Macro Theme:

Key dates ahead:

- 9/3: JOLTS

- 9/4: Jobless Claims/PMI

- 9/5: NFP

Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Update 8/28: Post NVDA earnings the key upside target remains 6,500-6,525. We update our key “risk off” pivot level to 6,450. A break below there infers a test of 6,400. <6,400 infers a test of 6,315. If NVDA survives the open on 8/28 then we think vol selling comes in, which invokes positive gamma drift into the Labor Day weekend.

8/25: Post JHOLE: At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action would clash with volatility expectations that are de minimus – so VIX/vol would jump. We read this as downside is wide open into 6,150. The current best case scenario is a move to 6,525 to the upside, which also syncs with QQQ needing ~2% upside to match the ATH set into Aug OPEX.

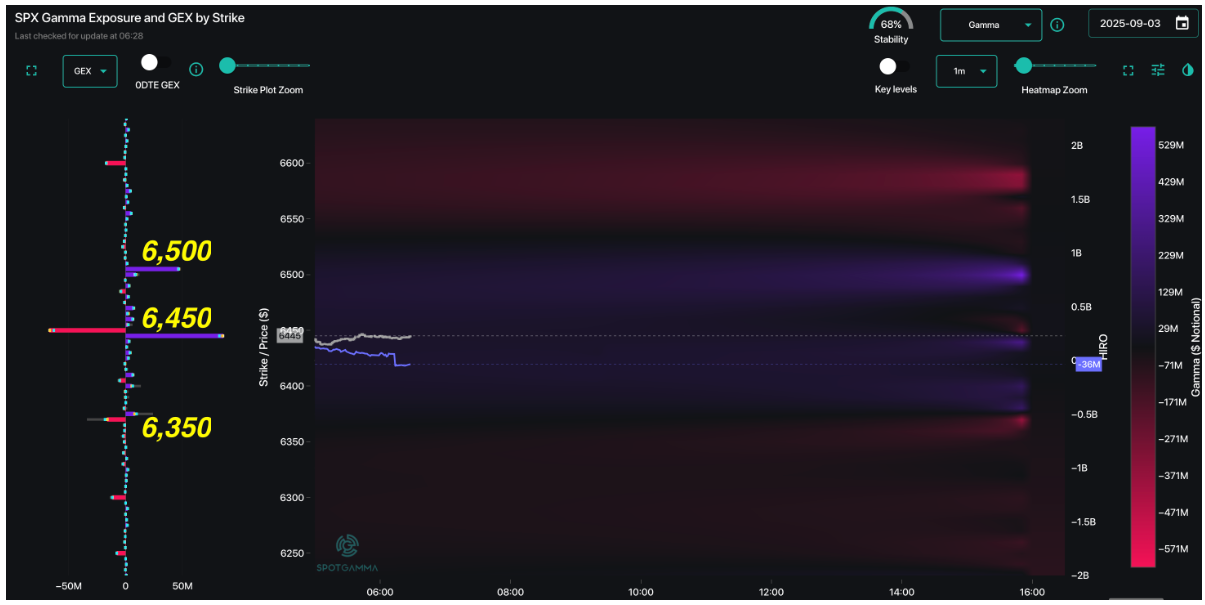

Key SG levels for the SPX are:

- Resistance: 6,450, 6,500

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,400, 6,350, 6,300, 6,175

Founder’s Note:

Futures are 50bps higher, with JOLTS at 10AM ET. Markets are getting a lift from GOOGL (+6% premarket), which passed a court case yesterday. This puts a bid into tech & the rest of the Mag 7.

TLDR: Bulls maintain the advantage while SPX >6,400. Implied vols remain elevated, and will likely “chunk down” with todays/tomorrows/Friday’s econ data. If this data is clean, then we see a path to 6,550 then 6,600 – driven by implied vol contraction. A break back <6,400 flips us back to risk-off.

A quick note on yesterday’s selling: Things seemed to be going with the plan yesterday (<6400->6,315), as the SPX broke <6,400 and quickly slid toward 6,350 with VIX hitting ~19.25. Right before noon we saw a large Oct put cover, and shortly after noon size 0DTE calls stepped in to buy the dip. This behavior of quick monetization of downside is an important tell, as it suggests we won’t see serious downside unless traders hands are forced via ugly data. Given this, if we break 6,400 again its important to roll /monetize protection actively.

Key levels are 6,450 to the upside due to a large 0DTE condor. Above that is 6,500. To the downside we see first support at 6,400, then 6,350.

Stepping into the macro, we see GLD calls bid, and the IV is pushing higher in kind. If that IV rank shifts >75 then we would take that as a topping signal. We also take note of the major bond funds TLT/LQD/HYG all showing high call ranks, and implication that traders are speculating on, or hedging lower yields. We’ve not seen such a stance in recent memory, and it could be related to month end and the upcoming FOMC.

Elsewhere we note that equity call implied vols remain very low. Calls remain a sensible way to play a move higher in equities. If we clear this weeks data without issue, then the rally caps likely come back on as IV contracts and equities push higher into Sep OPEX.

For downside hedges, puts are elevated vs calls, but as IV relatively low. This suggests put spreads are a sensible way to play downside. We also like OTM SPX put flies, as outlined in a recent note.

|

|

/ESU25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6426.65 |

$6415 |

$640 |

$23231 |

$565 |

$2352 |

$233 |

|

SG Gamma Index™: |

|

-0.04 |

-0.464 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.61% |

0.61% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.50% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6431.65 |

$6420 |

$642 |

$23150 |

$566 |

$2360 |

$233 |

|

Absolute Gamma Strike: |

$6011.65 |

$6000 |

$630 |

$23725 |

$560 |

$2300 |

$230 |

|

Call Wall: |

$6511.65 |

$6500 |

$650 |

$23725 |

$580 |

$2400 |

$235 |

|

Put Wall: |

$6386.65 |

$6375 |

$635 |

$22500 |

$560 |

$2250 |

$220 |

|

Zero Gamma Level: |

$6389.65 |

$6378 |

$643 |

$22998 |

$573 |

$2346 |

$235 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.996 |

0.644 |

1.164 |

0.611 |

0.944 |

0.811 |

|

Gamma Notional (MM): |

$130.969M |

‑$1.083B |

$6.227M |

‑$730.554M |

‑$3.827M |

‑$171.72M |

|

25 Delta Risk Reversal: |

-0.062 |

-0.057 |

-0.072 |

0.00 |

0.00 |

-0.034 |

|

Call Volume: |

561.762K |

1.402M |

10.603K |

731.785K |

15.853K |

160.304K |

|

Put Volume: |

910.427K |

1.981M |

10.687K |

1.185M |

34.791K |

685.467K |

|

Call Open Interest: |

7.632M |

5.317M |

69.143K |

3.559M |

300.586K |

3.691M |

|

Put Open Interest: |

13.163M |

12.626M |

82.187K |

6.062M |

478.587K |

8.311M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6500, 6400, 6450] |

|

SPY Levels: [630, 640, 635, 645] |

|

NDX Levels: [23725, 23400, 23000, 22500] |

|

QQQ Levels: [560, 550, 570, 565] |

|

SPX Combos: [(6698,95.96), (6672,72.92), (6653,95.16), (6627,86.16), (6602,99.05), (6576,91.78), (6563,82.75), (6550,96.13), (6537,81.94), (6531,78.56), (6525,92.78), (6518,71.20), (6512,90.86), (6505,96.55), (6499,99.25), (6493,77.46), (6486,74.55), (6480,70.38), (6473,89.89), (6467,76.83), (6460,82.59), (6454,88.84), (6448,99.18), (6441,68.57), (6409,78.89), (6403,93.42), (6390,86.05), (6383,75.02), (6377,98.38), (6371,95.99), (6364,94.20), (6358,80.01), (6351,93.98), (6345,72.44), (6339,77.48), (6332,88.66), (6326,78.55), (6313,93.59), (6300,95.31), (6287,73.37), (6274,83.18), (6262,82.73), (6249,93.15), (6223,70.94), (6210,85.91), (6197,89.85), (6178,81.29), (6153,85.24), (6114,79.33), (6101,90.44)] |

|

SPY Combos: [648.92, 659.24, 654.08, 668.92] |

|

NDX Combos: [22999, 23719, 22581, 22395] |

|

QQQ Combos: [560.13, 577.82, 549.87, 580.1] |