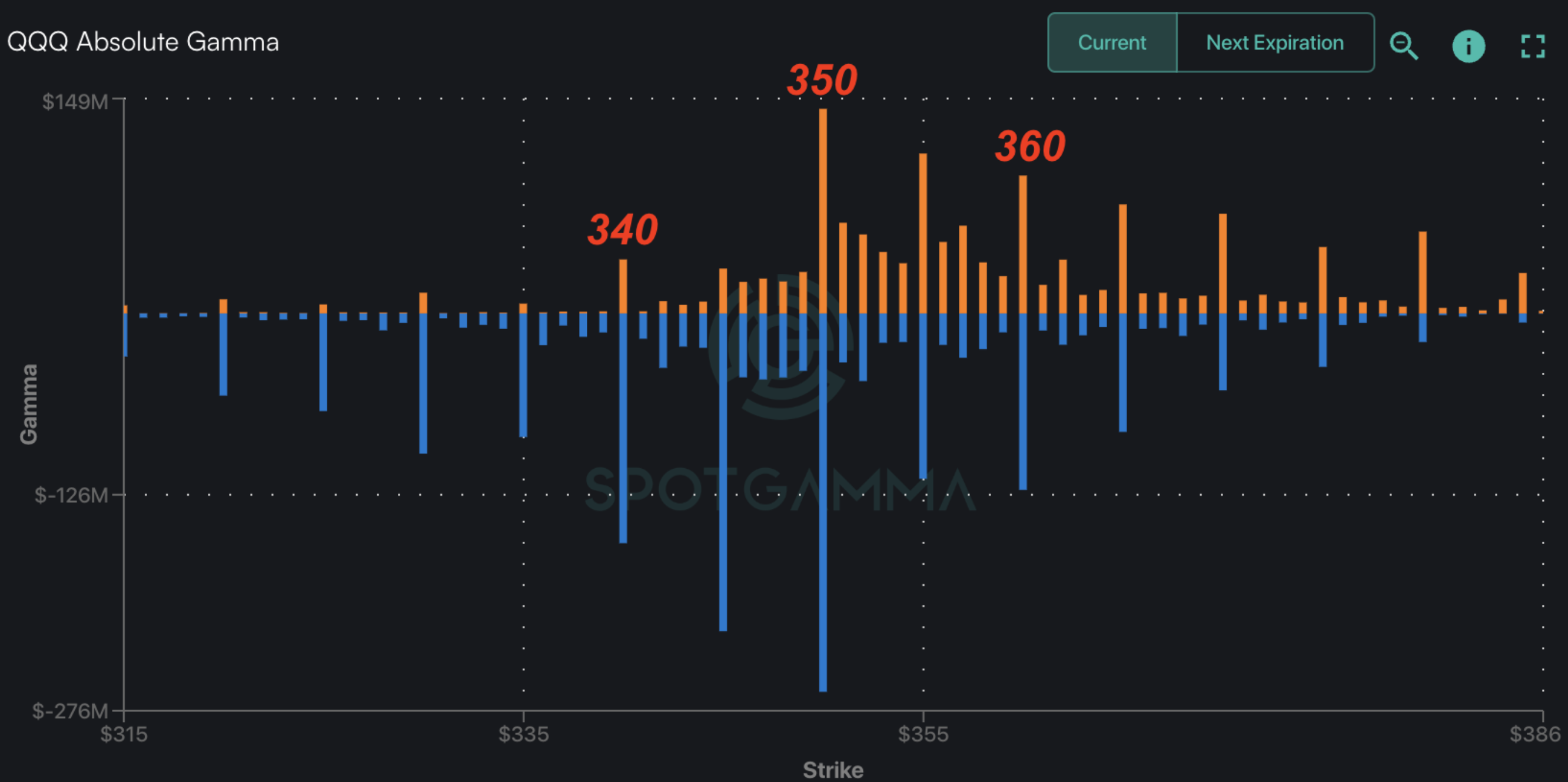

Finally, we look at the QQQ’s for outcomes out of FOMC. As with the RUT/IWM, we look more at the QQQ ETF vs NDX due to QQQ’s having more options interest.

The downside in QQQ is a bit less defined than in SPX/RUT. 340 is the largest downside level, but it does not offer the same major support that we see in 4,000 SPX/160 IWM.

Below we can see that 340 is the last, largest downside with put interest, but that level could easily flip down to 330 or 335 into Nov OPEX. However, a broad equity move ~2% lower would place us at the major SPX and IWM support levels, which lines up with 340 an interim low in QQQ’s. Our takeaway here is that if you are looking to chose short exposure, QQQ may have less support vs the SPX/RUT.

To the upside, 360 is the first stop in a Powell-triggered rally, with 370 forming as our Nov OPEX high.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4193 | $418 | $14409 | $350 | $1662 | $164 |

| SpotGamma Implied 1-Day Move: | 0.82% | 0.82% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.39% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4200 | $417 | $14525 | $350 | $1760 | $175 |

| Absolute Gamma Strike: | $4000 | $420 | $14600 | $350 | $1700 | $165 |

| SpotGamma Call Wall: | $4400 | $423 | $14600 | $380 | $1690 | $166 |

| SpotGamma Put Wall: | $4100 | $410 | $14000 | $345 | $1700 | $160 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4264 | $423 | $14265 | $361 | $1788 | $176 |

| Gamma Tilt: | 0.724 | 0.633 | 1.035 | 0.689 | 0.566 | 0.457 |

| SpotGamma Gamma Index™: | -1.652 | -0.349 | 0.004 | -0.129 | -0.035 | -0.109 |

| Gamma Notional (MM): | ‑$777.812M | ‑$1.667B | $1.063M | ‑$750.614M | ‑$41.32M | ‑$1.313B |

| 25 Day Risk Reversal: | -0.063 | -0.044 | -0.059 | -0.05 | -0.061 | -0.042 |

| Call Volume: | 561.743K | 1.37M | 8.132K | 814.707K | 13.992K | 481.25K |

| Put Volume: | 930.934K | 2.037M | 10.217K | 990.59K | 31.737K | 927.263K |

| Call Open Interest: | 6.744M | 7.313M | 55.898K | 4.728M | 243.147K | 4.138M |

| Put Open Interest: | 12.364M | 12.41M | 70.132K | 8.026M | 410.906K | 7.252M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4400, 4300, 4200, 4000] |

| SPY Levels: [425, 420, 415, 410] |

| NDX Levels: [15500, 15000, 14600, 14000] |

| QQQ Levels: [360, 355, 350, 345] |

| SPX Combos: [(4399,79.24), (4248,73.34), (4240,76.33), (4198,98.04), (4160,88.09), (4152,96.65), (4131,81.50), (4127,90.67), (4110,93.36), (4102,98.75), (4076,84.03), (4060,87.28), (4055,82.18), (4051,96.82), (4026,80.32), (4009,88.33), (4001,98.25)] |

| SPY Combos: [411.55, 401.51, 406.53, 421.59] |

| NDX Combos: [14597, 14165, 14381, 13963] |

| QQQ Combos: [346.71, 357.24, 341.8, 351.62] |

0 comentarios