Macro Theme:

Short Term SPX Resistance: 5,100

Short Term SPX Support: 5,000

SPX Risk Pivot Level: 5,000

Major SPX Range High/Resistance: 5,100

Major SPX Range Low/Support: 4,800

‣ 5,100-5,116 (SPY 510) is the likely high into next weeks 5/1 FOMC. We think 4,975 – 5,000 will remain as major support in through FOMC.*

*updated 4/24

Founder’s Note:

ES -60bps to 5,075. NQ futures -100bps to 17,490.

Key SG levels for the SPX are:

- Support: 5,026, 5,016, 5,000

- Resistance: 5,050, 5,100

- 1 Day Implied Range: 0.57%

For QQQ:

- Support: 420

- Resistance: 425, 426, 430

IWM:

- Support: 195

- Resistance: 200, 202, 205

GDP, jobless claims at 8:30 AM ET. Pending home sales 10AM ET. 4 & 8 week TBill at 11:30 AM ET. 7 year note auction at 1PM ET.

META is down -15% to 415 after earnings.

The S&P is back down into the 5,025 – 5,050 area after META’s earnings miss, and ahead of a fair amount of AM data. Despite the ~60bps decline in ES futures overnight, S&P vols are only mildly elevated for short dated contracts. You can see this below in the fixed strike matrix, with expirations out to May gaining a mild 30bps in IV across all strikes, but longer dated contracts remain flat. This is reflecting a short term vol reaction to the futures decline and ahead of AM data, not so much any fear, as skew is stable.

We continue to look for 5,000 area as major support into 5/1 FOMC, and suspect that short dated, pre-FOMC vol sellers will come in to take advantage of this decline. Things are a jumpier in Nasdaq, as tech reacts to the META earnings. There is also less gamma in that complex, and so relative volatility should remain higher for today.

While META earnings are a short term hang, traders will use tonights GOOGL/MSFT/INTC earnings for further narratives. These earnings may offer short term, mild market reactions, with 5/1 FOMC looming as the larger catalyst.

As far as META goes, we think that 400 is oversold, as options positioning is very light <=400. Note to the left of 400 (dashed red line) the gamma curves flatten out (orange/blue), which informs us that dealers have little hedging to do below that strike, based on last nights closing positions. Low hedging requirements are implied because when those gamma curves flatline it calculates gamma is 0, which in turn suggests there is no hedging required. Where those gamma curves turn more vertical, hedging flows may pick up (around 450). Certainly options activity will be high today, and so we will be looking to

HIRO

for signs of put selling and/or call buying as support.

We’ll also look to the IV tools to see how vol reacts. There was a moderate call skew into earnings (horizontal red arrow), with a high level of overall vol (vertical red arrow). That call skew infers calls were relatively rich into earnings, and so the unwind of related positions may exacerbate downside as call values drain off. We think put sellers are likely to step up to take advantage of the energy of this drop, which may help to offer short term support.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$5071 |

$505 |

$17526 |

$426 |

$1995 |

$197 |

|

SpotGamma Implied 1-Day Move: |

0.57% |

0.57% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

1.95% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$5075 |

$504 |

$17225 |

$426 |

$2050 |

$202 |

|

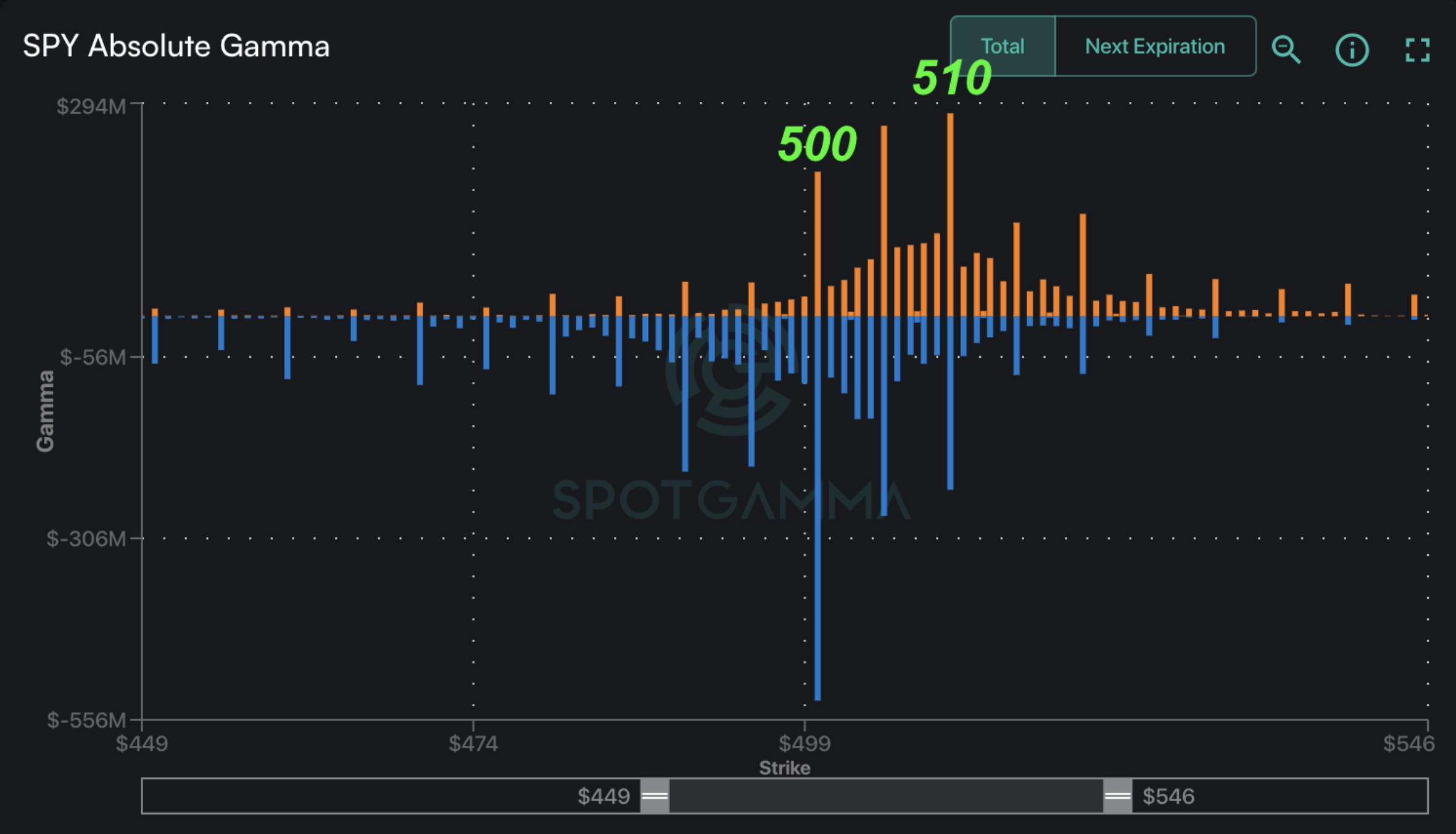

Absolute Gamma Strike: |

$5000 |

$500 |

$17250 |

$430 |

$2000 |

$200 |

|

SpotGamma Call Wall: |

$5100 |

$512 |

$17250 |

$430 |

$2200 |

$220 |

|

SpotGamma Put Wall: |

$5000 |

$500 |

$17500 |

$420 |

$1960 |

$195 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$5080 |

$508 |

$17351 |

$429 |

$2036 |

$206 |

|

Gamma Tilt: |

0.910 |

0.708 |

1.18 |

0.782 |

0.681 |

0.466 |

|

SpotGamma Gamma Index™: |

-0.69 |

-0.329 |

0.041 |

-0.094 |

-0.042 |

-0.124 |

|

Gamma Notional (MM): |

‑$273.778M |

‑$1.11B |

$4.30M |

‑$333.454M |

‑$39.207M |

‑$1.088B |

|

25 Delta Risk Reversal: |

-0.03 |

-0.005 |

-0.033 |

-0.009 |

-0.025 |

-0.001 |

|

Call Volume: |

920.844K |

2.903M |

10.89K |

839.672K |

24.526K |

250.567K |

|

Put Volume: |

1.61M |

4.027M |

8.815K |

1.062M |

39.492K |

421.533K |

|

Call Open Interest: |

6.769M |

6.333M |

62.348K |

4.015M |

314.053K |

3.866M |

|

Put Open Interest: |

13.24M |

13.003M |

77.303K |

6.29M |

544.506K |

7.979M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5000, 5100, 5200, 5150] |

|

SPY Levels: [500, 510, 505, 490] |

|

NDX Levels: [17250, 17500, 18000, 17600] |

|

QQQ Levels: [430, 425, 420, 440] |

|

SPX Combos: [(5300,94.53), (5274,74.89), (5249,92.16), (5224,79.23), (5198,96.10), (5188,73.34), (5173,82.95), (5168,76.03), (5158,76.34), (5148,88.52), (5138,80.62), (5132,81.52), (5122,83.72), (5117,89.07), (5112,86.08), (5107,81.12), (5102,99.31), (5097,79.48), (5051,94.09), (5046,88.10), (5041,87.71), (5036,75.48), (5031,72.15), (5026,94.53), (5016,93.22), (5001,97.92), (4996,74.83), (4990,72.78), (4985,79.02), (4975,95.26), (4965,82.54), (4950,95.09), (4925,85.73), (4919,86.54), (4909,72.54), (4899,97.19), (4874,91.45), (4848,94.05), (4823,84.59)] |

|

SPY Combos: [508.5, 508, 502.44, 501.93] |

|

NDX Combos: [17246, 17264, 17054, 16843] |

|

QQQ Combos: [420.89, 421.31, 416.2, 411.08] |