by ricardo@optionelements.es | Abr 27, 2022 | Option Levels

Macro Theme: A sustained rally is unlikely to occur until May 4th which holds the FOMC & Russian default. Due to these events, volatility (i.e. large puts) is unlikely to be meaningfully sold. This prevents an extended rise in equities. We see substantial,...

by ricardo@optionelements.es | Abr 26, 2022 | Option Levels

Macro Theme: A sustained rally is unlikely to occur until May 4th which holds the FOMC & Russian default. Due to these events, volatility (i.e. large puts) is unlikely to be meaningfully sold. This prevents an extended rise in equities. We see substantial, longer...

by ricardo@optionelements.es | Abr 25, 2022 | Option Levels

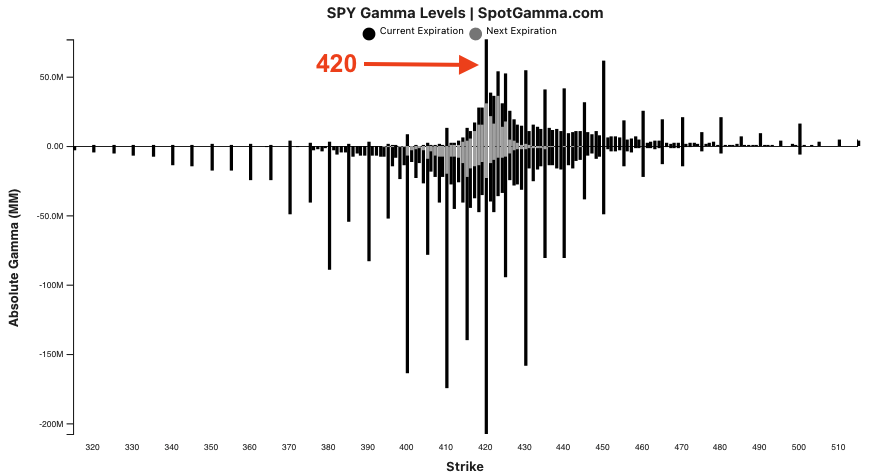

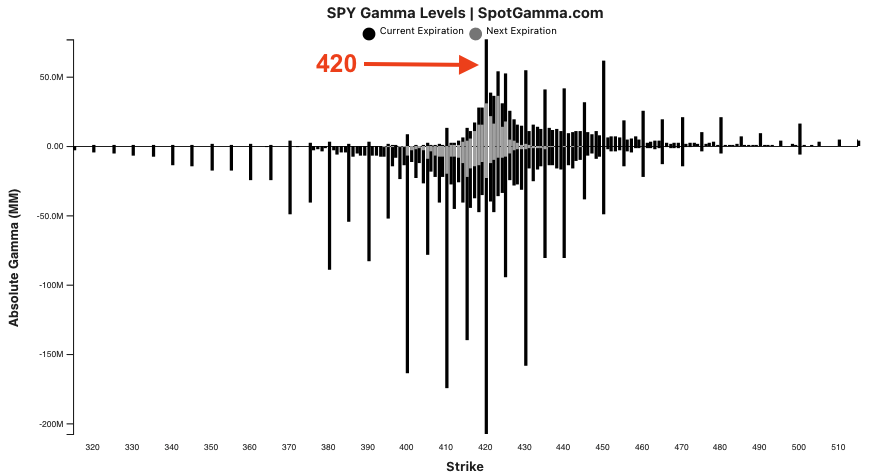

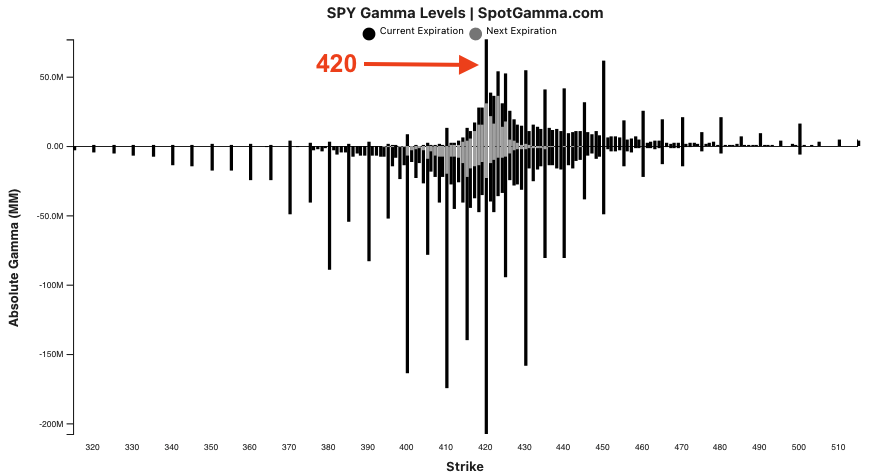

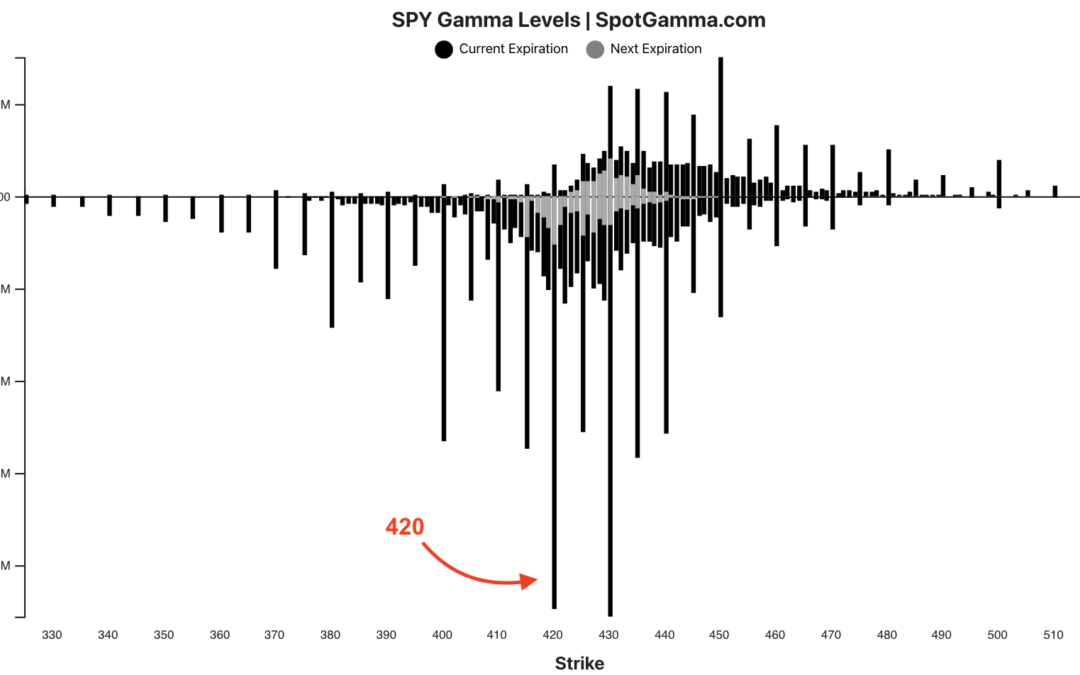

Futures are at 4240 which is up from overnight lows of 4218. The VIX is currently holding near 30. The gamma index shifts down to -1.28 which corresponds to a 1.08% open/close move for the SPX. We are looking for support down at the 420SPY/4200SPX level, with...

by ricardo@optionelements.es | Abr 22, 2022 | Option Levels

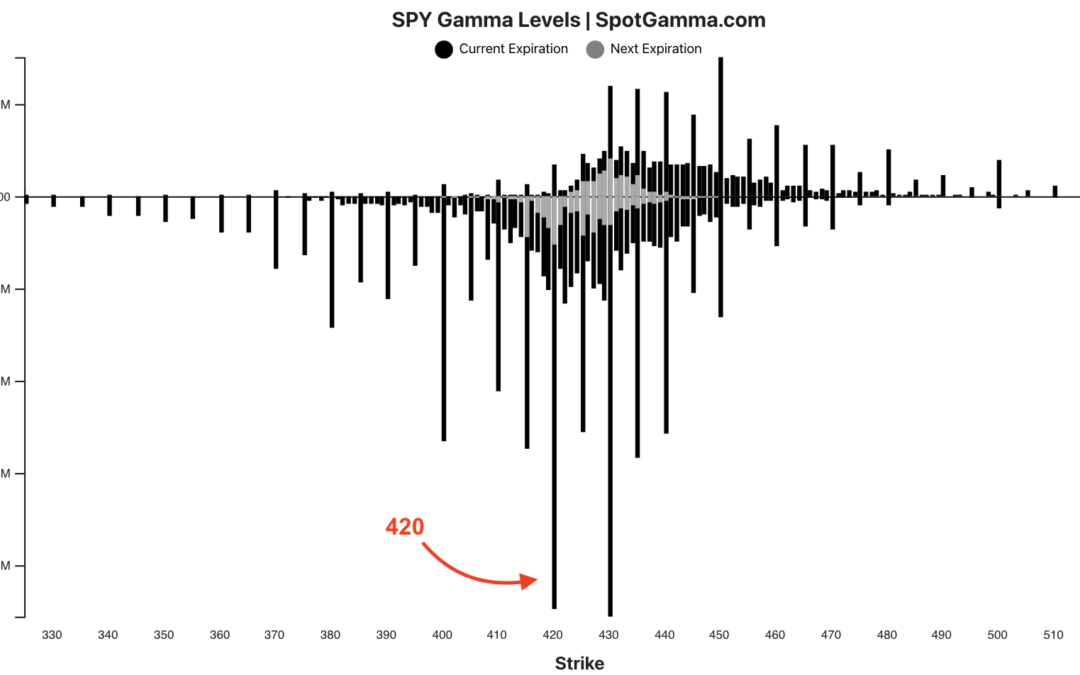

The overnight session was rather tame (4365 low, 4390 high), with ES near 4375. Our volatility estimate remains in line with that of the last few days: 1.13% (open/close). There was a large build in both SPY & QQQ negative gamma, which supports elevated...

by ricardo@optionelements.es | Abr 21, 2022 | Option Levels

Futures are higher, trading at 4485. Our volatility estimate holds at 1.2% (open/close) as, despite higher market prices, we saw an increase in negative gamma for SPX/SPY/QQQ. Resistance is at 4500, then 4520 (450SPY equivalent). Support is at 4450. It has been...