Macro Theme:

Key dates ahead:

- 9/10: PPI

- 9/11: CPI

- 9/17: VIX Exp, FOMC

- 9/19: OPEX

Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

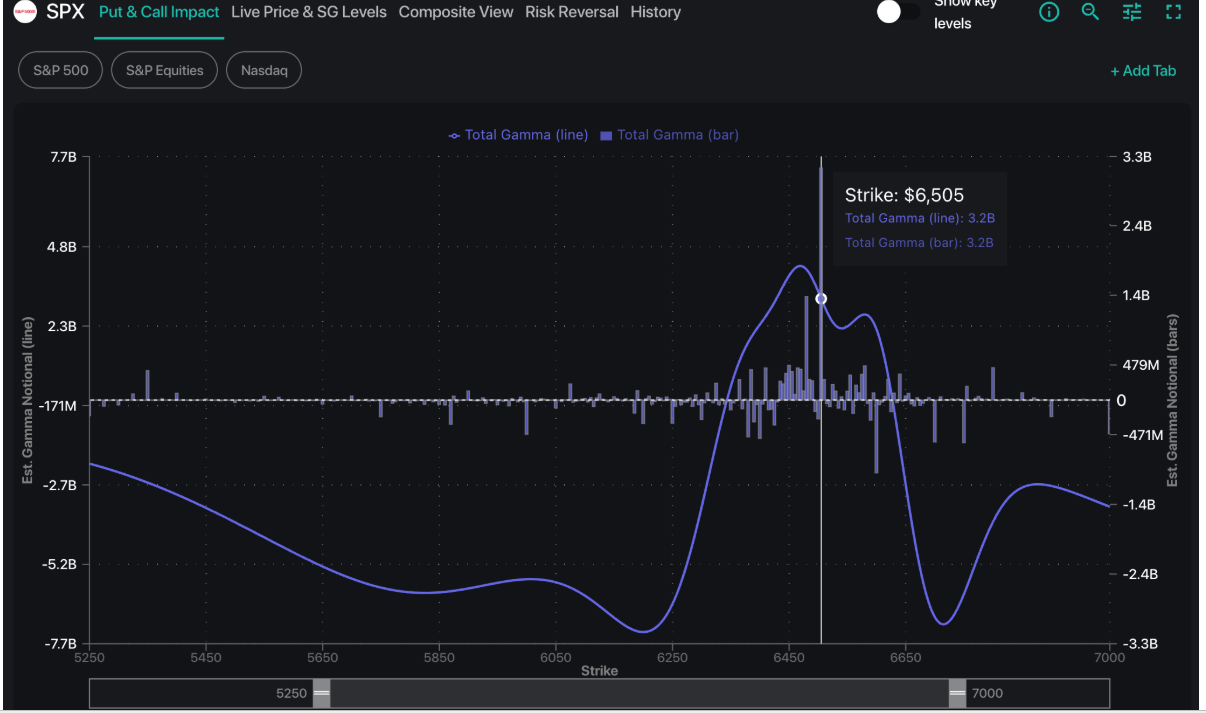

- Resistance: 6,505, 6,525, 6,550, 6,600

- Pivot: 6,450 (bearish <, bullish >)

- Support: 6,450, 6,400, 6,300, 6,175

Founder’s Note:

Futures are 20bps higher, with no major data on tap for today.

Resistance: 6,505, 6,525, 6,550

Support: 6,460, 6,450, 6,400

The big strike coming into focus is the 6,505 JPM Call, which expires at the end of month. If the SPX is near that strike it should act as a stabilizer. In this case, we want to see the SPX get above that strike, and it should help to put a floor under equities at least until 9/17 VIX Exp/FOMC. If we are <6,500 there is still some positive gamma, and our general idea is to stay “risk-on” as long as the SPX is >6,450. Its not until <6,400 that we think downside could stick. On this point, we continue to see very cheap put flies out there, and we like layering out in time on as very cheap downside protection (see this note).

A few weeks ago we were actively discussing “the Zombie” into Sep OPEX – the idea that vol would contract sharply, which would result in a fairly sleepy grind into Sep OPEX. Then, Sep OPEX could be a major turning point as it is likely to be the largest options expiration ever, and also a major FOMC.

This Zombie idea is still our preferred view, as 1-month SPX realized vol (RV) is 10%, and we think that could grind down toward the ~6% level – particularly if this weeks PMI/CPI are non-events. While the 15 VIX is pretty rich for a 10% RV, its now going to start pricing in FOMC and so that may be unable to drop too sharply, but we think 14’s is easy.

Away from that indexified measure (i.e. VIX), you can look at SPX term structure and find nearly all expirations in the next month hold <12.5% IV, with some short dated anxiety related to CPI. If these data points pass without issue, that should contract vol, pushing stocks up over the key 6,505 level. Above there, it looks like SPX is open to 6,550 and maybe 6,600…but that is our max high into Sep OPEX.

While we don’t want to shake a stick at 1-2% possible SPX upside over the next ~10 days, we still prefer to play single stock calls in top stocks. This is because the vol complex that is built around suppressing SPX vol shouldn’t be as strong in certain single stocks. So – we search for negative gamma to the upside in favored names (NVDA, MSFT are not it). Remember the OPENAI/AVGO news on Friday after the BABA chip news really but a damper on NVDA, and NVDA was just coming off of being the largest weighting in the S&P500 ever…that speaks to rotation out of that name into better values (or at least better narratives).

GOOGL is one we continue to like, as we see nice negative gamma bars to the upside into 250.

Another with negative gamma upside is HOOD, which was just announced to the S&P500 (to be added in a few weeks).

|

|

/ESU25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6489.43 |

$6481 |

$647 |

$23652 |

$576 |

$2391 |

$237 |

|

SG Gamma Index™: |

|

1.421 |

-0.17 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.63% |

0.63% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.76% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6478.43 |

$6470 |

$646 |

$23620 |

$575 |

$2340 |

$234 |

|

Absolute Gamma Strike: |

$6508.43 |

$6500 |

$650 |

$23725 |

$560 |

$2300 |

$235 |

|

Call Wall: |

$6608.43 |

$6600 |

$650 |

$23725 |

$580 |

$2500 |

$240 |

|

Put Wall: |

$6408.43 |

$6400 |

$635 |

$23590 |

$560 |

$2250 |

$220 |

|

Zero Gamma Level: |

$6451.43 |

$6443 |

$646 |

$23239 |

$575 |

$2367 |

$235 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.154 |

0.864 |

1.372 |

0.869 |

1.041 |

1.034 |

|

Gamma Notional (MM): |

$575.765M |

‑$47.759M |

$13.383M |

‑$50.484M |

$7.25M |

$150.383M |

|

25 Delta Risk Reversal: |

-0.048 |

-0.048 |

-0.055 |

0.00 |

-0.029 |

-0.028 |

|

Call Volume: |

602.245K |

1.572M |

9.191K |

730.529K |

35.345K |

334.175K |

|

Put Volume: |

1.091M |

2.265M |

10.853K |

1.196M |

67.583K |

783.894K |

|

Call Open Interest: |

7.755M |

5.557M |

69.064K |

3.536M |

304.522K |

3.756M |

|

Put Open Interest: |

13.523M |

13.106M |

83.797K |

6.046M |

494.027K |

8.451M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6500, 6000, 6450, 6400] |

|

SPY Levels: [650, 645, 640, 630] |

|

NDX Levels: [23725, 23800, 23600, 23500] |

|

QQQ Levels: [560, 580, 575, 570] |

|

SPX Combos: [(6799,95.93), (6747,94.30), (6702,98.04), (6676,77.42), (6657,69.07), (6650,97.55), (6637,72.87), (6631,72.18), (6624,88.67), (6618,77.84), (6611,84.92), (6598,99.78), (6592,84.27), (6579,82.61), (6572,97.64), (6559,90.58), (6553,99.23), (6546,77.04), (6540,93.79), (6533,71.65), (6527,99.18), (6520,95.84), (6514,75.68), (6507,99.73), (6501,99.59), (6488,93.92), (6482,81.65), (6475,89.72), (6462,70.60), (6449,93.17), (6443,93.74), (6436,80.55), (6430,84.74), (6423,88.54), (6417,82.33), (6410,91.06), (6397,96.66), (6391,79.30), (6384,74.98), (6378,89.98), (6358,90.37), (6352,92.09), (6332,71.69), (6326,68.97), (6306,83.14), (6300,91.80), (6287,68.09), (6274,69.50), (6261,76.08), (6248,92.04), (6209,77.35), (6203,89.59), (6177,72.92)] |

|

SPY Combos: [653.01, 652.37, 649.12, 644.58] |

|

NDX Combos: [23723, 23818, 22990, 24031] |

|

QQQ Combos: [577.53, 582.13, 581.56, 579.83] |