Macro Theme: Short Term SPX Resistance: 4,815 (SPY 480) Short Term SPX Support: 4,765 (SPY 475) SPX Risk Pivot Level: 4,700 Major SPX Range High/Resistance: 4,815 (SPY Call Wall) Major SPX Range Low/Support: 4,600 ‣ 4,800 - 4,815 is our current max...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,800 Short Term SPX Support: 4,720 SPX Risk Pivot Level: 4,700 Major SPX Range High/Resistance: 4,815 (SPY Call Wall) Major SPX Range Low/Support: 4,600 ‣ 4,815 is our current max upside target, due to a Call Wall...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,750 Short Term SPX Support: 4,700 SPX Risk Pivot Level: 4,700 Major SPX Range High/Resistance: 4,800 Major SPX Range Low/Support: 4,600 ‣ 4,800 is our current max upside target, due to a Call Wall shift on 12/19. Call...

Informe Option levels

Macro Theme: Short Term SPX Resistance: 4,800 Short Term SPX Support: 4,750 SPX Risk Pivot Level: 4,700 Major SPX Range High/Resistance: 4,800 Major SPX Range Low/Support: 4,500 ‣ 4,800 is our current max upside target, due to a Call Wall shift on 12/19. Call...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,800 Short Term SPX Support: 4,750 SPX Risk Pivot Level: 4,700 Major SPX Range High/Resistance: 4,800 Major SPX Range Low/Support: 4,500 ‣ 4,800 is our current max upside target, due to a Call Wall shift on 12/19. Call...

Informe Option Levels

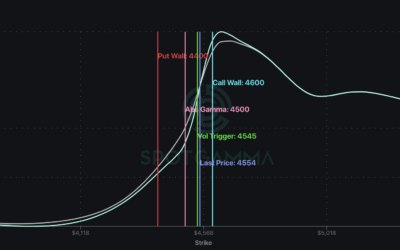

Macro Theme: Short Term SPX Resistance: 4,700 Short Term SPX Support: 4,600 SPX Risk Pivot Level: 4,600 Major SPX Range High/Resistance: 4,700 Major SPX Range Low/Support: 4,400 ‣ We look for higher volatility this week (12/11), triggered by 12/12 CPI,...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,623 Short Term SPX Support: 4,550 SPX Risk Pivot Level: 4,500 Major SPX Range High/Resistance: 4,600 Major SPX Range Low/Support: 4,400 ‣ We look for higher volatility this week (12/11), triggered by 12/12 CPI, 12/13...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,590 Short Term SPX Support: 4,540 SPX Risk Pivot Level: 4,500 Major SPX Range High/Resistance: 4,600 Major SPX Range Low/Support: 4,200 ‣ IV levels are anemic (~8%), which suggests that a pop higher in IV/equity...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,574 Short Term SPX Support: 4,550 SPX Risk Pivot Level: 4,500 Major SPX Range High/Resistance: 4,600 Major SPX Range Low/Support: 4,200 ‣ IV levels are anemic (~8%), which suggests that a pop higher in IV/equity...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,569 Short Term SPX Support: 4,525 SPX Risk Pivot Level: 4,500 Major SPX Range High/Resistance: 4,600 Major SPX Range Low/Support: 4,200 ‣ IV levels are anemic (~8%), which suggests that a pop higher in IV/equity...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,587 Short Term SPX Support: 4,550 SPX Risk Pivot Level: 4,500 Major SPX Range High/Resistance: 4,600 Major SPX Range Low/Support: 4,200 ‣ IV levels are anemic (~8%), which suggests that a pop higher in IV/equity...

informe Option Levels

Macro Theme: Short Term SPX Resistance: 4,568 (SPY 456 Call Wall) Short Term SPX Support: 4,550 SPX Risk Pivot Level: 4,500 Major SPX Range High/Resistance: 4,600 Major SPX Range Low/Support: 4,200 ‣ IV levels are anemic (~8%), which suggests that a pop higher...