Daily Note:

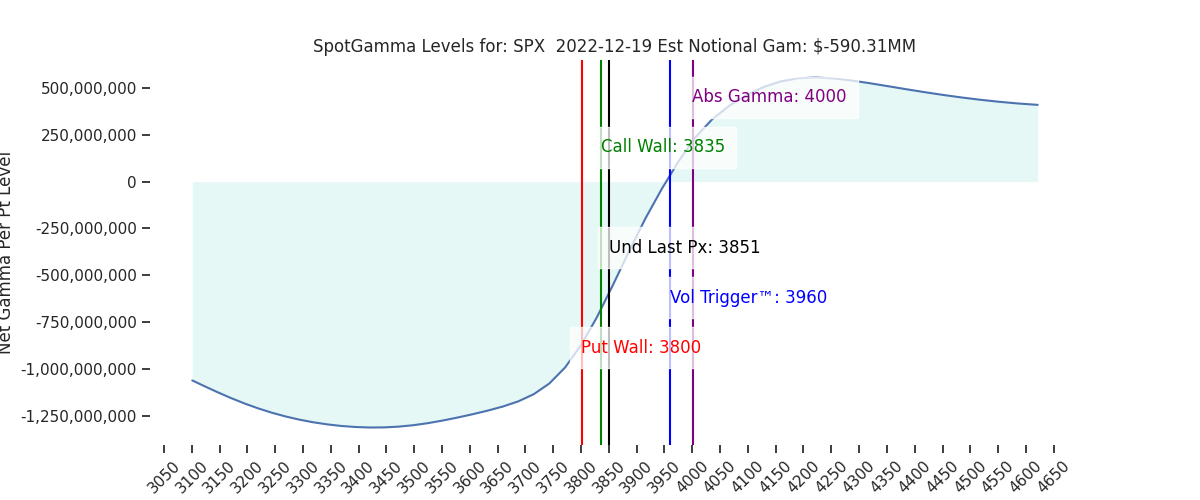

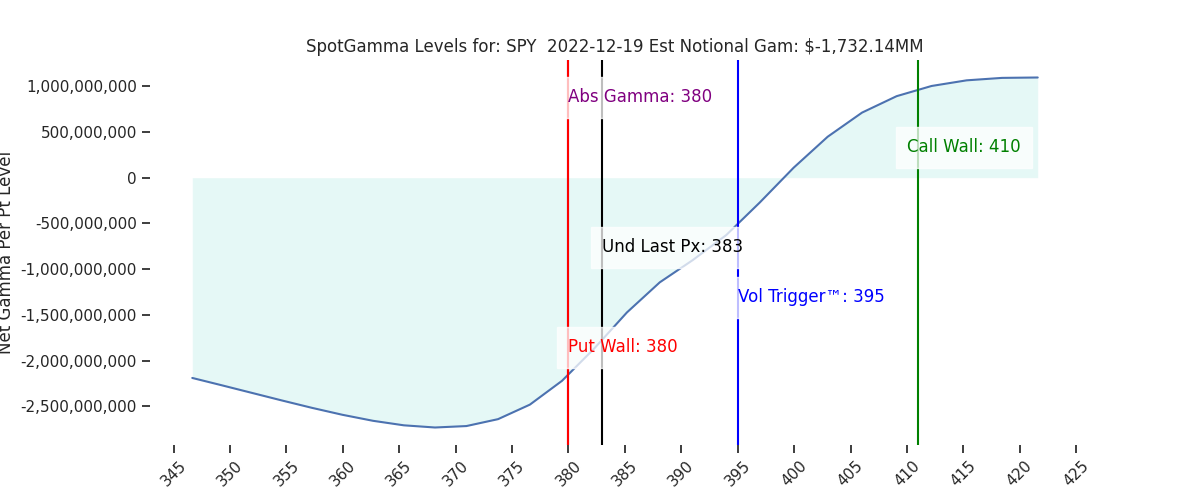

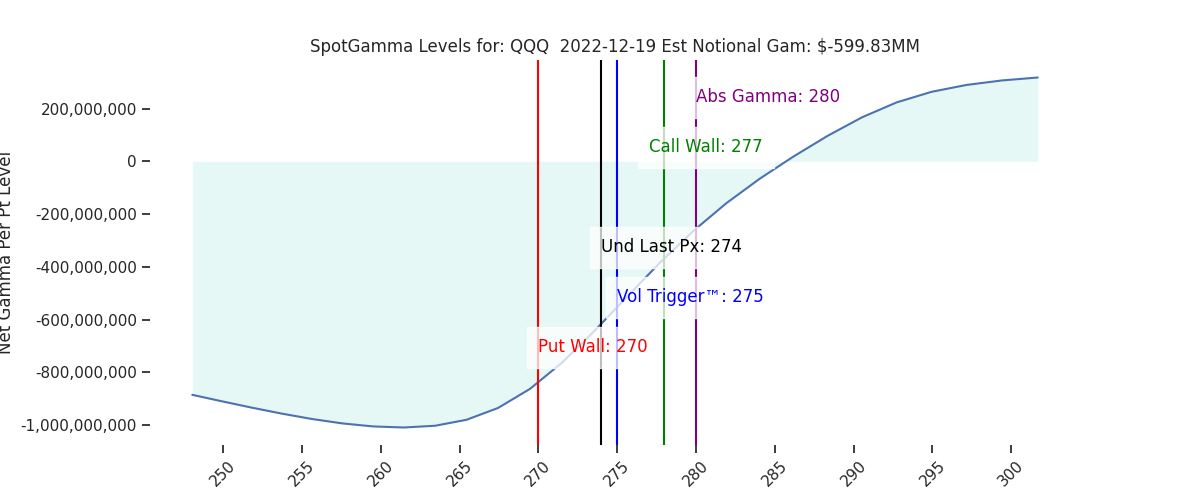

Futures are flat, trading near 3890. 3900 is first resistance, followed by 3960. Support is at 3835, then 3800. Our volatility estimate continues to remain fairly low at 0.89%. Based on the current positioning, our assessment is that this is lining up to dull holiday week, with an edge toward the upside.

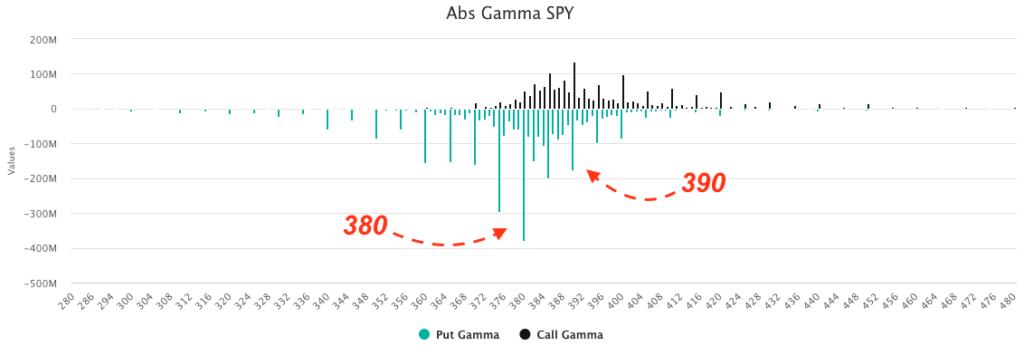

The current setup is that we see positions building at 380SPY/3800SPX to the downside, and 390/3900 to the upside. As you can see below all the strikes from ~385 to 400 are “balanced” meaning there is a fair amount of both call & put positions. We generally read this as an area for price churn. Further, we believe traders will continue to favor selling puts on downside moves, and selling calls on upside moves which helps to maintain this overall range.

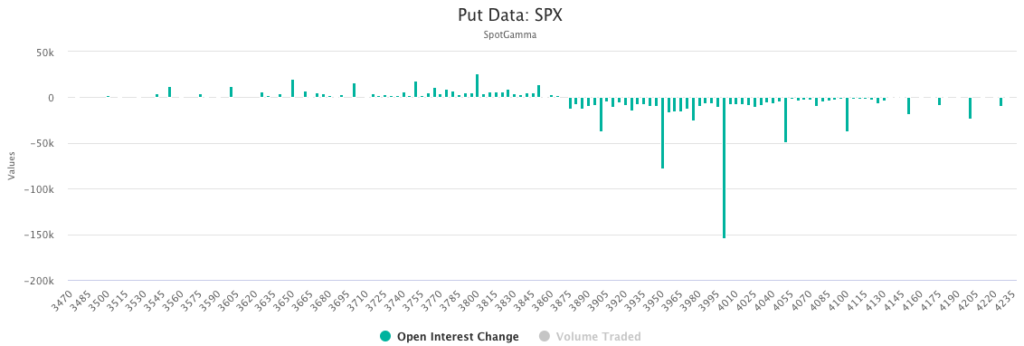

OPEX unsurprisingly led to traders rolling both ITM puts & ITM calls out in strike and out in time. This was particularly heavy on the put side, as shown below. Again, 3800 becomes the large, critical support line, and one that may be tough to break.

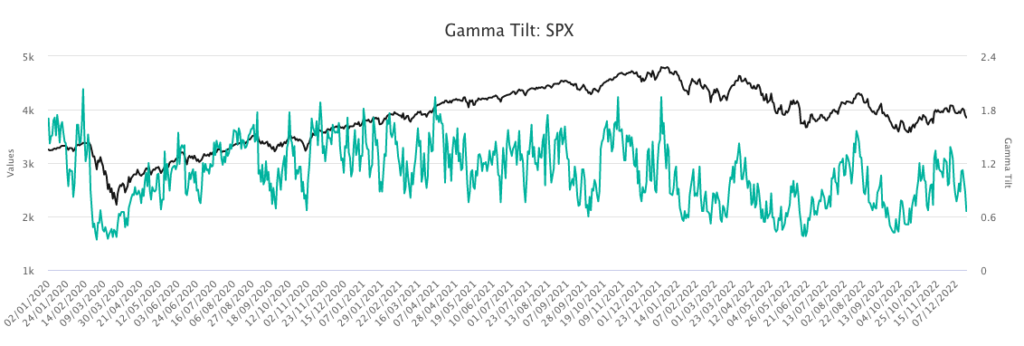

The shakeout of all of this is that the total market gamma is reduced vs Friday, but skewed much more negatively as shown below. This is driven by a higher relative put to call position. While this would often read as a volatile market setup, our models forecast fairly tight ranges on the day (89bps).

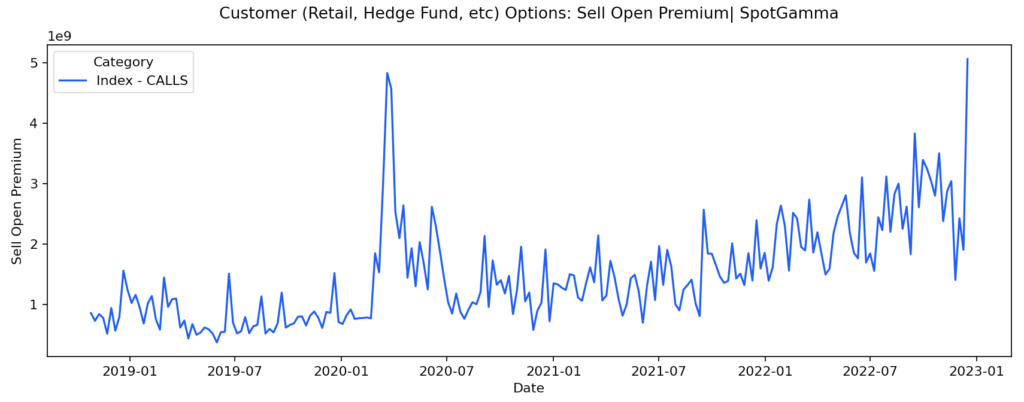

On the call side, you may note that our Call Wall in SPX currently shows at 3835 due to the 12/30 JPM collar strike. This is the largest net call strike on the board, and likely remains that way until 12/30 expiration. It’s clear that traders used the elevated CPI/FOMC IV (and giant futures gap higher) to sell calls. This can be seen in the OCC data below.

Last week registered the second highest level of call shorting since the week of March ’20. It’s important to note that there was a general increase in buying, too which offsets some of this extreme call selling (full chart here, OCC dashboard here). As noted above, we think that traders will use rallies as opportunities to sell calls, which serves to slow upside momentum.

Our largest takeaway on positioning is that the 3800 Put Wall area is shaping up as major downside support into year end. The Dec OPEX roll seemed to result in a concentration of puts at that strike, which is also the vicinity of the much-discussed 3835 JPM Call. This call should serve to support the market in the area just north of 3835, because dealers are long this call and therefore have positive gamma to hedge.

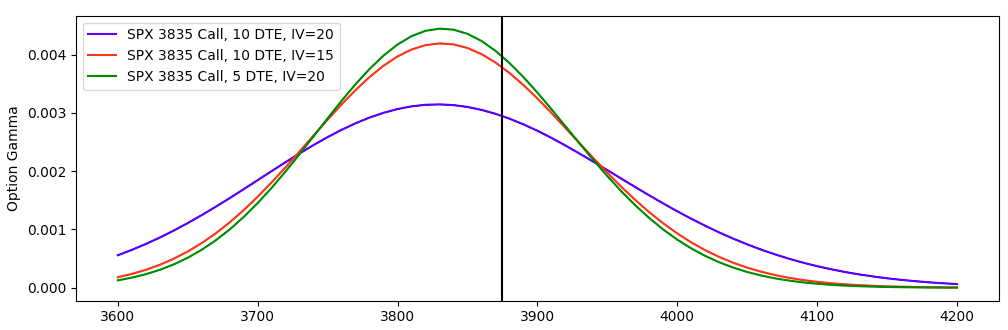

We plotted the gamma profile of this specific 3835 contract below, with its current calculation in blue (10 days to expiration). You can see as time passes (green line, 5 days to expiration), the gamma (and hedging impact) of the position concentrates around 3835. The net result is that if the market recaptures 3900 to the upside (or under 3700), the JPM strike becomes less important to market movement, particularly as we move past this week. Essentially, it loses its pull. If we end up near 3835 into next week, this position will likely pin markets down.

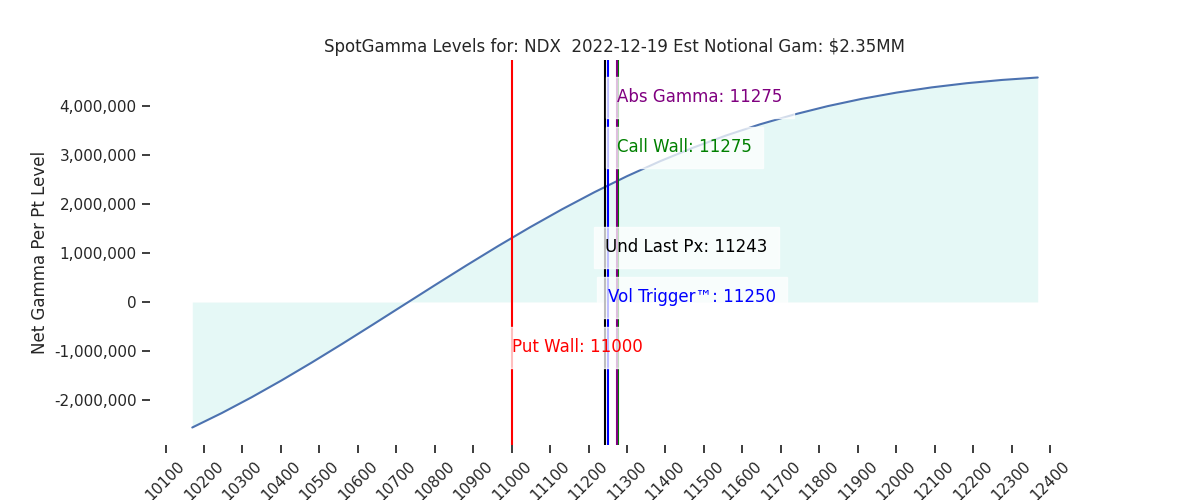

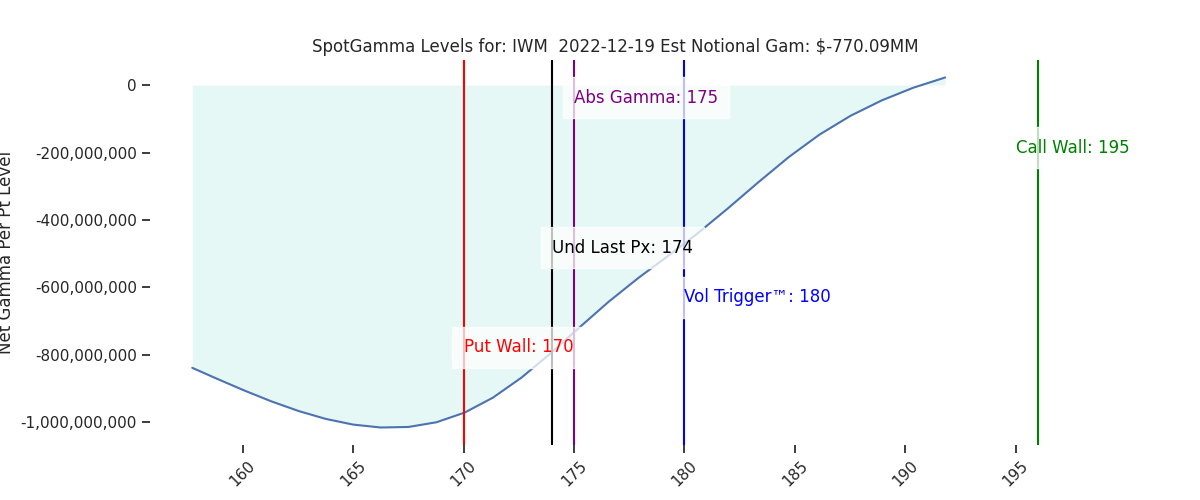

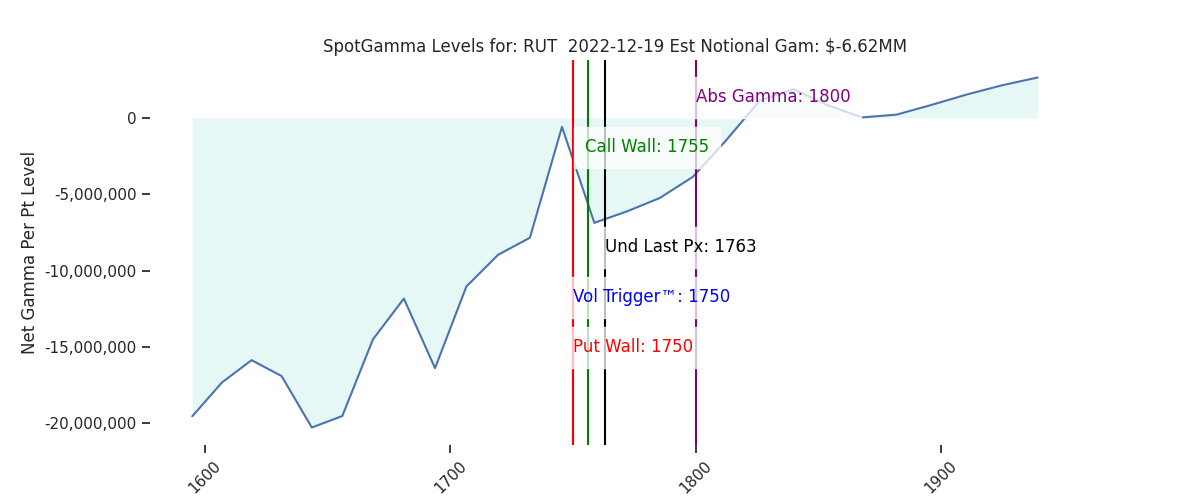

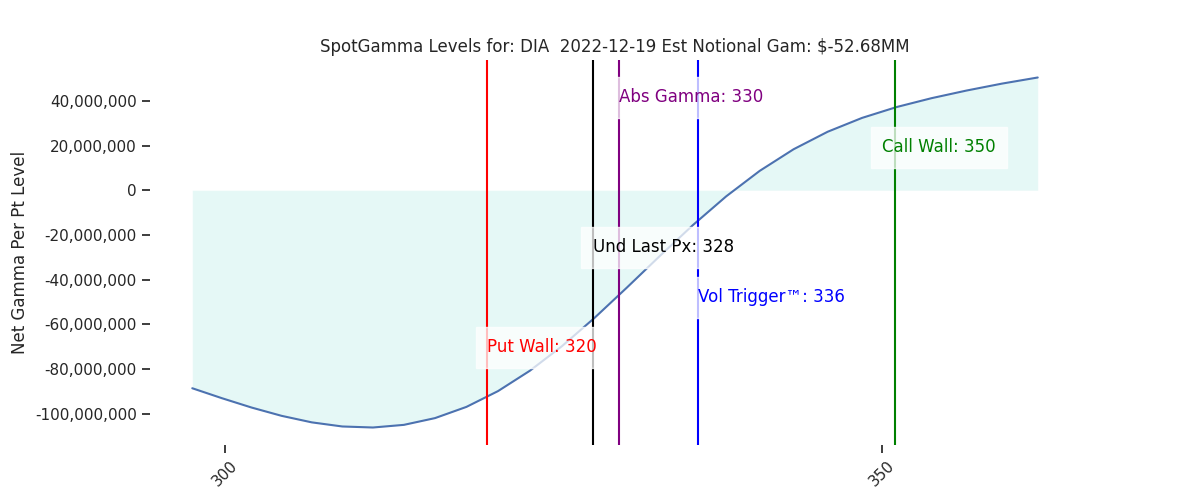

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3851 | 3839 | 383 | 11243 | 274 |

| SG Implied 1-Day Move:: | 0.89%, | (±pts): 34.0 | VIX 1 Day Impl. Move:1.42% | ||

| SG Implied 5-Day Move: | 2.53% | 3851 (Monday Ref Price) | Range: 3754.0 | 3948.0 | ||

| SpotGamma Gamma Index™: | -1.11 | -0.61 | -0.37 | 0.02 | -0.09 |

| Volatility Trigger™: | 3960 | 3925 | 395 | 11250 | 275 |

| SpotGamma Absolute Gamma Strike: | 4000 | 3900 | 380 | 11275 | 280 |

| Gamma Notional(MM): | -590.0 | -880.0 | -1732.0 | 2.0 | -600.0 |

| Put Wall: | 3800 | 3900 | 380 | 11000 | 270 |

| Call Wall : | 3835 | 4000 | 410 | 11275 | 277 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3970 | 4019 | 397.0 | 10745.0 | 309 |

| CP Gam Tilt: | 0.66 | 0.7 | 0.54 | 1.29 | 0.64 |

| Delta Neutral Px: | 3965 | ||||

| Net Delta(MM): | $1,289,445 | $1,905,887 | $165,834 | $36,368 | $85,278 |

| 25D Risk Reversal | -0.05 | -0.04 | -0.02 | -0.05 | -0.05 |

| Call Volume | 610,516 | 780,250 | 2,347,793 | 15,206 | 796,464 |

| Put Volume | 1,088,221 | 1,499,844 | 3,122,830 | 7,583 | 799,456 |

| Call Open Interest | 4,904,865 | 7,401,373 | 6,688,411 | 50,131 | 4,352,684 |

| Put Open Interest | 9,437,262 | 12,740,352 | 11,277,972 | 46,584 | 6,133,746 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4000, 3950, 3900, 3800] |

| SPY: [390, 385, 380, 375] |

| QQQ: [285, 280, 275, 270] |

| NDX:[12500, 12000, 11500, 11275] |

| SPX Combo (strike, %ile): [(3897.0, 82.83), (3847.0, 90.53), (3832.0, 93.09), (3824.0, 88.05), (3816.0, 89.04), (3797.0, 97.6), (3774.0, 81.93), (3766.0, 86.22), (3747.0, 93.0), (3697.0, 95.31)] |

| SPY Combo: [377.9, 367.94, 381.35, 372.92, 382.89] |

| NDX Combo: [11075.0, 10861.0, 11277.0] |

0 comentarios