Macro Theme:

Short Term SPX Resistance: 5,100

Short Term SPX Support: 5,077

SPX Risk Pivot Level: 5,000

Major SPX Range High/Resistance: 5,100

Major SPX Range Low/Support: 4,800

‣ We look for index volatility to now contract after hitting the 5,100 is the upside target.*

‣ 5,000 is critical support, up from 4,900 the week ending 2/16.*

‣ March Quarterly OPEX (3/15) is the next major inflection point.*

*updated 2/23

Founder’s Note:

ES futures are flat at 5,100. NQ futures flat at 18,035.

Key SG levels for the SPX are:

- Support: 5,077, 5,060

- Resistance: 5,100, 5,112 SPX

Call Wall

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 433

- Resistance: 440

Call Wall

IWM:

- Support: 197, 195

- Resistance: 200, 210

Call Wall

Today we see the SPY

Call Wall

at 408, which lines up with the SPX

Call Wall

at 5,100 to provide S&P500 market resistance. In the QQQ’s the

Call Wall

remains just above at 440, which has been the

Call Wall

strike for several weeks. The summary of this, we believe, is that the current index price area likely requires a bit of digestion before moving higher. With that our 1-day SG implied move is a tight 59bps, suggesting some pinning/tighter index moves around current levels.

Looking at 1-month SPX skew we can see that upside strikes (i.e. calls) have relatively higher IV’s than at any time vs last several months, as shown by today’s skew plot (green line) being above the shaded cone (red box). However, the IV’s for upside strikes did not increase into yesterday’s 2% SPX rally, which is shown by the current skew (green line) staying flat to Tuesday’s close (gray line). This signals that S&P call buyers didn’t chase higher strikes into yesterday’s move.

With that, the key signal of higher forward returns on the index side will be the rolling higher of both S&P & QQQ

Call Walls

. We also flag that IWM’s are falling behind, managing just +97bps of return yesterday vs >200bps returns in SPY/QQQ.

Via

HIRO

yesterday we can see that 408/5,100 level saw heavy options selling, which was driven by call selling. Interestingly, 0DTE was the primary S&P500 options flow until right into the bell. You can infer this by how closely the 0DTE flow line (teal) tracked the All Exp flow line (purple). There was however stronger, longer dated flows in the stuff that matters: tech/Mag 7. Seen through this lens, it seems traders are not trying to “get long” vs SPX, and instead continuing to express longs via the concentrated high flyers – which makes sense.

The underperformance risk of just holding long the index is real, and likely only to get more dramatic.

On this note, while we see some short term pause likely on the index side, several of the Mag7 names (MSFT, AAPL, GOOL) are not yet at highs suggesting some opportunity to “catch up”.

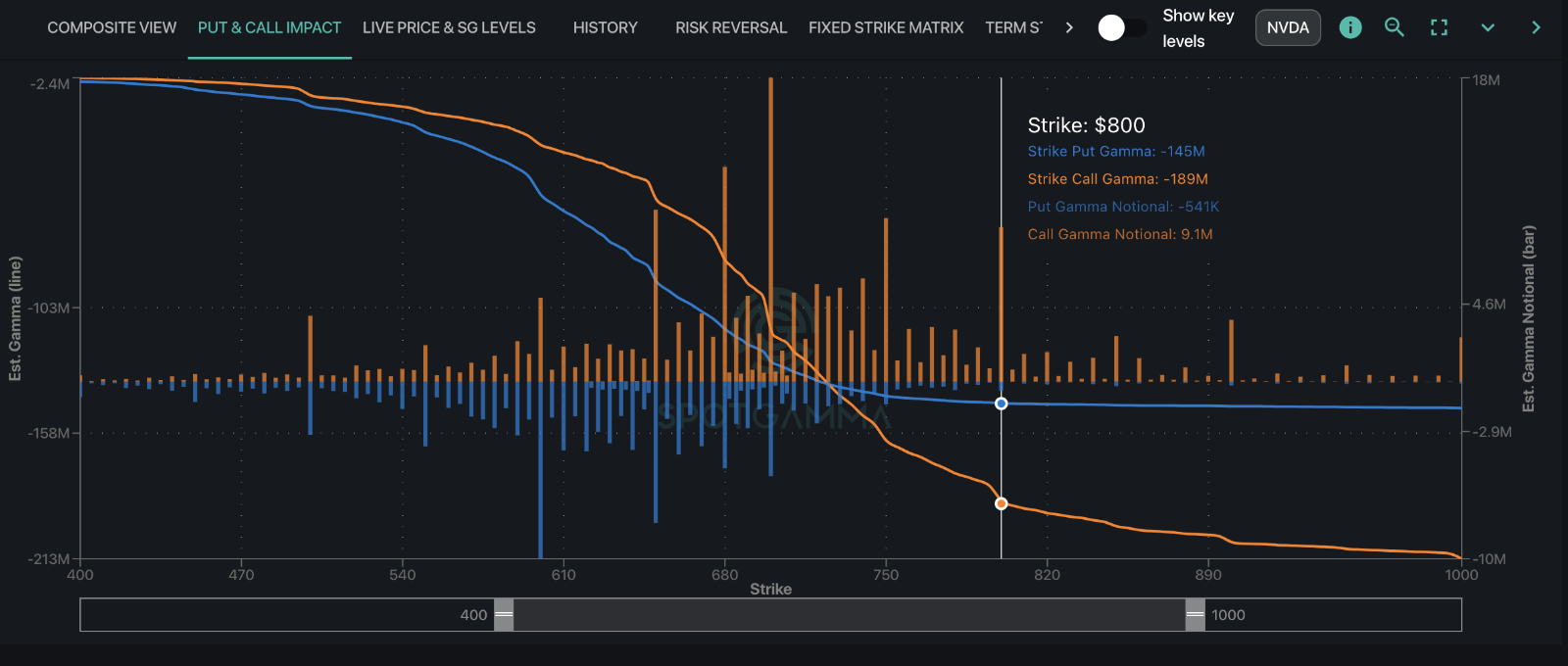

Clearly NVDA set off concerns about right tail risk, and missing upside. To this point the magnitude of yesterday’s move held up ATM vols (i.e stock up/vol up & the VIX didn’t really “crush”), but the left tail (OTM puts) – we’ll that is getting crushed. You can see this in “indexified” measures like VVIX, or SDEX, shown below. The SDEX measures the relative IV of a put 1 standard deviation move lower in the SPY, which is now back near all-time lows.

There seems to be little to change this dynamic of systematically selling downside puts, but we do think that ATM index vol is now likely to start sinking. This may open the door for VIX (and its linked ETN’s like VXX/UVXY) to start decaying.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5087 | $507 | $18004 | $438 | $2013 | $199 |

| SpotGamma Implied 1-Day Move: | 0.59% | 0.59% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.63% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4995 | $499 | $17600 | $433 | $2000 | $198 |

| Absolute Gamma Strike: | $5000 | $508 | $17750 | $440 | $2000 | $200 |

| SpotGamma Call Wall: | $5100 | $508 | $17750 | $440 | $2050 | $210 |

| SpotGamma Put Wall: | $4800 | $495 | $16000 | $420 | $1850 | $195 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4982 | $502 | $17037 | $434 | $2039 | $199 |

| Gamma Tilt: | 1.543 | 1.242 | 1.667 | 1.222 | 0.834 | 0.908 |

| SpotGamma Gamma Index™: | 2.781 | 0.219 | 0.075 | 0.085 | -0.016 | -0.018 |

| Gamma Notional (MM): | $704.585M | $649.10M | $7.46M | $227.078M | ‑$12.293M | ‑$129.085M |

| 25 Delta Risk Reversal: | -0.028 | -0.023 | -0.028 | -0.025 | -0.004 | -0.015 |

| Call Volume: | 818.847K | 2.625M | 20.109K | 1.156M | 16.61K | 646.889K |

| Put Volume: | 1.316M | 3.612M | 12.426K | 1.731M | 22.60K | 647.622K |

| Call Open Interest: | 6.543M | 6.358M | 48.004K | 4.047M | 255.535K | 4.578M |

| Put Open Interest: | 13.569M | 16.121M | 65.324K | 8.178M | 467.414K | 8.028M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5050, 4900] |

| SPY Levels: [508, 500, 505, 510] |

| NDX Levels: [17750, 18000, 17600, 17625] |

| QQQ Levels: [440, 435, 439, 438] |

| SPX Combos: [(5301,96.08), (5275,77.02), (5250,93.79), (5224,81.11), (5199,99.22), (5174,89.80), (5168,77.62), (5163,79.77), (5158,72.11), (5148,98.27), (5138,82.43), (5133,92.55), (5128,92.82), (5123,98.58), (5118,88.37), (5112,99.49), (5107,84.37), (5102,100.00), (5097,85.37), (5092,97.88), (5087,77.71), (5082,96.42), (5077,98.69), (5072,91.70), (5051,97.02), (5026,74.02), (5016,90.76), (5001,84.12), (4960,72.22), (4899,81.14), (4848,77.05)] |

| SPY Combos: [509.49, 519.64, 514.56, 499.34] |

| NDX Combos: [18077, 17753, 18041, 18005] |

0 comentarios