Macro Theme:

Short Term SPX Resistance: 5,515

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,515

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

Next week (7/29) is critical both on the earnings front (MSFT, META, AAPL, AMZN, AMD, INTC), and macro front (FOMC, PMI, NFP). We expect this data to trigger a large directional move into August OPEX.

When the SPX moves above the Vol Trigger area (currently 5,515), we look to hold a core equity long position.

If equities are weak (<5,400) out of next weeks events, we may look to hold a core short position with major SPX targets below at 5,300 & 5,000.

- Upside scenario:

- SPX 5,600 is the top of our upside range into 7/31 FOMC

- We are “risk on” if SPX moves back over 5,515 (SPY 550)

- Downside scenario:

- A break <5,400 implies a test of 5,300

- A break <5,300 implies a test of 5,000

Founder’s Note:

We apologize for the login issues this morning, which appears to be due to a cyber attack. Our tech team is working on it and should have it resolved ASAP.

MSFT – 3% post-ER to $308

AMD +8% post-ER to $150

Futures are ~1% higher ahead of 2PM ET FOMC. The 0DTE straddle pricing in a healthy ~$46 or 83bps move (ref 5,485 IV 32.4%).

Key resistance at 5,500 & 5,515. As per our “Macro Theme”, we shift to a risk-on stance on a push >5,515 (SPY 550), with an multi-day upside target at 5,600.

To the downside 5,460 & 5,450 is first support. Should 5,450 break we look again (like yesterday) for a quick test of 5,400. <5,400 we are risk-off over a longer time frame.

Digging in, the downside scenario is rather simple:

A break <5,400 places us solidly into negative gamma territory across major indexes and major single stocks. You can see the negative gamma <5,400 in the plot from our new beta models, below. (Note: We had not planned on exposing these models yet, but we wanted to give some positive excitement against this AM’s site issues).

<5,400 is risk-off territory, invoking what we used to refer to as a “gamma trap”.

A gamma-trap occurs with downside equity movement drawing dealer negative delta hedging (stock/futures selling). As those negative dealer hedging flows push stocks lower, it elicits more negative deltas to hedge. This is also referred to as “reflexive” flow, because the action itself reinforces more of that same behavior (selling stock brings requires incrementally more selling of stock).

To break such a cycle, we’d need to hit a level wherein major puts are closed: 5,300, 5,000 or Aug 16th OPEX.

The upside scenario may be a bit more nuanced:

There are many aggressive longs in the small cap space, counting on a “small cap summer” (I say “aggressive” as if you post some bearish small cap views on Twitter/X, you will get harassed).

The reason we are relatively bearish on small caps is because of high call IV’s, and the decrease in negative gamma at strikes >=225. Less negative gamma = less momentum.

We are also clear here to say relative because if equities rip higher on good earnings + rate cuts, then all equities likely rise. We just believe it will be QQQ/SPX > small caps. Further, if one wants to play a “broadening out” of a rally going forward, we’d prefer RSP (equal weighted S&P500) vs small caps.

Additionally, tech IV’s are also very elevated, but because tech has been crashing.

Consider that at yesterday’s close, NVDA was -23% since highs put in on July 10th. Its 1-month ATM IV, now at 69%, is the highest since May ‘22! Now, NVDA is +6% this morning to $110, off of MSFT (CAPEX spend) & AMD ER’s.

You can see this is, technically speaking, a critical juncture in the SMH plot, below…maybe AMD “kick saved” the semi’s from a certain death.

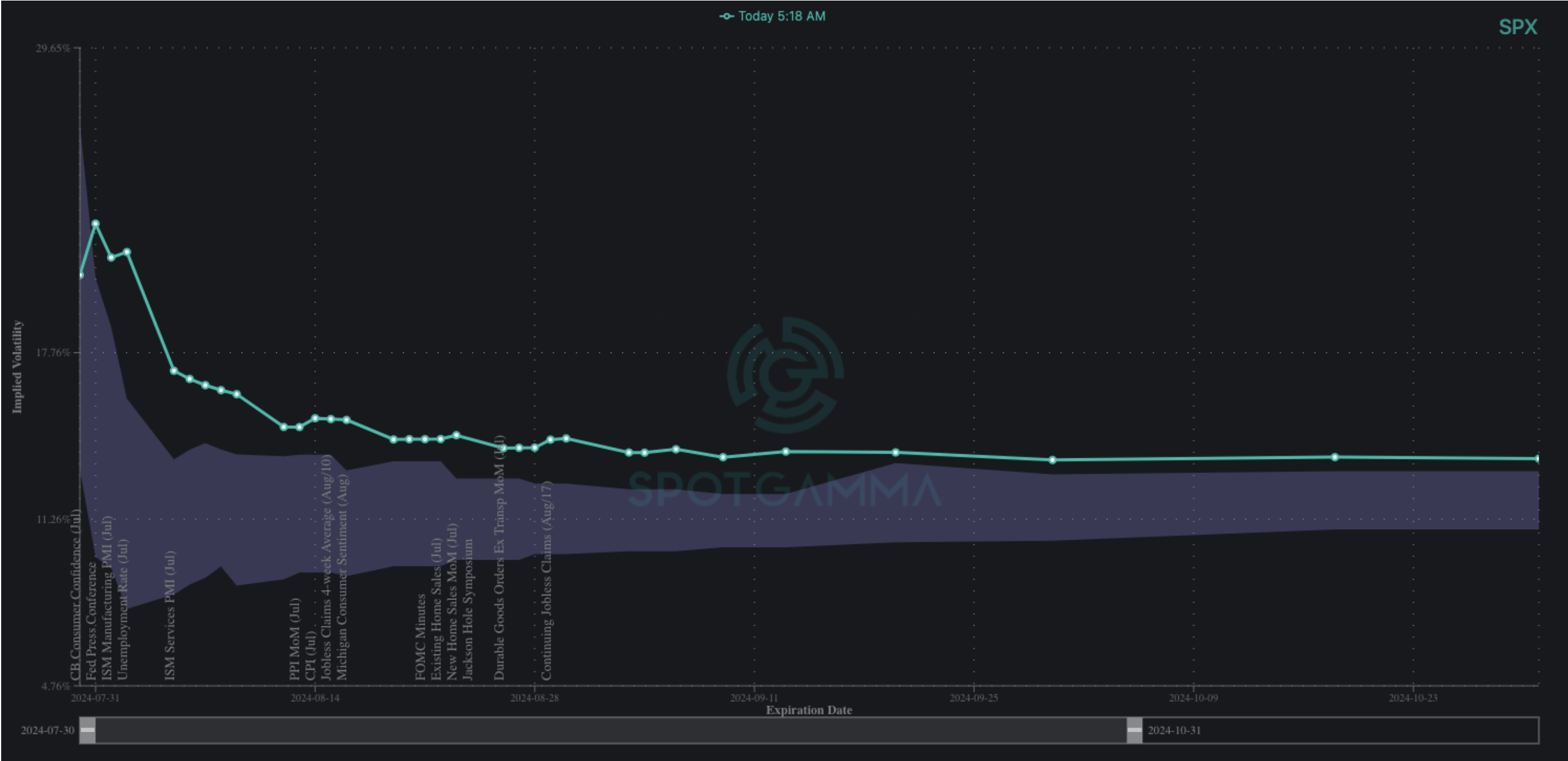

Through our options lens, this sharp tech price downside has jacked-up implied vols across the board, particularly for downside strikes (i.e. puts). This high IV increases vanna as a fuel for stock prices, as dealers may need to buy more shares when/if IV recedes.

Therefore should stocks rally, vanna may turbocharge these stocks higher, with August 16th OPEX a forward time target.

Of course “vanna” works both ways – its just that we feel a macro/geopolitical trigger needs to emerge to justify buying puts with IV at major highs (NDX VIX, below). Powell failing to meet dovish expectations could check that bearish-box (with geopolitical tensions back in view), which is why we won’t second guess downside <5,400 SPX.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5472.93 | $5436 | $542 | $18796 | $457 | $2243 | $222 |

| SG Gamma Index™: |

| -2.091 | -0.493 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5577.75 | $5540.83 | $552.48 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5507.28 | $5470.35 | $545.46 |

|

|

|

|

| SG Volatility Trigger™: | $5531.93 | $5495 | $545 | $19375 | $465 | $2160 | $221 |

| Absolute Gamma Strike: | $5036.93 | $5000 | $540 | $19650 | $470 | $2200 | $220 |

| Call Wall: | $5786.93 | $5750 | $565 | $19650 | $500 | $2300 | $230 |

| Put Wall: | $5336.93 | $5300 | $540 | $17000 | $440 | $2050 | $210 |

| Zero Gamma Level: | $5523.93 | $5487 | $549 | $19177 | $467 | $2187 | $222 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.738 | 0.533 | 0.558 | 0.631 | 1.29 | 0.959 |

| Gamma Notional (MM): | ‑$698.493M | ‑$1.501B | ‑$13.803M | ‑$535.841M | $24.959M | $54.833M |

| 25 Delta Risk Reversal: | -0.035 | 0.00 | -0.036 | -0.017 | -0.006 | 0.020 |

| Call Volume: | 444.067K | 1.392M | 9.086K | 1.028M | 12.521K | 495.349K |

| Put Volume: | 864.819K | 1.80M | 11.538K | 1.03M | 21.451K | 828.146K |

| Call Open Interest: | 6.774M | 5.081M | 64.188K | 3.839M | 350.945K | 5.142M |

| Put Open Interest: | 13.858M | 12.132M | 114.092K | 6.046M | 535.322K | 9.196M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5500, 5550, 5400] |

| SPY Levels: [540, 545, 550, 530] |

| NDX Levels: [19650, 17000, 20000, 16900] |

| QQQ Levels: [470, 460, 450, 440] |

| SPX Combos: [(5697,95.55), (5648,84.50), (5627,69.98), (5600,93.16), (5572,81.63), (5567,71.41), (5551,79.80), (5529,72.69), (5480,73.61), (5469,77.93), (5447,94.76), (5436,78.06), (5426,94.04), (5420,76.44), (5415,91.34), (5409,86.07), (5398,98.03), (5388,88.83), (5377,92.20), (5371,70.03), (5366,87.14), (5360,75.82), (5349,95.17), (5344,73.21), (5339,73.46), (5328,94.12), (5317,87.67), (5311,71.14), (5301,98.89), (5273,94.86), (5268,83.06), (5252,92.35), (5224,81.21), (5214,80.12), (5203,97.05), (5175,87.91), (5170,81.89)] |

| SPY Combos: [525.65, 535.41, 565.21, 540.28] |

| NDX Combos: [18496, 18082, 19642, 18890] |

| QQQ Combos: [471.56, 453.72, 443.66, 448.69] |

0 comentarios