Macro Theme: Major Resistance: $4,200 Pivot Level: $4,150 Critical Support: $4,000 Range High: $4,200 Call Wall Range Low: $3,800 Put Wall ‣ $4,200 is likely heavy resistance into April 21st OPEX ‣ High market volatility is unlikely with SPX >$4,000 due to positive...

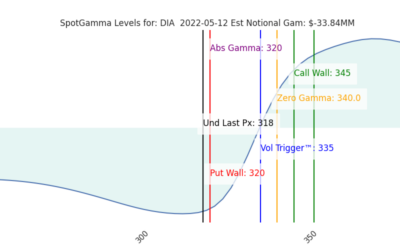

Informe Option Levels

Macro Theme: Major Resistance: $4,200 Pivot Level: $4,150 Critical Support: $4,000 Range High: $4,200 Call Wall Range Low: $3,800 Put Wall ‣ $4,200 is likely heavy resistance into April 21st OPEX ‣ High market volatility is unlikely with SPX >$4,000 due to positive...

Informe Option Levels

Macro Theme: Major Resistance: $4,200 Pivot Level: $4,150 Critical Support: $4,000 Range High: $4,200 Call Wall Range Low: $3,800 Put Wall ‣ $4,200 is likely heavy resistance into April 21st OPEX ‣ High market volatility is unlikely with SPX >$4,000 due to positive...

Informe Option Levels

Macro Theme: Major Resistance: $4,200 Pivot Level: $4,150 Critical Support: $4,000 Range High: $4,200 Call Wall Range Low: $3,800 Put Wall ‣ $4,200 is likely heavy resistance into April 21st OPEX ‣ High market volatility is unlikely with SPX >$4,000 due to positive...

Informe Option Levels

Macro Theme: Major Resistance: $4,150 Pivot Level: $4,100 Critical Support: $4,000 Range High: $4,200 Call Wall Range Low: $3,800 Put Wall Events: 4/12 CPI, FOMC Mins ‣ $4,200 is likely heavy resistance into April 21st OPEX ‣ High market volatility is unlikely...

Informe Option Levels

Futures are unchanged overnight at 4150, ahead of today's CPI (8:30 AM ET) & FOMC Minutes (2pm ET). Key levels are in line with the last several days: 4100-4110 (SPY 410) is the pivot line Resistance overhead is at 4140 (SPY 413), 4150 (Large Gamma Strike) &...

Informe Option Levels

S&P futures are flat at 4133, with NQ futures off 65 bps to 13,214. The S&P Call Walls have rolled higher, to SPY 410 (4115), and 4150 SPX. These are the key overhead resistance levels for today. To the downside we mark support at 4050. With Friday's move...

Informe Option Levels

S&P futures are flat at 4133, with NQ futures off 65 bps to 13,214. The S&P Call Wall s have rolled higher, to SPY 410 (4115), and 4150 SPX. These are the key overhead resistance levels for today. To the downside we mark support at 4050. With Friday's...

Informe Option Levels

Futures are modestly higher to 4080. This morning we see the SPY Call Wall roll higher to 407 (SPX 4080 equivalent), while the SPX Call Wall holds at 4065. This implies the max resistance is now 4065-4080 for today, vs 4050-4065 yesterday. Other key SG levels remain...

Informe Option Levels

Futures are higher this morning, to 4070. This places the market up near our final resistance line of the 4065 Call Wall, which is just above other resistance lines at 4050 & 4060 (SPY 405 Call Wall). To the downside key resistance lies at 4010 (SPY 400) &...

Informe Option Levels

Futures have pressed higher to 4035, indicating a cash open on the large 4000 strike. 4000 – 4010 remains the key resistance line for today, with 4031 above that. To the downside the key range is 3960 (SPY 395) – 3950. Yesterday was simply churning inside of the big...

Informe Options Levels

Futures were flat overnight, holding 4000. SG levels remain unchanged, with 4000-4010(SPY400) serving as primary resistance. First support shows in the 3960(SPY395) – 3950 range, with more critical support at 3900. We do continue see a close over 4000 as bullish, as...