Macro Theme:

Short Term SPX Resistance: 5,100

Short Term SPX Support: 5,000

SPX Risk Pivot Level: 5,000

Major SPX Range High/Resistance: 5,100

Major SPX Range Low/Support: 4,800

‣ Call skews remain heavy, which indicates strong bullish demand for upside. This places dealers in a negative gamma position, which leaves them to directionally chase stocks (buy into higher prices, sell into lower prices), which in turn exacerbates volatility – including stocks up, vol up.‣ 5,100 is the major upside target. 5,000 is critical support.‣

*updated 2/22

Founder’s Note:

ES futures are +120bps to 5,060. NQ futures are +200bps to 17,886.

Key SG levels for the SPX are:

- Support: 5,000, 5,015

- Resistance: 5,050, 5,076

- 1 Day Implied Range: 0.62%

For QQQ:

- Support: 430

- Resistance: 440

Call Wall

IWM:

- Support: 197, 195

- Resistance: 200, 210

Call Wall

NVDA earnings crushed it, sending the stock +15% AH’s to 775. In response ES futures lifted +1% to new all time highs, and NQ futures 2%. We also see SMH (semi ETF) +6% to new ATH’s at 208.

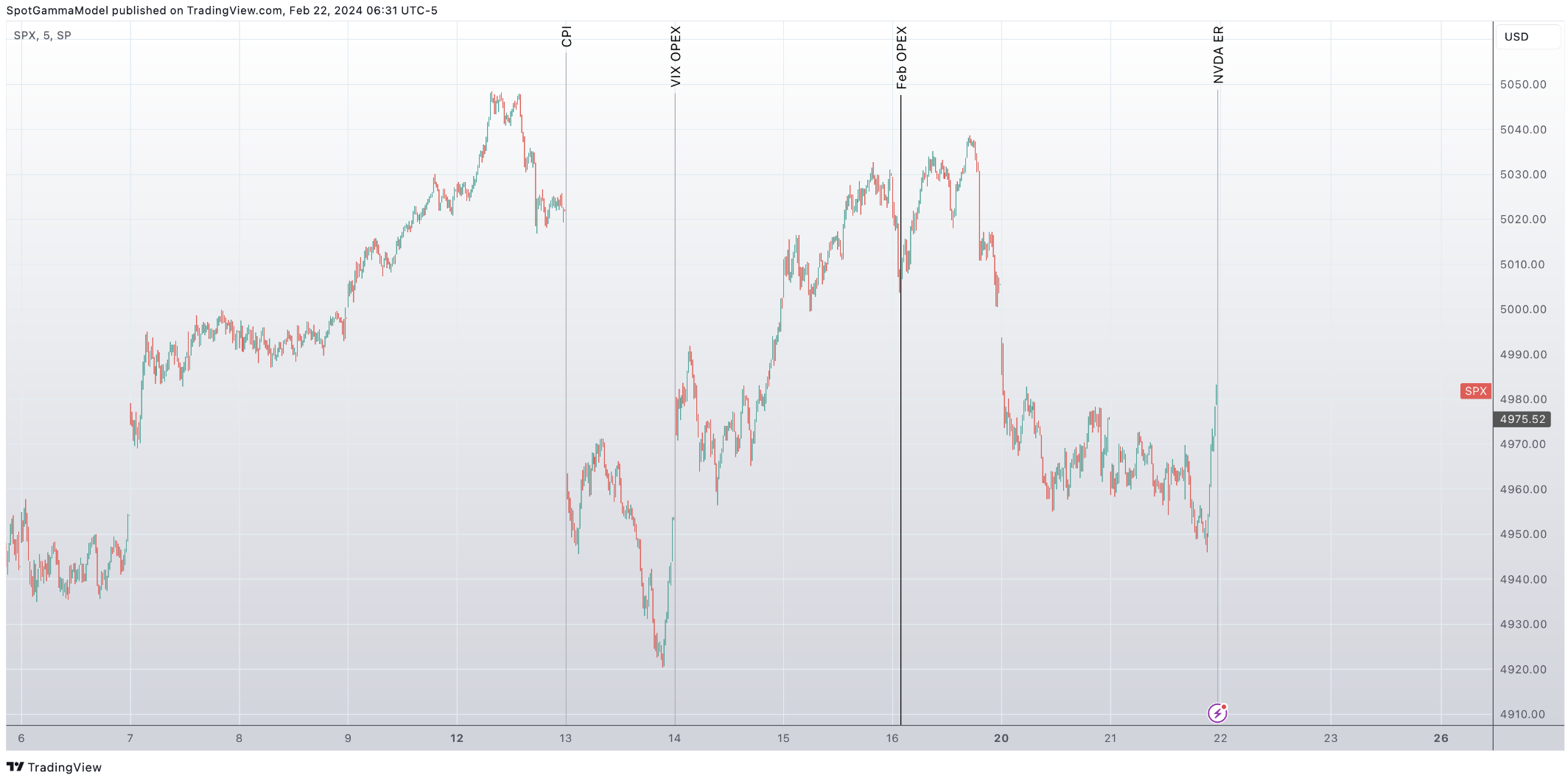

Heading into today, we had been looking for some equity market consolidation, and defined NVDA’s ER’s as the last trigger point for a broader directional move out into March 15th OPEX.

The consolidation phase appears to have ended thanks to NVDA, which has pushed ES futures up enough to indicate an SPX opening well over the 5,000 strike, which is our critical bull threshold. We should therefore start looking as 5,000 as the support base, with eyes on the 5,100 SPX

Call Wall,

and 440 QQQ Call Wall as upside targets.

We have also been marking 4,900 as our major risk

pivot

level (i.e. risk off under this level), and that level now shifts to 5,000. You can see this infered by the Vol Trigger &

Zero Gamma

levels now shifting to the 5,000 level.

Establecer la imagen destacada

Establecer la imagen destacada

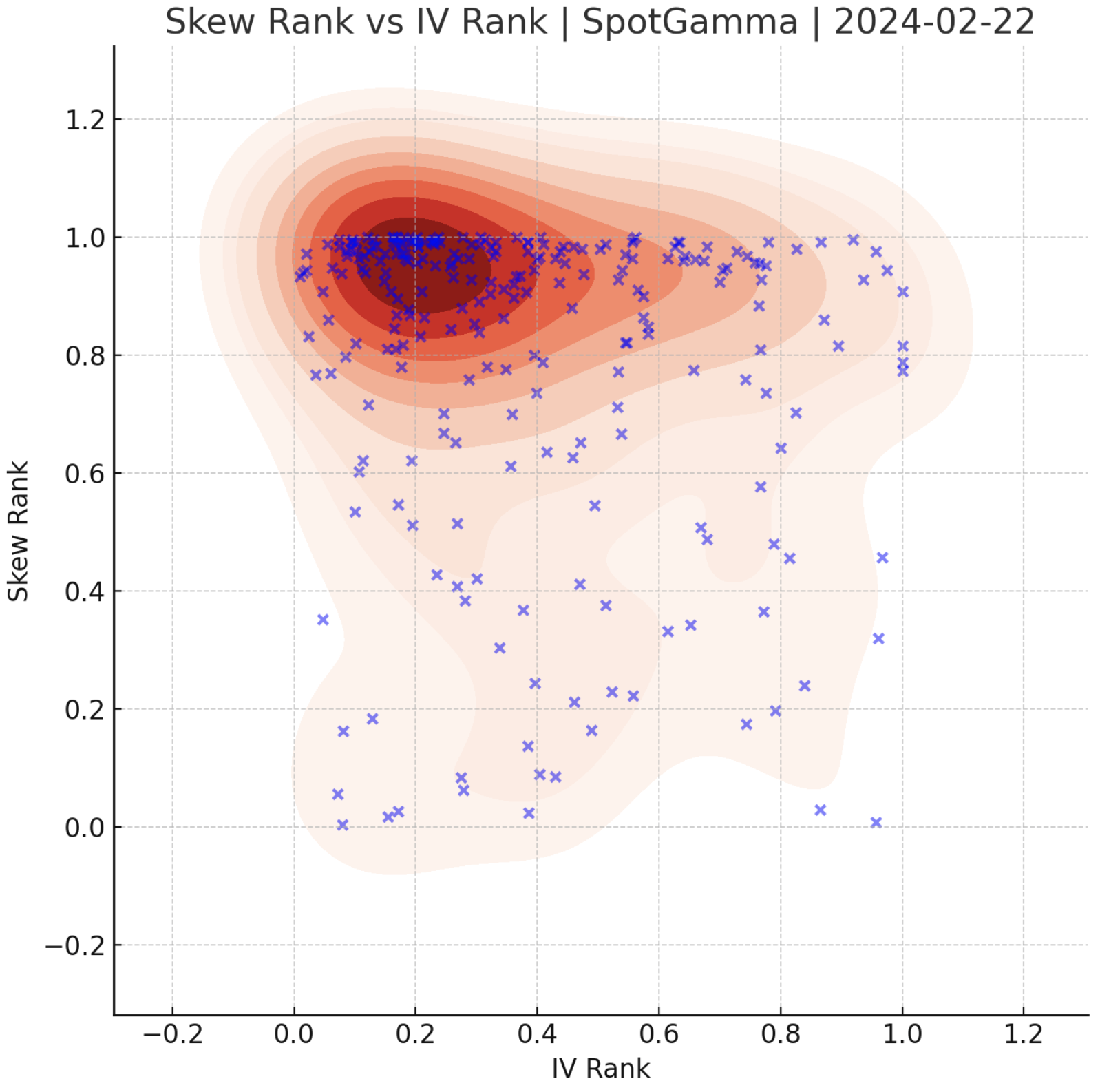

Here we have updated the skew rank vs iv rank plot which shows us that most of the top options-trading stocks have skew rankings (i.e. call values are high relative to puts) in the +90th percentile. This is a crowded bull market, there are no doubts about that, but, you don’t want to fight the flow. To this point these high skews inform us that dealers are likely in a negative gamma position, leaving them to have to chase stocks as they go higher (or sell as stocks go lower), which exacerbates volatility.

We had been operating from the idea that these heavy call-skews were broadly likely to flatten due to the passing of NVDA earnings, but the massive bullish response to NVDA’s earnings puts that idea into question.

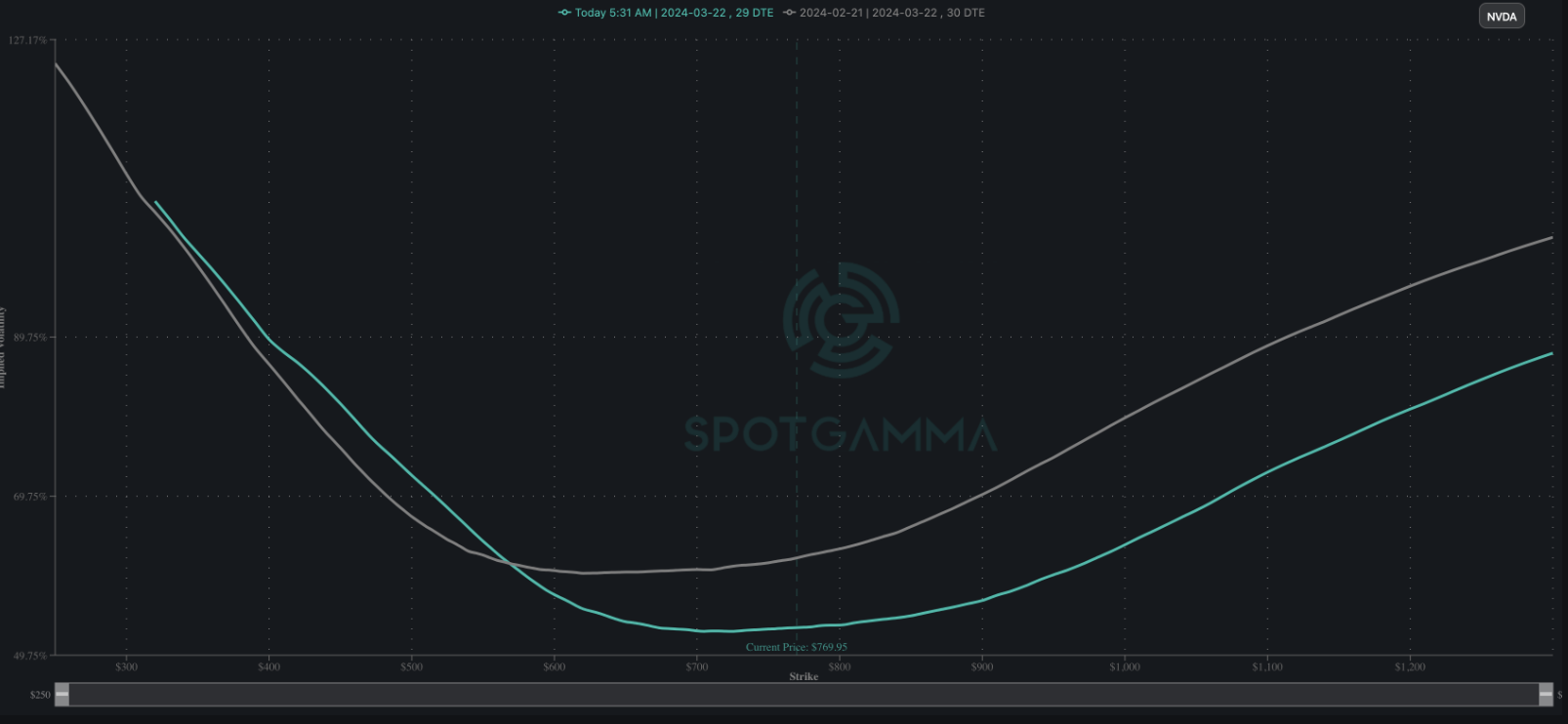

Zooming into that idea, one would have to assume that NVDA’s earnings embolden/reinvigorate call buyers, but consider the indicative IV decline in NVDA 1-month skew, shown below (green) vs last night (gray). As you can see, the IV’s are likely to have deflated after last nights earnings, which could invoke some early dealer selling (for more on this see this note). For this reason we think some initial consolidation of the major overnight gains will arrive after the open.

Of course, any related selling flows could be ultimately be counteracted by voracious, short term call buying speculation, which is a major feature of this market. Further, the recent consolidation in prices across many tech names, may be seen as “the dip” to grab today. Take for example SMCI which is +15% premarket to 850. Recall this stock dropped -20% last Friday!

The point here is that we’ll need to wait for the air to clear, but our base case is that any early dip is bought. This seems ultimately like a setup for a blow-off top, and rallies would only become suspect if the SPX breaks back below 5,000.

We also note that NVDA flagged a product release for March 18th, which lines up with the large quarterly March OPEX. This is the next major time frame to mark for the options market.

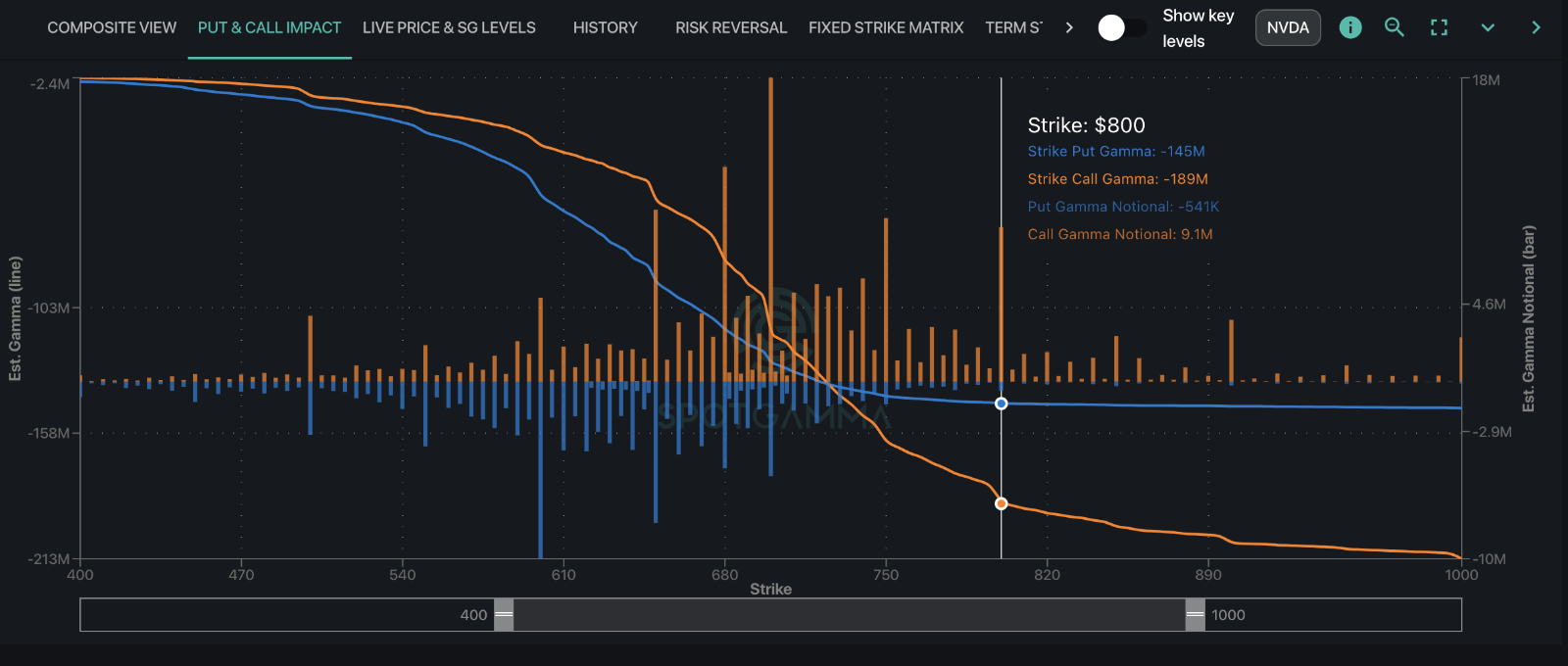

Lastly, in regards to NVDA levels specifically, we flag 800 as the major upside strike. Above that strike there is little in the way of call positioning (orange bars), as shown in the plot below, which makes 800 a potential “stalling point”. First support is at 750, with larger support at 700.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4981 | $497 | $17478 | $425 | $1994 | $197 |

| SpotGamma Implied 1-Day Move: | 0.62% | 0.62% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.63% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5000 | $495 | $17675 | $427 | $2015 | $197 |

| Absolute Gamma Strike: | $5000 | $500 | $17750 | $420 | $2000 | $195 |

| SpotGamma Call Wall: | $5100 | $500 | $17750 | $440 | $2050 | $210 |

| SpotGamma Put Wall: | $5000 | $490 | $17350 | $420 | $1850 | $195 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4990 | $496 | $17174 | $431 | $2066 | $200 |

| Gamma Tilt: | 0.928 | 0.821 | 1.102 | 0.710 | 0.668 | 0.729 |

| SpotGamma Gamma Index™: | -0.561 | -0.213 | 0.016 | -0.155 | -0.036 | -0.057 |

| Gamma Notional (MM): | ‑$264.00M | ‑$504.789M | $1.765M | ‑$577.673M | ‑$28.915M | ‑$419.058M |

| 25 Delta Risk Reversal: | -0.017 | -0.015 | -0.013 | -0.017 | -0.001 | -0.012 |

| Call Volume: | 465.797K | 1.587M | 10.316K | 1.01M | 14.889K | 367.685K |

| Put Volume: | 995.872K | 2.23M | 11.891K | 1.41M | 18.64K | 526.586K |

| Call Open Interest: | 6.627M | 6.28M | 49.517K | 4.101M | 254.29K | 4.472M |

| Put Open Interest: | 13.288M | 15.184M | 63.852K | 7.847M | 464.511K | 7.95M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 4900, 4800, 4950] |

| SPY Levels: [500, 495, 490, 497] |

| NDX Levels: [17750, 17600, 17000, 17625] |

| QQQ Levels: [420, 430, 425, 415] |

| SPX Combos: [(5201,96.29), (5151,91.59), (5131,72.33), (5126,84.97), (5111,73.80), (5101,99.09), (5091,85.31), (5081,85.34), (5076,93.02), (5071,83.87), (5062,88.96), (5052,97.55), (5042,81.93), (5032,92.72), (5027,84.64), (5022,85.43), (5017,94.20), (5012,94.36), (5002,99.43), (4992,75.73), (4962,92.51), (4952,93.06), (4942,87.61), (4932,83.72), (4927,89.24), (4922,86.68), (4912,77.24), (4907,90.54), (4902,97.41), (4897,78.36), (4887,76.69), (4882,72.78), (4877,90.24), (4867,80.13), (4862,72.55), (4857,80.59), (4852,93.73), (4827,85.62), (4802,96.67), (4773,75.32), (4748,90.28)] |

| SPY Combos: [506.34, 501.4, 516.22, 497.94] |

| NDX Combos: [17759, 17252, 17042, 16832] |

| QQQ Combos: [427.54, 415.29, 420.36, 410.22] |

0 comentarios